November 2023 Portfolio Update

Topics: Quote, Portfolio & Discussion, Comments From Me, Quick PSA, Staying away from Babkin Bazar, Q&A Section, Book + Section for Paid subscribers.

Quote for this month:

“Some things are up to us and some are not up to us.“ - Epictetus - "The more we value things outside our control, the less control we have."

Portfolio Update*

*I am NOT a financial advisor, I’m sharing my investing journey. Do your own research.*

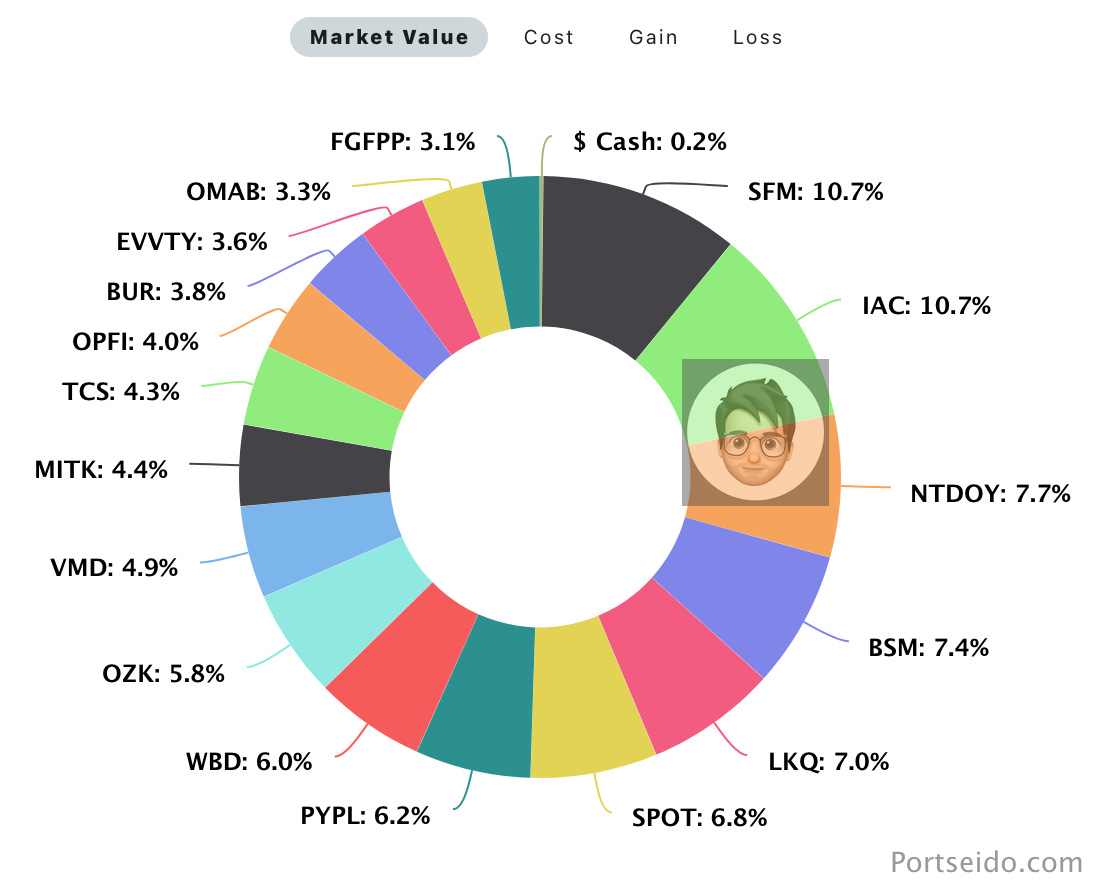

Portfolio (Basic):

To get access to full (detailed) portfolio + some other extras consider seven day free trial to get a sneak peek “behind the curtain”

Portfolio Discussion

Currently the numbers as of 11/15/2023: (total) $268,002 - (other) $25,000 = (mine) 243,002.

Quick side note: I have on purpose kept the “graphs” at the beginning from the start of the month, just to show the potential wild swings from month to month or even day to day to demonstrate how irrational “Mr Market” can be.

I sold out of UG 0.00%↑ , it was about 1% of portfolio and I relocated that capital into PYPL, EVVTY, and IAC. I did take a loss on UG 0.00%↑ but given that I’m not adding any capital to this portfolio and wanting to maximize my best “calls” I thought it was the right thing to do at this time.

I will still keep an eye on UG 0.00%↑ moving forward.

Otherwise, not too much was done on the portfolio just moving some money around buying and selling within the portfolio (again because I’m not adding any new capital), as always if you like to know “up-to-date” what I do, I post everything in chat for paid subscribers.

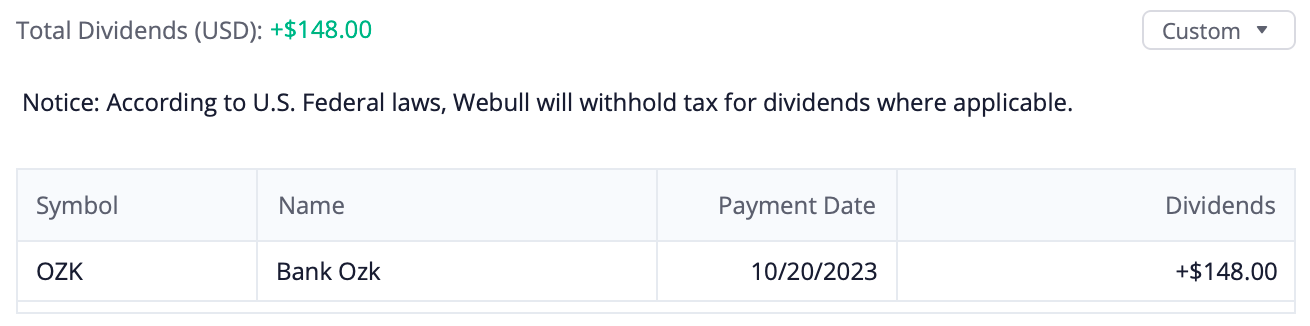

Dividends for October:

Paypay - got new CEO (Alex Chriss) and now we give the time-frame for positive change or sell. I will be following how the new CEO is working the company and will re-evaluate the situation (hopefully with no shorter then at least one year time frame) Alex Chriss will need time (which I’m willing to give) but I will not be giving second change if within 1-3 years I’m not satisfied with “turn around” I must sell and move on. Not based on stock market price (be it up or down) but based of what Alex Chriss have promised and achieved.

That said, there is usually always some kind of caveat, and I’m giving myself permission to change my mind at any point :)

Earnings Results

The “GOOD”

SFM - VMD - NTDOY - OZK - OPFI - SPOT

The “its okay”

PYPL - OMAB - LKQ - BSM - BUR - MITK

The “BAD”

TCS - IAC - WBD

Comments From Me

As some of you may (or may not) know I am located in NY, so I will be checking out this week’s Stripe Press Pop-Up in Brooklyn. If anyone wants to attend I think there are still spots available and if you want to meet up there and say Hi it would be awesome to meet readers of my substack. If you are going to the event reply to this email or send me DM via Twitter.

Also next month (December) I will be going to MOI Global Latticework 2023, I have attended last years and I really enjoyed it, so I’m sure this year will be as great as one before. Again if you or you know anyone who is attending the event, I would love to meet and have a chat.

Quick PSA

I just wanted to quickly remind my readers both paid and free that the whole point of this substack (blog) is to share my journey of taking $100,000 and turning it hopefully into $1,000,000 or something close to it and this is not a blog for “popular content” or to get the largest amount of likes.

Sometimes there are things to do and so you will see some “action” in portfolio and sometimes there is nothing to do so I must do nothing and that means I will be more quite. It does not mean that I don’t follow my portfolio / companies or that I do not take responsibility of what is happening in the markets , quite the opposite it means that I’m being patient (although there is still work to do) and trying to optimize my portfolio to the best possible outcome with the current given REAL information.

You must understand that this is real money (and big money for me) I don’t know many other writers (on substack) that share their portfolio and also share the AMOUNT of money that they are investing in the same transparent way that I do and for the amount of time that I have been doing without missing a month and always being honest.

So if you are thinking of becoming a paid subscriber or if you are already one just remember that I’m doing this for the LONG TERM and that I’m investing real money with real outcomes be they are good or bad (hopefully more good than bad) .

Things will not always be going in a “up and to the right” , real world is messy and unpredictable … when you join me on the journey … there will be up days and down days, up months and down months … and hopefully the big picture (on the yearly basis) it will be up up and away… but that I cant promise.

I’m also learning and molding myself as investor, and as much as I like to learn from others mistakes and not to repeat them myself, sometimes I make mistakes and that’s just life.

One of the most important parts of doing this, is that I enjoy the process and the journey, “Investing is simple, but not easy.” - WEB

Staying away from Babkin Bazar

As some of you may recall from September update, I did one week detox from investing, which included one week of ZERO social media. Although even before the detox I start using less of Twitter and other social apps, but after the detox I started going to the bird app (or I guess now its X app) even less which gave me an idea for this segment…

When I think of “Babkin Bazar” (which I roughly translate as Old Lady’s ((grandma type)) Market from Russian) I think of lots of old chatty ladies (imagine your grandma type or in this case I’m thinking of my sweet chatty old grandma) in a market place environment trying to sell all different types of goods and they are all next to each other and they all simultaneously trying to sell their goods and at the same time chat with the next seller about life and the latest gossip (who is her friend maybe even best friend, so its really friendly environment) and because its crowded they have to yell loudly so each one can hear the other while at the same time people are walking around and shopping. So unless you know exactly what you need to purchase, you can get lost very easily and/or get distracted (in that bazaar) by others in this type of environment, in reality its neither good nor bad, its only bad if you are short on time and need something unique and specific and ASAP… this is how I (more or less) imagine Twitter these days.

There is a lot of noise… there is a lot of (some friendly some are not so) discussions on different topics and a lot of times a lot of it is useless (people gossiping or trying to sell you something), but there are gems if you are being focused on what you need. The problem is if you don’t pay attention, you can get sucked in and not realize that you are wasting your time aka you come up to a shop keeper and ask him/her about one thing and yet you get answer for something else and then someone else comes into the conversation and everyone keeps talking and by the end you don’t even remember what you originally needed to ask or look for.

I don’t know if this makes sense to any of you, but it made sense to me and so I wanted to share it…

TL;DR - When using social media only go there with specific objective aka “I need to research on stock XYZ” and once you looked that up leave the social media, I know its easier said then done but I think that’s what needs to be done … I’m saying that from my perspective , I know some people enjoy the “chat” and socializing on social media but I think for majority it would be more useful to go outside or read a book (wow I sound like an old grumpy man).

Most will ignore my advice and waste their time on social media and after some time will ask themselves “How come I’m unable to do “more” in a day or how come I can’t ever finish anything on time etc etc etc”

I’m sure there will be some (plenty?) of people who ill probably disagree with me or find this rude/offensive, although that’s not my intentions to be rude but just share my opinion…

Stay away from Babkin Bazar … stay away from the noise…

Q&A Section

This new section is something I would like to try out, every month I will try to gather some questions and answer them in this section…

If no questions, I would be skipping for that particular month.

Q: You have made it known that Terravest Industries is a great microcap likely to grow 15%-20% a year in most of its earnings metrics, and that its priced low at the movement. Why is it not in your portfolio?

A: This is a great question and the answer has three parts.

Part one, and this is the most important part of the answer and that is … its not interesting to me. Yes its not an exciting answer and yet its so important and powerful. When it comes to investing (at least for me) in whatever I’m investing large sums of money, I need to “sell myself on it” not get married to it but get excited by the company and what it does and how it does it. Yes the quantitative aspect is important, but if I’m not excited about “digging deep” and learning a lot about a company whats the point? a) if it goes down 50% I might not feel as comfortable buying more b) if it doesn’t do much in a long period of time I might sell out of it for no reason c) if its not exciting I might just not follow it as closely and if there is a major event not be prepared for it. Every company that I’m invested in my main portfolio there is some kind of a spark that keeps me attached to it, with some the spark is stronger and with others its diminishing and it has nothing to do with the “stock price”(most of the time). The spark or “exciting” part for every business is different and most of the time is not just ONE thing. Each is like a child or a piece of art, beautiful in its own ways … unlike our children or a piece of art … public companies can drastically change in a short period of time.

Part two, Terra has more debt then I would like , yes I know that WBD / LKQ / OPFI have large (or large ish) amount of debt but those three I picked up for reasons although maybe with WBD I should of waited a bit (we live and we learn) but moving forward I have tweaked my checklist to be more rigid, so for a company to get into my portfolio it will be a lot harder.

Lastly part three, this research was done by Inbox Alpha and although I did enjoy the write up it did not “click” with me so I shared a great write up of a great company in hopes that maybe Terra finds “a home” with some of my readers.

If you would like to ask me a question for the next Q&A, you can do so by:

To anonymously Ask Me Anything click here via NGL app

Twitter/Instagram/Commonstock DMs

Chat via Substack (there is a thread for free subscribers)

Email me with your questions to from100kto1m@substack.com

Book

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished one audiobook:

The Price of Time: The Real Story of Interest by Edward Chancellor

YZ:

A bit long for my taste, but definitely worth the read/listen, especially as an investor.

This book has given a new-ish (better) perspective on interest rates and although I thought a lot of it would be common sense (at least to me) apparently it has not been so for many years to previous generations (and my guess to the future generations too) and its nice to get detailed look into the history and how we as humans don’t really change, especially when it comes to money…

Read the Goodreads below to get a good sense of what the book is a bout.

Goodreads:

All economic and financial activities take place across time. Interest coordinates these activities. The story of capitalism is thus the story of interest: the price that individuals, companies and nations pay to borrow money.

In The Price of Time, Edward Chancellor traces the history of interest from its origins in ancient Mesopotamia, through debates about usury in Restoration Britain and John Law ' s ill-fated Mississippi scheme, to the global credit booms of the twenty-first century. We generally assume that high interest rates are harmful, but Chancellor argues that, whenever money is too easy, financial markets become unstable. He takes the story to the present day, when interest rates have sunk lower than at any time in the five millennia since they were first recorded - including the extraordinary appearance of negative rates in Europe and Japan - and highlights how this has contributed to profound economic insecurity and financial fragility.

Chancellor reveals how extremely low interest rates not only create asset price inflation but are also largely responsible for weak economic growth, rising inequality, zombie companies, elevated debt levels and the pensions crises that have afflicted the West in recent years - conditions under which economies cannot possibly thrive. At the same time, easy money in China has inflated an epic real estate bubble, accompanied by the greatest credit and investment boom in history. As the global financial system edges closer to yet another crisis, Chancellor shows that only by understanding interest can we hope to face the challenges ahead.

I give it 4 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

Also, I would really appreciate if you would share this post with one person who you think might enjoy it.

IAC 0.00%↑SFM 0.00%↑ $NTDOY LKQ 0.00%↑ BSM 0.00%↑ PYPL 0.00%↑ SPOT 0.00%↑ OZK 0.00%↑ WBD 0.00%↑ VMD 0.00%↑ OPFI 0.00%↑ TCS 0.00%↑ MITK 0.00%↑ BUR 0.00%↑ $EVVTY OMAB 0.00%↑ FGFPP 0.00%↑ VEA 0.00%↑ VTI 0.00%↑ C 0.00%↑ MKL 0.00%↑ OPBK 0.00%↑ URI 0.00%↑ RICK 0.00%↑ RBLX 0.00%↑ IDT 0.00%↑ $ASHTY BN 0.00%↑ LH 0.00%↑ DJCO 0.00%↑ U 0.00%↑ BABA 0.00%↑ DLTR 0.00%↑ BOC 0.00%↑ MBLY 0.00%↑ MASI 0.00%↑ ONFO 0.00%↑ MELI 0.00%↑ ONON 0.00%↑ FLWS 0.00%↑ CDLX 0.00%↑ GDOT 0.00%↑ ASO 0.00%↑ DEO 0.00%↑ DBX 0.00%↑ SGA 0.00%↑ XPEL 0.00%↑ NNI 0.00%↑ $OTGLY ENZ 0.00%↑ IBKR 0.00%↑ CPRT 0.00%↑ UHAL 0.00%↑ $BRK NU 0.00%↑ EDR 0.00%↑

Section below is for paid subscribers…