ACCESS Newswire, Inc. ($ACCS)

"The PR industry optimized for pricing power. ACCESS Newswire optimized for users."

Hello and welcome, if you are not a subscriber, you can do so with the button below:

With that out of the way…

What’s inside…

Company (elevator pitch)

(Past) From Issuer Direct to ACCESS Newswire

(Present) About ACCS

Management

Competitors

Financials & Metrics

Thesis

Conclusion

Holdings Disclosure

Personal Touch

Disclaimer is at the end.

1. Company (elevator pitch)

ACCESS Newswire (ACCS) is a founder-led communications platform that’s transitioning from transactional press releases to a subscription-first PR and IR SaaS model. About half of revenue is already recurring, gross margins run around 75%, and the core business is EBITDA-positive. The market still prices it like a legacy newswire, but if ARR conversion continues, this is a small-cap platform re-rating story with operating leverage just starting to show.

2. (Past) From Issuer Direct to ACCESS Newswire

Issuer Direct’s roots date back to 1988, when it was founded as part of the early wave of corporate communications and regulatory technology providers focused on helping public companies manage disclosure obligations and investor communications. Over its first decade, Issuer Direct established itself as a niche provider of compliance and communications solutions serving thousands of clients ranging from startups to large global brands.

Throughout the 2010s, the company expanded both organically and through strategic acquisitions, steadily broadening its product footprint. Early acquisitions included precision investor relations tools and transfer agent capabilities, which added depth to its compliance and corporate communications offerings. In 2014, Issuer Direct acquired ACCESSWIRE, bringing in a press release distribution business that complimented its core regulatory services. In 2017, it acquired Interwest Transfer Company, further strengthening its service portfolio. By 2019, the company had moved its operations to Raleigh, North Carolina, centralizing its growth efforts.

A particularly pivotal event in Issuer Direct’s evolution occurred in November 2022, when the company acquired Newswire.com, a leading press release distribution and media analytics platform. This acquisition almost doubled its press release customer base and significantly increased its communications revenues, reshaping Issuer Direct from a primarily compliance-oriented business into a more communications-focused technology company.

Over time, Issuer Direct built a blended business encompassing regulatory compliance, investor relations, press release distribution, media monitoring, and communications analytics. While successful, this hybrid model also led to a complex portfolio with varying capital intensity and growth profiles

3. (Present) About ACCS

ACCESS Newswire, Inc. (ACCESS) ACCS 0.00%↑ is undergoing a fundamental transformation. In early 2025, the company formally rebranded as ACCESS Newswire and divested its legacy compliance business in February of that year. This transaction removed a capital-intensive, lower-multiple segment and materially simplified the operating structure. Proceeds from the sale were used to reduce debt by approximately 80%, significantly improving balance sheet flexibility.

Today, ACCESS Newswire provides an integrated suite of communications, distribution, and analytics tools designed to help organizations create, distribute, monitor, and measure corporate messaging across traditional media, digital outlets, and investor-facing channels.

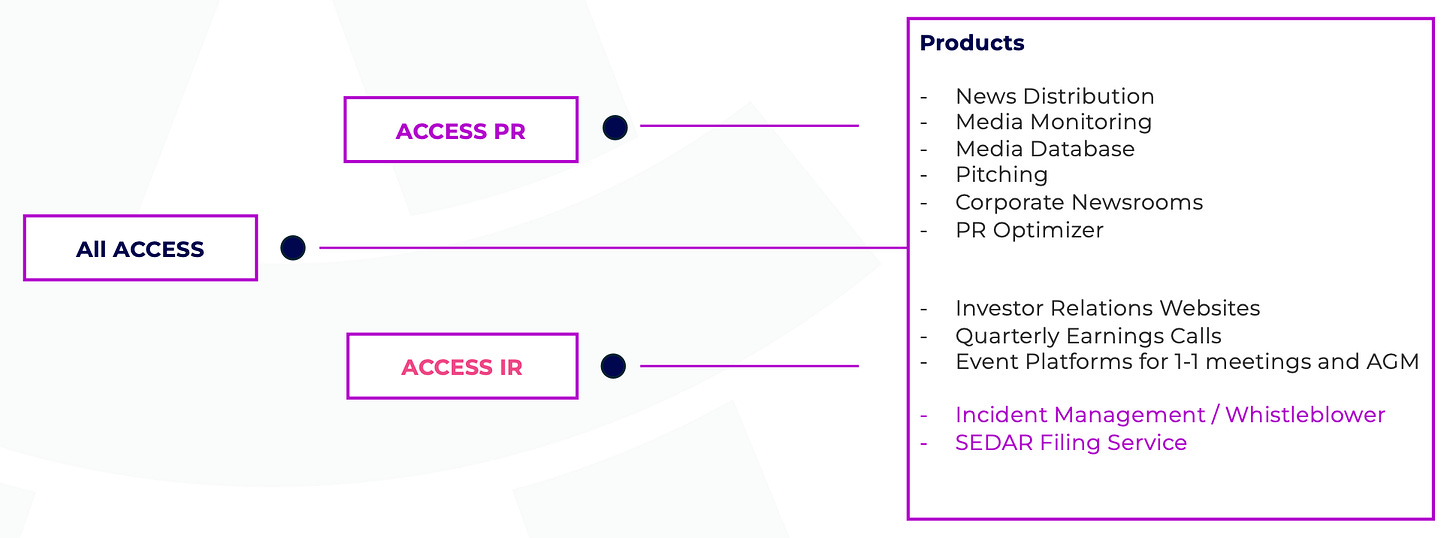

The platform is organized across three primary product groupings:

ACCESS PR - a subscription that includes press release distribution, media monitoring, pitching and database.

ACCESS IR - a subscription that includes investor relations website, quarterly earnings calls, and press release distribution to cover the announcement of your earnings date and actual

earnings releasesALL ACCESS – encompasses the best of both ACCESS PR and ACCESS IR into a customized platform for each custome

This convergence strategy is central to management’s long-term vision of positioning ACCESS as a single system of record for corporate storytelling and stakeholder communication.

Historically, the corporate communications industry has been dominated by transactional pricing models, particularly pay-per-press-release economics. ACCESS is actively shifting away from this model toward recurring subscriptions.

As of 2025, approximately half of company revenue is subscription-based, and management has stated a target of roughly 75% subscription revenue by the end of 2026. Subscription customers generate meaningfully higher lifetime value, more predictable revenue streams, and improved margin stability compared to transactional users.

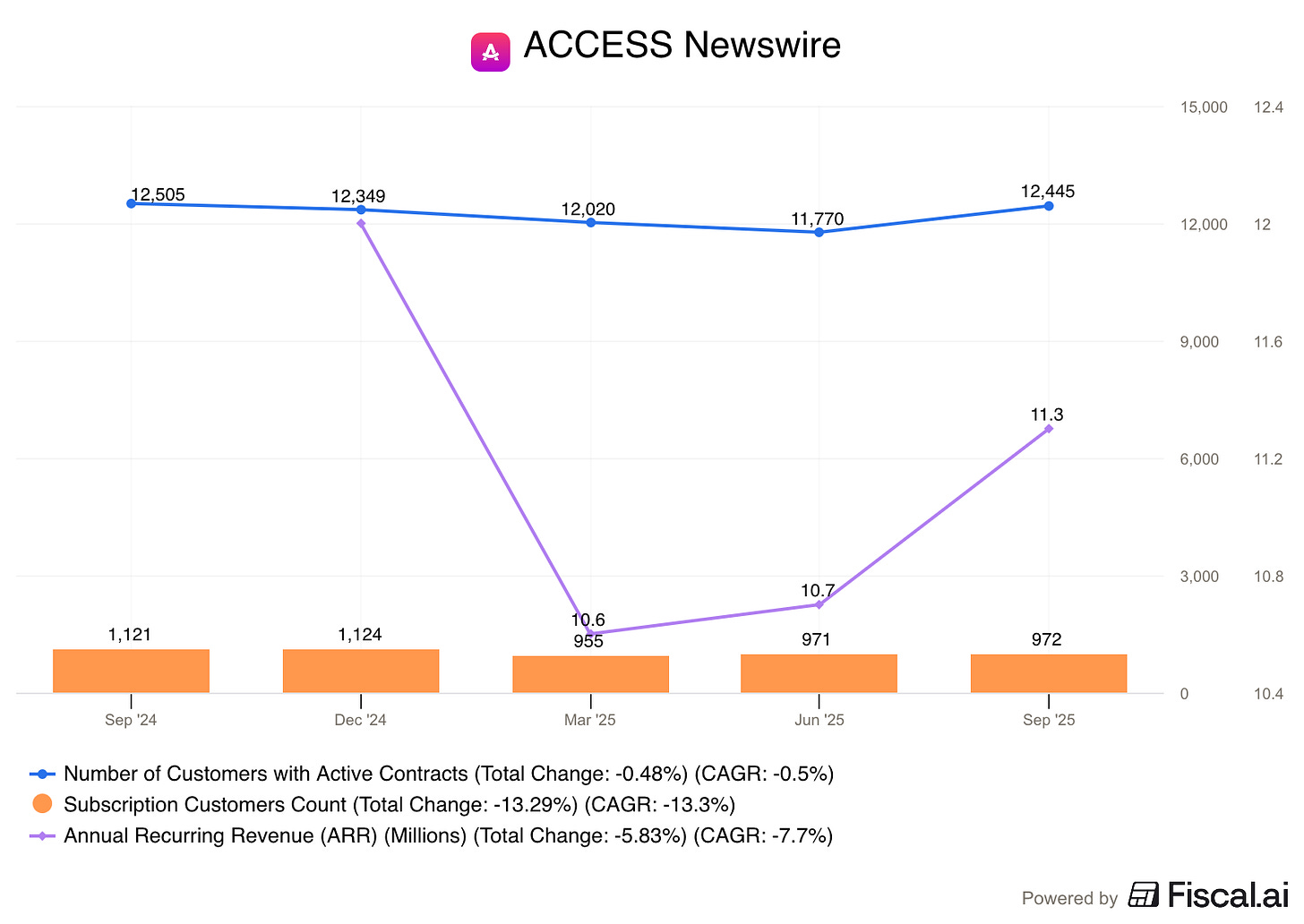

From a customer perspective, ACCESS reported approximately 12,400 total customers as of Q3 2025, of which roughly 970 were subscription customers. Average ARR per subscriber stood at approximately $11,650, representing roughly 14% year-over-year growth. Even modest conversion of the remaining non-subscriber base represents a meaningful ARR expansion opportunity.

ACCESS is increasingly positioning itself as a technology-enabled communications platform rather than a simple distribution utility. AI-driven editorial automation has already produced measurable internal efficiency gains of approximately 10% through real-time content validation and workflow optimization. Customer-facing AI tools are in the process of being rolled out to reduce friction in reporting, analytics, and post-distribution measurement.

The platform also incorporates social media monitoring across more than 30 platforms, providing real-time sentiment analysis, engagement metrics, and reach analytics. These tools are integrated with leading social management platforms, enabling a more comprehensive view of communications performance.

The company’s #KillTheReport initiative reflects this broader shift. By replacing static post-distribution reports with real-time, prompt-based analytics, ACCESS addresses a longstanding pain point for PR professionals and further differentiates its platform from legacy competitors.

4. Management

ACCESS Newswire is led by Brian Balbirnie, the company’s Founder and Chief Executive Officer. Balbirnie co-founded Issuer Direct (now ACCESS Newswire) and has served as CEO continuously since inception. His background is primarily rooted in corporate communications, disclosure, and investor relations services, and he has been directly involved in shaping the company’s product offerings and strategic direction throughout its history.

Under Balbirnie’s leadership, Issuer Direct expanded through a combination of organic development and acquisitions, building capabilities across compliance services, investor relations infrastructure, and press release distribution. Over time, this included the acquisition and development of the ACCESSWIRE platform and, later, the acquisition of Newswire.com, which materially expanded the company’s communications footprint and customer base. Balbirnie has overseen the integration of these platforms and the consolidation of multiple brands into a unified operating structure.

The broader management team consists of executives with long tenures inside the organization, particularly across product, technology, and operations. Many senior leaders joined the company through acquisitions and have remained through subsequent integrations, contributing to institutional knowledge and continuity. Collectively, management’s experience is concentrated in communications technology, PR workflows, investor relations services, and regulatory-facing customer environments.

Other notable shareholders:

Topline Capital Management, LLC - 18.3% or 709,264 shares.

Graeme Rein (Board Member and CIO of Yorkmont Capital Management, LLC) - GR owns 1.61% and Yorkmont owns 5.24% and in total 6.85% or 265,091 shares.

5. Competitors

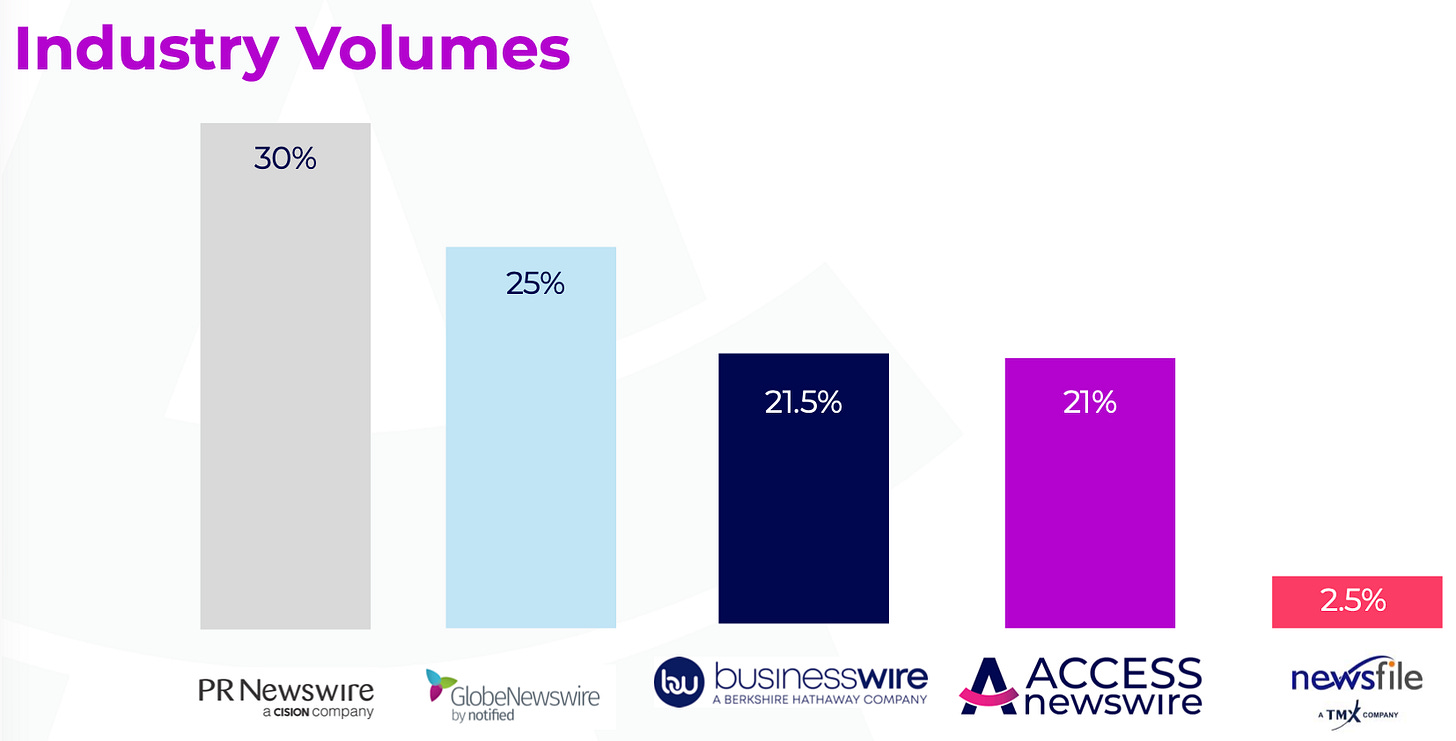

The press release and corporate communications market remains dominated by legacy incumbents that historically benefited from distribution scale, deep enterprise relationships, and high switching costs. While these incumbents continue to hold meaningful pricing power, the category is also increasingly defined by customer dissatisfaction with opaque pricing, rigid contracts, siloed product experiences, and slow platform innovation. This creates an opening for a more unified, subscription-oriented platform that competes on workflow, analytics, and customer experience rather than pure distribution reach. Enter ACCESS

GlobeNewswire, now part of Notified, is typically strongest where global distribution breadth and enterprise credibility matter most. Its footprint and long-standing relationships can make it a default choice for larger customers with global needs or established vendor lists. However, for many mid-market and cost-sensitive organizations, GlobeNewswire is perceived as relatively expensive and more rigid in contract structure. In addition, its offering is often viewed as distribution-led rather than deeply integrated PR tooling, which can limit its appeal for teams that want a single platform that connects creation, distribution, monitoring, and measurement in one workflow.

PR Newswire, owned by Cision, remains one of the most recognized names in the industry and benefits from strong market positioning, regulatory familiarity, and entrenched corporate procurement relationships. That said, the PR Newswire model is frequently criticized by customers for opaque pricing, transaction-heavy economics, and the feeling of paying “tolls” rather than subscribing to a value-expanding platform. Where ACCESS aims to align incentives through subscriptions and bundled functionality, PR Newswire’s legacy structure can feel misaligned with modern expectations around predictability, usability, and measurable ROI.

ACCESS Newswire’s competitive positioning is best understood not as an attempt to outspend incumbents, but as an attempt to out-execute them on customer experience and business model alignment. The company emphasizes transparent and predictable pricing, a unified PR and IR offering that reduces fragmentation, and a subscription-first approach that encourages platform adoption rather than one-off transactions. ACCESS also appears to be innovating faster in areas like AI-assisted workflows, social monitoring, and real-time analytics, which can resonate with customers who are dissatisfied with static reporting and legacy toolchains. In effect, ACCESS’s go-to-market advantage is based on being a more modern, converged platform that is easier to adopt, easier to understand economically, and more capable of increasing customer value over time

6. Financials & Metrics

All financial figures referenced below reflect continuing operations only and exclude the divested compliance business.

For the first nine months of 2025, ACCESS generated revenue of $16.8 million and maintained gross margins of approximately 75%. Operating losses narrowed materially to $1.1 million, compared to a $2.0 million operating loss during the same period in 2024. Net loss from continuing operations was approximately $1.0 million.

Importantly, Q3 2025 marked a near break-even quarter on a GAAP basis for continuing operations, reflecting the early impact of operating leverage following restructuring.

Adjusted EBITDA further highlights this trend. The company generated adjusted EBITDA of $933,000 in Q3 2025, representing a 16% margin. For the first nine months of the year, adjusted EBITDA totaled $2.3 million, or approximately a 14% margin. These results underscore the profitability potential of the core business as revenue mix continues to shift toward subscriptions.

As of September 30, 2025, ACCESS reported cash and equivalents of $3.26 million and net accounts receivable of $4.14 million. Deferred revenue stood at $5.02 million, up from $4.74 million at year-end 2024, signaling continued momentum in subscription bookings.

The balance sheet has been materially strengthened following the compliance divestiture. Long-term debt declined from $15.9 million at year-end 2024 to approximately $2.8 million post-sale. This reduction significantly lowers financial risk and allows management to focus capital allocation on product development and growth initiatives rather than debt service.

7. Thesis

ACCESS Newswire should be evaluated as a high-margin communications SaaS platform in transition rather than a declining legacy newswire business. The company represents a subscription conversion story supported by a post-restructuring balance sheet and visible operating leverage.

If management continues to execute on ARR growth, platform adoption, and sustained profitability, ACCESS has the potential to re-rate from a legacy services valuation toward a modern platform multiple.

Why the Market Is Mispricing ACCESS

Legacy Labeling Error:

A meaningful portion of the market still appears to mentally categorize ACCS as either a legacy issuer-services business or a low-growth press release utility. That framing fails to fully reflect the strategic transformation that occurred through the compliance divestiture, the corporate rebrand, and the company’s deliberate repositioning around a converged communications platform. As a result, the market may be anchoring on an outdated business mix and an outdated narrative, rather than underwriting the go-forward model.

GAAP Noise Obscures Core Earnings Power:

Reported GAAP results can appear messy during periods of restructuring and major portfolio changes, particularly when discontinued operations, tax impacts, and transaction-related items distort comparability. In ACCS’s case, these items can obscure the underlying progress of the continuing operations business, which has already demonstrated positive adjusted EBITDA at mid-teens margins. As long as the market continues to focus on noisy GAAP headlines rather than normalized operating performance, the company’s improving earnings power may remain underappreciated. Then again you can’t “eat” EBITDA…

ARR Is Underappreciated (and Not Fully Surfaced in Filings):

Despite the fact that subscription mix has reached roughly half of revenue and management has communicated a clear target to push that mix materially higher, subscription ARR is not always cleanly “headline visible” in the way many SaaS investors expect. In the absence of a highly standardized ARR disclosure format, investors may underestimate the extent of recurring revenue durability and the degree to which future cash flows are becoming more predictable. In this context, deferred revenue trends may be a more useful signal than the market is currently crediting, particularly because deferred revenue functions as a forward indicator of contracted subscription activity that has not yet been recognized on the income statement.

Small-Cap Illiquidity and Limited Coverage Create Structural Discount:

ACCS’s position as a small-cap name on NYSE American naturally limits its investor audience. With modest liquidity and limited sell-side coverage, the stock is less likely to attract generalist SaaS investors, large funds with liquidity constraints, or passive inflows tied to major indices. This dynamic can create a persistent valuation discount that only closes when operational progress becomes impossible to ignore, or when a broader investor base begins to understand the business as a platform rather than a legacy service provider.

Operating Leverage Is Inflecting Faster Than Perception:

The company’s financial profile includes structural elements that are typically associated with platform businesses, including gross margins around 75%, improving efficiency post-restructuring, and the potential for strong incremental margins as subscription revenue expands. If headcount remains relatively flat and subscription mix rises, incremental revenue should translate into disproportionately higher EBITDA. The market may be slow to price this dynamic until revenue growth becomes more visibly ARR-driven and profitability becomes more consistently reflected in reported results.

With that said near-term revenue growth remains modest, and the company faces ongoing competitive pressure from larger incumbents with substantial resources. Execution risk exists around subscription conversion, and customer budgets may prove sensitive during macroeconomic downturns. That said, the company’s significantly reduced leverage, strong gross margins, and improving profitability profile materially mitigate existential risk.

8. Conclusion

ACCESS Newswire should be analyzed as a platform transition and re-rating candidate rather than a static press release business. The company has simplified its model, cleaned up its balance sheet, demonstrated subscription traction, and achieved early operating leverage. The remaining question is top-line acceleration, not structural viability. If subscription mix and ARR growth continue to progress toward management’s stated targets, the gap between market perception and underlying economic reality is likely to narrow meaningfully, and if not buy backs should take care of that over time.

That said, I’ve too often jumped in prematurely and paid for it mentally while companies worked through long transformation periods. Even when operational progress became visible, Mr Market frequently withheld recognition for extended stretches. While that delay can ultimately create opportunity, it has taught me the value of patience. This time, I plan to wait for clearer visibility before committing capital.

This one is on my watchlist.

9. Holdings Disclosure

At the time of this publication, I do not own shares of ACCS 0.00%↑ in my main porftolio.

P.S. Don’t forget to ❤️ if you enjoyed it.

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.