01.11.2022 Portfolio Update (Monthly Edition)

Topics: Portfolio Update, Portfolio Discussion, 2021Y Review, More Books and Monthly Munchies.

Remember that:

"That which does not kill us makes us stronger." - Friedrich Nietzsche

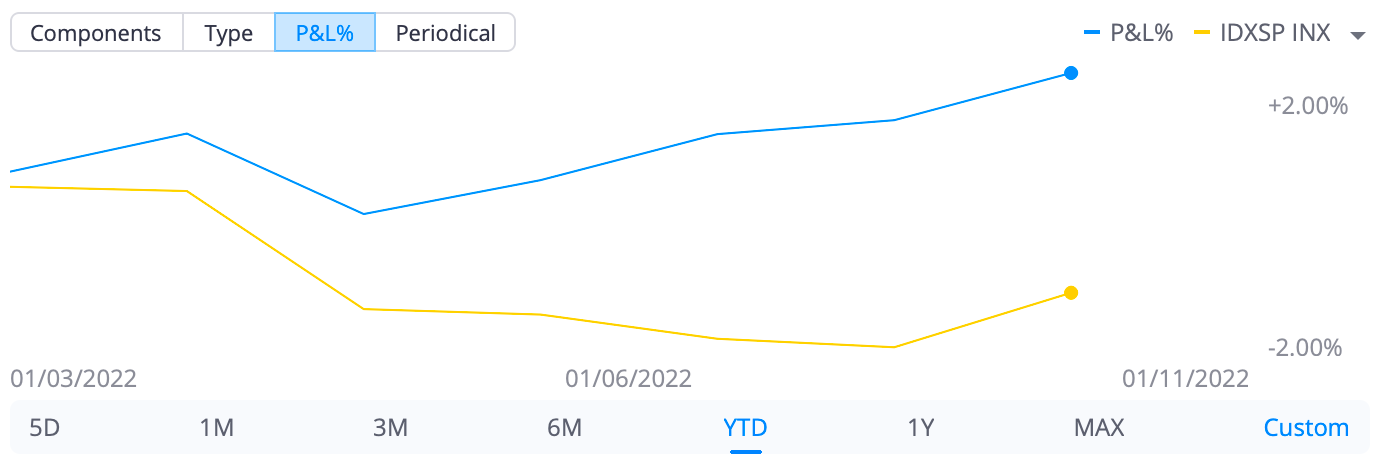

P&L Snapshots + Account Details w/ Monthly P&L

Portfolio Update*

*I am NOT a financial advisor, I’m sharing my investing journey. Do your own research.*

Stocks + Options

Options Only

Portfolio Discussion

There are a bit of changes since last time, first I got back into OPFI 0.00%↑ although it seems not big enough, if it dips below $5 I will add otherwise will let it play out.

I have added more to OMAB 0.00%↑ & SSSS 0.00%↑ , both are way below what I want them to be at but I’m being strict with my buy ins, I enjoy a lot more paying price I believe is good rather then chasing and dollar cost average up (that’s not my style)

Moved money around a bit from FF 0.00%↑ and WWE 0.00%↑ to IAC 0.00%↑ , SPOT 0.00%↑ , and TWTR 0.00%↑ nothing crazy.

I did start position in OZK 0.00%↑ Preferred shares for the dividend that’s due in February.

Also if you are interested in investing in OMAB 0.00%↑ or other airports, check this one:

Lastly if you are invested in $IAC, there are news of Turo going public via IPO and since $IAC has a stake in it you can read about it here

and this:

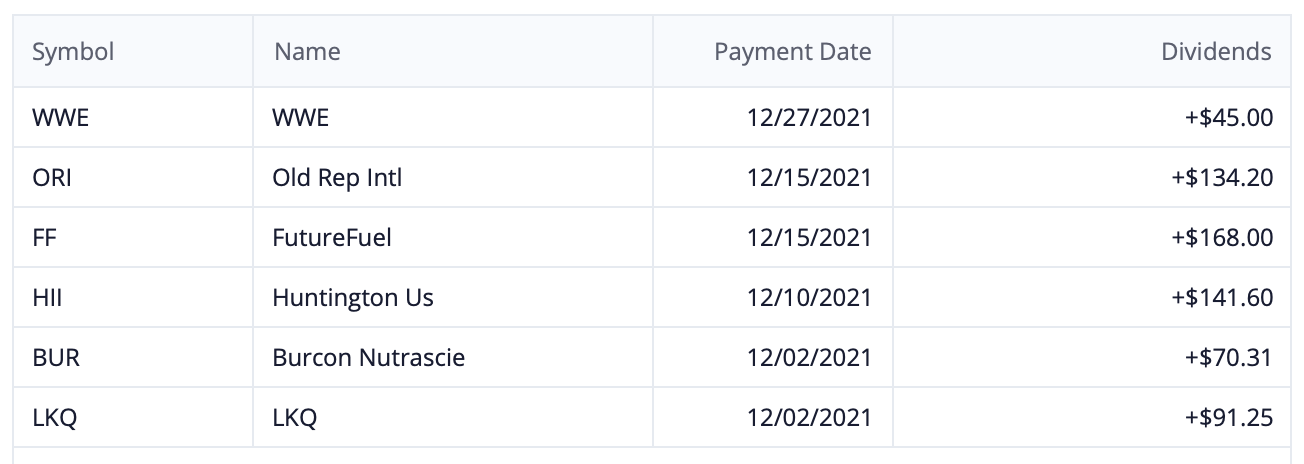

Dividends for December:

2021Y Review

For the 2021Y Review I would like to go over a few things:

Show some stats

My best investment(s)

My worst investment(s)

I finished 2021Y with +20.35% while S&P500 with +26.89% (in 2020 +13.56%, +16.26% and in 2019 September +20.31%, +7.77%)

When it comes to my best trades of 2021Y, there are a few that I would like to point out:

$IRBT, $OPBK, and $ORI/ FF 0.00%↑

Why IRBT 0.00%↑ d OPBK 0.00%↑ ?

Both have played out the way I would like them too although $IRBT mainly due to “luck” aka short squeeze that happened in 2021, while $OPBK was just buy low and sell high that played out for 100% profit.

When it comes to $ORI/$FF both came out with special dividends that I spoke about and benefited from both.

When it comes to my worse trade of 2021Y, there are also a few that I would like to point out:

$DISCA and $OPFI

Why $DISCA? Because although I made money on it, I got greedy and didn’t sell out when I was up 200-300% I knew it was not normal for this thing to shoot up and yet I left (at that time) almost $9,000.

Why $OPFI? Because I really had no business of buying into SPAC before learning more about it, I got caught up in the “fun and groupthink” instead of buying it (as I buy most things) at MoS price (the current price around $4-$5 mark)

More Books

For the month of December I have listened to two books, well completed one and dropped one until later.

Super Founders: What Data Reveals About Billion-Dollar Startups by Ali Tamaseb

I thought originally this book is like The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success but it turns out to be more for VC investors with a sprinkle of The Outsiders. Numbers/stats driven with some interesting information on VC/Start Up world but not really for value investors per se.

I will say it was interesting to listen to but to say that it was useful to me? Not as much as I would like, but if you are VC/Start Up I would say it should be in top five to read.

I give it 3 out of 5 stars.

The one that I started but didn’t finish and instead moved to something else was How Markets Fail: The Logic of Economic Calamities by John Cassidy.

It’s not a bad book per se but I think I can find (and I did) better time spend. It is free with your subscriptions if you have Audible, so might be worth downloading and checking it out (I know everyone has different tastes so maybe someone will enjoy it)

Monthly Munchies

Here are some things to munch on…

2022 Semiconductor Webinar (and Outlook) (Article)

52 Books in 52 Weeks (2021) (Article)

The Cartel Theory of Everything; Housing (Article)

Disparity of Large-Cap vs. Small-/Mid-Cap Valuations | Peter Bernstein on Bubbles and Survival (Podcast)

Thank you for reading all the way to the end…

I hope you enjoyed this post and I would love to hear your feedback (both positive & negative).

Lastly, I would really appreciate if you would share this newsletter with anyone who you think might benefit from this or just might enjoy reading what I’m writing.

Sincerely,

Mr Zaye

P.S. Check out my LinkTree ⬅️ .

P.S.S. Don’t forget to ❤️ if you enjoyed it.