May 2024 Portfolio Update

Topics: Quote, Portfolio & Discussion, Tax Season, Earnings, Omaha Trip (Public post), Books + Section for Paid subscribers (including detailed portfolios, investing idea of the month, & much more)

Quote for this month:

“To make money in stocks you must have the vision to see them, the courage to buy them and the patience to hold them.” - George Fisher Baker

Portfolio Update*

*I am NOT a financial advisor. I’m sharing my investing journey. Not investment advice. Do your own research.*

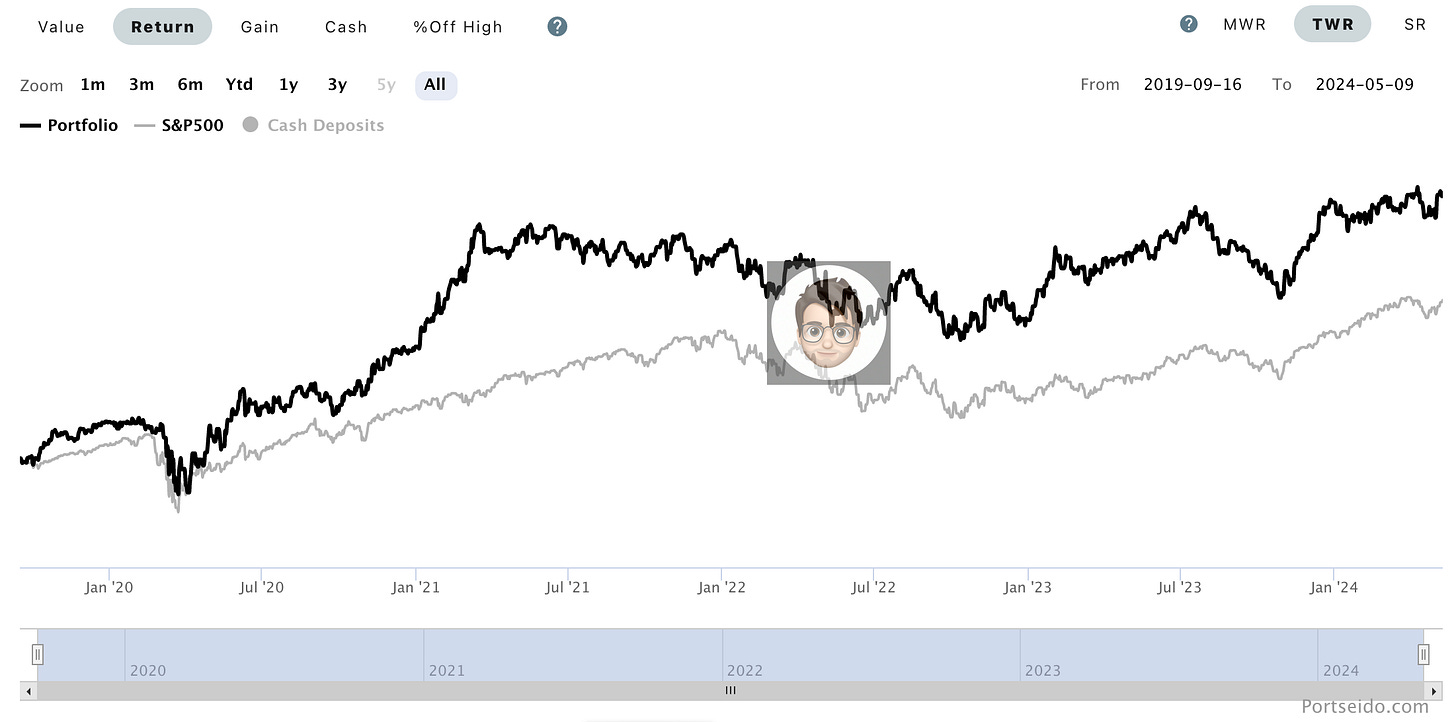

Portfolio (Basic):

Holding since:

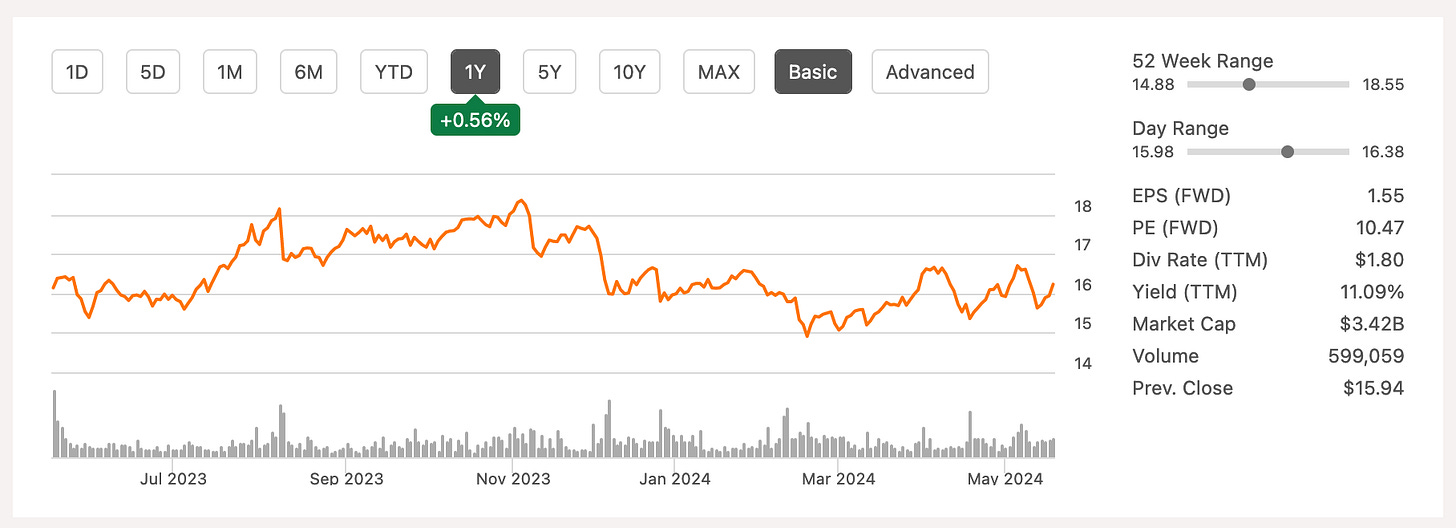

SFM 0.00%↑ - 3/21 | IAC 0.00%↑ - 8/21 | SPOT 0.00%↑ - 11/21 | $NTDOY - 12/22 | PYPL 0.00%↑ - 1/23 | BSM 0.00%↑ - 5/23 | LKQ 0.00%↑ - 3/20 | BUR 0.00%↑ - 9/23 | $EVVTY - 9/22 | OPFI 0.00%↑ - 5/21 | WBD 0.00%↑ - 4/22 | VMD 0.00%↑ - 5/21 | MITK 0.00%↑ - 1/22 | OZK 0.00%↑ - 3/20 | ??? - 1/24 | TCS 0.00%↑ - 1/23 | UG 0.00%↑ - 11/23 | ??? - 4/24

Portfolio Discussion

Currently the numbers as of 05/17/2024: (total) $312,846 - (other) $25,000 = (mine) 287,846.

Above I have added “Holding since”, it a way for me to keep track of when I originally bought a stock in the company to remember how long I been holding companies (with life being busy sometimes these things slip away). I also thought it would be fun for others to see how long I been holding stock in company XYZ, etc.

In Omaha I had a chance to speak to someone who knows about BSM and who is very knowledgeable in taxes and after the conversation I decided that I will be sticking to my BSM position size and maybe even increasing it in the future., but I will not be buying shares in IRA only in my main portfolio

Dividends for April:

Also, moving forward I will ONLY be discussing my stocks in “private section”, reason for that is mainly due to me not having enough time to keep posting things in free section and paid section. It is much easier for me (and takes less brain power) to keep all in on section and to keep my thoughts more focused.

Basic chart (Portfolio (Basic)) will still be available for all to see and if you ever have any questions but do not want to become paid subscriber you are always welcomed to ask away via DMs, and a reminder if you sign up with .edu account you get full access for couple of years for free.

Tax Season

Tis the tax season (almost…kind of) I got my 2023 Tax Doc from Webull and figured I would continue the (new?) tradition to compare my Webull results on yearly basis based on tax docs. Started it last year with this post.

This is just for fun

If you don’t have access or just want results, here they are:

2019

Short-term Profit - around $170

2020

Short-term Profit - around $3,000

Long-term Profit - around $400

Qualified Dividend - around $400

2021

ST Profit - around $12,000

LT Profit - around $8,000

QD - around $5,000

2022

ST Profit (Loss) - around (-$8,000)

LT Profit - around $6,000

QD - around $2,000

2023

ST Profit - around 3,000

LT Profit - around 4,000

QD - almost 3,000

Earnings

Omaha Trip (Public post)

Here are some of the public events that you can see (now) online from Berkshire Meeting Week:

Value investing in an uncertain world - Bill Ackman - Founder and CEO of Pershing Square Capital Management - in Omaha.

Books

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished two audiobook :

The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime by MJ DeMarco

YZ:

Shout out to Sai Charan for mentioning this book to me a while back. Although at the current state in my life this book is more of a reminder of what needs to be done to keep moving forward, I do believe sharing it with my readers (especially those who are still very young and/or having trouble “moving forward”) would be beneficial in potentially changing the way people think about business and success.

Overall I enjoyed listening to the book with one caveat, not much was mentioned about family (except generic parts of how “we” need to grind it out) and from I understand MJ DeMarco (and I might be wrong) does not have “wife and kids” and might not really truly comprehend how hard it is to go from “slow lane” and into “fast lane”.

At the end of the day, TMF (to me) goes into the bucket of books like The Power of Now, The Alchemist, Think and Grow Rich, etc… its not really the book that matters (per se) but the fact that after reading any of those books, you as a person start thinking differently (in a good way) about life. Sort of like that scene from Matrix.

Goodreads:

Is the financial plan of mediocrity-a dream-stealing, soul-sucking dogma known as The Slowlane-your plan for creating wealth? You know how it goes-go to school, get a good job, save 10 percent of your paycheck, buy a used car, cancel the movie channels, quit drinking expensive Starbucks mocha lattes, save and penny-pinch your life away, trust your life-savings to the stock market, and one day you can retire rich. The mainstream financial gurus have sold you blindly down the river. For those who don't want a lifetime subscription to "settle for less," and a slight chance of elderly riches, there is an expressway to extraordinary wealth that can burn a trail to financial independence faster than any road out there. Demand the Fastlane, an alternative road to wealth that actually ignites dreams and creates millionaires young, not old. Hit the Fastlane, crack the code to wealth, and find out how to live rich for a lifetime.

I give it 4.5 out of 5 stars.

Gambler: Secrets from a Life at Risk by Billy Walters

YZ:

Listening to life of Billy Walters with all the details makes me almost speechless when trying to explain everything that he had to go through and yet come out the way he has.

There is lucky and then there is Billy Walters.

And yet there is a lot we can learn from life of Mr Walters … some good, some bad, and some sad.

I think everyone should read / listen to this book … if there is one thing I would say as a takeaway from this book is to keep on moving forward… For Billy Walters life was one step forward three steps back and then somehow make a jump that’s worth ten steps… But that’s just how life is, as long as you don’t quit and keep moving something good things are bound to happen…

Please read Goodreads review below.

Goodreads:

Anybody can get lucky. Nobody controls the odds like Billy Walters. Widely regarded as “the Michael Jordan of sports betting,” Walters is a living legend in Las Vegas and among sports bettors worldwide. With an unmatched winning streak of thirty-six consecutive years, Walters has become fabulously wealthy by placing hundreds of millions of dollars a year in gross wagers, including one Super Bowl bet of $3.5 million alone. Competitors desperate to crack his betting techniques have tried hacking his phones, cloning his beepers, rifling through his trash, and bribing his employees. Now, after decades of avoiding the spotlight and fiercely protecting the keys to his success, Walters has reached the age where he wants to pass along his wisdom to future generations of sports bettors.

Gambler is more than a traditional autobiography. In addition to sharing his against-all-odds American Dream story, Walters reveals in granular detail the secrets of his proprietary betting system, which will serve as a master class for anyone who wants to improve their odds at betting on sports. Walters also breaks his silence about his long and complicated relationship with Hall of Fame professional golfer Phil Mickelson.

On a typical weekend gameday packed with college and pro sports, Walters will bet $20 million. It’s a small sum for someone with his resources today, but an unbelievable fortune for the child who was raised by his grandmother in extreme poverty in rural Kentucky. By the age of nine, Walters became a shark at hustling pool and pitching pennies. As a young adult, he set records as a used-car salesman, hustled golf, and dabbled in bookmaking. He eventually moved to Las Vegas, where he revolutionized sports betting strategy and became a member of the famed Computer Group, the first syndicate to apply algorithms and data analysis to sports gambling. He built a fortune while overcoming addictions and outmaneuvering organized crime figures made infamous by Martin Scorsese’s film Casino.

In Gambler , Walters shares everything he’s learned about sports betting. First, he shows bettors how to mine the information we have at our fingertips to develop a sophisticated betting strategy and handicapping system of our own. He explains how even avid bettors often do not grasp all of the variables that go into making an informed wager—home field advantage, individual player values, injuries or illness, weather forecasts, each team’s previous schedule, travel distance/ difficulty, stadium quirks, turf types, and more. Variable by variable, Walters breaks down the formulas, betting systems, and money-management principles that he’s developed over decades of improving his craft.

A self-made man who repeatedly won it all, lost it all, and earned it all back again, Walters has lived a singular and wildly appealing American life, of the outlaw variety. Gambler is at once a gripping autobiography, a blistering tell-all, and an indispensable playbook for coming out on top.

I give it 5 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

Also, I would really appreciate if you would share this post with one person who you think might enjoy it.

Section below is for paid subscribers…