Welcome to another Audio Dive Dive + Write Up, this time on Deckers Outdoor Corp.

Disclaimer is at the end.

Deckers Outdoor Corporation - DECK 0.00%↑ - stands as a compelling example of how strong brands, strategic discipline, and global diversification can transform a niche seasonal player into a durable multinational enterprise. Founded in 1973 and headquartered in Goleta, California, DECK has built an impressive portfolio of footwear brands, including HOKA, UGG, and Teva.

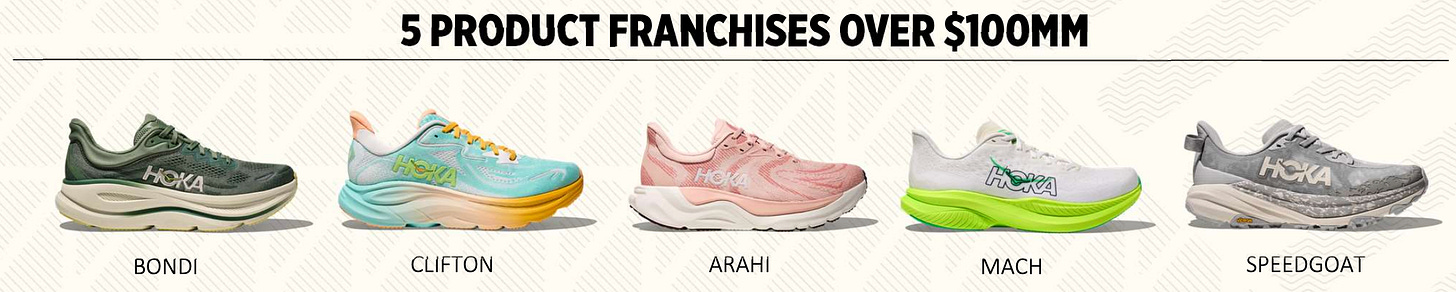

At the heart of Deckers success lies its dual-engine model powered by HOKA and UGG. These two brands serve different yet complementary markets: HOKA appeals to performance-oriented athletes and every-day casual yet affluent consumer while UGG caters to lifestyle consumers who value ease, comfort, and developed brand design. This balance provides DECK with both stability and scalability, enabling it to thrive across economic cycles.

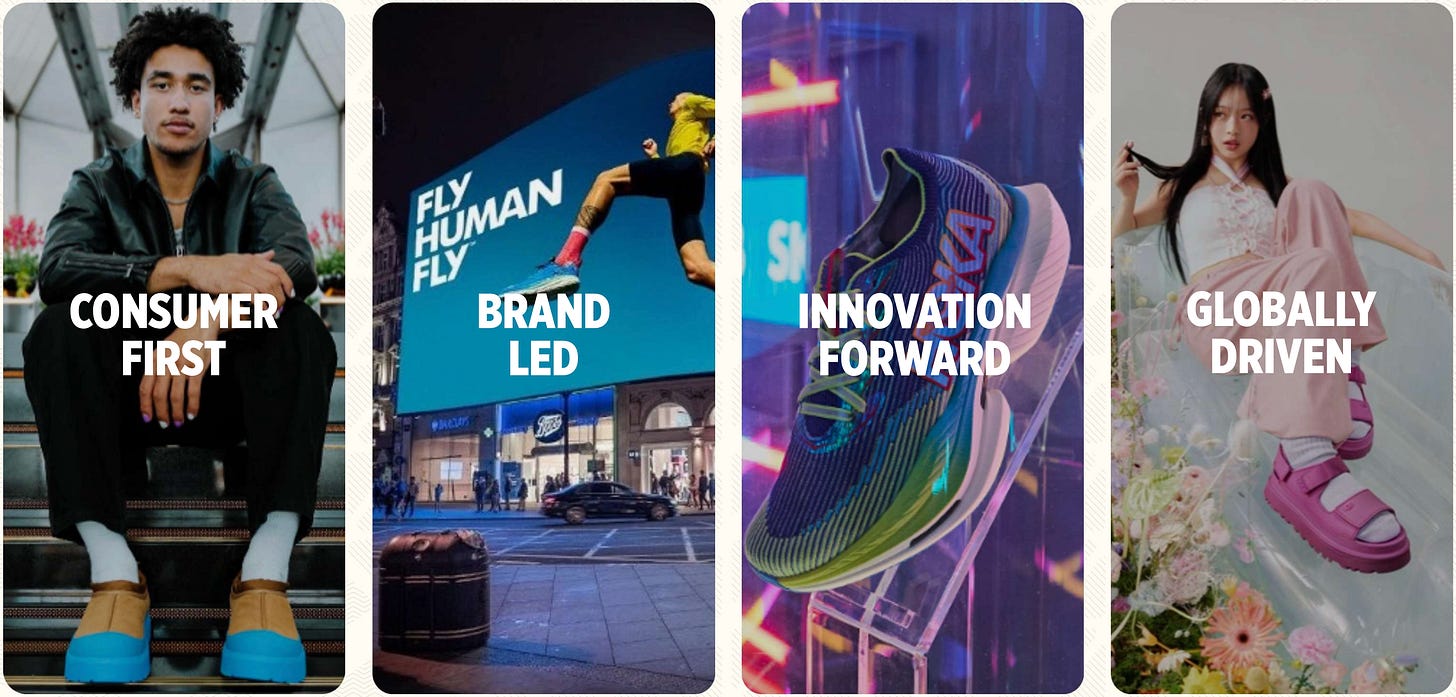

Under the leadership of CEO Stefano Caroti (Caroti is a seasoned executive with deep operational experience at both PUMA and NIKE), who assumed the role in 2025, company has sharpened its focus on four guiding principles: maintaining a consumer-first mindset, fostering a brand-led culture, driving innovation, and pursuing global expansion. This framework defines Deckers’ current trajectory and serves as a blueprint for its long-term vision.

Financially, Deckers is among the strongest operators in its sector. As of November 2025, company had market cap of about $12 billion and reported a cash balance of $1.5 billion and carried no long-term debt. Its gross margin expanded to 57%, reflecting the company’s pricing power and operational efficiency. In its fiscal second quarter of 2026, both HOKA and UGG posted double-digit sales growth, driven largely by international expansion. However, the domestic U.S. market showed softness, with sales declining by almost 2% and direct-to-consumer (DTC) revenue slipping by almost 1%. Despite these near-term pressures, DECK’s wholesale business grew almost 20%, offsetting weaker DTC performance.

The company’s strength lies in its ability to navigate market headwinds without sacrificing long-term brand integrity. Deckers’ management has consistently emphasized sustainable growth over short-term gains, prioritizing pricing discipline and product quality. This approach has insulated the company from the pitfalls of over-promotion and brand dilution that often plague competitors. By maintaining its premium positioning, Deckers preserves its reputation and consumer loyalty, ensuring that its brands remain aspirational.

Nevertheless, the company faces notable challenges. The U.S. consumer environment has become increasingly price-sensitive, leading to a temporary slowdown in direct sales. Rising operating expenses have also created margin pressure. Compounding these internal issues is the external threat of international tariffs, which management estimates could result in a $150 million headwind for fiscal 2026 if left unmitigated. These risks have prompted a cautious outlook, which, while prudent, led to a temporary stock decline following the company’s October 2025 earnings. At the same time, company’s active share repurchase program and minimal dilution risk reflect a shareholder-friendly capital allocation policy.

Despite these challenges, Deckers’ opportunities outweigh its short term risks. The company’s international business has become a primary growth engine, particularly in Europe and Asia-Pacific, where both HOKA and UGG are gaining traction. Furthermore, the push to grow the DTC channel to 50% of total revenue signals a strategic shift toward higher-margin and consumer focused operations. By investing in digital ecosystems, loyalty programs, and data analytics, DECK aims to build deeper relationships with consumers, reducing dependence on wholesale partners and increasing long-term profitability.

Competition remains intense from brands like Nike, Crocs, Brooks, and On Holding among Deckers’ key rivals. While Nike grapples with slower forward growth, On Holding represents a more direct competitor in performance footwear.

Looking ahead, the company’s outlook can be envisioned through three broad scenarios. In the best case, easing trade tensions and a rebound in U.S. consumer confidence would spur a recovery in DTC sales and lift earnings beyond current guidance. The base case assumes continued tariff pressures and muted domestic demand, partially offset by strong international and wholesale performance. In the worst case, prolonged tariffs and macroeconomic weakness could dampen growth and margins, forcing downward revisions to revenue and earnings expectations.

In summary, DECK exemplifies a high-quality company in the consumer discretionary sector (which is cyclical and competitive). Its combination of premium brands, operational discipline, and financial strength positions it to weather macroeconomic uncertainty while maintaining steady growth. Short-term challenges such as tariffs, inflationary pressures, and a cautious U.S. consumer may test investor patience, but they do not alter the company’s durable fundamentals, if anything these short term challenges provide an opportunity for investors with a long-term horizon.

Holdings Disclosure

At the time of this publication, I do own shares of DECK 0.00%↑.

P.S. Don’t forget to ❤️ if you enjoyed it.

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

I have decided to also start to include my checklist for 1) to provide even more look into the way I do research companies but also (mostly) 2) to keep myself from being lazy and not “skipping” on steps when researching companies.

This available to paid subscribers only.

Checklist: