March 2025 Portfolio Update

Quote, Portfolio, Complimentary Monthly Commentary - CMC, Earnings Recap, Latest 13Fs, & Books + much more ...

Quote for this month:

"The difference between successful and unsuccessful investing is not intelligence or access to information. The difference is emotional discipline and keeping your nerve when everyone else is losing theirs." - Bill Miller

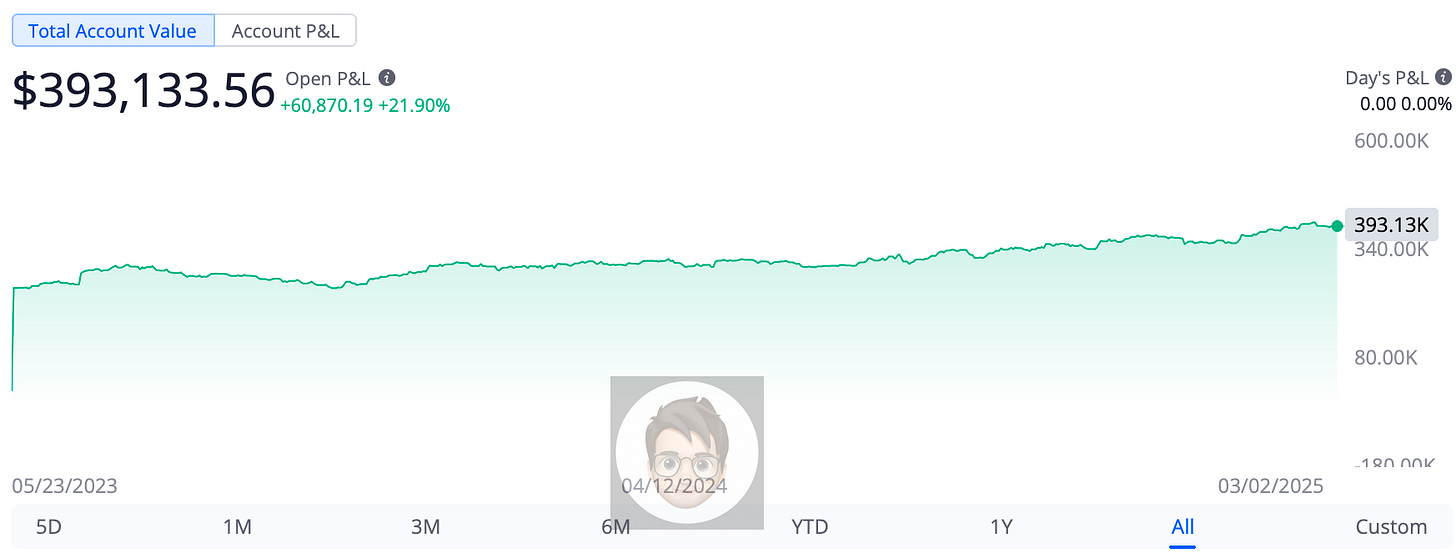

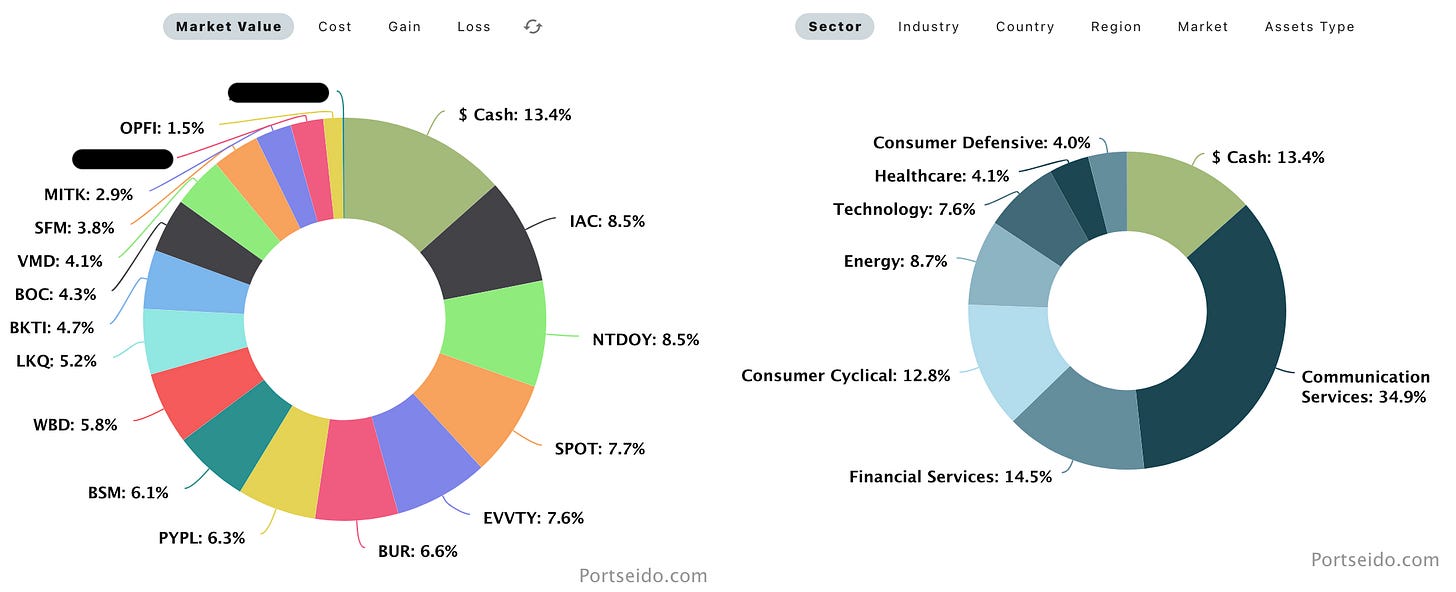

*Portfolio*

*I am NOT a financial advisor. I’m sharing my investing journey. Not investment advice. Do your own research.*

Portfolio (Basic):

Holding since:

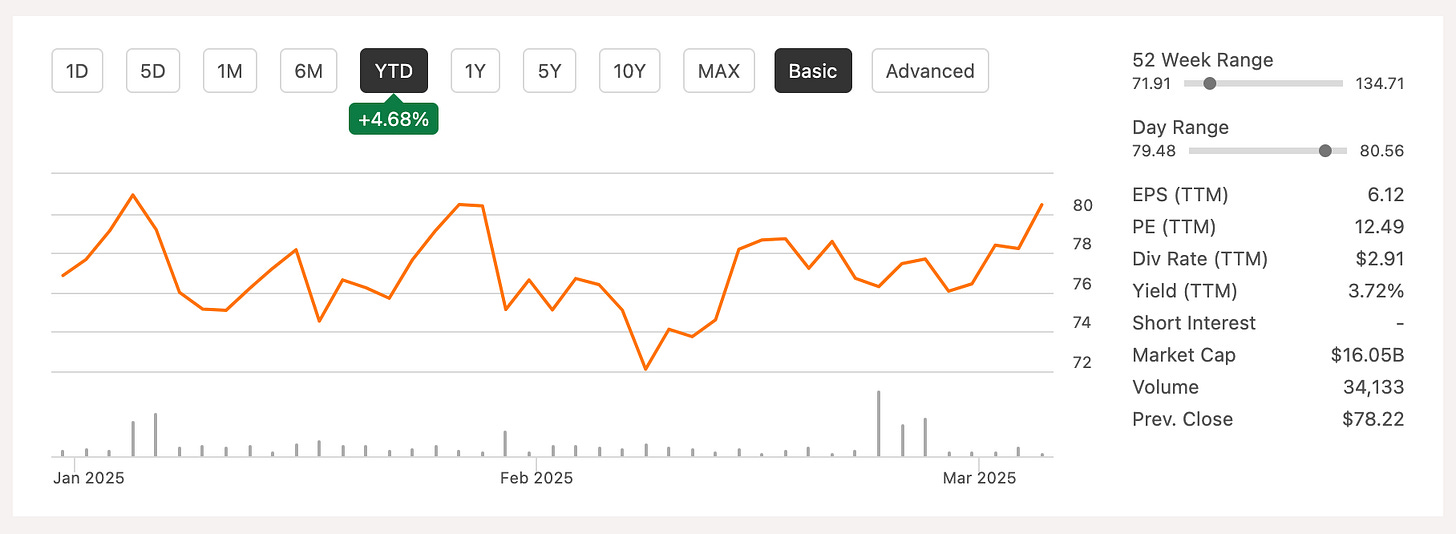

2020 - LKQ 0.00%↑ - 03

2021 - SFM 0.00%↑ - 03 | OPFI 0.00%↑ - 05 | VMD 0.00%↑ - 05 | SPOT 0.00%↑ - 11

2022 - MITK 0.00%↑ - 01 | WBD 0.00%↑ - 04 | $EVVTY - 09 | $NTDOY - 12

2023 - PYPL 0.00%↑ - 01 | BSM 0.00%↑ - 05 | BUR 0.00%↑ - 09

2024 - (First ???) - 01 | BKTI 0.00%↑ - 04 | BOC 0.00%↑ - 09

2025 - IAC 0.00%↑ - 01 | (Second ???) - 03 | (Third ???) - 03

Complimentary Monthly Commentary - CMC

Given the volatility in the market I decided to start two starter positions. They are both very tiny right now but I’m looking to build up the positions over time, in one of them I will probably do it a bit quicker while with the other one, there is a chance that it will take me a year or longer to establish full position or I might not be able to do it in full because it might run up in price and in either case I’m okay with the out come.

I will discuss both in greater details later for paid subscribers, but most of the paid subscribers already know about both of them, because of the complimentary paid chat feature.

Quick note on PayPal, I listened to the Investor Day and I think company is moving in the right direction, its just sad that it took a new CEO to do so, I just image how much better the company would be if the old CEO implemented the changes that Alex Chriss is doing right now.

Earnings Recap

Part 1

Part 2

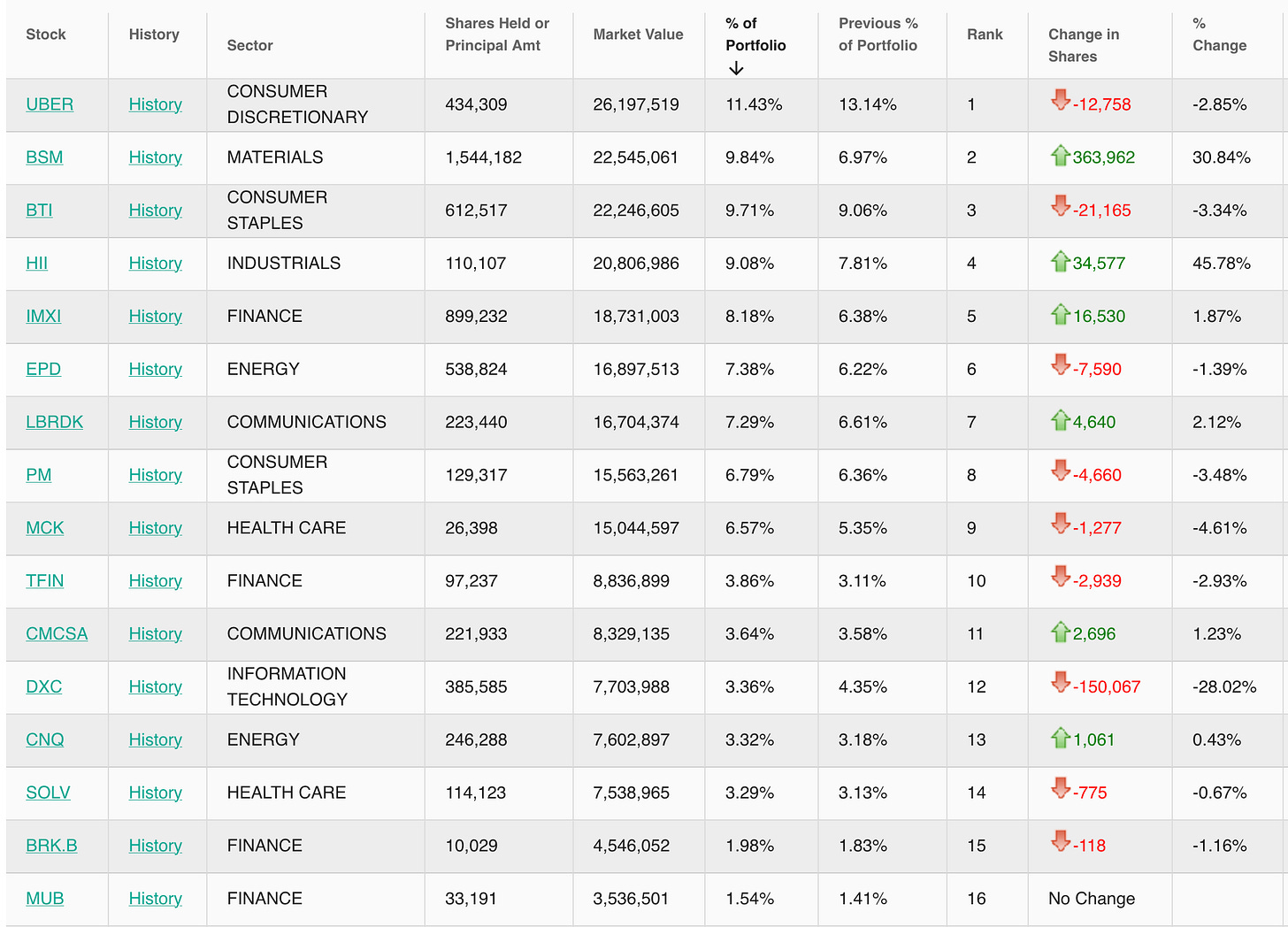

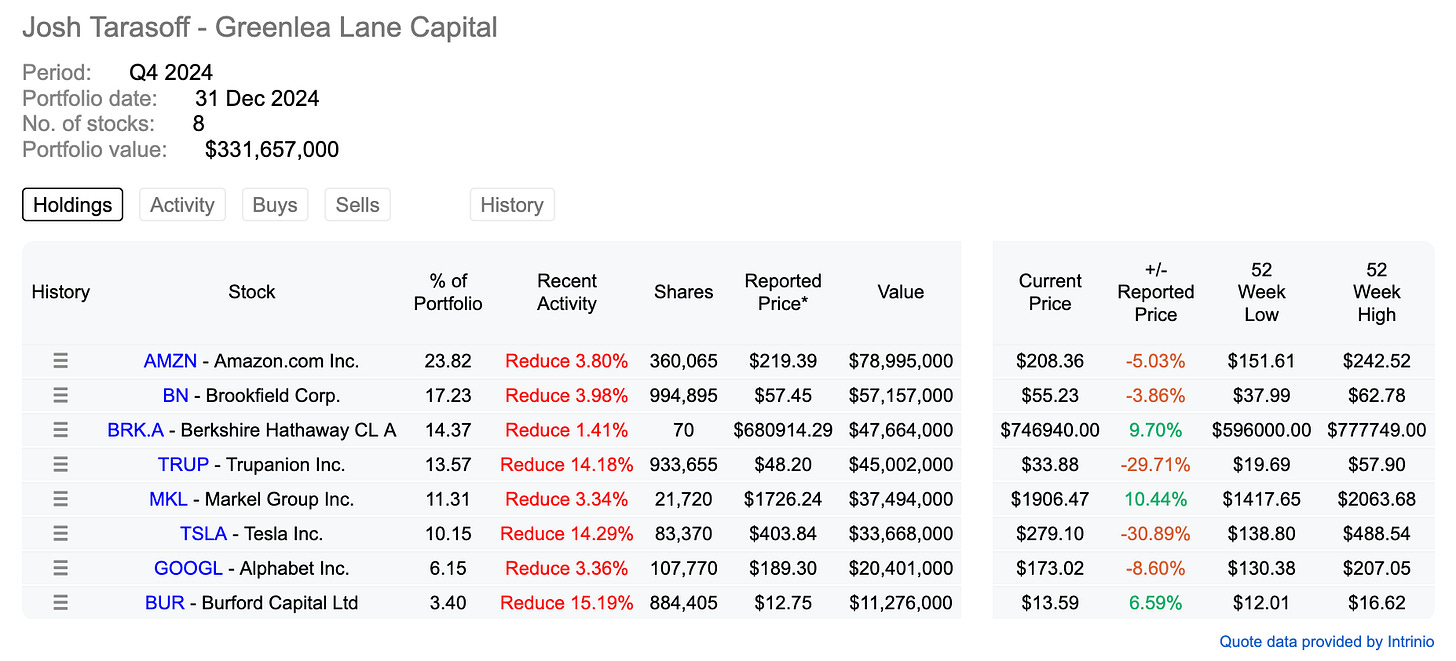

Latest 13Fs (That I think are worth looking at)

Rule One Fund- (RULRX)

INVESTMENT MANAGEMENT ASSOCIATES (IMA)

AltaRock Partners - No interesting changes

Li Lu - Himalaya Capital Management - No interesting changes

ValueAct Capital - No interesting changes

Valley Forge Capital Management - No interesting changes

Clifford Sosin - CAS Investment Partners - No interesting changes

Books

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished one audiobook and one physical book:

The World for Sale: Money, Power and the Traders Who Barter the Earth’s Resources by Javier Blas and Jack Farchy

YZ:

It really is fascinating to read about how traders and investors did business pre - internet age … Truly wild wild west (before and potentially in any new things to come that are not well overseen like crypto for example) and in a way shows that they way you made money before - yo can not make the same way now (given the regulations), but I guess you could learn from history … adopt to the present and succeed in the future…

I think The World For Sale is worth a read or listen to anyone who cares about history, investing, or trying to learn from the past to understand were we came from and/or can potentially end up (this I mean more towards the psychological level) especially when it comes to different commodities (and geo political situation) …

Goodreads:

Meet the traders who supply the world with oil, metal and food - no matter how corrupt, war-torn or famine-stricken the source.

The modern world is built on commodities - from the oil that fuels our cars to the metals that power our smartphones.

We rarely stop to consider where they come from. But we should.

In The World for Sale, two leading journalists lift the lid on one of the least scrutinised corners of the economy: the workings of the billionaire commodity traders who buy, hoard and sell the earth's resources.

It is the story of how a handful of swashbuckling businessmen became indispensable cogs in global markets: enabling an enormous expansion in international trade, and connecting resource-rich countries - no matter how corrupt or war-torn - with the world's financial centres.

And it is the story of how some traders acquired untold political power, right under the noses of Western regulators and politicians - helping Saddam Hussein to sell his oil, fuelling the Libyan rebel army during the Arab Spring, and funnelling cash to Vladimir Putin's Kremlin in spite of strict sanctions.

The result is an eye-opening tour through the wildest frontiers of the global economy, as well as a revelatory guide to how capitalism really works.

I give it 4 out of 5 stars.

Oil: A Beginner's Guide (Beginner's Guides) by Vaclav Smil

YZ:

I decided to read “Oil” as one of the books in physical format, but to be honest I think you could have 30-60min conversation with ChatGPT and come out with similar understanding. I’m planning to do so with the other commodities get better understanding and not to spend as much time reading.

Again, its a beginners guide so if you know nothing about Oil or ChatGPT, this book is a good start…

Goodreads:

Packed with fascinating facts and insight, this book will fuel dinner party debate, and provide readers with the science and politics behind the world’s most controversial resource. Without oil, there would be no globalisation, no plastic, little transport, and a global political landscape that few would recognise. It is the lifeblood of the modern world, and humanity’s dependence upon it looks set to continue for decades to come. In this captivating book, the author of the acclaimed A Beginner’s Guide, Vaclav Smil, explains all matters related to the ‘black stuff’, from its discovery in the earth, right through to the political maelstrom that surrounds it today

I give it 3.75 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

Sections below are for paid subscribers only…$$$ Topics: Full Portfolio(s) Updates, Discussion of Two New Positions, LTMH, and Stocks To Look At.