April 2023 Portfolio Update

Topics: Quote, Portfolio Update, Comments From Me, Portfolio Discussion, Announcing Collaboration, Book, & something extra for paid subscribers...

Quote for this month:

“The discipline which is most important in investing is not accounting or economics, but psychology.” - Howard Mark

Portfolio Update*

*I am NOT a financial advisor, I’m sharing my investing journey. Do your own research.*

Portfolio (Basic):

To get access to detailed (full) portfolio breakdown (which will be at the end) consider becoming a paid subscriber:

Comments From Me

I would like to start with a few quick comments:

I’m currently on vacation (first real vacation in a really long long time), so I’m doing this post a quick one. I hope I’m forgiven for that.

I will hit on few points, but there wasn’t really much happening in the month of March anyways ex macro stuff (there is something always happening in the world).

On April 11th I will be at Project Punch Card Investing Conference 2023. If anyone is going to it let me know on Twitter or via email.

There is again some “hiccups” on the job (that’s what happens when you run your own business), so I have to spend a bit more time with my day job while I sort out the “problem” which means a bit less day to day on Twitter or Commonstock, which might be actually a good thing.

Lastly if you are going to Omaha for AGM, there will be a free event for Boston Omaha (company) that I might go to and so I’m sharing with others if you want to check it out too.

2023 Boston Omaha Eighth Annual Shareholder Meeting and Reception.

Portfolio Discussion

For the most part portfolio is unchanged.

I added back OZKAP 0.00%↑ as the fiasco with SIVB 0.00%↑ is easing up and it seems (but not guarantee) that the whole run on the bank is was temporary thing that was created out of the thin air (kind of ish).

While in Florida did some due diligence on SFM 0.00%↑

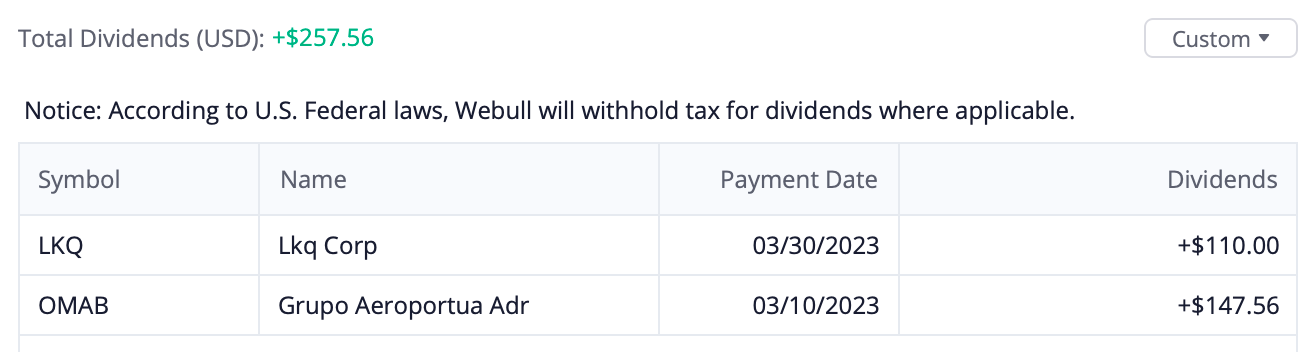

Dividends for March:

I’m sitting on almost zero cash in main portfolio, but I am currently transferring $25,000 into my IBRK account to start dipping my toes in international markets, once transfer is complete and I find a target I will discuss more in the “Section below is for paid subscribers only…”

Announcing Collaboration(ish)

I’m really excited to announce that I will be collaborating with SLT Research. SLT posts deep dives on different companies on Commonstock, sometimes in one big piece and sometimes in couple posts.

I will be taking everything together and combining it into one and posting it on my substack as an add-on to expend on my “Equity Research” library with SLT as Co-Author.

All research on those posts will be done by SLT and I highly recommend check out their Twitter and Commonstock and obviously following them to never miss anything new and interesting.

PS if you are interested in doing similar collaboration or if you would like to be featured with your own deep dive on my substack to get exposure to almost 1500 subscribers, email me at from100kto1m@substack.com to discuss some kind of partnership.

Book

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished one audiobook:

Flash Crash: A Trading Savant, a Global Manhunt, and the Most Mysterious Market Crash in History by Liam Vaughan

YZ: I really really enjoyed this audiobook. Flash Crash should be a movie! The story is about a kid (a man) who supposedly caused May 6, 2010 Flash Crash and how “he got to that point”. But when you actually read/listen to the book and the details of how crazy real life is / can be…it just shows how random our world can be and yet again how it shows it pays to be a long term investor.

Goodreads:

On May 6, 2010, financial markets around the world tumbled simultaneously and without warning. In the span of five minutes, a trillion dollars of valuation was lost. The Flash Crash, as it became known, represented the fastest drop in market history. When share values rebounded less than half an hour later, experts around the globe were left perplexed. What had they just witnessed?

Navinder Singh Sarao hardly seemed like a man who would shake the world's financial markets to their core. Raised in a working-class neighborhood in West London, Nav was a preternaturally gifted trader who played the markets like a computer game. By the age of thirty, he had left behind London's "trading arcades," working instead out of his childhood home. For years the money poured in. But when lightning-fast electronic traders infiltrated markets and started eating into his profits, Nav built a system of his own to fight back. It worked--until 2015, when the FBI arrived at his door. Depending on whom you ask, Sarao was a scourge, a symbol of a financial system run horribly amok, or a folk hero who took on the tyranny of Wall Street and the high-frequency traders.

A real-life financial thriller, Flash Crash uncovers the remarkable, behind-the-scenes narrative of a mystifying market crash, a globe-spanning investigation into international fraud, and the man at the center of them both.

I give it 4.3 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

SPOT 0.00%↑ VMD 0.00%↑ GOOG 0.00%↑ GOOGL 0.00%↑ IAC 0.00%↑ SFM 0.00%↑ LKQ 0.00%↑ WBD 0.00%↑ OZK 0.00%↑ PYPL 0.00%↑ TCS 0.00%↑ MITK 0.00%↑ OMAB 0.00%↑ OPFI 0.00%↑ OZKAP 0.00%↑ C 0.00%↑ VEA 0.00%↑ VTI 0.00%↑ URI 0.00%↑ OPBK 0.00%↑ MKL 0.00%↑ DJCO 0.00%↑ RICK 0.00%↑ BAM 0.00%↑ GDOT 0.00%↑ OXY 0.00%↑ ONFO 0.00%↑ KRE 0.00%↑ SYF 0.00%↑ UNP 0.00%↑ CVS 0.00%↑ UHAL 0.00%↑ DG 0.00%↑ PACW 0.00%↑ IDT 0.00%↑ TROW 0.00%↑ SAM 0.00%↑ IBKR 0.00%↑ PBR 0.00%↑ ASO 0.00%↑ IBA 0.00%↑ KNX 0.00%↑ WWE 0.00%↑ FLWS 0.00%↑ NNI 0.00%↑ SGA 0.00%↑ MASI 0.00%↑ ONON 0.00%↑ CRPT 0.00%↑ ORI 0.00%↑ TZOO 0.00%↑ ULTA 0.00%↑

$EVVTY $ADYEY $LNSTY $HEINY $NTDOY

Section below is for paid subscribers only…