Gravity Co., Ltd. ($GRVY)

"A growing, profitable, negative EV company with great prospects in 2026!"

This write up was done in collaboration with AppInvestor.

100% of the research was done by AppInvestor, I just added couple of final touches.

If you would like to learn more about AppInvestor, check out his Substack and his website.

Disclaimer is at the end.

Gravity 101: From PC MMORPG pioneer to mobile powerhouse

Gravity is a South Korean game developer best known for the Ragnarok Online franchise, a classic 2002 MMORPG that defined an era of Korean PC gaming. After a blockbuster IPO in 2005, Gravity’s early growth stalled in the 2010s as PC gaming matured. The company’s fortune turned around post-2015 when it partnered with Shanghai developer Dream Square to bring the Ragnarok IP to mobile platforms.

This mobile shift was transformative: mobile games now contribute 75% to 85% Gravity’s revenue any given quarter. Gravity now generates revenue through a mix of self-published games (where it earns microtransaction and subscription revenue directly) and licensed titles (where partners run the game and pay Gravity royalties/license fees).

Gravity’s ownership structure is tightly held: GungHo Online (the publicly-traded Japanese gaming firm behind Puzzle & Dragons) beneficially owns 59.3% since purchasing majority ownership in 2008, leaving a small public float. This majority control has historically meant minimal shareholder engagement – a point we’ll revisit later in the article.

The Ragnarok IP and game lineup: Gravity effectively lives and dies by Ragnarok at this stage. The intellectual property (based on Norse-mythology-inspired anime styling) has been continually milked via new titles. Gravity does not own the IP itself, but they have an exclusive license to use the Ragnarok IP until 2063, from its creator, the manhwa artist Myoung‑Jin Lee.

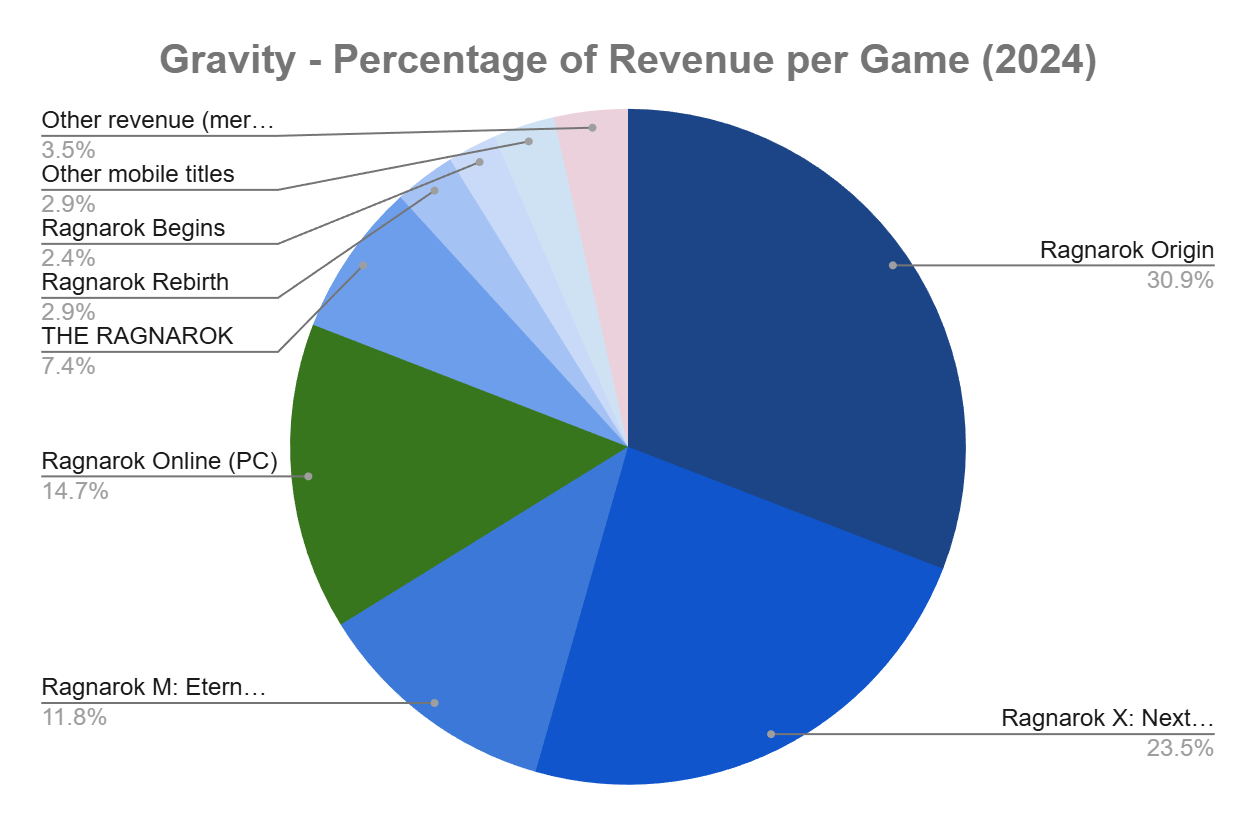

Ragnarok Online (PC) is long in the tooth but still generates steady income, about ₩71.3 billion in 2024 (~15% of total revenue). The real cash cows, however, are the mobile spinoffs:

In total, games based on the Ragnarok IP (including the PC original and all mobile offshoots) made up ~97% of Gravity’s 2024 revenue, a staggering concentration which continued in 2025.

Gravity’s revenue model varies by title. For self-operated games (e.g. ones Gravity publishes directly in certain regions), revenue comes from players’ in-game purchases (microtransactions) and subscriptions. For licensed regions, Gravity books royalty fees from the local operator. For example, Nuverse pays a cut of Ragnarok X sales in Southeast Asia, and GungHo pays royalties for running Ragnarok Online in Japan. This model yields high margins (royalty revenue has minimal cost) but also outsources a lot of control. If a licensing partner underperforms or a contract lapses, Gravity’s revenue can swoon. The dependence on Dream Square-developed games is another risk: 63.4% of 2024 revenues came from mobile titles developed by Dream Square or its subcontractors, reflecting how crucial that partner was. Gravity has both expanded offices for publishing games themselves in more countries, as well as increased internal development (and new third-party collaborations) to reduce this reliance.

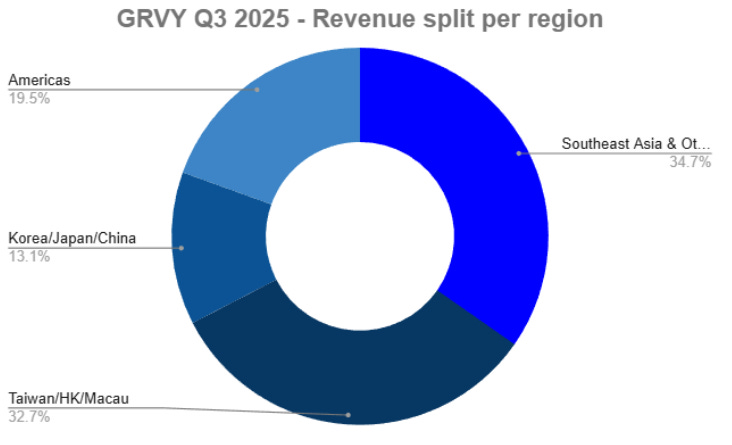

Geographic reach: Historically, Gravity’s money was made in Asia, in particular Korea (its home), Taiwan, Thailand, and other Southeast Asian countries where Ragnarok is a nostalgic brand name. Americas accounts for about a fifth of their revenue.

This regional mix will keep evolving: Gravity is pushing hard into new markets (more on that in later) and has multiple China launches on deck, so China’s contribution could surge in 2026 if things go well.

Valuation: Why So Cheap?

A thriving business valued at zero dollars

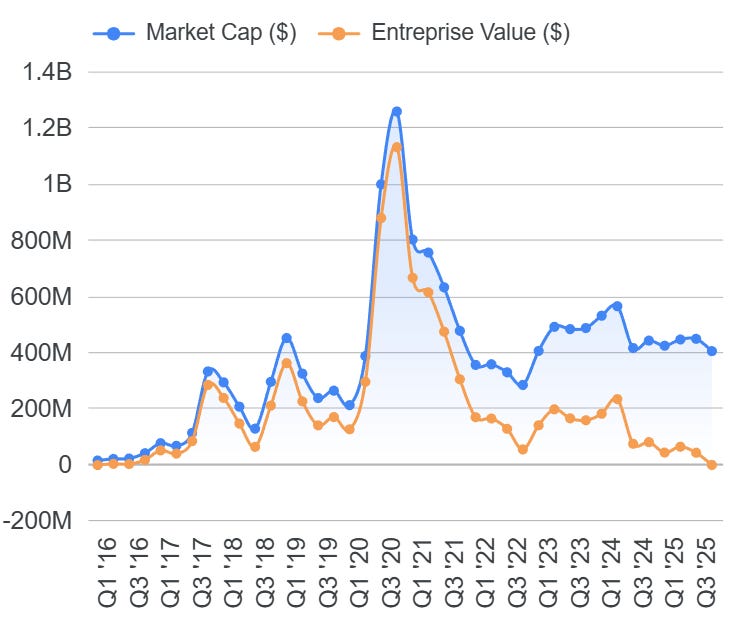

Before discussing valuation metrics, it’s important to note Gravity’s financial health: the company is solidly profitable and cash-rich. Even after funding new game development and marketing, Gravity has amassed a war chest of ₩609.9 billion in cash as of Q3 2025 (roughly $460 million) against negligible debt. In fact, the net cash on the balance sheet is roughly equal to Gravity’s entire market cap, an almost absurd situation. This conservative balance sheet provides a huge margin of safety (Gravity could survive years of misfires), though some argue it also reflects management’s unwillingness to return capital to shareholders.

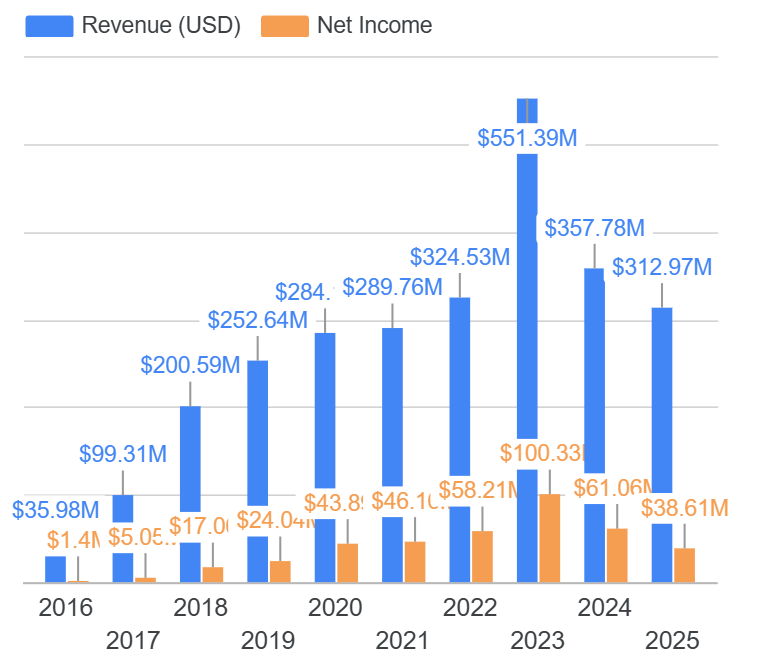

Yet despite its strong earnings — 29% CAGR from 2016 to 2024 whilst growing net profits from $1 to $58 millions in the same time — Gravity’s stock has been persistently poorly priced. At around $57 per share, the ADR trades at a trailing P/E of ~7. EV/Sales is not even worth mentioning, since it’s now negative! In other words, the market is assigning zero value to Gravity’s business beyond its cash holdings.

As Appleseed value fund mentioned, “Gravity’s market capitalization nearly equals the cash on its balance sheet; we believe good things happen when valuation is so staggeringly cheap.” Indeed, it’s rare to find a growing, profitable tech company trading for free. Let’s have a look at their peers in the gaming sector.

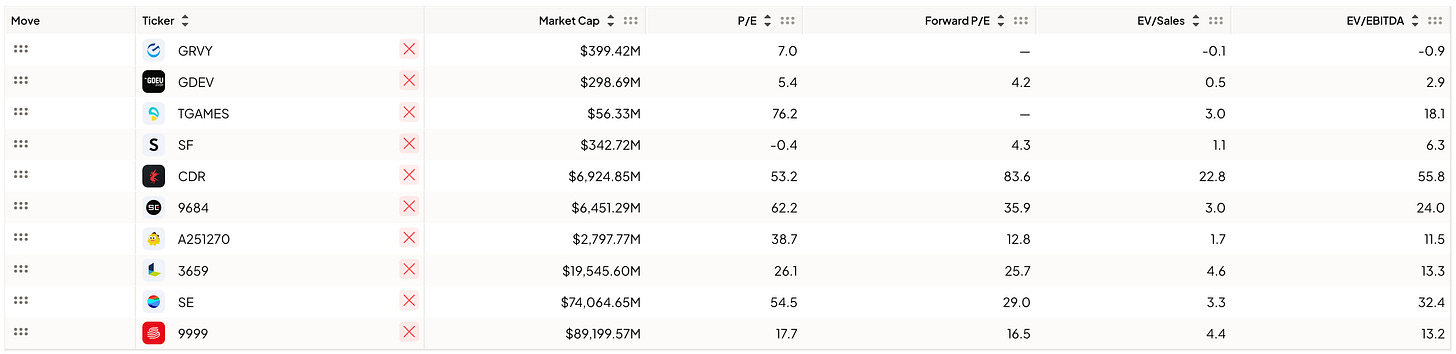

Competitor Benchmark

CD Projekt (Polish studio behind The Witcher and Cyberpunk 2077): Trades around 50x P/E and 22x sales despite a rocky 2020-2021. Investors give it a rich multiple in hopes of future blockbuster releases. Basically the opposite of Gravity’s situation.

Stillfront Group (Swedish F2P consolidator with a portfolio of midcore/mobile studios): Trades at roughly 3–4x P/E, ~1.1–1.3x sales, and about 4x EV/EBITDA. The low equity multiple reflects skepticism about its leveraged, acquisition‑driven model and muted organic growth. Unlike Gravity, investors are discounting balance sheet risk and integration complexity rather than a net‑cash, under‑promoted cash cow.

GDEV (Cyprus-based publisher best known for Hero Wars): Trades around 9–10x P/E, ~0.7–0.8x sales, and mid‑4x EV/EBITDA. The market gives it a premium to Gravity on earnings for its flagship live‑ops franchise, but still values it as a neglected gaming asset. In practice, it sits much closer to Gravity’s “deep value” bucket than to high‑multiple large‑cap peers

Nexon (Japan/Korea online game publisher, known for MapleStory): Trades at ~30x earnings and ~5–6x sales. Nexon is profitable and cash-rich too, but it’s valued far higher for its steady franchise income and big-IP portfolio.

Electronic Arts (EA) (US gaming giant): Around 24x forward earnings (after a temporary dip in trailing EPS) and 6–7x sales, with an EV/EBITDA north of 30x currently. EA’s multiple reflects its stable of sports titles and live services: reliable, slower growth than mobile, but investors still pay a premium for scale and IP. Yes, they were purchased recently, but it is still worth considering them.

NetEase (Chinese gaming powerhouse): ~17x P/E and ~5.6x sales, making it one of the “cheaper” big gaming stocks. NetEase is highly profitable with a strong mobile lineup, yet its P/E is still double Gravity’s and EV/Sales ~30x higher.

Sea Limited (Singapore-based, owns Garena): Sea’s gaming division (Garena) is a cash cow, but the overall company has e-commerce losses. Still, Sea is valued ~55x P/E and ~12x sales (on a sum-of-parts logic). Its EV/EBITDA has been in the 30–50x range. Investors basically bet on its growth and overlook near-term profit volatility.

Trophy Games (Denmark mobile game dev, much smaller scale): Trades at 50–75x earnings (depending on the source) with ~3.9x sales. As a micro-cap, it’s volatile, but clearly the market is willing to pay up for any growth story in mobile gaming – except, it seems, Gravity’s.

Possible reasons behind this low valuation

The market’s skepticism boils down to a few things:

Sustainability of earnings: investors doubt Gravity can maintain its current profits as game cycles ebb (the Ragnarok hype could fade). This one I generally disagree with, on the contrary they are growing the Ragnarok IP every year with fresh games, different types too.

Corporate governance and capital allocation: with GungHo in charge, there’s fear that cash will just sit idle or be used for empire-building rather than returned to shareholders. My take: honestly, fair.

Lack of diversification: essentially all revenue is from one franchise in a very hit-driven industry, which merits a “conglomerate discount” on the IP. My take: “Jein”. Yes, Gravity is Ragnarok IP today, but that’s not a one-hit wonder like Puzzle & Dragons (GungHo), it’s actually multiple successful launches every year of that IP. And they’re investing into diversification quite a bit.

Low visibility: no guidance, few updates between quarters, and a history of lumpy results make it hard to model, so many investors take a hard pass. My take: True and unlikely to change.

Foreign issued: U.S. investors may view it as a Korean ADR with governance quirks and low float, and US investors trust in these is low. My take: True. I even believe they could benefit greatly from dual-listing on the KOSDAQ.

This is what Gravity is dismissed by some as a value trap. However, as commented, these risks are partially mitigated and one could argue they are more than priced in at current multiples. Gravity’s own operating history shows it can deliver consistent profits (even if quarterly revenue swings). The company has no debt and significant cash, so downside risk is limited unless Ragnarok completely implodes. We’d also note that even if Gravity’s earnings stagnated or declined, at this valuation it could liquidate and return cash for a gain!

In sum, Gravity’s undervaluation is recognized by a small circle of “savvy” investors but ignored by the wider market, creating an intriguing situation: if any positive catalyst emerges, the rerating could be dramatic, but one must be patient (and perhaps a bit contrarian) to hold this stock in the meantime. In the past 3 years, the NASDAQ has beaten GRVY 0.00%↑ by 100%. Hence the air quotes on savvy here, and I absolutely include myself in there.

Gravity’s Operations Today

Global Bush, Diversification and Increased Marketing spend

While the stock market snoozes, Gravity’s business has been quite busy. The company in the fast years has aggressively expanded its global operations beyond its traditional strongholds. A few years ago, Gravity mostly licensed its games abroad; now it’s establishing regional publishing arms and directly reaching players in new markets.

The launch of Ragnarok Origin in the Americas in early 2024 and of Ragnarok X: Next Gen in 2025 are important milestones. Instead of handing the Western markets to a licensee, Gravity self-published these titles, with encouraging response in particular in Brazil, as well as Canada and to a lesser extent, the U.S. Gravity showed it can execute a global release, which lays groundwork for future titles.

Moreover, Gravity is diversifying beyond both Ragnarok and the core MMO genre. In particular, the company has started an “indie publishing” initiative, signing deals to publish smaller, non-Ragnarok games on PC and console. For example, in Q3 2025 Gravity announced it will publish “The Game of LIFE” for Nintendo Switch in Asia (in partnership with TOMY Company (TSE:7867). It is a board game adaptation that’s a far distance from its usual RPG fare. It’s also remastering some older Japanese IP (like Wizmans World Re:Try and Hashire Hebereke: Ex) and incubating indie titles (Little Gods of Abyss, Light Odyssey, etc). The strategy seems to be: leverage Gravity’s publishing infrastructure to bring a slate of niche games to global audiences, effectively utilizing that cash pile to broaden the portfolio. None of these indie/console games have yet nor are likely to be blockbusters, but collectively they could add incremental revenue and signal to investors that Gravity isn’t just a one-trick Ragnarok pony. Management explicitly mentioned a goal to position Gravity as a “global game company” offering self-developed, console, and indie games alongside its flagship MMORPGs.

One area seeing higher investment is marketing. Gravity historically spent very little on advertising. Ragnarok Online grew organically, and early mobile launches were handled by partners. But as Gravity takes charge of global releases, it has had to spend on user acquisition and brand-building. We saw selling & marketing expenses jump in late 2024 and again in mid-2025 (SG&A spiked to ₩33.5B in Q2 2025, much higher than usual), likely due to promoting multiple game launches (Origin’s Western debut, Ragnarok M: Classic relaunch campaigns, Next Gen global push, etc.). Gravity’s booth at G-STAR 2025 featured a whopping 19 titles (5 of them Ragnarok-related) on display for media and fans. This goes beyond numbers: by showcasing a full pipeline, Gravity can attract developers and partners who see that it’s serious about growth.

However, expanding operations globally is not without growing pains. Gravity’s core competency has been managing Ragnarok in Asia; entering Western markets means dealing with different player expectations (and far tougher competition from entrenched titles). Gravity will need to adjust its approach, perhaps fine-tuning gameplay or monetization for regional tastes. The company has started localizing content more deeply and even experimenting with platforms like blockchain integration (e.g. Ragnarok Landverse on Web3), which is a niche play but shows they’re willing to try new angles.

Gravity operations financials remains solid

As of Q3 2025, Gravity delivered ₩138.9B ($105–110M) in quarterly revenue with ₩21.3B OP (operating profit). That was up +8% YoY in revenue (though down from a spike in Q2) and an operating margin of ~15%. Notably, Q3 profit improved QoQ despite lower revenue, suggesting better cost control or more efficient marketing spend. Management commented that revenue fell from Q2’s high due to a natural post-launch stabilization of Ragnarok M: Classic (one of the 2025 releases), but profitability actually rose 8% QoQ thanks to marketing efficiency. This hints that Gravity isn’t just burning money to chase growth – they are mindful of ROI on ads. With so many launches in 2025, one might expect margins to suffer, yet Gravity maintained healthy earnings. It helps that a lot of revenue still comes from royalties which drop straight to the bottom line.

In summary, Gravity’s current operations show a company transitioning from an Asian leader to a global publisher. They are taking on more roles (self-publishing, multi-platform releases) and spending more upfront (marketing, event appearances) to build a worldwide audience. The big question is whether these efforts will pay off in significantly higher revenue/profits, or if they’ll just dilute focus. So far, the core Ragnarok business remains the cash cow powering everything, and the new ventures are small-scale. But the groundwork is being laid for Gravity to potentially have multiple IPs or at least a wider geographic reach, which could, in time, convince the market to assign a less absurd valuation. After all, if Gravity starts acting more like a Nexon or NetEase (diverse games, global footprint), perhaps it can earn a fraction of their multiples rather than <1x book value.

Why It Might Be a Good Time to Hold Gravity: Catalysts & Outlook

With the stock in the doldrums and many investors unconvinced, why am I still holding (and even bullish) on Gravity? In our view, 2025–2026 represents a convergence of factors that could help wake this “sleeper” stock from its slumber.

Defensive setup, limited downside

Gravity’s valuation, as we’ve harped on, is so low that the downside appears cushioned. At EV ≈ $0, the market is essentially saying Gravity’s existing business has no value. But the company has been solidly profitable for years, has a net cash position (~$460M cash vs <$10M debt), and an entrenched player base for its games. This makes Gravity a relatively defensive play in a volatile market at all time high. Simply put, even if a recession or industry downturn hits, Gravity has the cash to weather it and minimal fixed costs. Its games, especially older ones, have surprisingly sticky revenue (Ragnarok Online still makes money 23 years on!). In a scenario where global markets get shaky, we’d much rather hold a company like Gravity with a huge cash buffer and loyal user base, than a richly-valued growth stock that needs constant good news. In short, the margin of safety is high. Ben Graham would probably nod in approval at a profitable net-net with an iconic franchise.

Activist investor on board of the mothership

While direct shareholder activism is blocked by GungHo’s majority control, there’s still pressure building. Activist fund Strategic Capital has taken a stake in GungHo and, in 2023–2024, publicly pushed for better capital allocation and even called for the CEO’s removal (unsuccessfully, so far). That matters for Gravity because any shake-up at GungHo—who owns nearly 60% of Gravity—could spill over. One possible move? A tender offer to take Gravity private. But if that happens, there’s a risk it gets lowballed. There are past examples of Japanese parent-subsidiary deals like Hitachi buying out Hitachi High-Tech at a 47% premium) or Nissin Foods absorbing Myojo at a 24% premium). It’s a credible path to value unlocking, but not without caveats for minority holders.

Cash allocation

This is a long shot but hear me out. What if Gravity…allocated their cash? Audacious, I know. Whether through a studio/IP purchase, a share buyback, dividends (the company has no debt and could easily afford a buyback) or even better investing it, Gravity would signal to the market that management cares about shareholder value. Right now, any whiff of shareholder-friendly action could re-rate the stock from “uninvestable” to “undervalued gem.” You won’t catch me betting on this, but the status quo of hoarding cash cannot persist forever.. either they deploy it effectively or return it. Gravity’s cash is an “ace in the hole”: it provides optionality. In essence, by holding Gravity you’re also holding a pile of cash that’s growing and could be used opportunistically.

Global brand expansion & new audiences

2025 has been about sowing seeds globally, and 2026 will hopefully be about harvesting them. I think now is a good time to hold Gravity because the company is on the cusp of potentially broadening its fanbase beyond Asia. The multiple game launches in diverse genres, presence at international events, collaborations (like the board game tie-in) is expanding Ragnarok’s reach. If even a couple of these initiatives take off, Gravity could see a step-change in recognition. For example, if one of the indie console games becomes a cult hit on Steam or Switch, Gravity’s image would shift from “the Ragnarok company” to “hey, these guys publish cool games.” That could attract a new class of investors who value IP portfolios and publishing networks.

Additionally, Gravity’s push into China (discussed next in the lineup) could dramatically boost revenues if successful. Chinese gamers are a huge audience, and virtually untapped in terms of revenue. A reminder that Gravity traded publishing rights in China against game development (Dream Square deal for example). With more and more licenses obtained in China (check), and more self-developed games (check), Gravity stands to increase their revenue in China.

Strong execution and massive 2026 lineup

Gravity’s management, while conservative, has executed well operationally. Launches in 2024-2025 were generally on time and hit decent numbers. Without a major hit (the likes of Ragnarok SEA in 2023), Gravity has managed to keep a steady growth at >15% net profit margin. This low profile means expectations are always low, setting up a scenario where any positive surprise can jolt the stock.

And they’re hard. The Q4-2025 and 2026 lineup is massive, bigger than it has ever been, it deserves its own chapter.

The 2026 Lineup – Big Launches and What’s at Stake

Perhaps the most exciting (and uncertain) part of Gravity’s near future is the 2026 game lineup. The company has an unusually large slate of titles scheduled through 2026, which is both an opportunity and a risk factory. Here are the major projects:

Ragnarok 3 (PC/Mobile MMORPG) – Initial launch: 2026 globally. This is arguably the crown jewel of the pipeline. “Ragnarok 3” appears to be a true next-generation MMORPG in the Ragnarok universe – the first big-numbered sequel since the early 2000s (there was a Ragnarok Online 2 that flopped, so the numbering might be symbolic). The fact it’s planned for a global launch suggests Gravity aims to make this the new flagship platform for Ragnarok fans everywhere. If Ragnarok 3 succeeds, it could prolong the franchise’s life for another decade. However, the stakes are high, can Gravity with co-developer JoyMaker deliver a modern MMORPG that competes with today’s offerings? On the positive side, the Ragnarok IP gives it an immediate built-in fanbase, and Gravity has 20+ years of lore to draw on. One of the gameplay video has gotten 1.5 millions views in just a few days. Also, the ISBN approval in China is already in place.

Ragnarok M: Eternal Love 2 (PC/Mobile MMORPG) – Initial launch: TBD (possibly late 2026 or beyond). Externally developed by Big Cat Studio, this one is listed as a sequel to the original Ragnarok M (the 2017 mobile hit that is still today a 10% revenue earner). It’s a bit curious because Ragnarok M: Classic was launched in 2024 and is still running hot. A sequel suggests a significant engine update and/or new content.Given M singlehandedly brought Gravity back to life, it’s fair to have high expectations of the sequel.

Ragnarok: The New World (PC/Mobile MMORPG) – Initial launch: 1Q 2026 in Taiwan/HK/Macau. This appears to be a new, self-developed game, perhaps tailored for Chinese-speaking markets. Medium expectations there, but this launch targets key markets.

Ragnarok Abyss (PC/Mobile MMOARPG) – Initial launch: 1H 2026 in Southeast Asia. This is interesting: “MMOARPG” implies an action RPG spin, possibly more hack-and-slash oriented. It’s self-developed (which tends to lower my initial expectations), and the Closed Beta Test (CBT) starts this December.

Ragnarok X: Next Generation – Europe/MENA release – Additional launch: 1H 2026 in Europe, Middle East & North Africa (excluding a few countries). Expanding X into new territories, as they did in 2025. More juice squeezing for that game, but I would see that as positioning the brand and learning, and have no expectation of solid revenue there for now.

Ragnarok: Back to Glory (also referred to as Ragnarok: Rebirth) – Initial launch: 4Q 2025 in China. It’s Rebirth rebranded for China, and will be published by Kingnet there. Honestly, it did not do well elsewhere, so aside from increasing brand recognition, I would not expect much.

Ragnarok Endless Trails (Mobile Battle Royale) – Initial launch: 1Q 2026 in SEA. Sounds like an experimental spin-off. Internally-developed, “roguelike survival action game” departs from the usual MMO. More spaghettis thrown at the wall, low expectations, but credits given for pushing the IP into a new genre.

Ragnarok Landverse: Genesis (Blockchain/PC MMORPG) – Additional launch: Dec 11, 2025 in North & South America. This is Gravity’s web3 experiment, integrating blockchain (maybe NFTs) into a variant of Ragnarok Online. Expect nothing and get nothing here, is my opinion.

Console/PC Indie Titles (non-Ragnarok): These include:

The Game of LIFE (Switch) – party board game, launching Dec 18, 2025 in Asia. Should generate some console revenue, but niche. It’s more a signal Gravity can partner with known brands.

Wizmans World Re:Try (PC/Console) – JRPG remaster, 1Q 2026 global (ex Japan). Could get some retro JRPG fans excited. Financially, likely small.

Little Gods of Abyss (PC/Console) – puzzle platformer, 1H 2026 global. New indie IP, could be charming but unknown.

Arcade 30 (PC/Console) – 2H 2026 global It’s a codename for a a retro‑style PC/console game planned.

LIGHT ODYSSEY (PC/Console) – “Boss Rush Action, Souls-like”, 1H 2026 global.

Final Knight (PC/Console) – action RPG, 1H 2026 global.

Hashire Hebereke: Ex (PC/Console) – racing game remake, 1H 2026 global. Likely a remaster of a 90s game; may attract retro enthusiasts in Japan/Asia primarily.

In summary, 2026 is going to be a hectic year for Gravity. They have multiple Ragnarok variants launching across regions and platforms, plus a slew of non-Ragnarok games. For a company of Gravity’s size, this is an ambitious undertaking. Execution will be key – delays could happen (not unusual in gaming), or some projects could quietly be shelved if early tests are poor. But if even a few of these titles hit paydirt, Gravity’s revenue could climb significantly.

Upside scenario: Ragnarok 3 becomes a global success (reviving old fans and attracting new ones), one of the China launch turns China into a top-3 region for Gravity, and one of the indie titles surprises with cult popularity. We could be looking at Gravity posting record revenues in 2026–2027 and finally getting more respect from investors.

Downside scenario: The new games mostly cannibalize existing ones or flop, leading to stagnant revenue, which, given the low valuation, is likely already assumed by the market.

One thought: Gravity doesn’t need every game to be a hit. The current business is stable enough to keep the lights on. So 2026’s lineup is more like a free set of lottery tickets: any winner could dramatically improve the outlook, but losers won’t sink the ship.

The Big Question Marks

No investment is perfect, and Gravity certainly isn’t. We’ve been optimistic so far, but to keep a balanced, skeptical but grounded view (I’m a Debbie Downer), let’s address the major question marks hanging over Gravity:

1. Can Gravity succeed without Dream Square? For years, Gravity’s success relied on external studios like Dream Square, which delivered hits like Ragnarok M: Eternal Love and Ragnarok X: Next Generation. The most successful title to date, Ragnarok Origin, well.. Has unclear origins *cough cough*. I have seen it attributed to Dream Square by some accounts, and could not verify the claims. It could well have been internally developed.

Now, with Dream Square out of the picture (for new games), Gravity is leaning more on self-development and new partners. That’s a real test. Making a low-cost retentive MMORPG requires a lot of balancing, and beyond replicas (e.g. Ragnarok M: Classic), Gravity has little to show in terms of major success on mobile recently.

2. Traction in China: will it ever happen? China is the world’s biggest gaming market, and Ragnarok is a known IP there (there were private servers of RO in China as far back as 2003). Yet Gravity has historically struggled to crack China in a meaningful way. They have to go through local publishers and a tough approval process. Now in 2024–2025, things have moved: Ragnarok X: Next Generation launched in China (with Nuverse) and Ragnarok Origin got a China release as well. However, the Dream Square deal meant the upside was very limited in that market, so the impact was minimal.

I am cautiously optimistic with the bigger titles like Ragnarok Online 3 and Eternal Love 2. If China flops, Gravity may remain heavily dependent on Southeast Asia and Taiwan, which are good markets but not as scalable.

3. Western market viability: Gravity’s push into the West has yielded mixed results. Western gamers tend to prefer premium PC/console RPGs (think Elden Ring, Genshin Impact) or mobile titles with high production value. Ragnarok’s retro charm appeals to nostalgic players, but may look dated to new ones. Its anime aesthetic, popular in Asia, remains niche in the West, though regions with large Southeast Asian diaspora respond better. The Western expansion is more about long-term growth and image. But for Gravity’s valuation to shift meaningfully, they’ll need real revenue and profit from the region, not just presence. That remains uncertain. The risk is over-investing in Western ops without returns, denting margins. So far, their West foray is a modest start: neither a failure, nor a breakthrough.

4. Will that cash ever come back to shareholders? Gravity has never paid a dividend or bought back stock, despite sitting on over $450M in cash. That’s frustrating for investors, especially as the pile keeps growing. Without a plan to return capital, it risks depressing ROE and leaving value on the table. The risk isn’t just inaction—it’s misallocation. While management has been prudent so far, a poorly timed acquisition or off-strategy bet could erode trust fast.

We’ve noted earlier that activist investor Strategic Capital is pressuring GungHo, Gravity’s parent. If their influence grows, it could eventually lead to more shareholder-friendly actions at Gravity too. Until then, the cash sits idle, and the market keeps discounting it accordingly.

5. Competition and market saturation: Underlying all these points is the fact that Gravity operates in a hyper-competitive industry. Every new Ragnarok game not only competes with other companies’ games, but also with other Ragnarok games! Gravity has like 5 different Ragnarok mobile titles now; they risk cannibalizing their own user base. Whilst they manage the releases per region, giving usually enough time for one MMO to fade before launching the next one, it remains a risk. Essentially, Gravity must keep Ragnarok fresh while fending off competitors and not oversaturating its own market. A tricky balance.

Conclusion

Investing in Gravity requires a certain temperament. You have to be comfortable with contrarian positions: holding a stock that most of the market has essentially forgotten. And doing so not for weeks or months, but possibly years. Over the last couple of years, Gravity’s operations have improved markedly (higher revenue base, more diversified releases, sustained profits) while the stock has drifted or declined. That disconnect can test one’s patience and conviction. It’s easy to see why some throw in the towel, labeling Gravity a value trap.

However, I believe the risk/reward remains firmly in favor of reward for those who can wait. Gravity offers something rare: the downside is buffered by assets and ongoing cash flow, while the upside is tied to multiple “free” options (the new game launches, potential strategic moves) that could materialize at any time. Owning Gravity at this juncture is a bit like holding a deep-value stock and a growth stock at the same time – you have the deep value of the core business and cash, and the growth potential of the upcoming pipeline.

Let’s also consider the long-term potential. Ragnarok is one of the few Korean gaming IPs that has stood the test of time. It may never be as globally huge as, say, Warcraft or Final Fantasy, but it has a rich world and loyal fanbase that can be monetized over decades (as it already has). Gravity has begun exploring ways to leverage that IP beyond just games. From Ragnarok merchandise and concerts (they held an orchestra concert in Dec 2025), to potential media tie-ins. If we zoom out 5-10 years, Gravity could evolve into a more diversified entertainment company anchored by Ragnarok, with multiple revenue streams (games, licensing, media). The market likely doesn’t price any of that optionality right now.

Of course, one must be prepared for volatility. Gravity’s quarterly results can swing based on game release timing (e.g., a big launch can cause a revenue spike one quarter and a drop the next). The stock itself is thinly traded (on some days only a few thousand shares change hands) so price can move on air. An investor in Gravity needs to have a strong stomach for these swings and not read too much into day-to-day quotes. It’s the classic value investor mindset: focus on business value, not ticker noise.

In conclusion, Gravity ( GRVY 0.00%↑ ) remains a compelling hold in our view because the asymmetry is attractive. We have a fundamentally sound, profit-generating business with an overcapitalized balance sheet trading at one of the lowest valuations in the market. We have a clear catalyst path (the 2026 product slate and potential corporate actions) that could unlock significant upside if even modestly successful. And importantly, we have management finally showing signs of proactive behavior – expanding globally, courting new audiences – which addresses some (but not all) past criticisms.

It may require patience through 2026’s twists and turns, but I believe the endgame (no pun intended) could be well worth it.

As always, we’ll need to keep a close eye on the developments, ready to adjust our thesis if facts change. I even did one better: I’ve recently created a “Gravity Dashboard” page. It’s a first draft, but the goal is for that page to provide key financials, mobile data (my area expertise) and news about Gravity, updated daily. You can check it out here https://appinvestor.co/stocks-picks-track-record/gravity-dashboard-mobile-data/

Good luck to all!

Holdings Disclosure

At the time of this publication, AppInvestor and I (Yegor) do own shares of GRVY 0.00%↑

P.S. Don’t forget to ❤️ if you enjoyed it.

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

FYI this is a PFIC which is annoying for US investors

Dream Square isn't too much of a risk given GRVY contracts with most of the sub developers that were responsible for the underlying development of Dream Square games anyway - if anything, there's potential margin improvements by going direct.

The risk the market is pricing in is that they make a dumb acquisition to justify paying management higher salaries. Management owns no stock, so there is no incentive to unlock shareholder value through div or repos (which would also push the underlying price up, given the current cash drag).