December 2024 Portfolio Update

Free Topics: Quote, Portfolio Update - Revealing New Stocks , Earnings Part 2, Investing Podcasts 2024, 13Fs, Books ... Paid Topics: Portfolio(s) Discussion/Commentaries, and so much more...

Quote for this month:

"Don't tell me what you think, tell me what you have in your portfolio." - Nassim Nicholas Taleb

*Portfolio*

*I am NOT a financial advisor. I’m sharing my investing journey. Not investment advice. Do your own research.*

Portfolio (Basic):

Holding since:

2020 - LKQ 0.00%↑ - 03

2021 - SFM 0.00%↑ - 03 | OPFI 0.00%↑ - 05 | VMD 0.00%↑ - 05 | 08 | SPOT 0.00%↑ - 11

2022 - MITK 0.00%↑ - 01 | WBD 0.00%↑ - 04 | $EVVTY - 09 | $NTDOY - 12

2023 - PYPL 0.00%↑ - 01 | TCS 0.00%↑ - 01 | BSM 0.00%↑ - 05 | BUR 0.00%↑ - 09

2024 - (First ???) - 01 | BKTI 0.00%↑ - 04 | BOC 0.00%↑ - 09 | ANGI 0.00%↑ - 11 |

Quick Free Portfolio Update

Although I did mention that most of my updates will be provided behind paywall, I thought it would be good idea to let know on exits and “some” entering (entering that are liquid enough or known well enough I have no problem sharing).

Revealing my second pick of 2024: BKTI 0.00%↑ (I’m not revealing first pick yet, because I’m still trying to build up a position in it and it has not “moved too much” and its illiquid)

Given how much BKTI has “ran up” since I first mentioned it to my paid subscribers, I will include it as “not hidden” in the Portfolio (Basic).

Since start buying shares in April, I’m up on it about 130% and still think there is a lot of potential upside on this company, not in terms of the share price (I cant predict share price) but in terms of what the company can do in the near future … I think this company has a long run way but as always the price we pay for things matter as much as the story…

BK Technologies Corporation (BKTI) is a communications equipment company that designs, manufactures, and markets wireless communication products. Founded in 1997 and headquartered in West Melbourne, Florida, BKTI operates through its subsidiary, BK Technologies, Inc. The company offers a range of products including two-way land mobile radios (LMR), repeaters, base stations, and related components and subsystems. These products are marketed under the BK Technologies, BKR, and BK Radio brands, primarily serving professional radio users in government, public safety, and military sectors. Their big competitor is Motorola and I think BKTI can take a good chunk of share from Motorola in this line of business…

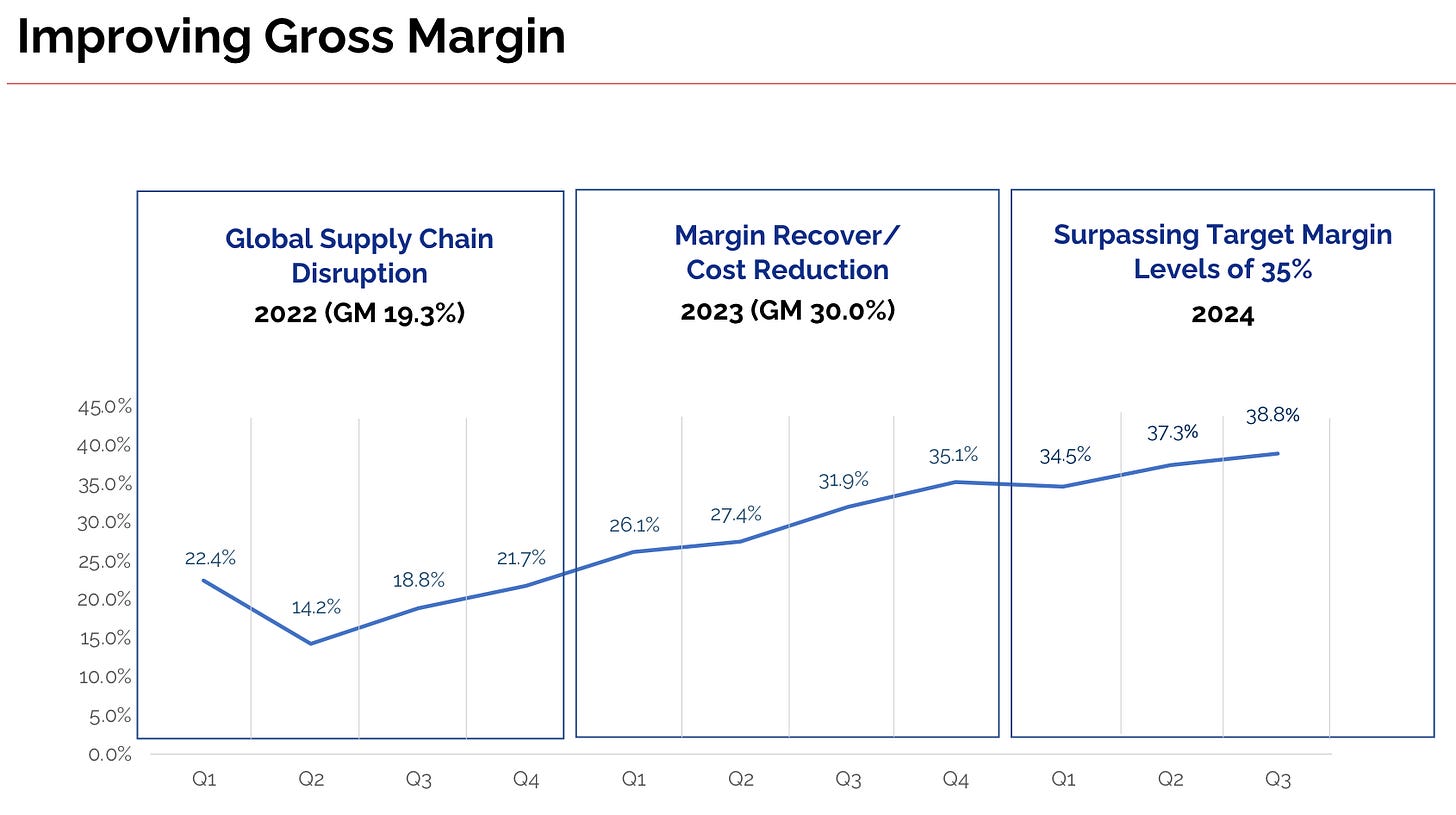

I followed it since Kyle Cerminara from Fundamental Global spoke about it but did not pull a trigger until I saw the new CEO start executing on what he laid out, especially gross margins…

I think I should (probably) do a write up on it… but where to find the time (sad face)…

Exited - IAC 0.00%↑ and Entering ANGI 0.00%↑

Hold on hold on let me explain…

It was done for tax purposes, I gave a better explanation to paid subscribers so I wont be going in too much detail here … All I will say is that IAC will be back in portfolio soon.

Earnings Part 2

Check out Value Degen’s quick overview on BUR

Check out LBS’s comments and more detail breakdown of BOC’s Q

Investing Podcasts 2024

Mike Fritzell at Asian Century Stocks did a cool X post with great investing podcasts:

I would like to add a few of my own that are in my top list:

Value Investing with Legends

This Week In Intelligent Investing

Nano Cap Podcast

HoldCo Builders

Talking Billions by Bogumil Baranowski

InvestEd: The Rule #1 Investing Podcast

Compounders Podcast

13Fs

41investments has a good list of 13Fs that I think y’all should check out:

But I also wanted to add a few that I look forward to looking at that are concentrated and run less than a billion (or around) dollars:

Lastly, Rule1 Fund:

Books

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished three audiobook and one physical book:

Collaboration Is the New Competition by Priscilla McKinney

YZ:

It was an interesting read and made me realize that I already have that in my “mental model” especially when it comes to collaborating with other writers on Substack or working with people in medical supplies (in my real world type of work line)

Goodreads:

In today's fast-paced business landscape, true collaboration isn't just desirable—it's essential for survival and success. Collaboration Is the New Competition offers a digestible approach to problem-solving and decision-making that empowers professionals to thrive in their careers, drive business growth, and make a meaningful impact in their communities.

This transformative book demystifies the process of collaboration and provides practical strategies for choosing the right people, leveraging networks, and amplifying wins. Whether you're a seasoned business leader seeking fresh perspectives or a junior manager eager to accelerate your career growth, this book will help you take advantage of new ways to analyze complex issues, explore a spectrum of possible solutions, and solve real problems.

This book utilizes McKinney's vast expertise in change management, leadership development, and marketing strategy to instill a transformative mindset. It empowers individuals and organizations to embrace a new way of thinking, alter their problem-solving approach, and gain the confidence to take proactive action. From digital transformation to social influence, McKinney explores the common themes that drive business success and networking, offering readers a roadmap for achieving their goals and making a lasting impact.

I give it 4 out of 5 stars.

The New Map: Energy, Climate, and the Clash of Nations by Daniel Yergin

YZ:

Finally finished all three books by Daniel Yergin and it was a lot of info to process but a good way to catch up on “quick” macro level on energy and big nations from past to present. Making me keep being bullish on Nat Gas but not as much as I was before, Oil will be around for some time and I was not (before) so bullish on renewables as it didn’t make sense to me how people thought renewables would be the cure to all human problems and this book shows that although we are moving in the right (very slow) direction there is still a long long way form being 100% renewable nation and I think we will never be so as oil and gas will be playing role for some time…

Goodreads:

Pulitzer Prize-winning author and global energy expert, Daniel Yergin offers a revelatory new account of how energy revolutions, climate battles, and geopolitics are mapping our future

The world is being shaken by the collision of energy, climate change, and the clashing power of nations in a time of global crisis. Out of this tumult is emerging a new map of energy and geopolitics. The “shale revolution” in oil and gas has transformed the American economy, ending the “era of shortage” but introducing a turbulent new era. Almost overnight, the United States has become the world's number one energy powerhouse. Yet concern about energy's role in climate change is challenging the global economy and way of life, accelerating a second energy revolution in the search for a low-carbon future. All of this has been made starker and more urgent by the coronavirus pandemic and the economic dark age that it has wrought.

World politics is being upended, as a new cold war develops between the United States and China, and the rivalry grows more dangerous with Russia, which is pivoting east toward Beijing. Vladimir Putin and China's Xi Jinping are converging both on energy and on challenging American leadership, as China projects its power and influence in all directions. The South China Sea, claimed by China and the world's most critical trade route, could become the arena where the United States and China directly collide. The map of the Middle East, which was laid down after World War I, is being challenged by jihadists, revolutionary Iran, ethnic and religious clashes, and restive populations. But the region has also been shocked by the two recent oil price collapses--and by the very question of oil's future in the rest of this century.

A master storyteller and global energy expert, Daniel Yergin takes the reader on an utterly riveting and timely journey across the world's new map. He illuminates the great energy and geopolitical questions in an era of rising political turbulence and points to the profound challenges that lie ahead.

I give it 4 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

Sections below are for paid subscribers…