February 2026 Portfolio Update

Quote, Portfolio, Complimentary Monthly Commentary, Dealflow Discovery Conference + bonus, Tax Season, Earnings, VC Investing and venting and more ...

Quote for this month:

“You must survive the bad days, not just look good on average.” - Howard Marks

I’m going to keep quote from last month’s update for this one too, as a reminder for myself…

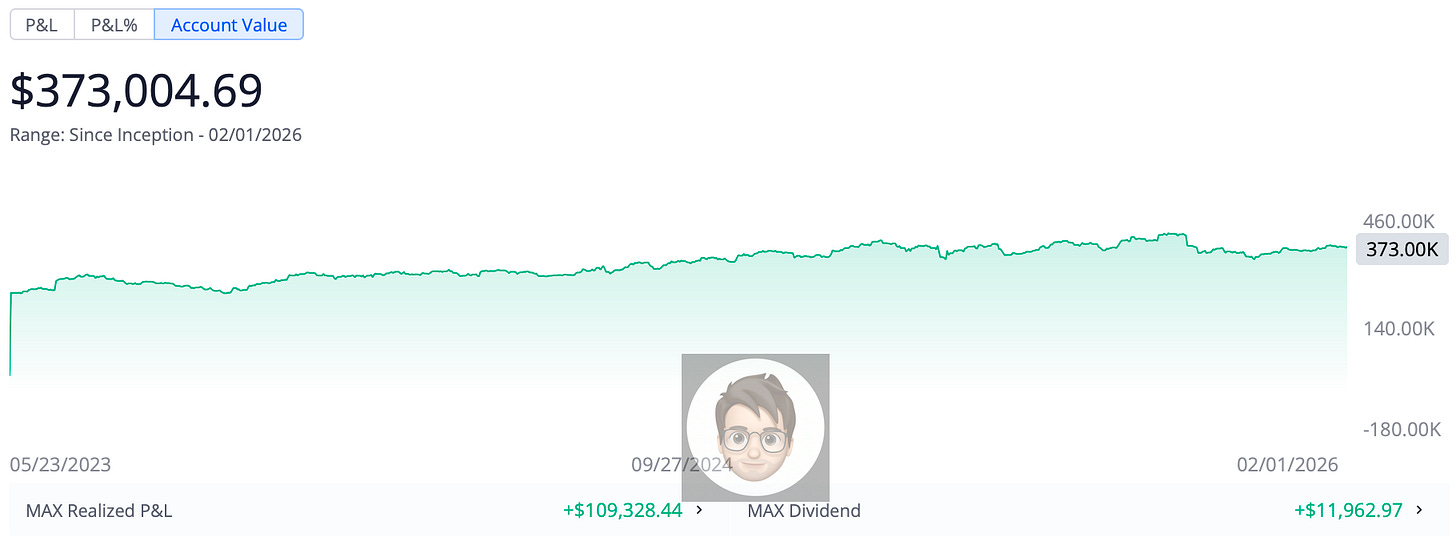

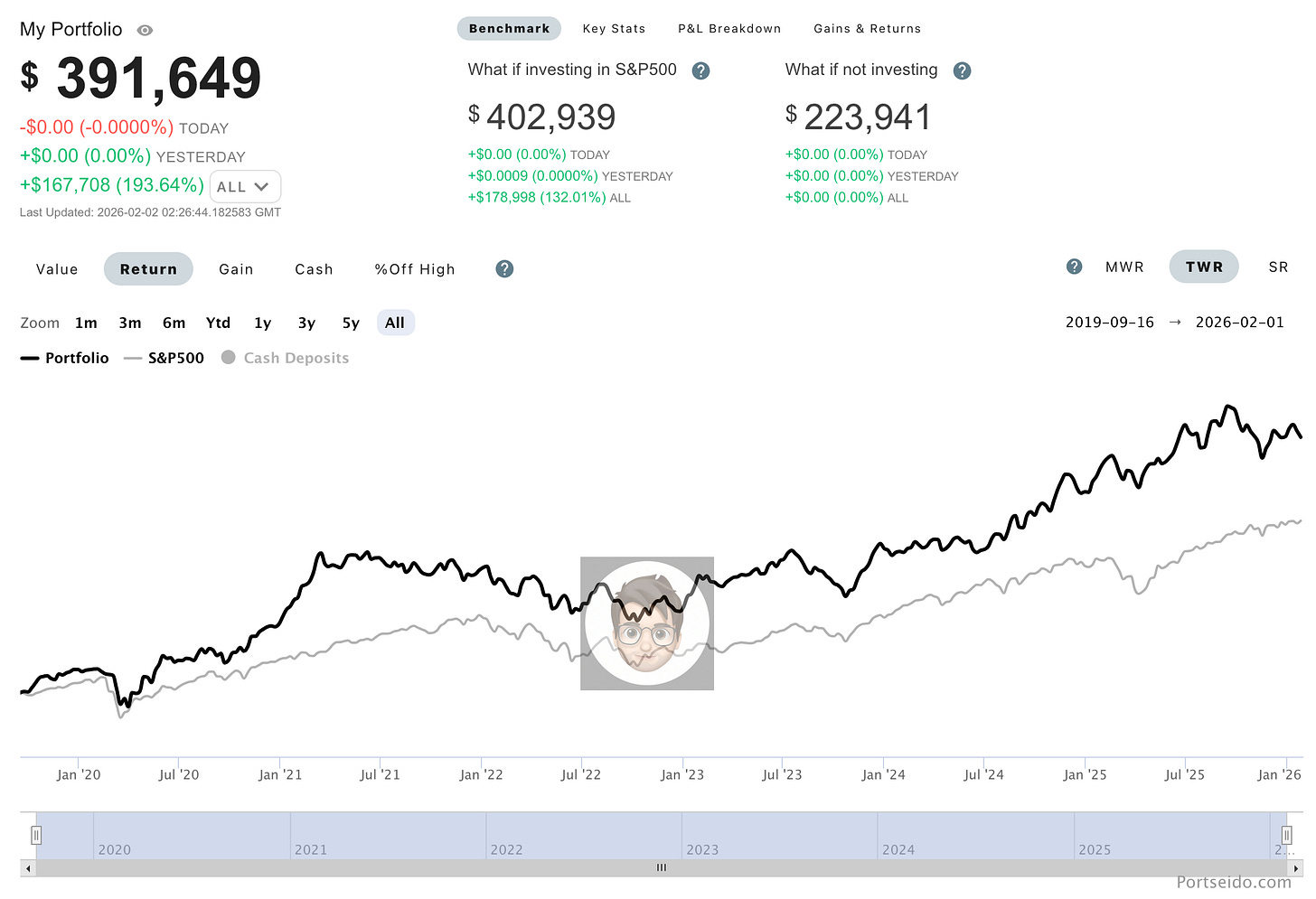

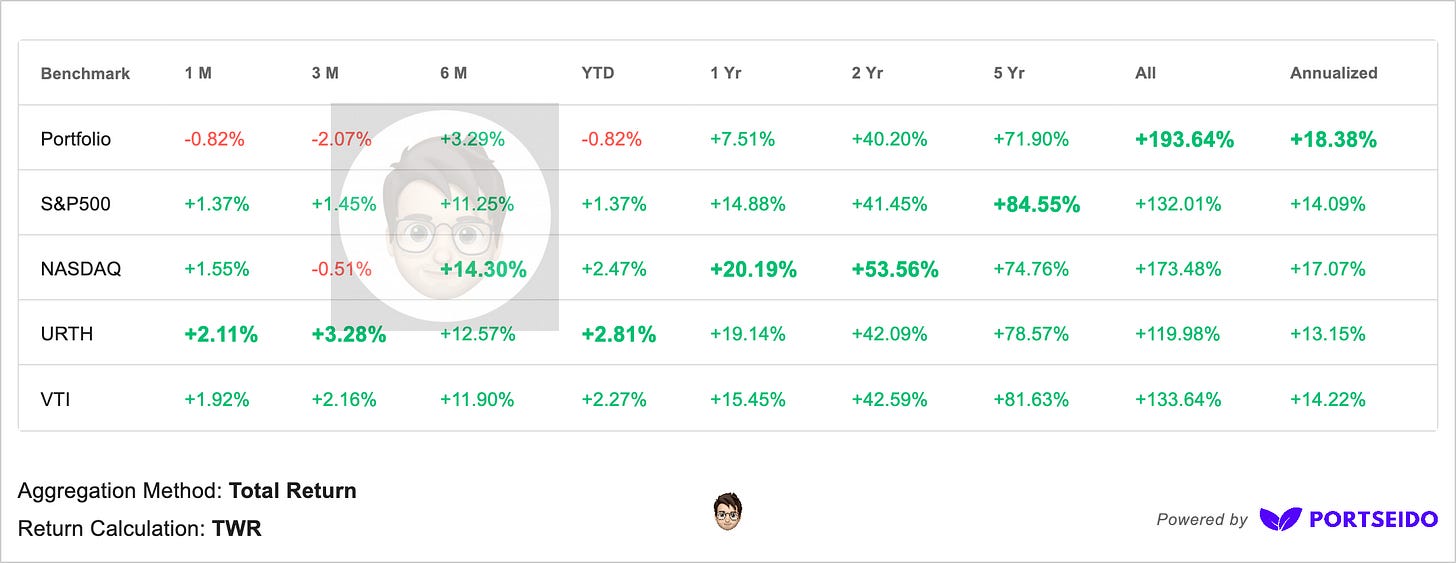

*Portfolio*

*I am NOT a financial advisor. I’m sharing my investing journey. Not investment advice. Do your own research.*

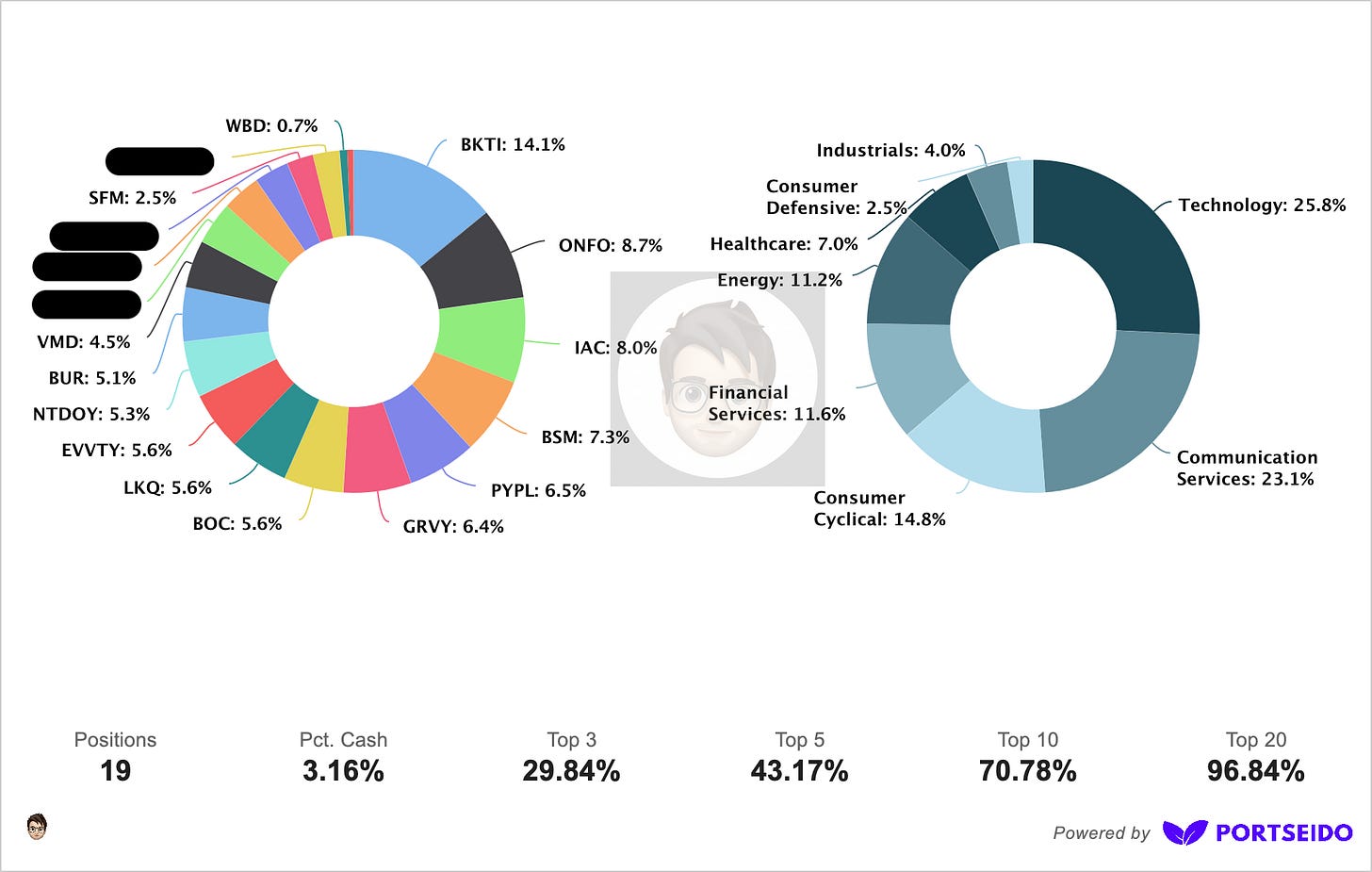

Portfolio (Basic):

Holding since:

2020 - LKQ 0.00%↑ - 03

2021 - SFM 0.00%↑ - 03 | VMD 0.00%↑ - 05

2022 - $NTDOY - 12

2023 - PYPL 0.00%↑ - 01 | BSM 0.00%↑ - 05

2024 - $M?? - 01 | BKTI 0.00%↑ - 04 | BOC 0.00%↑ - 09

2025 - IAC 0.00%↑ - 01* | GRVY 0.00%↑ - 08 | $CR?? - 08 | $CR?? - 10 | ONFO 0.00%↑ - 10 | $EVVTY - 11 | $F? - 12

2026 - BUR 0.00%↑ - 01* | MITK 0.00%↑ - 02* |

*IAC originally was purchased in 2021, but sold at the end of 2024 for tax loss purposes and re-bought back in 2025.

*EVVTY originally was purchased in 2022, but sold at the end of 2025 for tax loss purposes and re-bought back in 2025.

*BUR originally was purchased in 2023, but sold at the end of 2025 for tax tax loss purposes and re-bought back in 2026.

*MITK originally was purchased 2022, but sold at the end of 2025 for tax tax loss purposes and re-bought back in 2026.

Complimentary Monthly Commentary - CMC

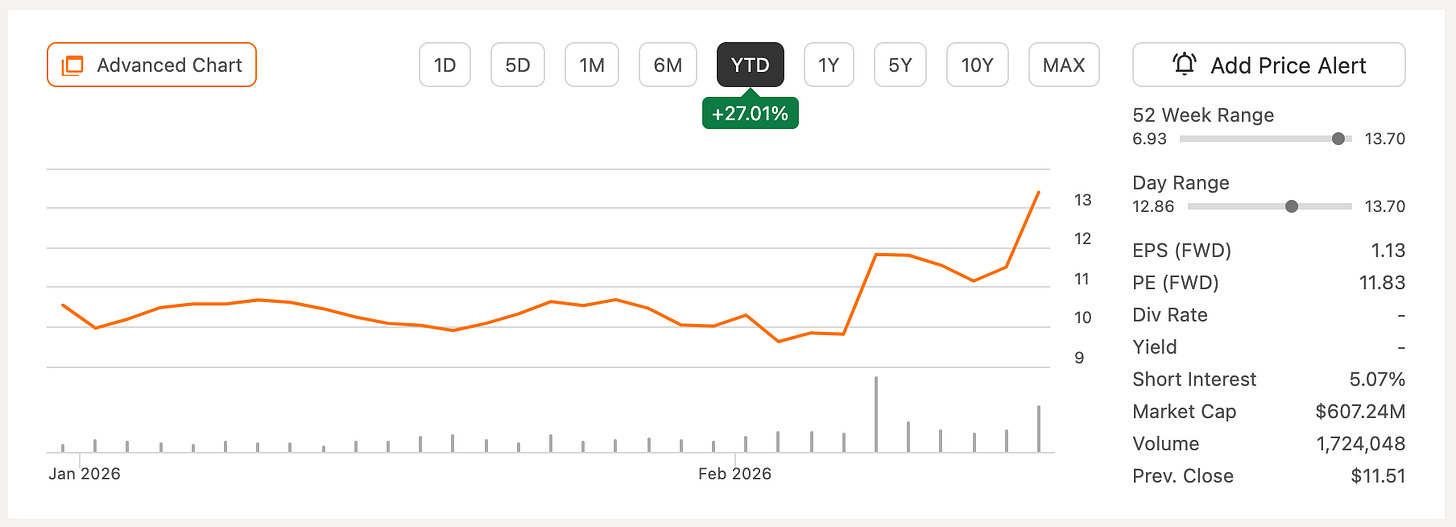

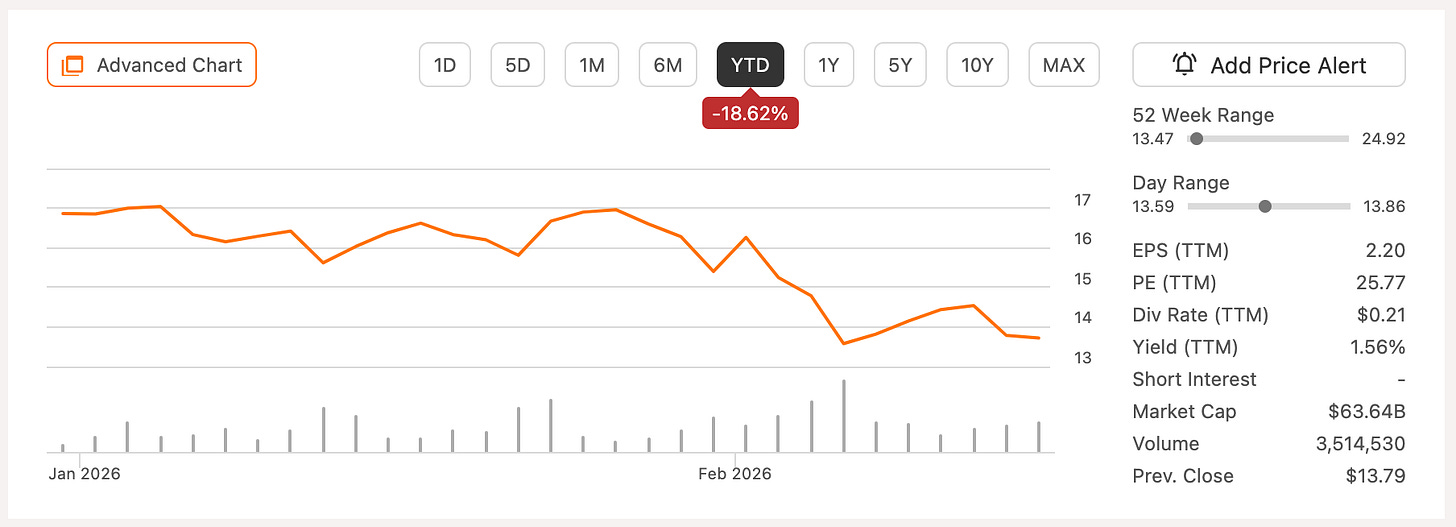

Buying back BURFORD and MITEK

2026 has been tough so far but luckily I’m not the only one who’s experiencing that (lol? not really) given that I do not add cash and working with the capital that’s already in there it makes it a bit tricky and maneuver the markets on the down side and sometimes “you need to move faster” but given that during the day I have my own business to run and I”m a father to 2 girls “moving faster” is not always possible.

Cant say I’m too upset about performance but I’m sure we all would be much happier to see green days > red days…

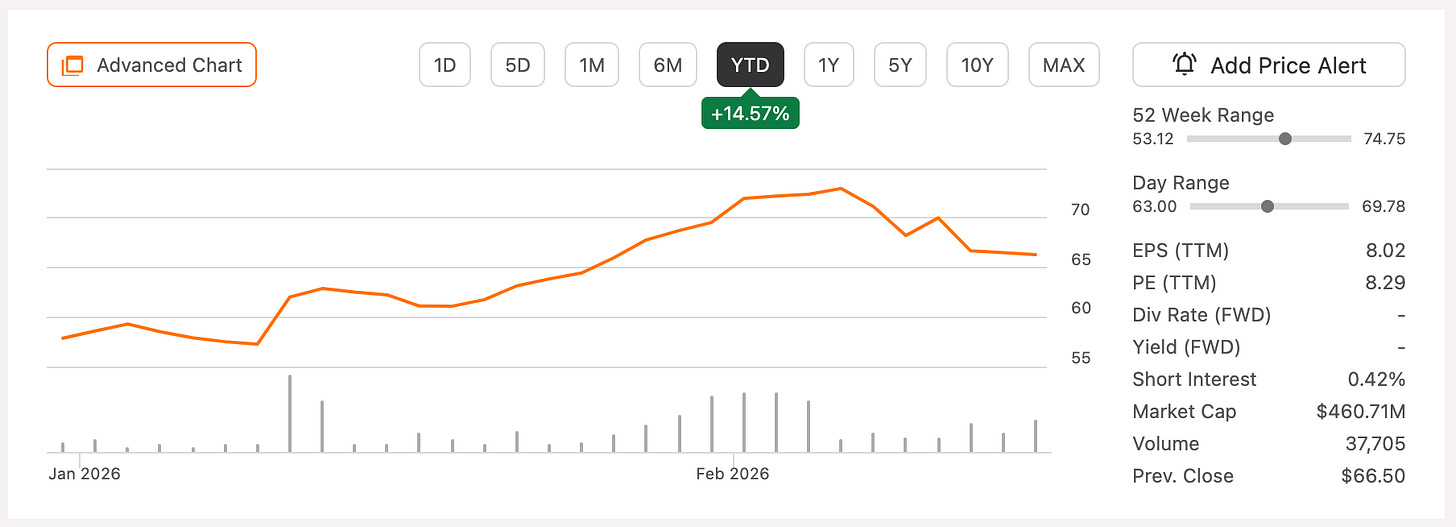

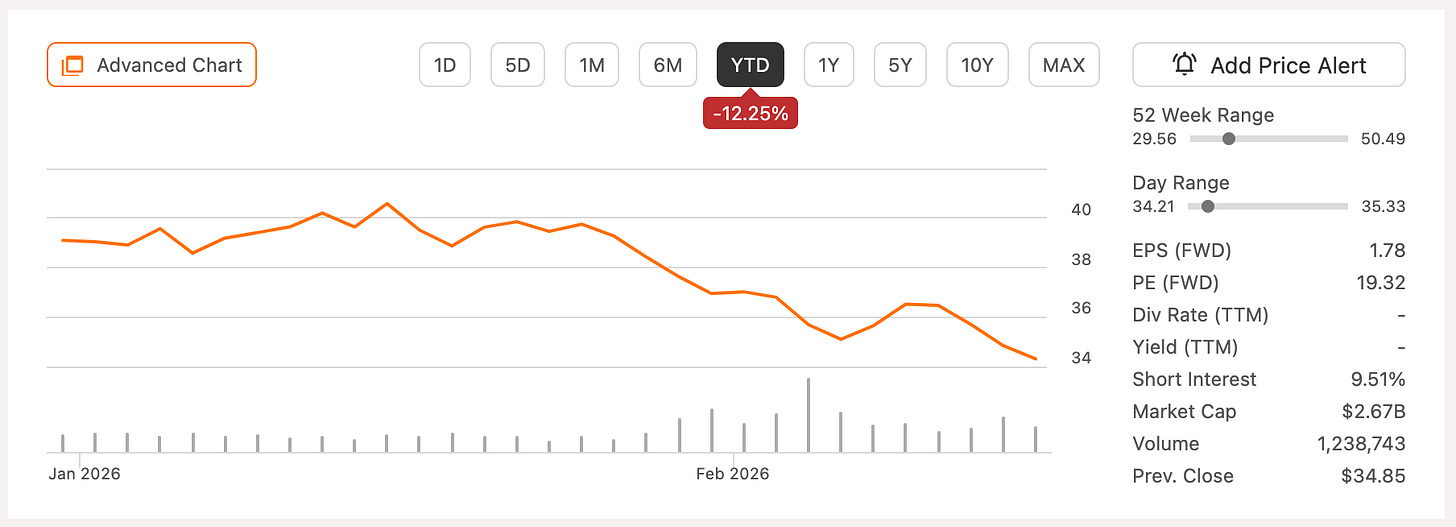

Big chunk on portfolio is leaning towards BKTI which is already up 300% and I’m not planning to sell for now and ONFO which is a microcap that so far market thinks its going to zero … I have different opinion from the market but I’ll be honest its not easy to go against the crowd … I really don’t care what others are saying on the web because a lot of times people will quote your famous investors and figures about holding companies and not stocks and back up the truck when there is blood on the streets and bluh bluh bluh but the problem with a lot of them they will post they will tweet and if sh!t hits the fan they will delete the post they will delete the tweet and maybe they will even delete the account or just restart with different post as if history doesn’t matter … I do not do that I been doing this publicly since 2021 and as I said I will be doing this at least until 2030 to build the public track record with good and the bad (I just hope there will be more good lol)

Enough with “yelling at the clouds” I’m doing my best with what I got and I do what I think is right and let time show if my unconventional way is alpha positive or not.

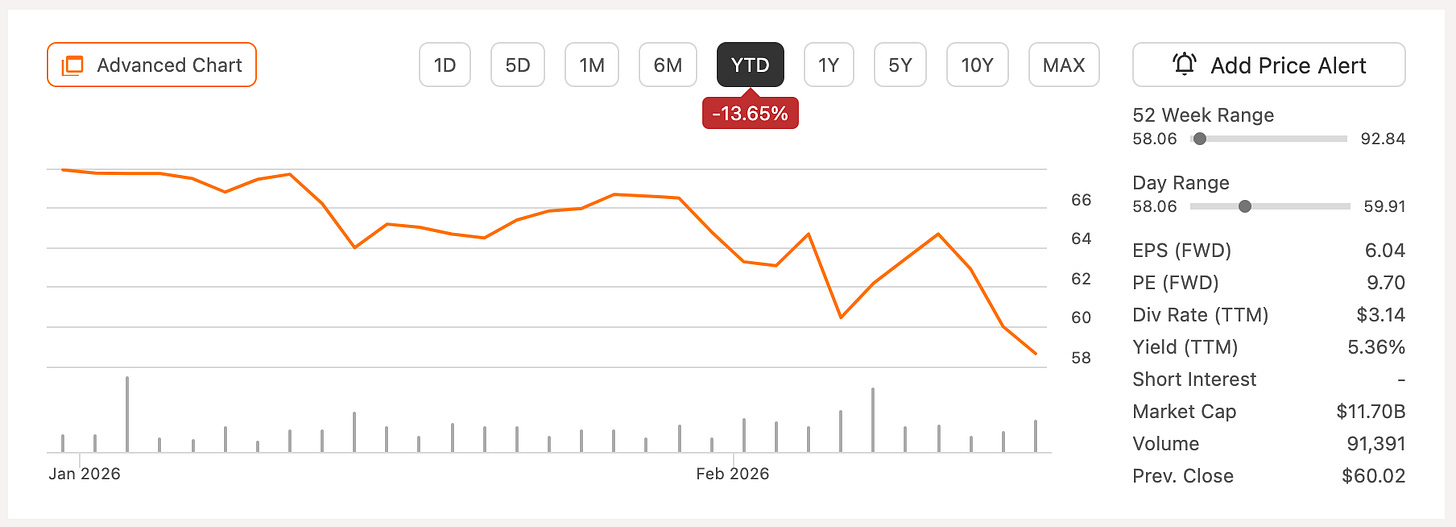

I bought back BUR, because until judge gives final “call” anything is possible…

I bought back MITK, although I was not sure I want to but I waited until earnings came out and I’m happy with the turnaround and what the current management is trying to do and so I’m back in it, again the problem is I need to rotate something to get more cash since I do not add money in main portfolio.

I also sold the rest of my WBD to get some more cash for purchases of BUR and MITK

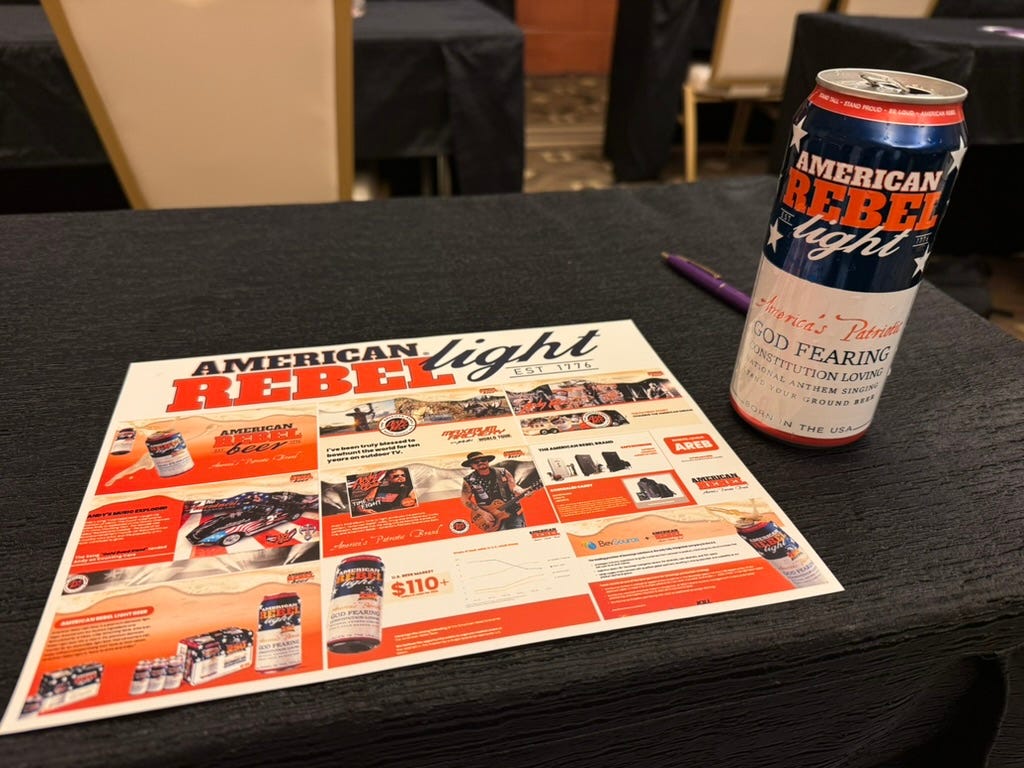

Dealflow Discovery Conference + bonus

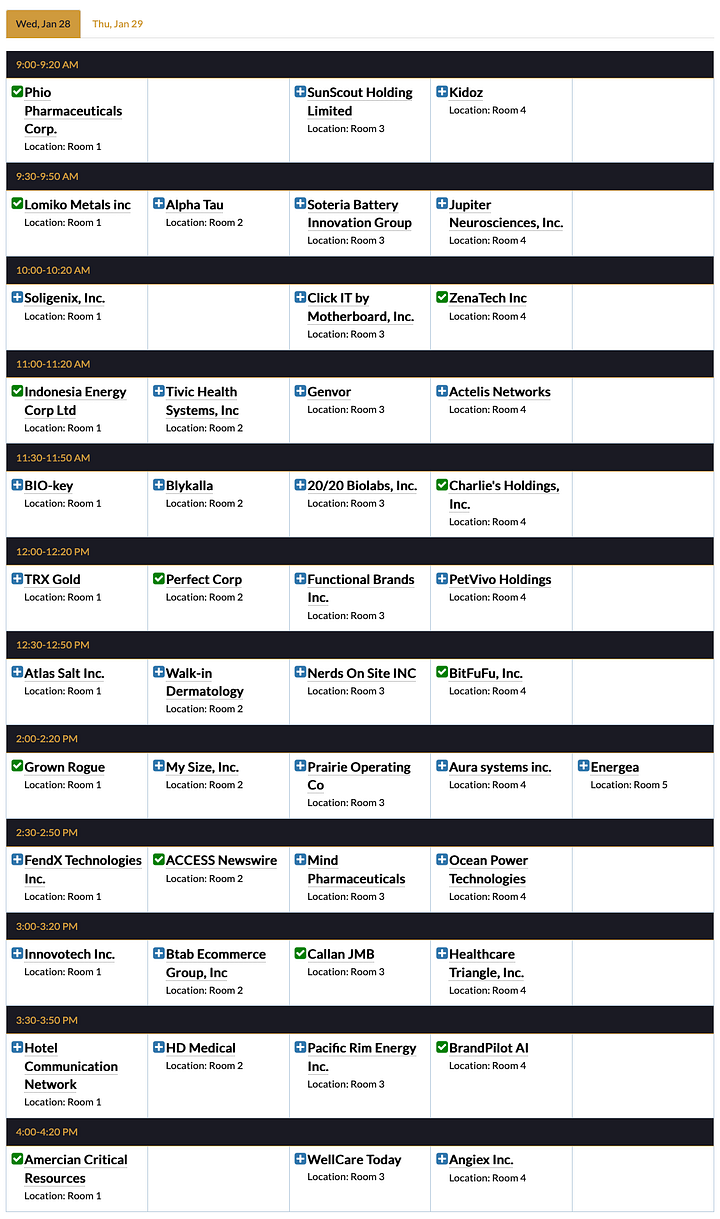

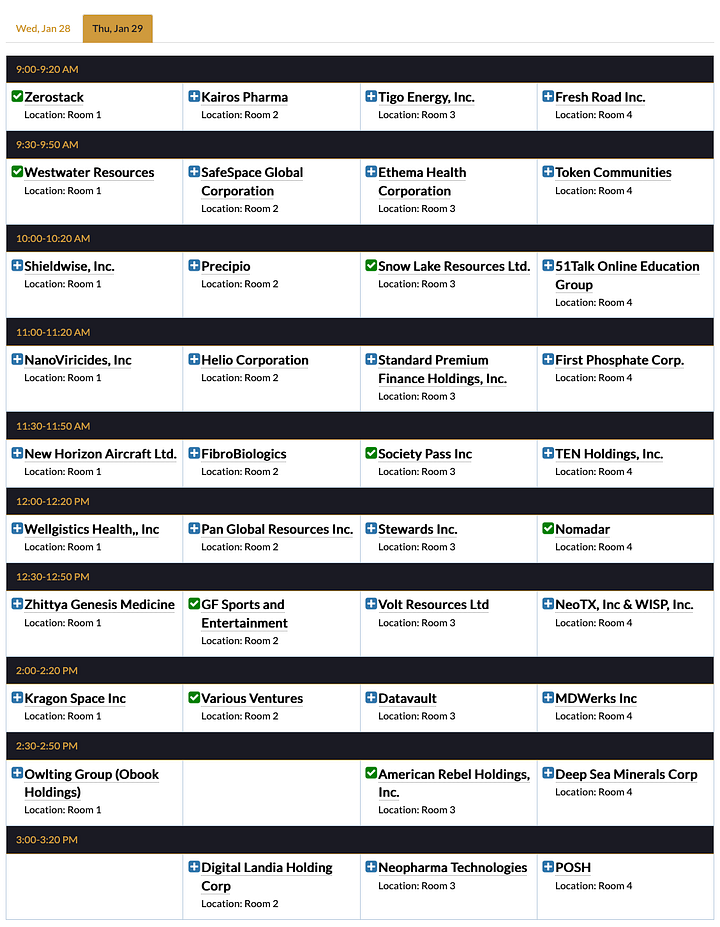

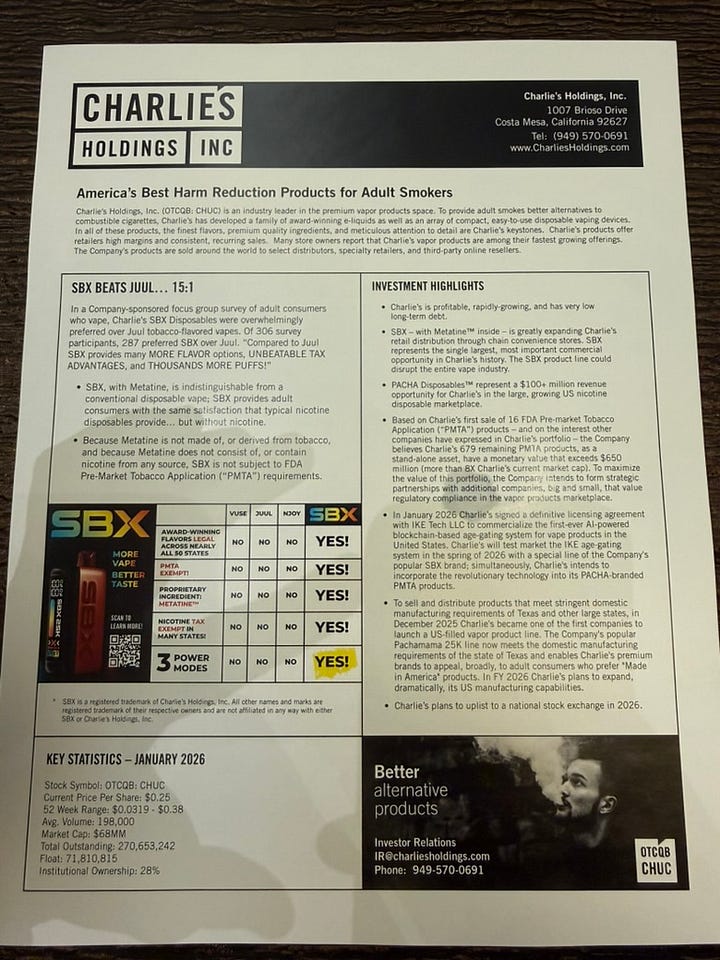

I went to Dealflow Discovery Conference in Atlantic City, see the images below for the companies that presented…

Above you can see check mark are those that I have attended

Here are a few that I found interesting:

Grown Rogue - I’m gonna keep an eye on this one, CEO was very interesting and it reminds a bit of Cronos (but not really)

Perfect - I been following it and there is a lot of write ups or mentions on Substack but it’s basically a net-net but there is just something off IDK need to do more work on this

Access Newswire - I did a write up on

Charlie Holdings - potentially might be interesting to those who willing to dig deeper, President Heny Sicignano, interesting guy…

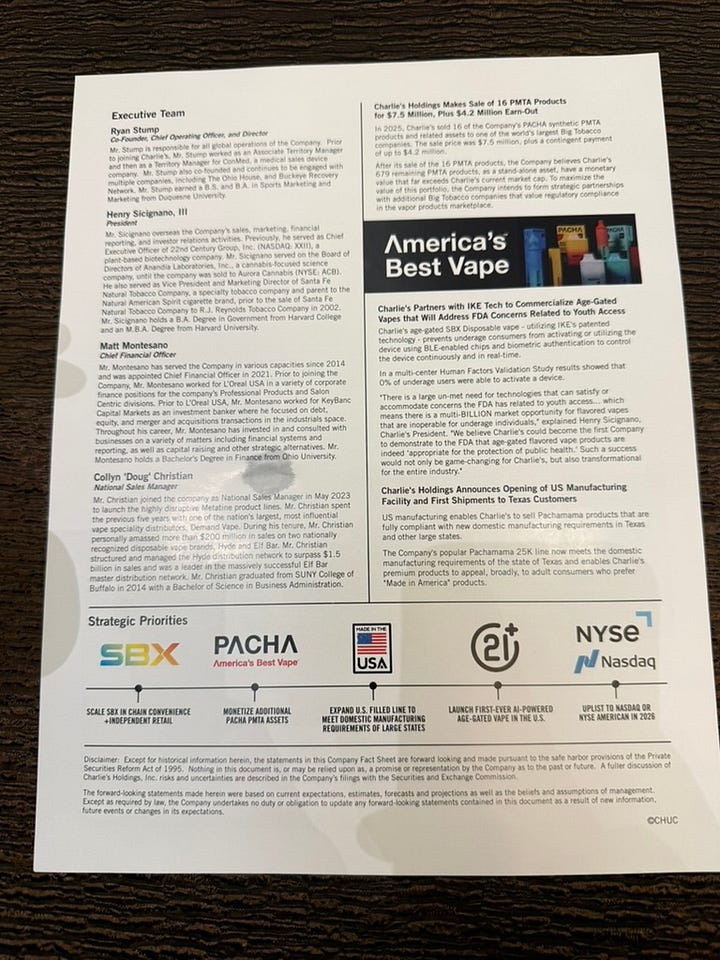

I must also speak about American Rebel Holdings as that one was a wild card

They gave me their beer to try and company called American Rebel … I mean like what else do you want , right?

Do your own due diligence…

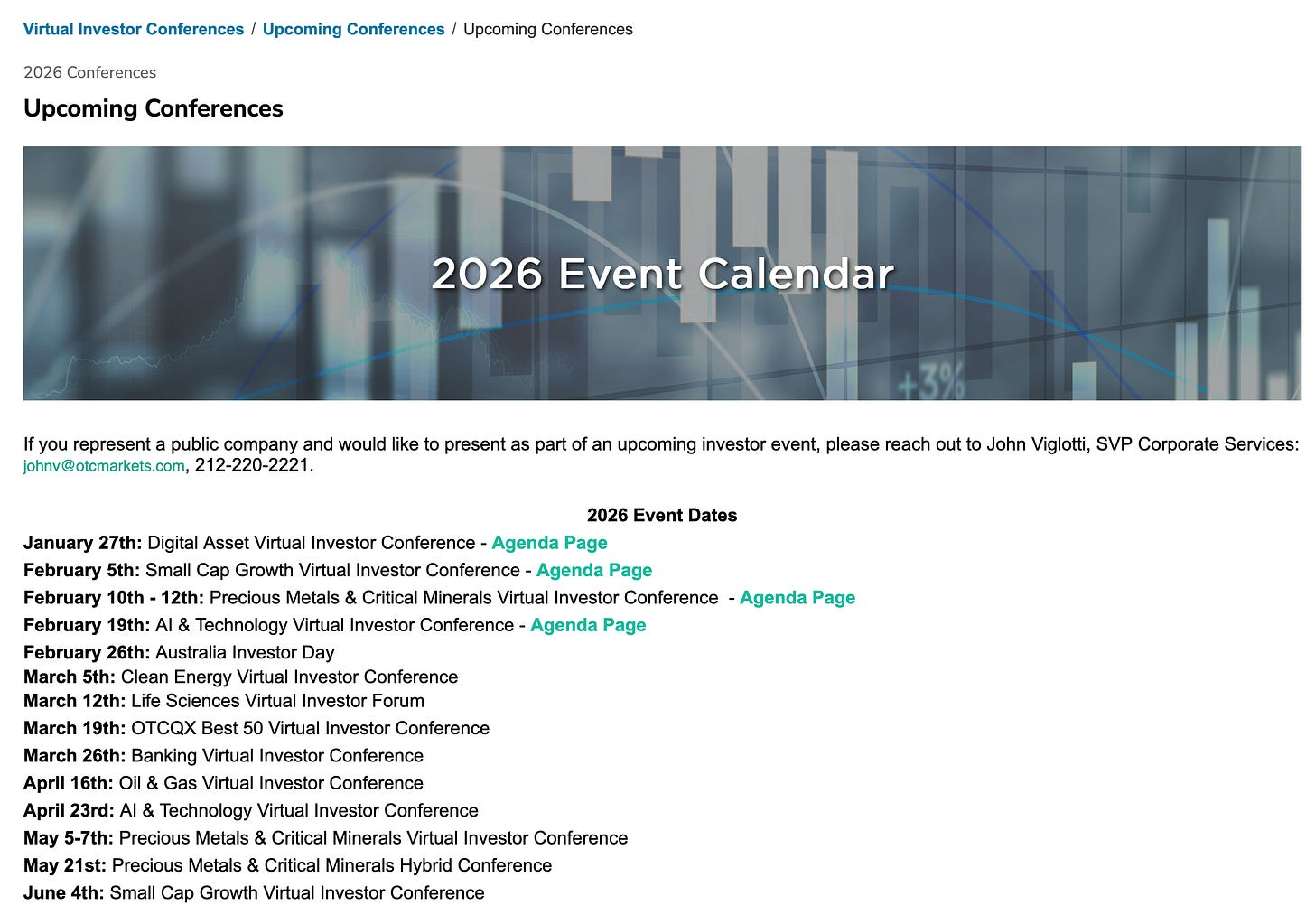

BONUS

Check out Virtual Investor Conferences for more interesting ideas (image above is clickable to go to their website, its not affiliation, I don’t get paid, I’m just sharing more ways to get interesting ideas to turn over more rocks and look for gems)

Tax Season

Tis the tax season (almost…) I got my 2025 Tax Doc from Webull and figured I would continue the tradition to compare my Webull results on yearly basis based on tax docs. Started it with this post…

This is just for fun

ST - Short term, LT - Long Term, QD - Qualified Divided

2019

Short-term Profit - around $170

2020

Short-term Profit - around $3,000

Long-term Profit - around $400

Qualified Dividend - around $400

2021

ST Profit - around $12,000

LT Profit - around $8,000

QD - around $5,000

2022

ST Profit (Loss) - around (-$8,000)

LT Profit - around $6,000

QD - around $2,000

2023

ST Profit - around $3,000

LT Profit - around $4,000

QD - almost $3,000

2024

ST Profit - around $1,600

LT Profit - around $15,000

QD - around $2,500

2025

ST Profit (Loss) - around (-$5,500)

LT Profit - around $88,000

QD - almost $3,000

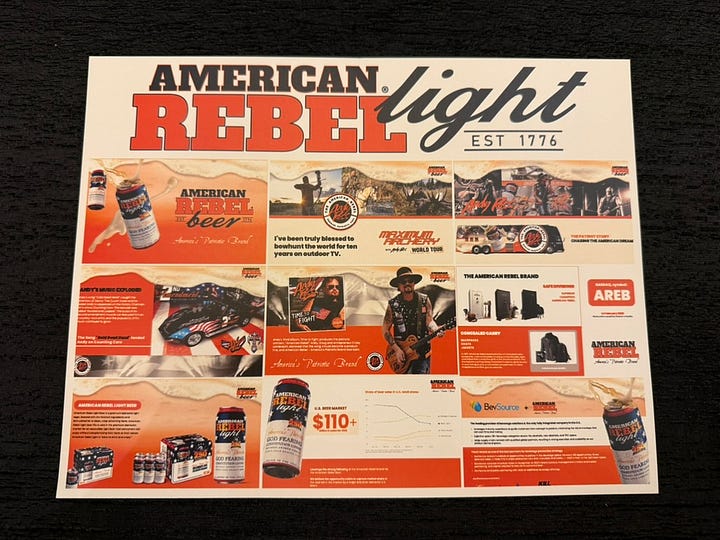

Earnings

https://appinvestor.substack.com/i/188112711/gravity-co-inc-grvy

VC Investing and venting

Before going to good news I need vent a bit… as some of you might know / remember I posted about a year go that I invested into ElevenLabs and I was very excited … well I got notified not too long ago that ‘investment” was canceled and they returned the money but I actually wanted to invest and signed everything but company just decided they can (A YEAR LATER) not fulfill on their promise, I’m not really sure how it works and the investment was only in THAT huge amount but still, I think its really NOT COOL to hold on to the funds for a year and then be like “nope here is your money back you cant invest” VC investing is interesting game I have to say and I’m learning something new every time.

Also learning that trying to do investment directly rather then via some platform also makes a difference VC is about connections and people so when doing it via platforms sometimes that gets lost…

Anyways , that kind of played out in different way (good) because I increased my stake in Ivee which you can learn about click here.

But that’s not even the good news, the good news is that Our Bond went public!

I invested into BOND or now OBAI 0.00%↑ via Wefunder and its my first official VC investment that went public (via direct listing) so not an IPO but still (little wins). With BOND going public I also learned a few more things about VC investing again you live and you learn …

I will share a bit more about it later on in the post but here just wanted to celebrate a little win in public.

Don’t forget to ❤️ this post. It helps a lot!

Sections below are for paid subscribers only…