February 2024 Portfolio Update

Topics: Quote, Portfolio & Discussion, Some Earnings, Looking at Portfolio as S.O.T.P., Books + Section for Paid subscribers.

Quote for this month:

“Maintaining the attitude of being a perpetual learner, being openminded to new knowledge, is paramount in preventing your ego and your success from fossilizing and stifling your learning and self-improvement.” - Vitaliy Katsenelson from Soul in the Game: The Art of a Meaningful Life.

Portfolio Update*

*I am NOT a financial advisor, I’m sharing my investing journey. Do your own research.*

Portfolio (Basic):

Portfolio Discussion

Currently the numbers as of 02/06/2024: (total) $296,181 - (other) $25,000 = (mine) 271,181.

Fascinating, as OPFI 0.00%↑ went up as it went down … almost like it was a New Years gift for me to hit 300,000 ( lol ) since last time no earnings and nothing has changed and yet OPFI went down 30% … market is “efficient” …

I did start a new position that I’m not ready yet to disclose to everyone, I’m still trying to figure out if I stumbled on something great or if its a mistake (paid subs will get more info on it) . I’m trying to accumulating tiny amount of shares almost every day because its really illiquid (I might be the only one who is buying it) but I’m also trying to get hold of the management and ask them some questions, for now no luck, will keep on trying.

Some earnings:

Bank OZK - something something NYCB 0.00%↑ something something OZK is NOT NYCB!

OZK had a great quarter and bank and its CEO are always careful and cautious and that is exactly what you want in your bankers.

Stock has recently sold off a bit due to NYCB, but I will be holding my shares and if anything drops below 25 would be interested in buying more until then I hold.

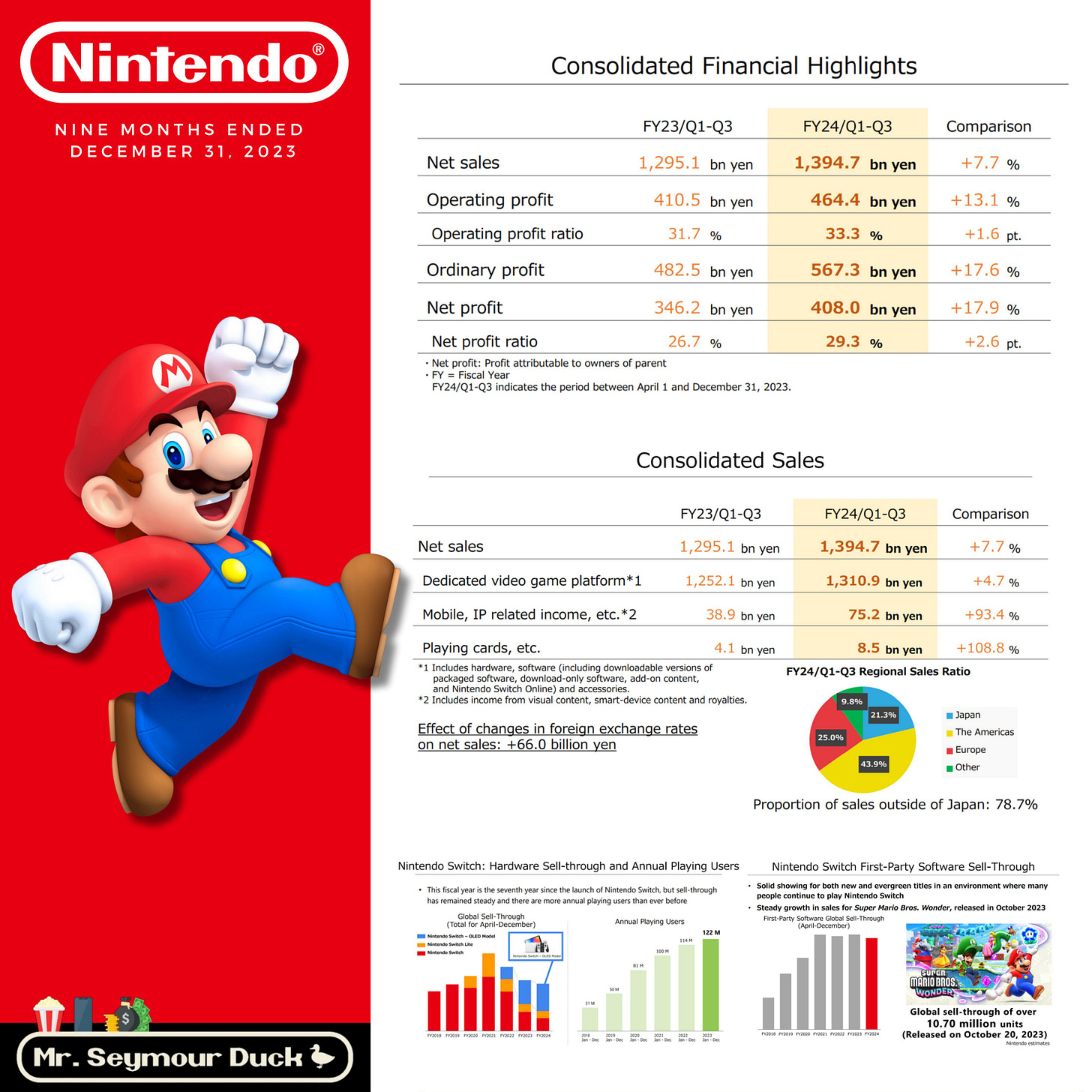

Nintendo - is still killing it even though there is no new console yet, great quarter and the future is bright although my concerns are that of if and when Switch 2 comes out and how it will be received by the consumers.

Evolution - It’s a little bit concerning how good Evolution is as a business and how it just keeps printing money. Ali at Do Not Distribute does great overview of EVVTY’s earnings, click link here .

PayPal - Earnings were okay, I’m just watching and wait and giving new CEO (Alex Chriss) some time to execute and try to turn this ship around. I mentioned before that I’m willing to wait until 2025 to see some visible improvements and Brad Freeman at Stock Market Nerd does great overview of PYPL earnings, click link here .

Spotify - I think Spotify had great quarter and company is still “firing on all cylinders” as some like to say and (again) Brad at Stock Market Nerd does a much better job at reviewing earnings for SPOT, click link here .

Left worst for last … The Container Store … TCS

They say picture speaks a thousand words , unfortunately these two don’t show anything pretty.

Management understand that situation is crappy and playing defensive in terms of spending and yet pushing harder into custom closets … I have nothing really to say except that I still think that not all hope is lost and so I hold and wait (I think as long as the net losses wont be that huge this will work out, but for that people need to keep buying stuff sooo there is that) … on a bit happier note Leonard Green & Partners, L.P. still holds 30% of the company and interesting if they are in anyways getting involved on helping to turn this around…

I think I’m starting to dislike turnaround stories 😅

Dividends for January:

Looking at Portfolio as S.O.T.P.

People in investing world say that Some Of The Parts plays don’t really work because its hard/impossible to unlock full value when you do not own the company or if you do not have majority of the voice (rights) … which may or may not be true … there are both successful public companies that have unlocked value for its shareholders and there are also cases were that did not work.

Yet when it comes to my own person investing (and don’t mind the fact that IAC is my largest holding) I think of my stocks/companies as being one big bag (portfolio) with optionality to take out or put it whatever I want & when ever I want … kind of like a company that has management team that understands how to unlock value when its time but also wait and do nothing until its the right moment, be it next quarter or in five years…

As a whole I think in the long run I should do fine (I hope, I cant guarantee) but on the day to day (month to month?) basis some companies will go up (OPFI) and some will go down (also OPFI) okay jokes aside … actual good example is SFM 0.00%↑ that is currently up over 100% and there is also TCS 0.00%↑ that is down over 50% but also there is company like BSM 0.00%↑ that is flat and yet generates 10%+ dividends for me.

Most are in different sectors or do something a bit different so I might have couple of companies in payment related stuff but not the whole portfolio although if you have your whole portfolio in tech you probably either broke or look like a genius … that is not my way … my way of being in different sectors or types means “there is hidden safety” in a way so if one company goes down 50% I don’t really have to worry about other companies on the same way especially from macro perspective.

When SVB panic happened, I only had to worry about my OZK (although I did not worry too much) so if any of my other holding went down due to Mr Market being irrational, that created buying opportunity.

Which brings me to idea that having 10 stocks and company like Berkshire as your largest holding and all others in high tech or w/e shitcos mean you are well diversified (just for example).

Also why I like companies like IAC / IDT and companies like VIVHY / FFH are interesting to me.

Book

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished three audiobook :

What I Learned About Investing from Darwin by Pulak Prasad

YZ:

What I Learned About Investing from Darwin was fascinating book to read but not because of the investing part but because of the “biology” aspects of the book, I mean investing part was also great but the facts that I learned about Blue booby was awesome … or was it Snapple fact … I think it was from the book, anyways…

Pulak Prasad did a great job on combining and comparing investing to biology and I think I will be re-listening to What I Learned About Investing from Darwin in the near future.

Goodreads:

The investment profession is in a state of crisis. The vast majority of equity fund managers are unable to beat the market over the long term, which has led to massive outflows from active funds to passive funds. Where should investors turn in search of a new approach?

Pulak Prasad offers a philosophy of patient long-term investing based on an unexpected source: evolutionary biology. He draws key lessons from core Darwinian concepts, mixing vivid examples from the natural world with compelling stories of good and bad investing decisions―including his own. How can bumblebees’ survival strategies help us accept that we might miss out on Tesla? What does an experiment in breeding tame foxes reveal about the traits of successful businesses? Why might a small frog’s mimicry of the croak of a larger rival shed light on the signs of corporate dishonesty?

Informed by successful evolutionary strategies, Prasad outlines his counterintuitive principles for long-term gain. He provides three mantras of investing: Avoid big risks; buy high quality at a fair price; and don’t be lazy―be very lazy. Prasad makes a persuasive case for a strategy that rules out the vast majority of investment opportunities and advocates permanently owning high-quality businesses.

Combining punchy prose and practical insight, What I Learned About Investing from Darwin reveals why evolutionary biology can help fund managers become better at their craft.

I give it 4 out of 5 stars.

Enemy of All Mankind: A True Story of Piracy, Power, and History's First Global Manhunt by Steven Johnson

YZ:

Enemy of All Mankind is not on investing (for the most part) but I very much enjoyed it. It was a bit different from my usual read or listen and yet the book did touch on the likes of The East India Company which as we know was one of the beginnings of stocks / stock market.

Enemy of All Mankind dives into life of Henry Every, pirate life during 1600s, and how large governments (corporations) can change “things” to fit their narrative.

Great book if you want something a bit on history with some “action”.

Goodreads:

Henry Every was the seventeenth century's most notorious pirate. The press published wildly popular--and wildly inaccurate--reports of his nefarious adventures. The British government offered enormous bounties for his capture, alive or (preferably) dead. But Steven Johnson argues that Every's most lasting legacy was his inadvertent triggering of a major shift in the global economy. Enemy of All Mankind focuses on one key event--the attack on an Indian treasure ship by Every and his crew--and its surprising repercussions across time and space. It's the gripping tale one of the most lucrative crimes in history, the first international manhunt, and the trial of the seventeenth century.

Johnson uses the extraordinary story of Henry Every and his crimes to explore the emergence of the East India Company, the British Empire, and the modern global marketplace: a densely interconnected planet ruled by nations and corporations. How did this unlikely pirate and his notorious crime end up playing a key role in the birth of multinational capitalism? In the same mode as Johnson's classic non-fiction historical thriller The Ghost Map, Enemy of All Mankind deftly traces the path from a single struck match to a global conflagration.

I give it 4 out of 5 stars.

Wanting: The Power of Mimetic Desire in Everyday Life by Luke Burgis

YZ:

Honestly… I did not like the book… I did not want to finish listening to this book and because of that I finished it. I wanted to see if this book would change my perspective on not all but pretty much everything that is discussed in it. Subjects of “mimetic” and “desires” is too generic and for me personally did not hit on anything concrete.

When listening to Wanting, I thought I would get vibes of Eckhart Tolle. I was wrong. Luke Burgis praises René Girard and his way of thinking … I on the other hand … found it time wasting …

Goodreads:

Gravity affects every aspect of our physical being, but there's a psychological force just as powerful – yet almost nobody has heard of it. It's responsible for bringing groups of people together and pulling them apart, making certain goals attractive to some and not to others, and fueling cycles of anxiety and conflict. In Wanting, Luke Burgis draws on the work of French polymath René Girard to bring this hidden force to light and reveals how it shapes our lives and societies.

According to Girard, humans don't desire anything independently. Human desire is mimetic – we imitate what other people want. This affects the way we choose partners, friends, careers, clothes, and vacation destinations. Mimetic desire is responsible for the formation of our very identities. It explains the enduring relevancy of Shakespeare's plays, why Peter Thiel decided to be the first investor in Facebook, and why our world is growing more divided as it becomes more connected.

Wanting also shows that conflict does not arise because of our differences--it comes from our sameness. Because we learn to want what other people want, we often end up competing for the same things. Ignoring our large similarities, we cling to our perceived differences.

Drawing on his experience as an entrepreneur, teacher, and student of classical philosophy and theology, Burgis shares tactics that help turn blind wanting into intentional wanting – not by trying to rid ourselves of desire, but by desiring differently. It's possible to be more in control of the things we want, to achieve more independence from trends and bubbles, and to find more meaning in our work and lives.

I give it 2 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

Also, I would really appreciate if you would share this post with one person who you think might enjoy it.

IAC 0.00%↑ SFM 0.00%↑ $NTDOY SPOT 0.00%↑ BSM 0.00%↑ LKQ 0.00%↑ VMD 0.00%↑ PYPL 0.00%↑ $EVVTY WBD 0.00%↑ OPFI 0.00%↑ BUR 0.00%↑ MITK 0.00%↑ OZK 0.00%↑ OMAB 0.00%↑ TCS 0.00%↑ (UNDISCLOSED) UG 0.00%↑

Section below is for paid subscribers…