December 2023 Portfolio Update

Topics: Quote, Portfolio & Discussion, Comments From Me, Books + Section for Paid subscribers.

Quote for this month:

"I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when they got up and boy does that help, particularly when you have a long run ahead of you." - Charlie Munger

R.I.P. Mr. Charles Thomas Munger

Portfolio Update*

*I am NOT a financial advisor, I’m sharing my investing journey. Do your own research.*

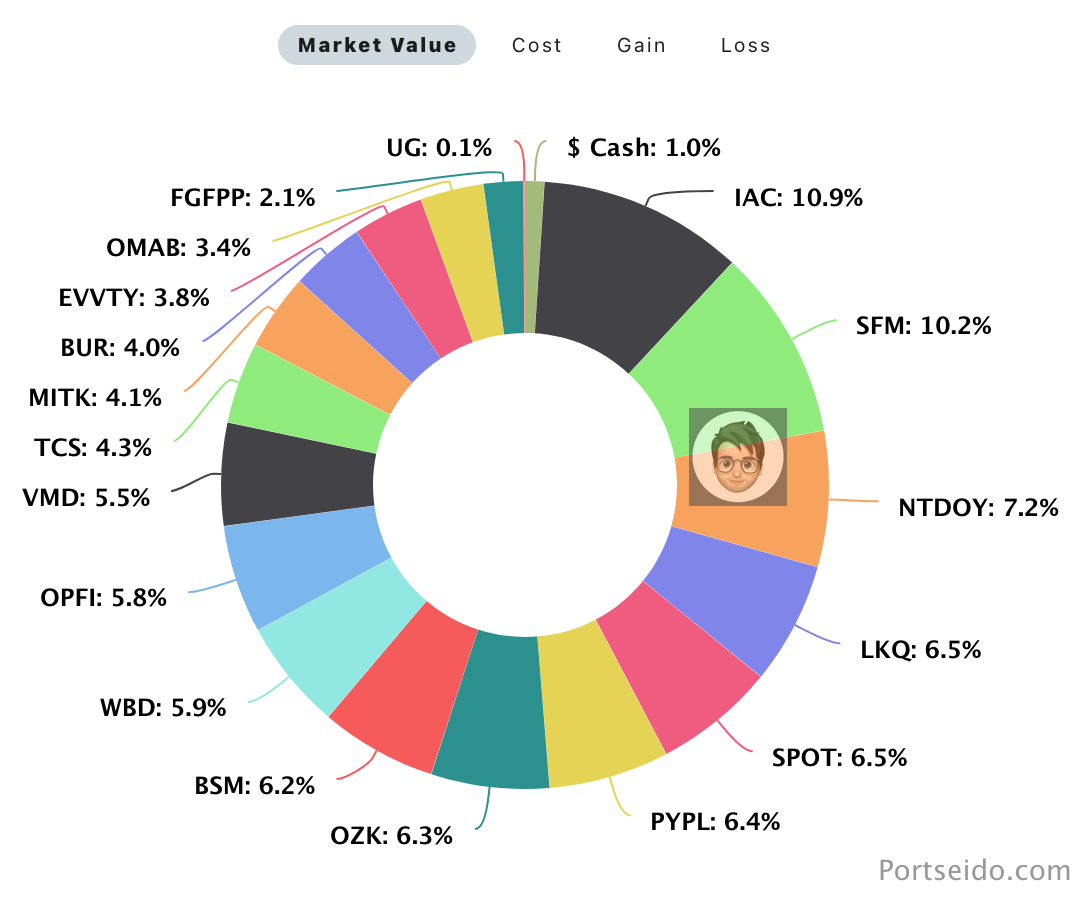

Portfolio (Basic):

To get access to full (detailed) portfolio + some other extras consider seven day free trial to get a sneak peek “behind the curtain”

Portfolio Discussion

Currently the numbers as of 12/06/2023: (total) $280,548 - (other) $25,000 = (mine) 265,548.

After 30 days and the latest quarterly filing, I have bought back a bit of UG 0.00%↑ (for now its less than 1%) company posted much better results that I thought they would and their focus on going offensive in 2024 + no debt gives me hope (not a good word to use) for much better future where UG doesn’t depend on Ashland Global Holdings as much…

Worth checking out article by Devin from Invariant

Since last update I have not sold out of anything (completely) but I did move money around (but nothing too extreme) inside of the portfolio (paid subs get all the details), so what gives about being up almost $40,000 since last update? nothing really … just Mr Market being sometimes too optimistic and sometimes too pessimistic… this time around I guess optimism is in the air…

This time around though, Mr Market found value in couple of things, such as:

OPFI - Had a big move, we went from being negative to finally being up double digits… no major news, I still think its undervalued…

SPOT , VMD, OZK, FGFPP + more - Had some good movements…

I’m not trying to put too much emphasis on anything as things go up and things go down and until you sell out of it, no real point of celebrations

Although it is kind of incomplete (because its missing FGFPP 0.00%↑ and it does not include cash or the actual buying and selling that was done throughout the year) its still cool stat that I was able to pull out of FinChat.io

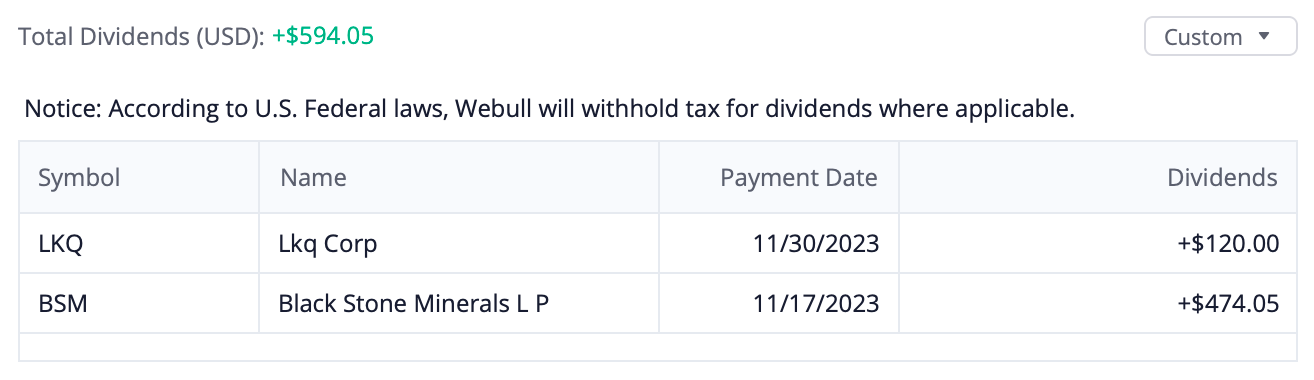

Dividends for November:

Comments From Me

I would like to keep this month’s portfolio semi-short as I will be entering into “December Holiday Season”. Next week there will be MOI Global Latticework, following week is Christmas, and the week after is New Year.

Work + Life schedule is extra busy for December.

In January Update I will do 2023Y Review, like last year .

December 2023, marks my third year at Substack … Woot Woot !

I cant believe how fast time flies when you enjoy the journey, I have removed paywall for the post that started it all, for those who are curious of how it all began:

I would like to wish everyone Happy Holidays and Happy incoming New Years, may everything good you wish for come true :)

I shall speak to most of you next year!

PS I’m always available via chat or Twitter DMs

Book

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished three audiobook and one physical book :

Same as Ever: A Guide to What Never Changes by Morgan Housel

YZ:

Morgan Housel’s new book was an interesting listen … Did I learn anything new? No not really … Did the book put big emphasis on that “things might change, but people don’t” ? Yes yes it did and that’s the whole point.

I wouldn’t say its a must-read-ASAP-kind of a book, but its definitely a must-read-at-some-point kind of book.

Goodreads:

From the author of the international blockbuster, THE PSYCHOLOGY OF MONEY, a powerful new tool to unlock one of life’s most challenging puzzles.

Every investment plan under the sun is, at best, an informed speculation of what may happen in the future, based on a systematic extrapolation from the known past.

Same as Ever reverses the process, inviting us to identify the many things that never, ever change.

With his usual elan, Morgan Housel presents a master class on optimizing risk, seizing opportunity, and living your best life. Through a sequence of engaging stories and pithy examples, he shows how we can use our newfound grasp of the unchanging to see around corners, not by squinting harder through the uncertain landscape of the future, but by looking backwards, being more broad-sighted, and focusing instead on what is permanently true.

By doing so, we may better anticipate the big stuff, and achieve the greatest success, not merely financial comforts, but most importantly, a life well lived.

I give it 4 out of 5 stars.

When Genius Failed: The Rise and Fall of Long-Term Capital Management by Roger Lowenstein

YZ:

When Genius Failed, had similar vibe to Same as Ever by MH except that technically it only followed one set of individuals. WGF was a great listen to get a feel for how no matter what Wall St does, it doesn’t change and probably will never change + this book showed that no matter what is your “rank” in life or how “smart” you are at the end of the day we all humans and we all make same dumb mistakes and we all want same “dumb” materialist things* so the next time you think someone is such a genius … really think about is that personally really “that much” better at whatever the task is…

We give too much credit to people with some kind of “rank-in-life”.

*to some extend, being over-dramatic

Goodreads:

In this business classic—now with a new Afterword in which the author draws parallels to the recent financial crisis—Roger Lowenstein captures the gripping roller-coaster ride of Long-Term Capital Management. Drawing on confidential internal memos and interviews with dozens of key players, Lowenstein explains not just how the fund made and lost its money but also how the personalities of Long-Term’s partners, the arrogance of their mathematical certainties, and the culture of Wall Street itself contributed to both their rise and their fall.

When it was founded in 1993, Long-Term was hailed as the most impressive hedge fund in history. But after four years in which the firm dazzled Wall Street as a $100 billion moneymaking juggernaut, it suddenly suffered catastrophic losses that jeopardized not only the biggest banks on Wall Street but the stability of the financial system itself. The dramatic story of Long-Term’s fall is now a chilling harbinger of the crisis that would strike all of Wall Street, from Lehman Brothers to AIG, a decade later. In his new Afterword, Lowenstein shows that LTCM’s implosion should be seen not as a one-off drama but as a template for market meltdowns in an age of instability—and as a wake-up call that Wall Street and government alike tragically ignored.

I give it 4 out of 5 stars.

Stillness is the Key: An Ancient Strategy for Modern Life by Ryan Holiday

YZ:

I listened to Stillness is the Key to refresh the “Power of Now” theme for myself. I’m far far away from being “stoic” when it comes to my family, because I can get really emotional when it comes to things that are close to me and yet I also can be rational when things are moving quickly and I have to “defuse” the situation… It’s hard for me to explain … but what I realized I like practice and listen to others (in books) concepts of self reflection and being presence in the moment, and although Stillness didn’t provide me with anything new … its good (for me) to keep reaffirming it.

Goodreads:

All great leaders, thinkers, artists, athletes, and visionaries share one indelible quality. It enables them to conquer their tempers. To avoid distraction and discover great insights. To achieve happiness and do the right thing. Ryan Holiday calls it stillness--to be steady while the world spins around you.

In this book, he outlines a path for achieving this ancient, but urgently necessary way of living. Drawing on a wide range of history's greatest thinkers, from Confucius to Seneca, Marcus Aurelius to Thich Nhat Hanh, John Stuart Mill to Nietzsche, he argues that stillness is not mere inactivity, but the doorway to self-mastery, discipline, and focus.

Holiday also examines figures who exemplified the power of stillness: baseball player Sadaharu Oh, whose study of Zen made him the greatest home run hitter of all time; Winston Churchill, who in balancing his busy public life with time spent laying bricks and painting at his Chartwell estate managed to save the world from annihilation in the process; Fred Rogers, who taught generations of children to see what was invisible to the eye; Anne Frank, whose journaling and love of nature guided her through unimaginable adversity.

More than ever, people are overwhelmed. They face obstacles and egos and competition. Stillness Is the Key offers a simple but inspiring antidote to the stress of 24/7 news and social media. The stillness that we all seek is the path to meaning, contentment, and excellence in a world that needs more of it than ever.

I give it 4 out of 5 stars.

All My Sons by Arthur Miller

YZ:

I must say that I almost did not listen to All My Sons Play by Arthur Miller, but I had couple of hours to spare and there was no good podcast so I said “why not” and I have to say I loved it!

It was short and (although) predictable at the end, the way the music and the actors made it very ‘ ALIVE ‘ and exciting.

Bonus points that you can listen to it for free with Spotify Premium :)

Goodreads:

Joe Keller and Herbert Deever, partners in a machine shop during the war, turned out defective airplane parts, causing the deaths of many men. Deever was sent to prison while Keller escaped punishment and went on to make lots of money. In a work of tremendous power, a love affair between Keller's son, Chris, and Ann Deever, Herbert's daughter, the bitterness of George Keller, who returns from the war to find his father in prison and his father's partner free, and the reaction of a son to his father's guilt escalate toward a climax of electrifying intensity.

Winner of the Drama Critics' Award for Best New Play in 1947, All My Sons established Arthur Miller as a leading voice in the American theater. All My Sons introduced themes that thread through Miller's work as a whole: the relationship between fathers and sons, and the conflict between business and personal ethics.

I give it 4.5 out of 5 stars.

Soul in the Game: The Art of a Meaningful Life by Vitaliy Katsenelson

YZ:

I must confess, there where two occasions when I could of met Mr Katsenelson, first one when I saw him at book discussion “The Enduring Value of Roger Murray,” at Fordham Gabelli School of Business last year and second time when I couldn’t attend his Meet and Greet at Omaha … and maybe it was for the best as I really did not know Mr Katsenelson so I don’t know what I could really talk to him about and yet now that I have read VK’s Soul in the Game, I have realized that we have a lot in common … obviously our lives have been different and yet they dance to similar tune, so when I start reading Soul in the Game, I really couldn’t put it down and I really very much enjoyed it!

( I feel like) Mr Katsenelson really made it good-down-to-earth-kind of a read, showing that he (just like everyone else) puts his pants on one leg at a time.

Book has a bit of everything for everyone, my favorite part is the personal/family stories.

Goodreads:

Soul in the Game , is a book of inspiring stories and hard-won lessons on how to live a meaningful life, crafted by investor and writer Vitaliy Katsenelson.

Drawing from the lives of classical composers, ancient Stoics, and contemporary thinkers, Katsenelson weaves together a tapestry of practical wisdom that has helped him overcome his greatest in work, family, identity, health—and in dealing with success, failure, and more.

Part autobiography, part philosophy, part creativity manual, Soul in the Game , is a unique and vulnerable exploration of what works, and what doesn’t, in the attempt to shape a fulfilling and happy life.

I give it 4 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

Also, I would really appreciate if you would share this post with one person who you think might enjoy it.

IAC 0.00%↑ SFM 0.00%↑ $NTDOY SPOT 0.00%↑ LKQ 0.00%↑ PYPL 0.00%↑ OPFI 0.00%↑ VMD 0.00%↑ BSM 0.00%↑ WBD 0.00%↑ OZK 0.00%↑ TCS 0.00%↑ $EVVTY MITK 0.00%↑ BUR 0.00%↑ OMAB 0.00%↑ FGFPP 0.00%↑ UG 0.00%↑ VEA 0.00%↑ VTI 0.00%↑ C 0.00%↑ MKL 0.00%↑ OPBK 0.00%↑ RICK 0.00%↑ URI 0.00%↑ ARCH 0.00%↑ IDT 0.00%↑ RBLX 0.00%↑ LH 0.00%↑ BN 0.00%↑ $ASHTY DJCO 0.00%↑ U 0.00%↑ DLTR 0.00%↑ MASI 0.00%↑ BOC 0.00%↑ MBLY 0.00%↑ MELI 0.00%↑ FLWS 0.00%↑ CDLX 0.00%↑ ONON 0.00%↑ BABA 0.00%↑ GDOT 0.00%↑ ASO 0.00%↑ DEO 0.00%↑ DBX 0.00%↑ SGA 0.00%↑ XPEL 0.00%↑ IBKR 0.00%↑ $OTGLY ONFO 0.00%↑ ENZ 0.00%↑ NNI 0.00%↑ UHAL 0.00%↑ CPRT 0.00%↑ $BRK NU 0.00%↑

Section below is for paid subscribers…