August 2025 Portfolio Update

Quote, Portfolio, CMC, Earnings Season, Books, and more ...

Quote for this month:

“My intention is to hold stocks forever, but the harsh reality is every stock has different shelf life.” - Ian Cassel

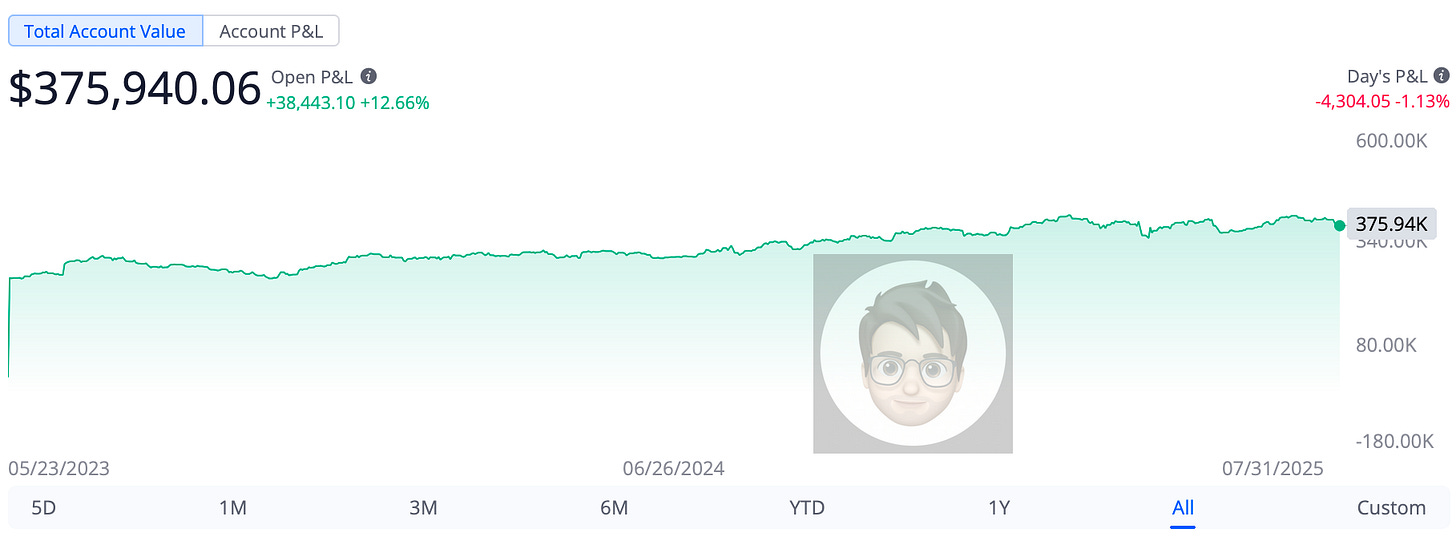

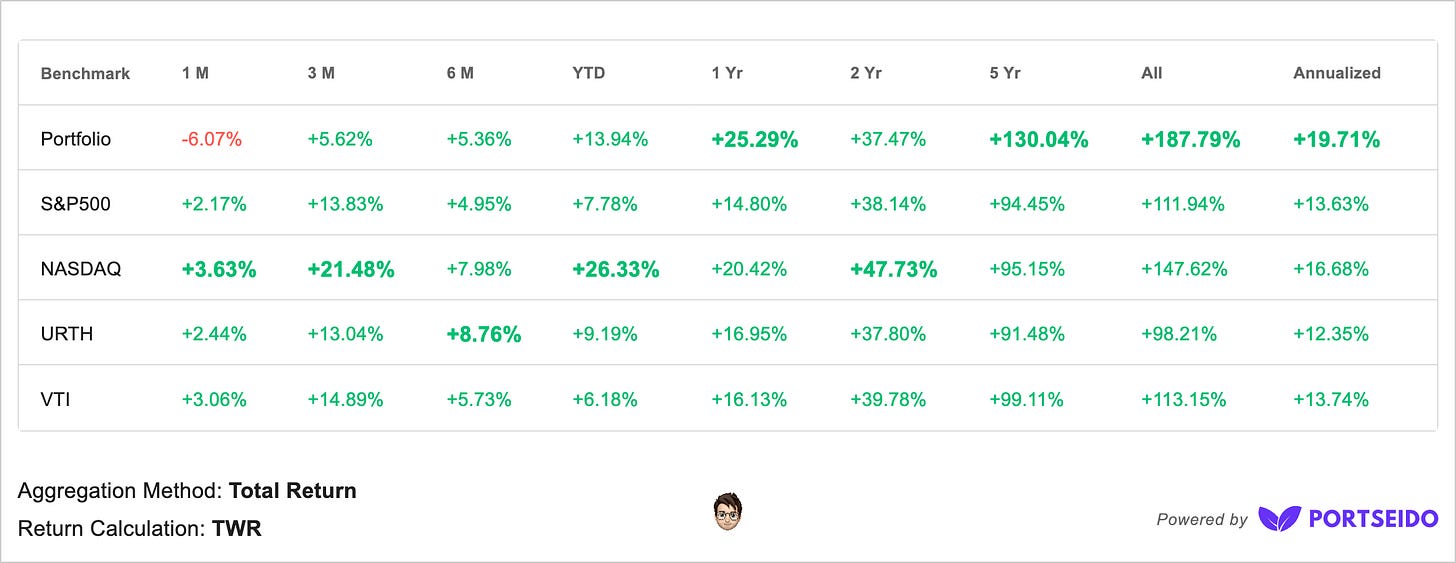

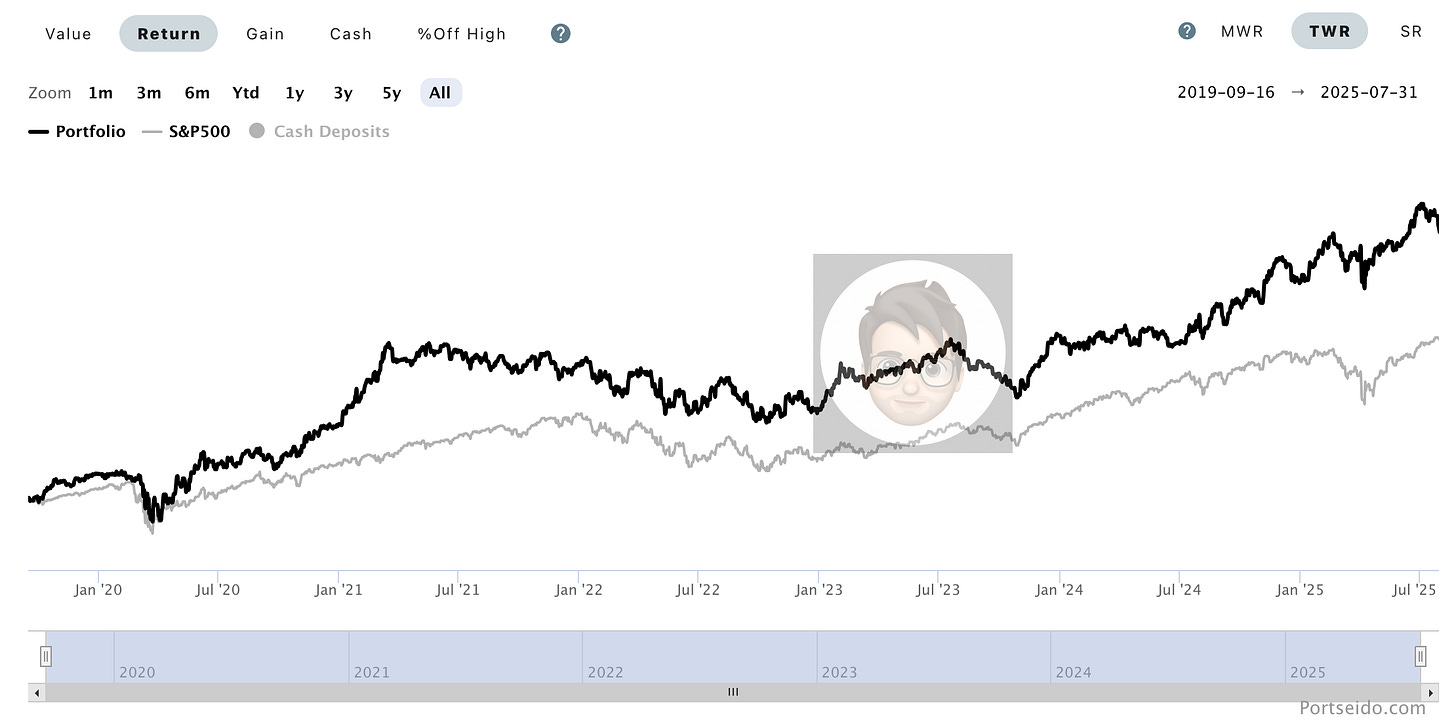

*Portfolio*

*I am NOT a financial advisor. I’m sharing my investing journey. Not investment advice. Do your own research.*

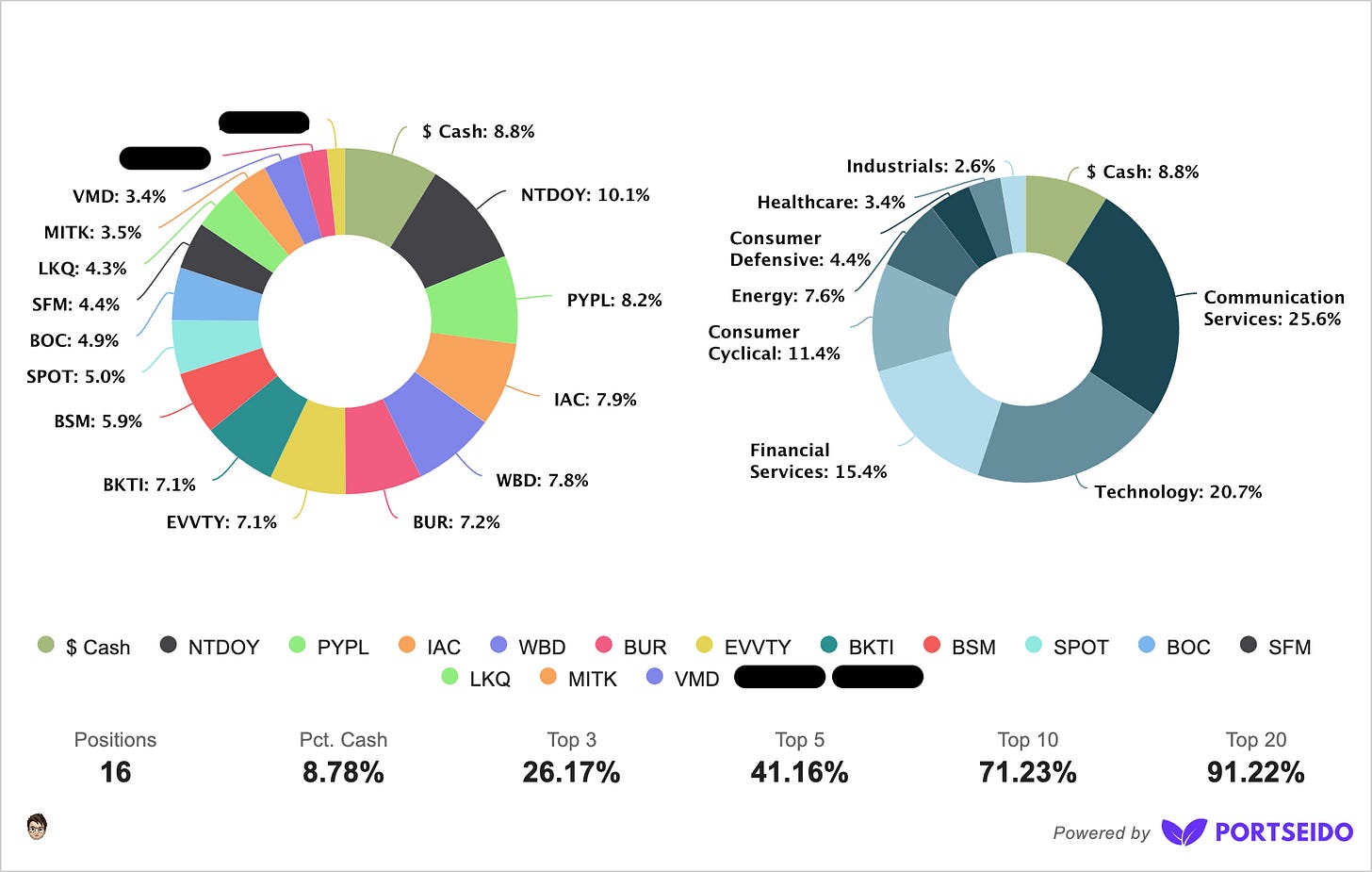

Portfolio (Basic):

Holding since:

2020 - LKQ 0.00%↑ - 03

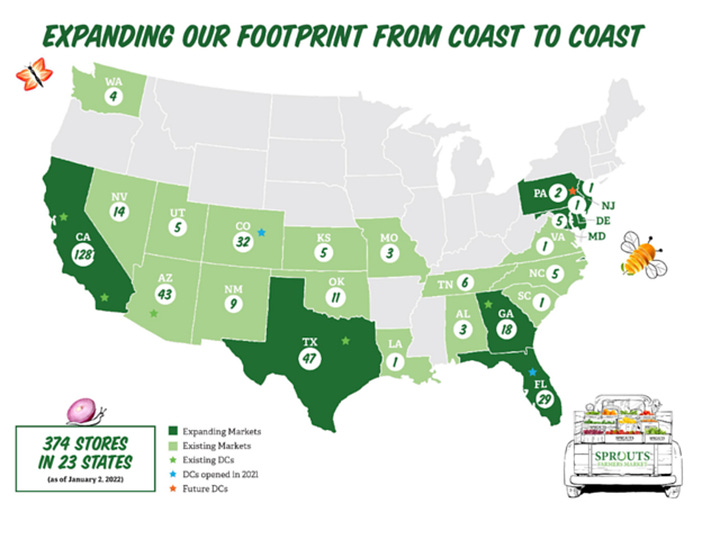

2021 - SFM 0.00%↑ - 03 | VMD 0.00%↑ - 05 | SPOT 0.00%↑ - 11

2022 - MITK 0.00%↑ - 01 | WBD 0.00%↑ - 04 | $EVVTY - 09 | $NTDOY - 12

2023 - PYPL 0.00%↑ - 01 | BSM 0.00%↑ - 05 | BUR 0.00%↑ - 09

2024 - (First ???) - 01 | BKTI 0.00%↑ - 04 | BOC 0.00%↑ - 09

2025 - IAC 0.00%↑ - 01* | (Second ???) - 03 |

*IAC 0.00%↑ originally was purchased in 2021, but sold at the end of 2024 for tax loss purposes and re-bought back in 2025.

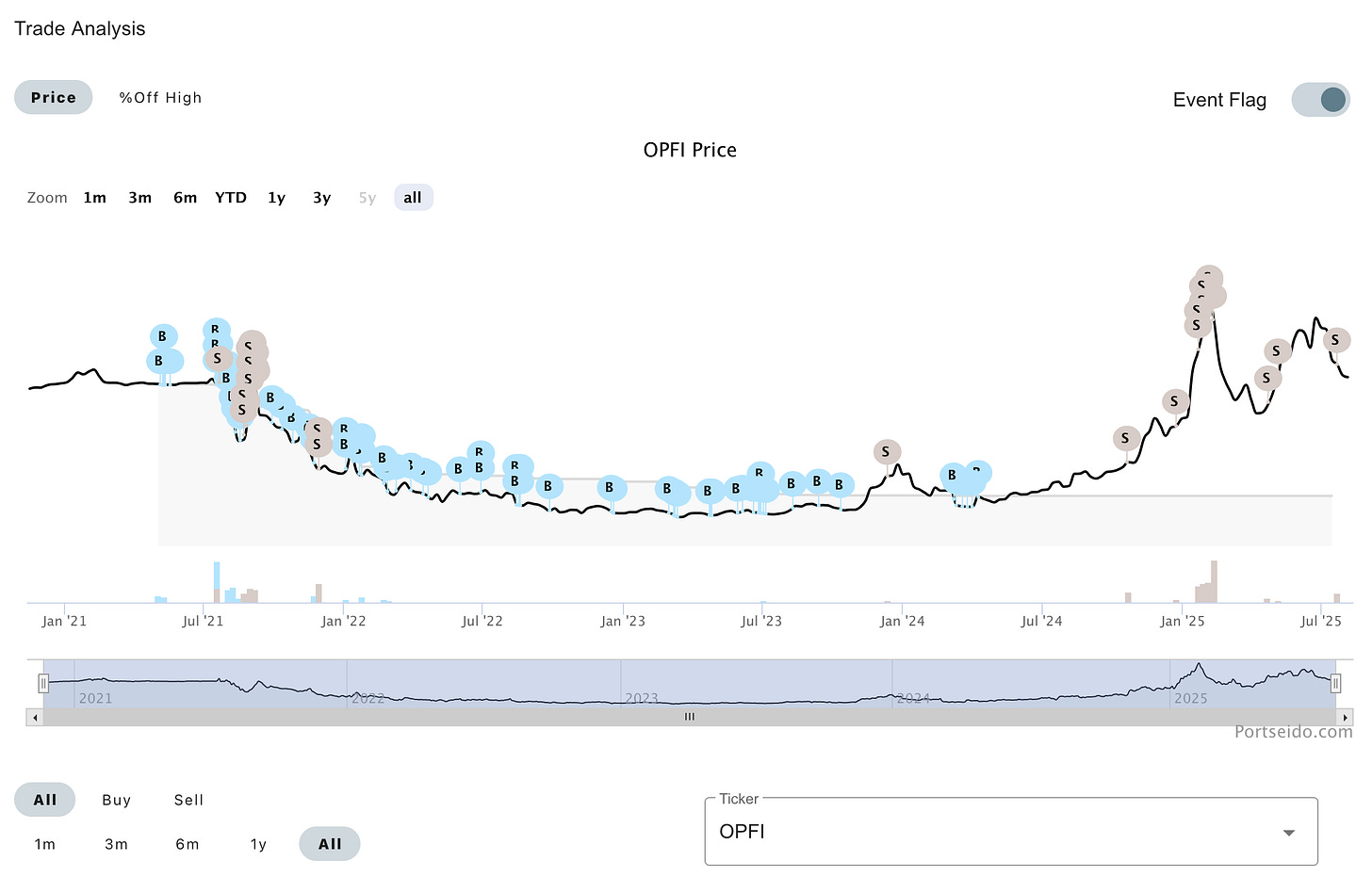

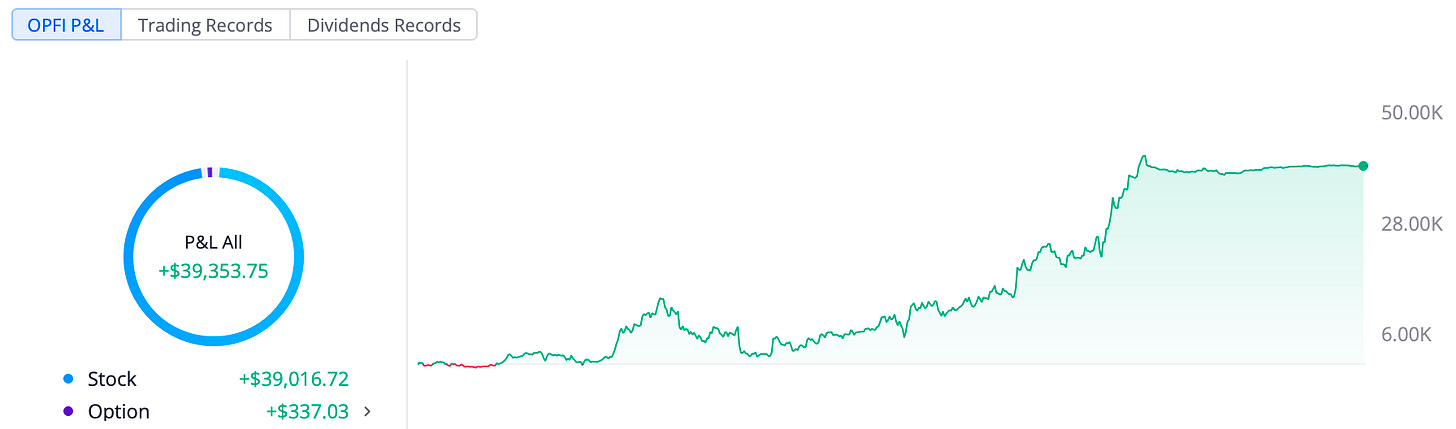

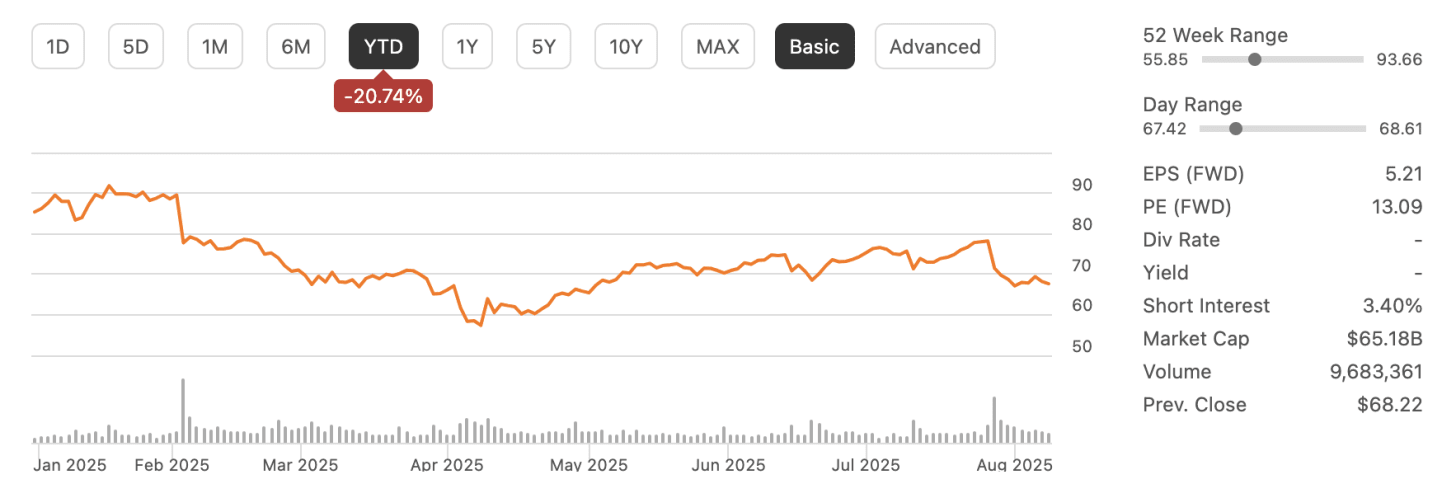

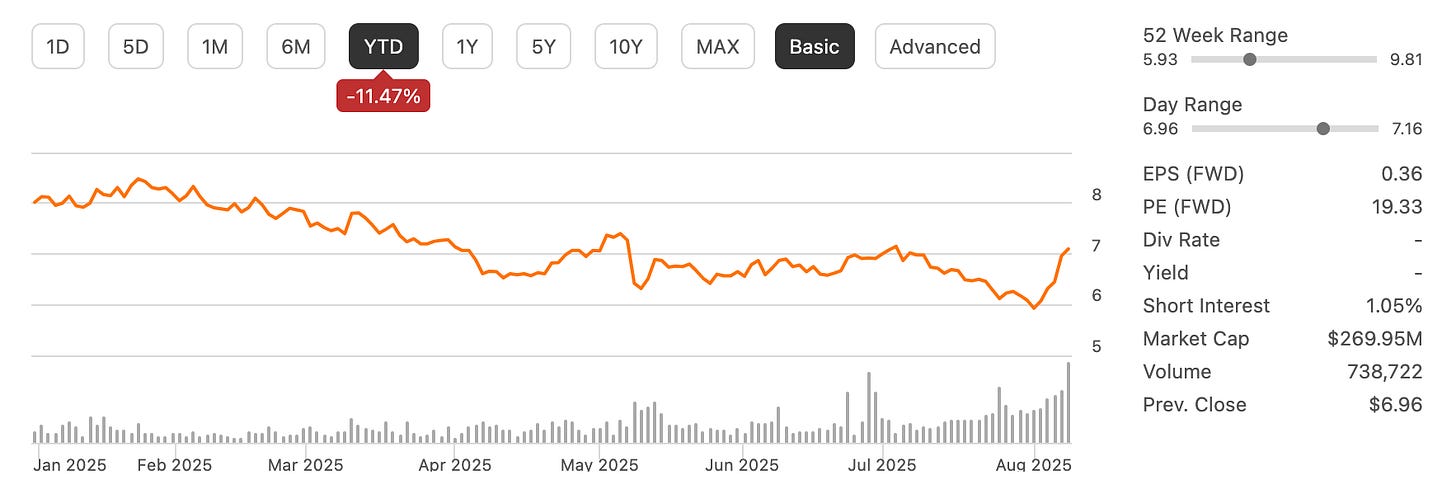

Complimentary Monthly Commentary - CMC

I have fully exited OPFI 0.00%↑ - the reason for exit is combination of profit taking, time spend in OPFI (mental burn), and the biggest one CEO’s conversion of V shares into A shares. I have originally bought OPFI when it was a spac - FGNA in 2021 … four years later and in 2025 its OPFI …

When I say this was not an easy hold, well you can see from the picture above … its not always fun catching “a falling knife” … with average price $2-$3 and average exit price $12-$15 … but when done right and when you get lucky …

… falling knifes become multi baggers…

So far OPFI is holding 3rd place for my largest win in $$$ (SFM 1st, and SPOT 2nd)

As always a reminder that if you are paid subscriber, I provide same day trades and weekly updates on the portfolio, with that said I don’t trading per se , which means sometimes I’m very active with portfolio and sometimes I am not. This is my real portfolio and my real money, I’m here to make more money, not to look cool.

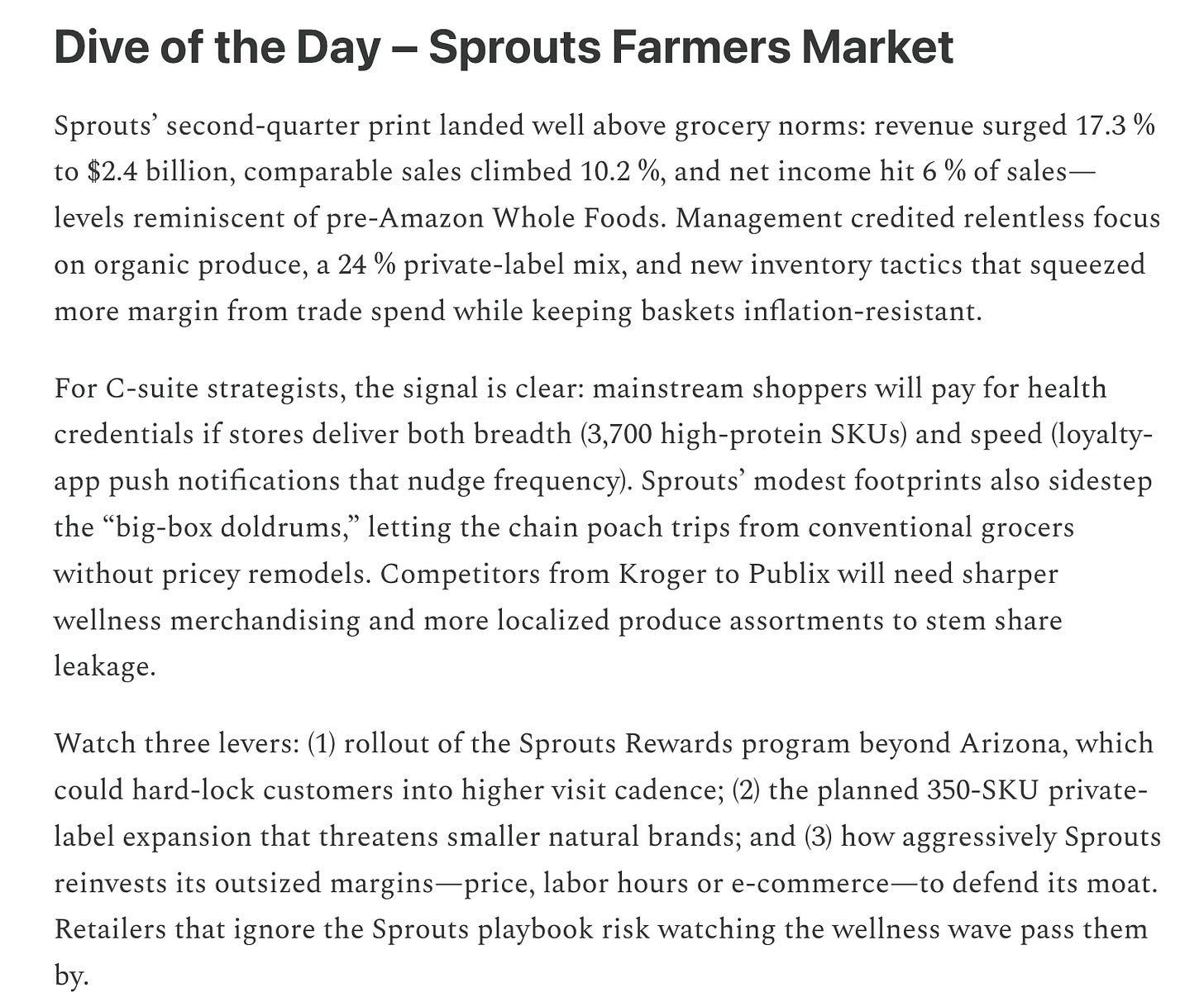

Earnings Season

Lets keep off the earning season…

Books

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished one audiobooks and one physical book:

The 5 Types of Wealth: A Transformative Guide to Design Your Dream Life by Sahil Bloom

YZ:

Before “The 5 Types of Wealth” if I was asked whats one book that I would recommend, I would say it would be a book by David Chilton called The Wealthy Barber, but I think I will be giving that title to The 5 Types of Wealth now.

Sahil Bloom really hits it home with not just wealth (money) type of well wealth but also time, family, personal health, etc.

Although I will not say that I agree with most of it FOR ME since a lot of things I’m already happy/comfortable with … for someone who is still looking and trying to figure out life, this book is a must!

If you can’t afford this book and you DM me about it, I will send you a copy for free!

(No, Sahil Bloom is not paying me, he probably doesn’t even know I exist)

Goodreads:

A groundbreaking guide to rejecting the default path and designing your dream life—a life centered around The 5 Types of Wealth. Launch your journey to fulfillment with this transformative system from inspirational writer, speaker, and entrepreneur Sahil Bloom.

Harsh You’ve been lied to. Throughout your life, you’ve been slowly indoctrinated to believe that money is the only type of wealth. The Your wealthy life may involve money, but in the end, it will be defined by everything else.

In The 5 Types of Wealth, Sahil Bloom offers a transformative guide for redesigning your life around five types of wealth—Time Wealth, Social Wealth, Mental Wealth, Physical Wealth, and Financial Wealth—that will lead to a durable satisfaction and happiness you can build and maintain across the seasons of your life.

Whether you are a recent college graduate, mid-life warrior, or a retiree, this playbook will unlock new levels of freedom and fulfillment,

• Control over how you spend your time

• Depth of connection with those around you

• Clarity of purpose, presence, and decision making

• Improved health and vitality

• Simple pathways to financial independence

Bloom’s unique blend of storytelling, questions, and actionable insights enables readers to make immediate positive change and build the joyful, balanced lives they’d previously only dreamed of.

I give it 4 out of 5 stars.

10½ Lessons from Experience: Perspectives on Fund Management by Paul Marshall

YZ:

101/2 Lessons was a quick read and didn’t really teach me anything new, but it was nice to get some reminders about practice vs theory and human psychology (when it comes to investing).

Personally book was a bit too much about Marshall Wace (almost like it was selling, but it wasn’t really) but Mr Marshall did say in the first pages that it will be his experience with Marshall Wace, so yeah…

Goodreads:

In 10½ Lessons from Experience, Paul Marshall distils the experience of 35 years of investing, including over 20 years at Marshall Wace, the global equity hedge fund partnership. He describes the disconnect between academic theory and market practice, in particular the reality and persistence of 'skill' - the continuing ability of the best practitioners to beat the market. But he also underscores the prevalence of uncertainty and human fallibility, showing how a successful investment management business must steer a path which recognises both the persistence of skill and the pitfalls of cognitive bias, human fallibility and hubris.

I give it 3 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

Sections below are for paid subscribers only…