November 2025 Portfolio Update

Quote, Portfolio, Complimentary Monthly Commentary, Earnings, Events, New 13Fs and more ...

Quote for this month:

“The genuine investor in common stocks does not need a great equipment of brains and knowledge, but he does need some unusual qualities of character.” - Benjamin Graham

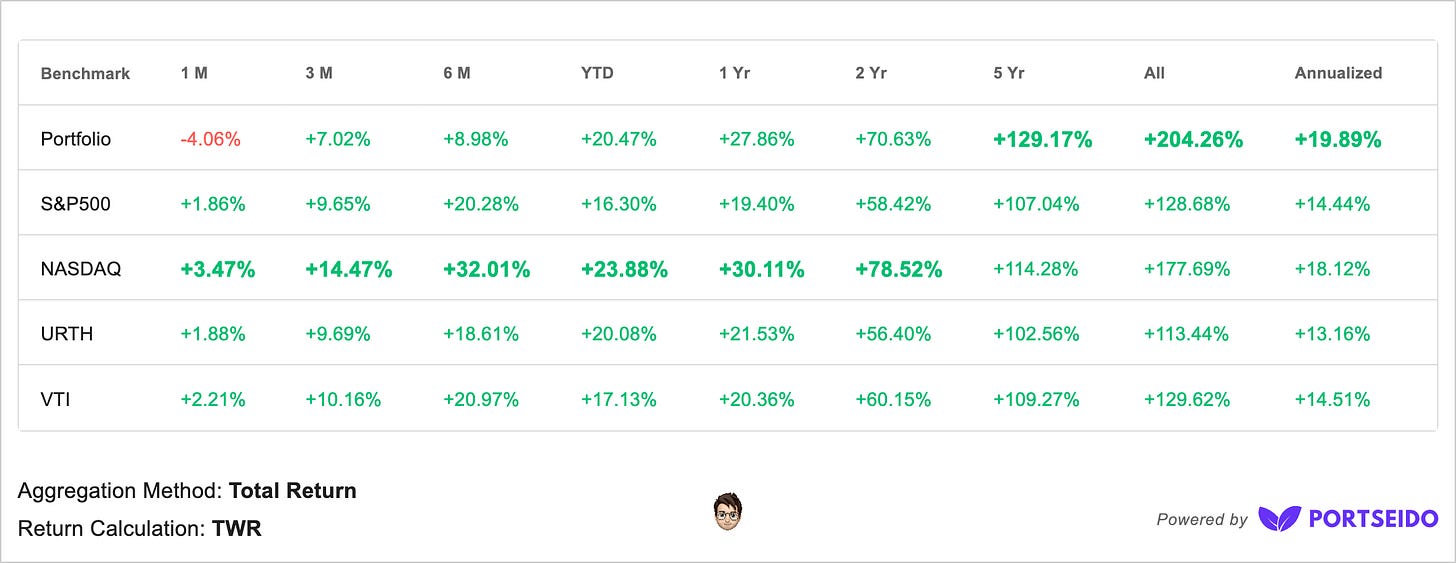

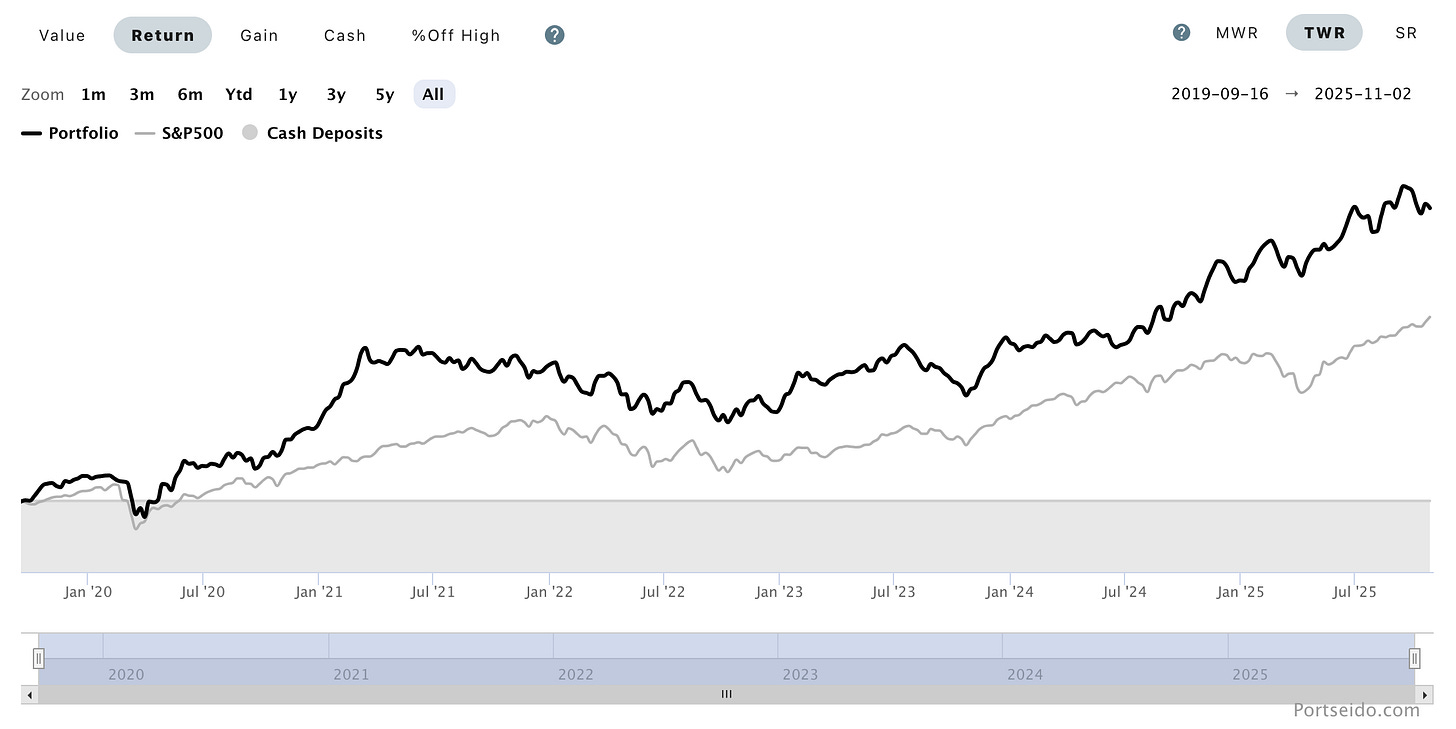

*Portfolio*

*I am NOT a financial advisor. I’m sharing my investing journey. Not investment advice. Do your own research.*

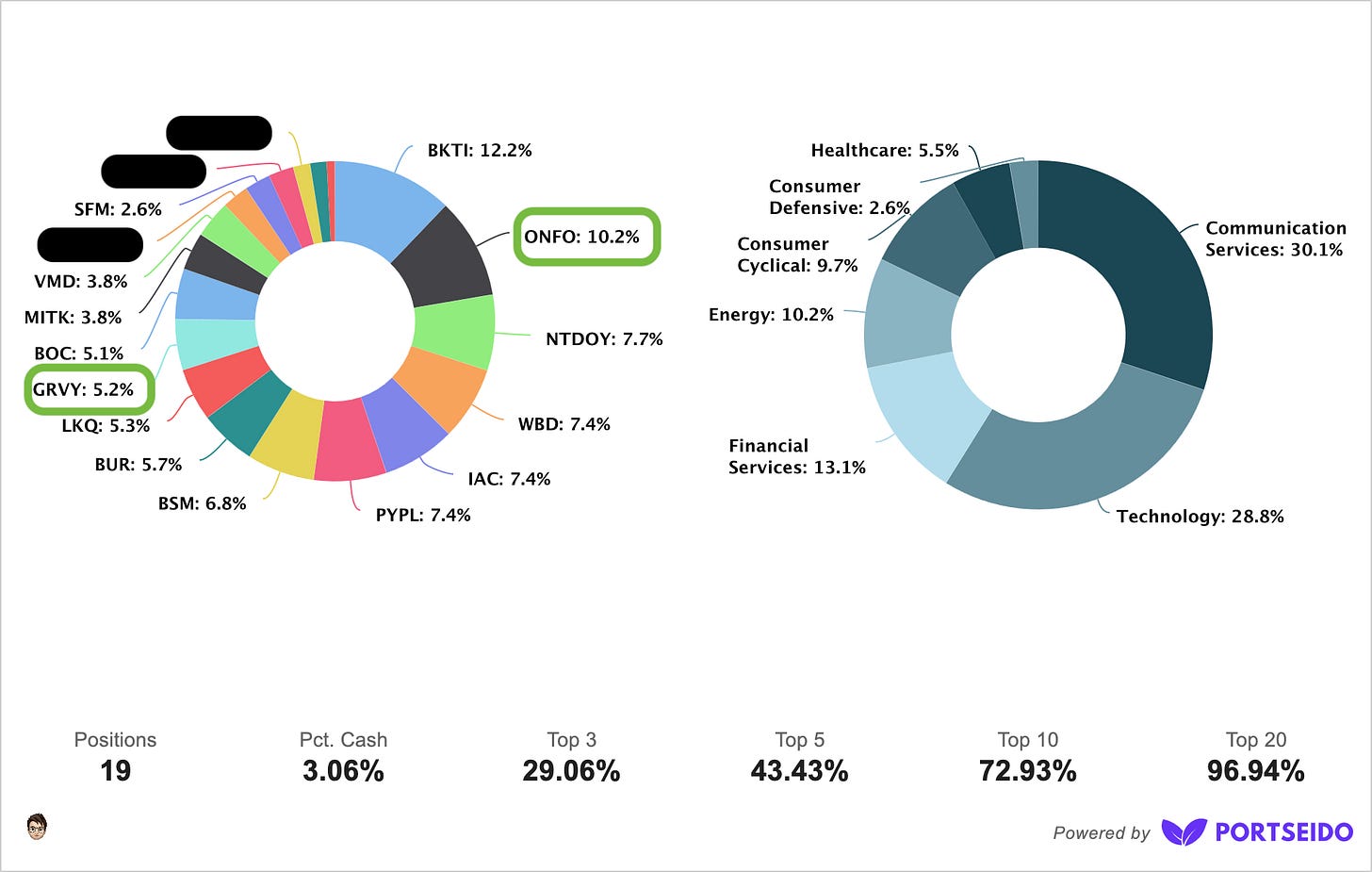

Portfolio (Basic):

Holding since:

2020 - LKQ 0.00%↑ - 03

2021 - SFM 0.00%↑ - 03 | VMD 0.00%↑ - 05 |

2022 - MITK 0.00%↑ - 01 | WBD 0.00%↑ - 04 | $NTDOY - 12

2023 - PYPL 0.00%↑ - 01 | BSM 0.00%↑ - 05 | BUR 0.00%↑ - 09

2024 - ($M??) - 01 | BKTI 0.00%↑ - 04 | BOC 0.00%↑ - 09

2025 - IAC 0.00%↑ - 01* | $GRVY - 08 | $C??? - 08 | $N??? - 10 | $D??? - 10 | $C?? - 10 | $ONFO - 10 |

*IAC originally was purchased in 2021, but sold at the end of 2024 for tax loss purposes and re-bought back in 2025.

Complimentary Monthly Commentary - CMC

There has been a lot of things happening under the hood for the last month or so …

So I wanted to provide more information now that I finally can…

ONFOLIO

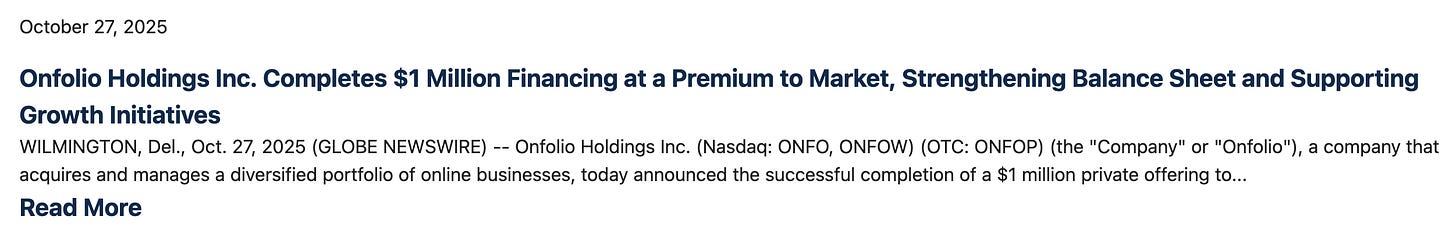

First of, the stock that I said in the last update that I couldn’t speak about was … Onfolio - $ONFO … paid subscribers know that I been following this company for a while and I have been dollar cost averaging into it via my IRA account + I am invested into ONFO via Pref and SPV …

I did a one pager on it in June:

I participated in the the private offering that was completed at the end of the October and although I did mention that I was taking out $30,000 from this account, the investment was a bit larger but for purpose of keeping this dollar for dollar, I have added ONFOLIO to my Portseido portfolio at the price that I participated at, so even though its in the separate account after some time it is possible for me to try and transfer those shares to my Webull account (at some future point).

So moving forward ONFOLIO will be in the main portfolio even if it does not reflect so in Webull, it will be reflected in via Portseido since be it “up” or “down” that $30,000 was invested in public company that has trackable share price (although given the volatility sometimes it can be stomach turning)

I think for now I will leave it at that, but I will be sure to come back to this holding in the near future…

GRAVITY

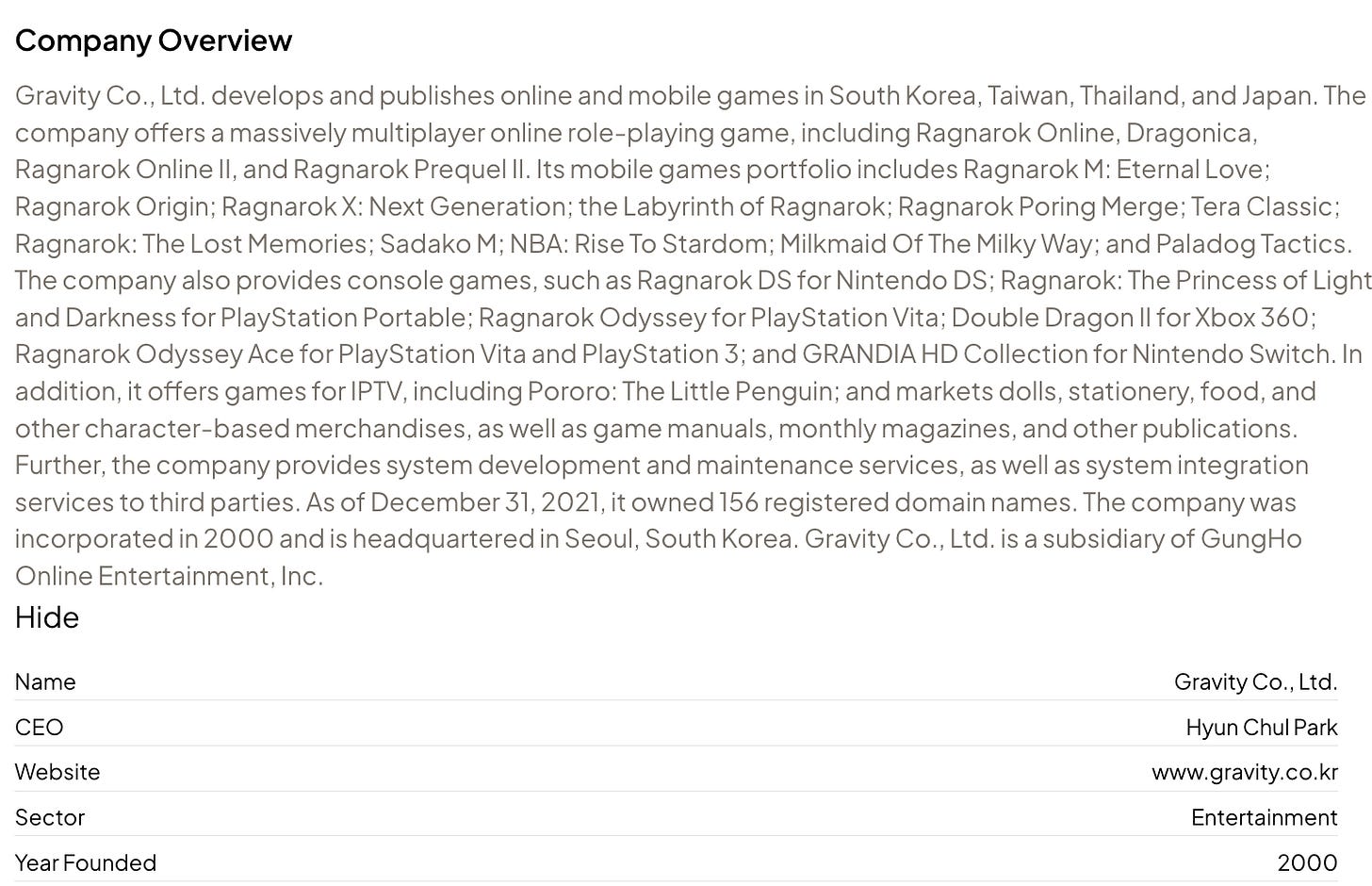

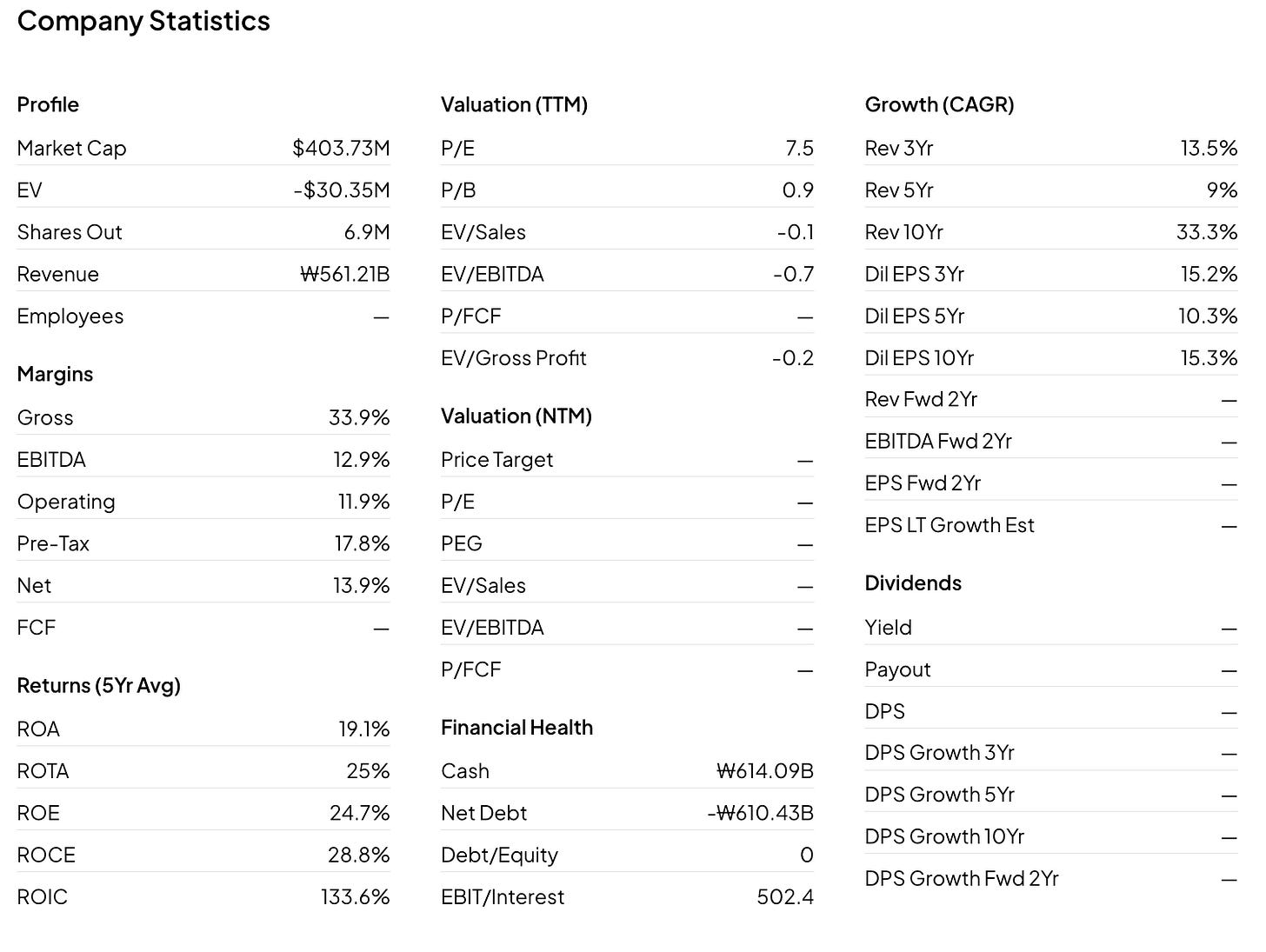

A new holding that I have been building up since August is $GRVY …

This one is interesting because company is a net-net

A few people have written about it over the past few years and yes there is a reason why its a net-net

I recommend reading the two write up above plus follow AppInvestor for more up to date updates on Gravity

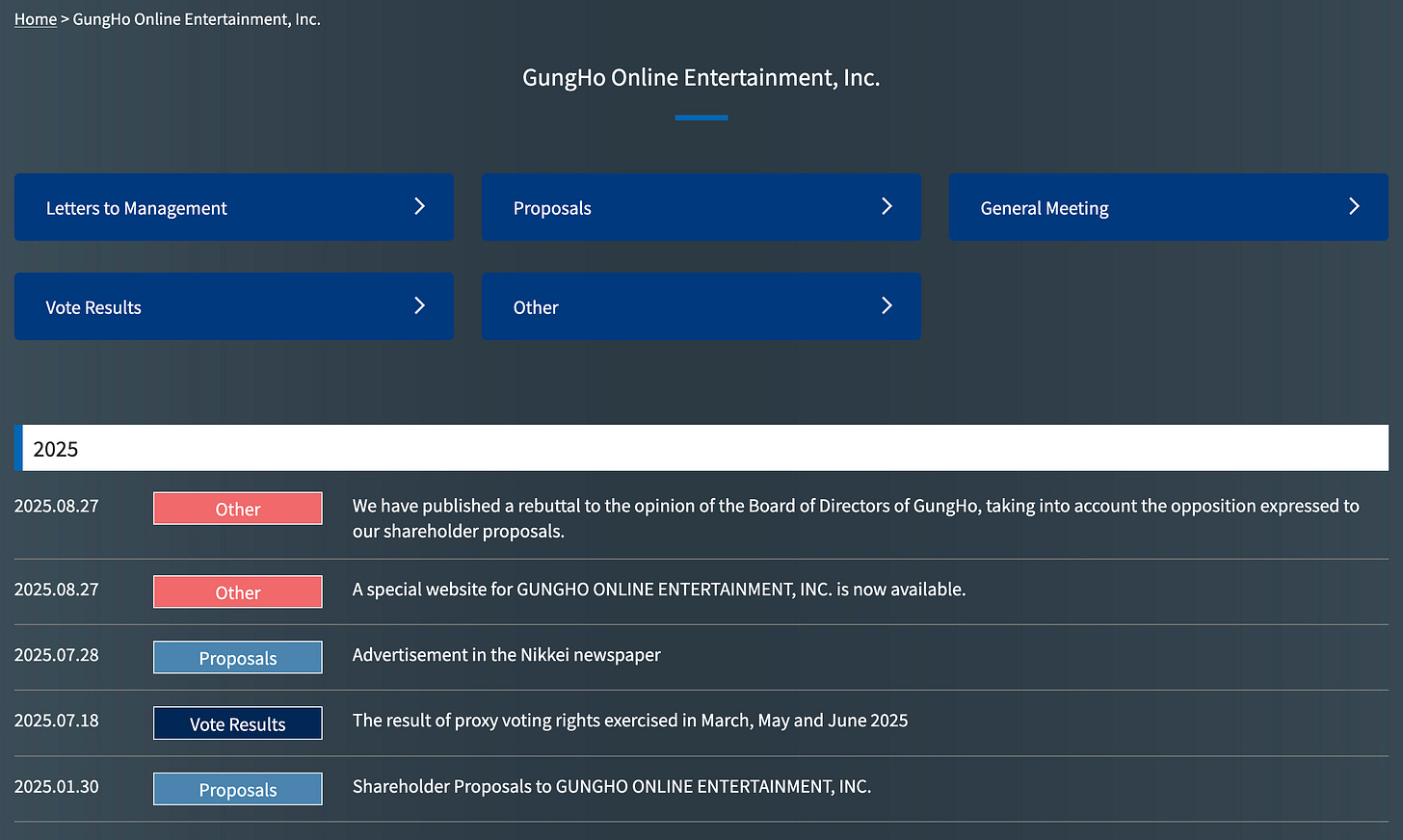

The parent company that owns large stake in $GRVY - Gungho Online Entertainment, a Japanese listed game developer is being targeted by an activist - Strategic Capital, Inc and they have been more active with Gungho …

Strategic Capital has been pointing out on multiple occasions that current management or more precisely Kazuki Morishita is not fit to run Gungho and has been running it for his own benefits and not for the benefits of Gungho (or Gravity) shareholders. I highly recommend checking out Strategic Capital website and more in details the website they have created for GungHo Online Entertainment.

Both Gungho and Gravity are ran too conservatively (regrading capital allocation) and my hope is that if Strategic Capital can change management then both Gungho and Gravity value can be unlocked.

I’m new to activism but I know in Japan its not been looked at “nicely” at least not until recently with Japan changing its ruling towards publicly traded companies and outside shareholders and I also know in Korea its even worse then in Japan so my hopes are not that high but I think it’s interesting situation, especially given that Gravity is actually making good progress with expending Ragnarok. I should definitely write more about Gravity especially with emphasis on Strategic Capital’s activism towards the parent co.

EVOLUTION and ???

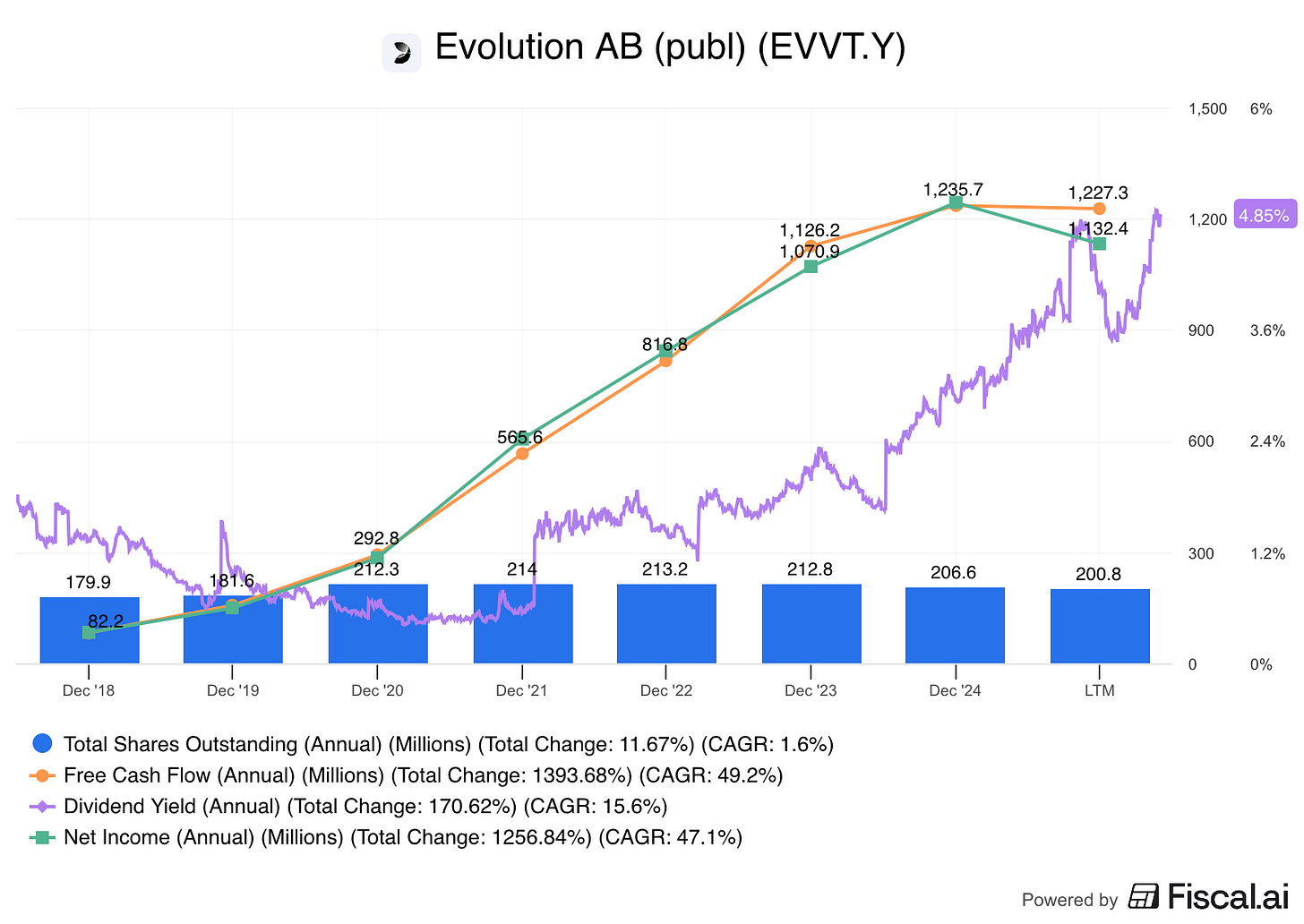

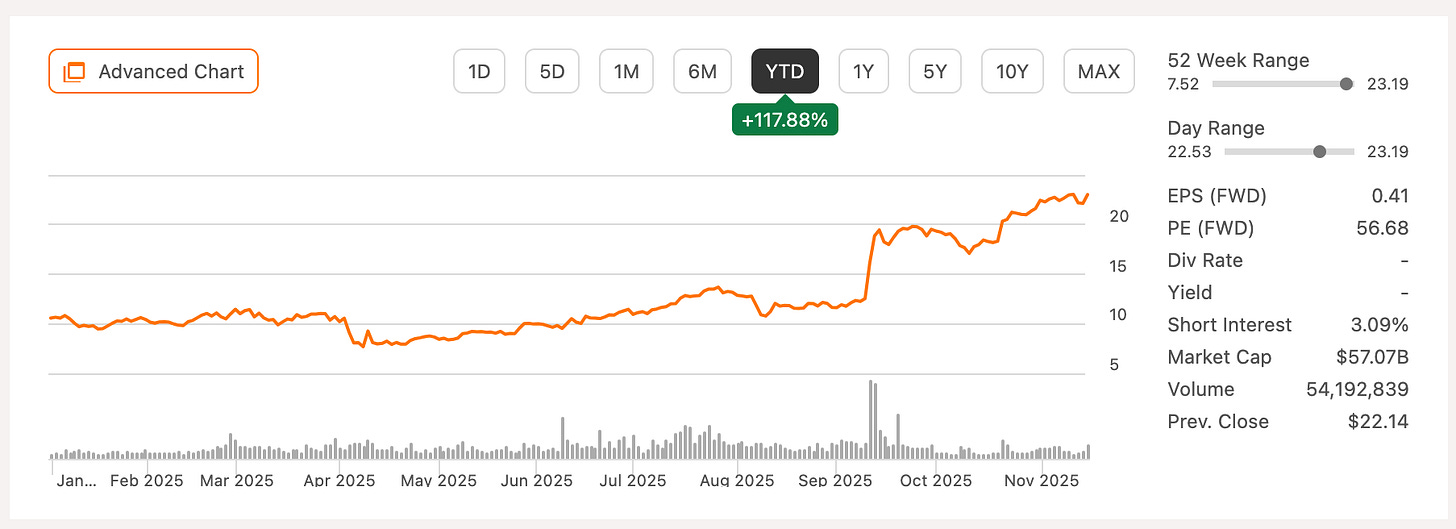

I have sold out of $EVVTY and another undisclosed holding for tax loss purposes. As of right now I have over $80,000 of realized profit and before the sale of those two it was almost $100,000. I will be looking to get back in those two before the end of the year / beginning of next.

I know Evolution has been seen as disappointment to the X community, but I don’t think the results were that bad + as long as they are generating cash as they are and buying back shares (as they are), I think in the long run things will work out … similarly how I think about $PYPL.

Earnings

Doing this review and it was a bit exhausting, what I mean I own to many companies … need to slim down because when I was writing on a few things I actually did not really remember well enough how the earnings went which is honest truth but also I understand is concerning because a lot of times I’m on the move and do not have time to write thoughts/comments … really need to re think about this…

Events

I had a pleasure of attending to two events in the month of November…

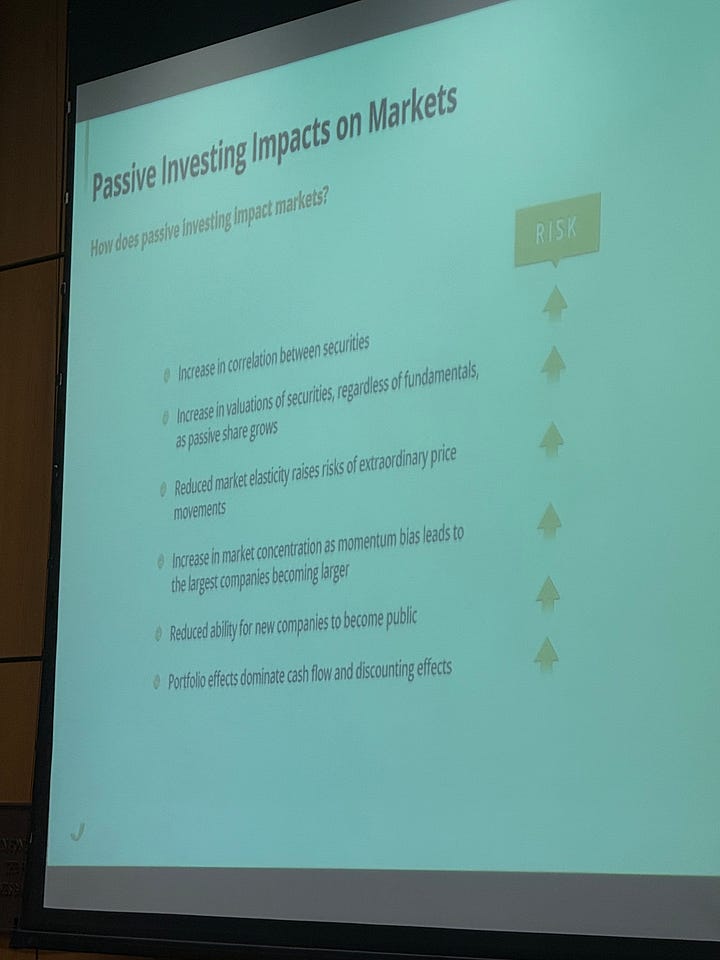

1 … by Michael W. Green at Fordham University Gabelli School of Business

Mr Green gave a talk on how passive investing “kind of (lightly said)” ruining the investing world, because of passive investing markets are more irrational then ever and in the bubble zone, the problem there is really no real solution (per se).

I also enjoyed the chat between Michael Green, Paul Johnson, and another Mike (I forgot the last name) who runs a hedge fund. Three of them had a great conversation on passive investing and how it has changed the markets (for the worse) over the years.

2 … by SuperJoost at NYU Stern School of Business

I want to say big thanks to Joost for letting me be present at his Fire-chat with CEO of Unity - Matthew Bromberg - I have never been to any events like these (or NYU for that matter) so if was really nice to listen on conversation on Unity but also gaming in general. Mr Bromberg was very generous with his time and had more then a few of good advises for those who seeking to be in the gaming business + lots of interesting personal stories.

For most of my life I been a big gaming nerd so it brought a bit of nostalgia and got a few of my neurons fired up when listening to gaming but from more of a corporate / investing angle.

I highly recommend checking Joost’s Substack:

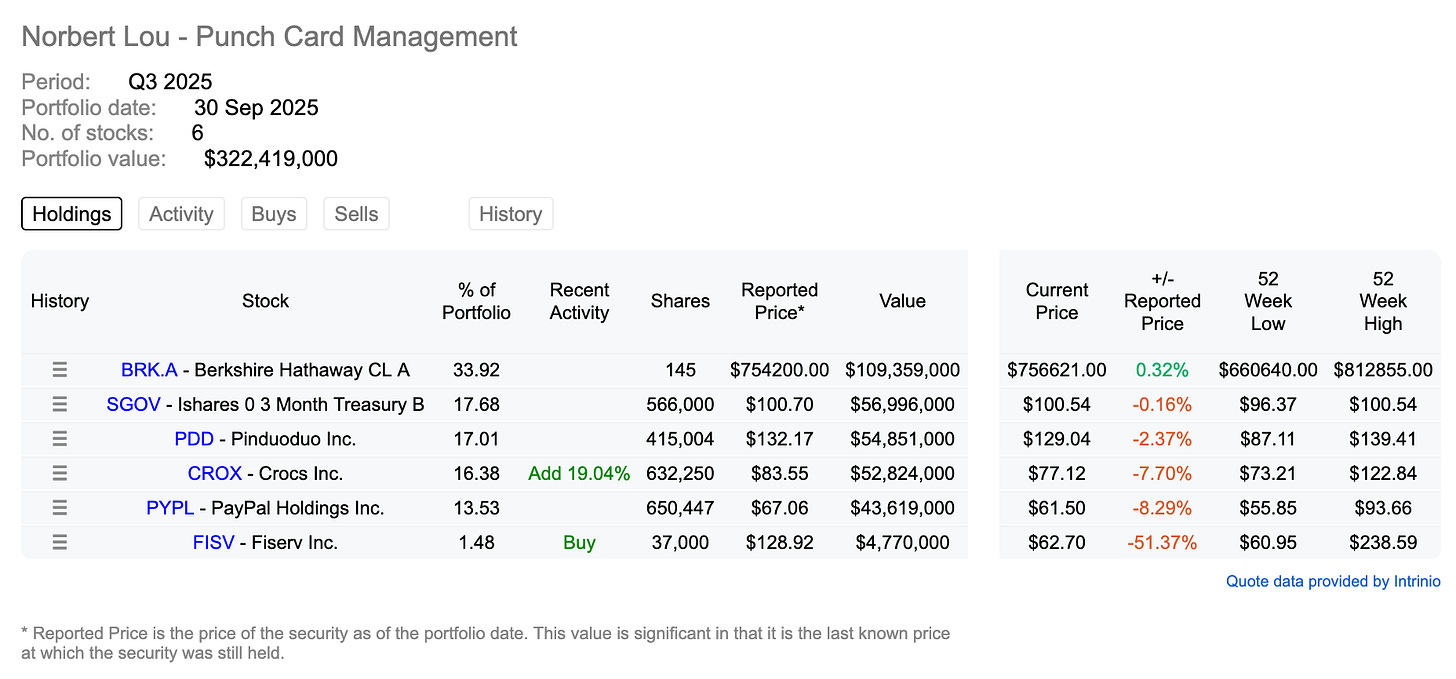

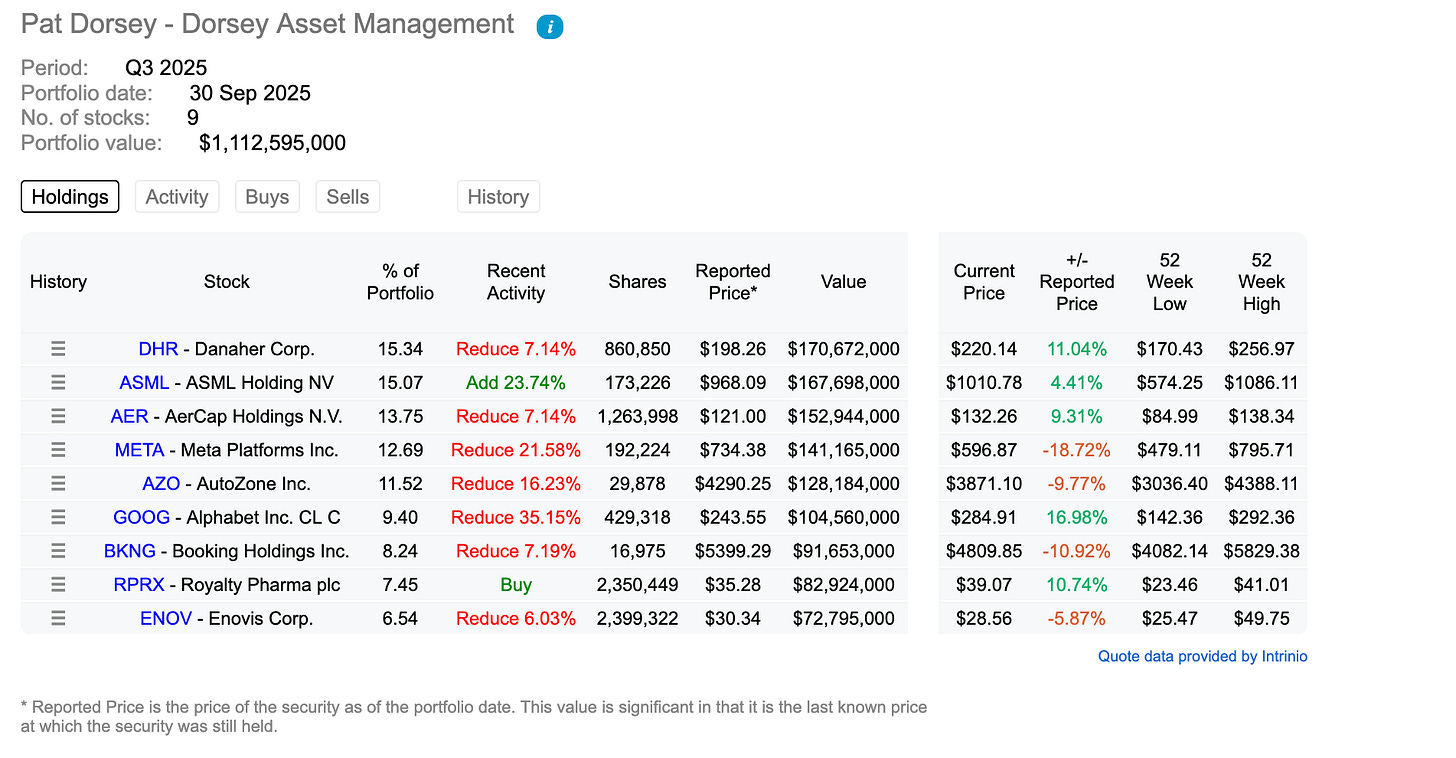

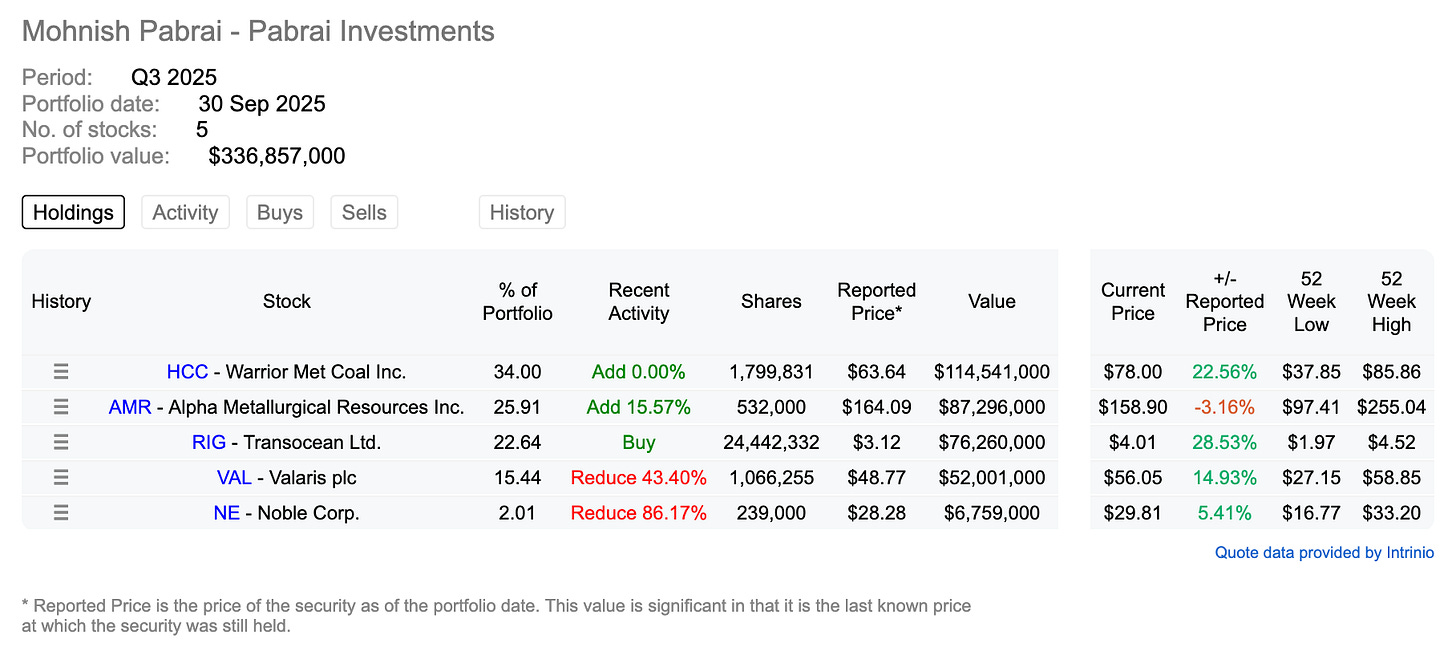

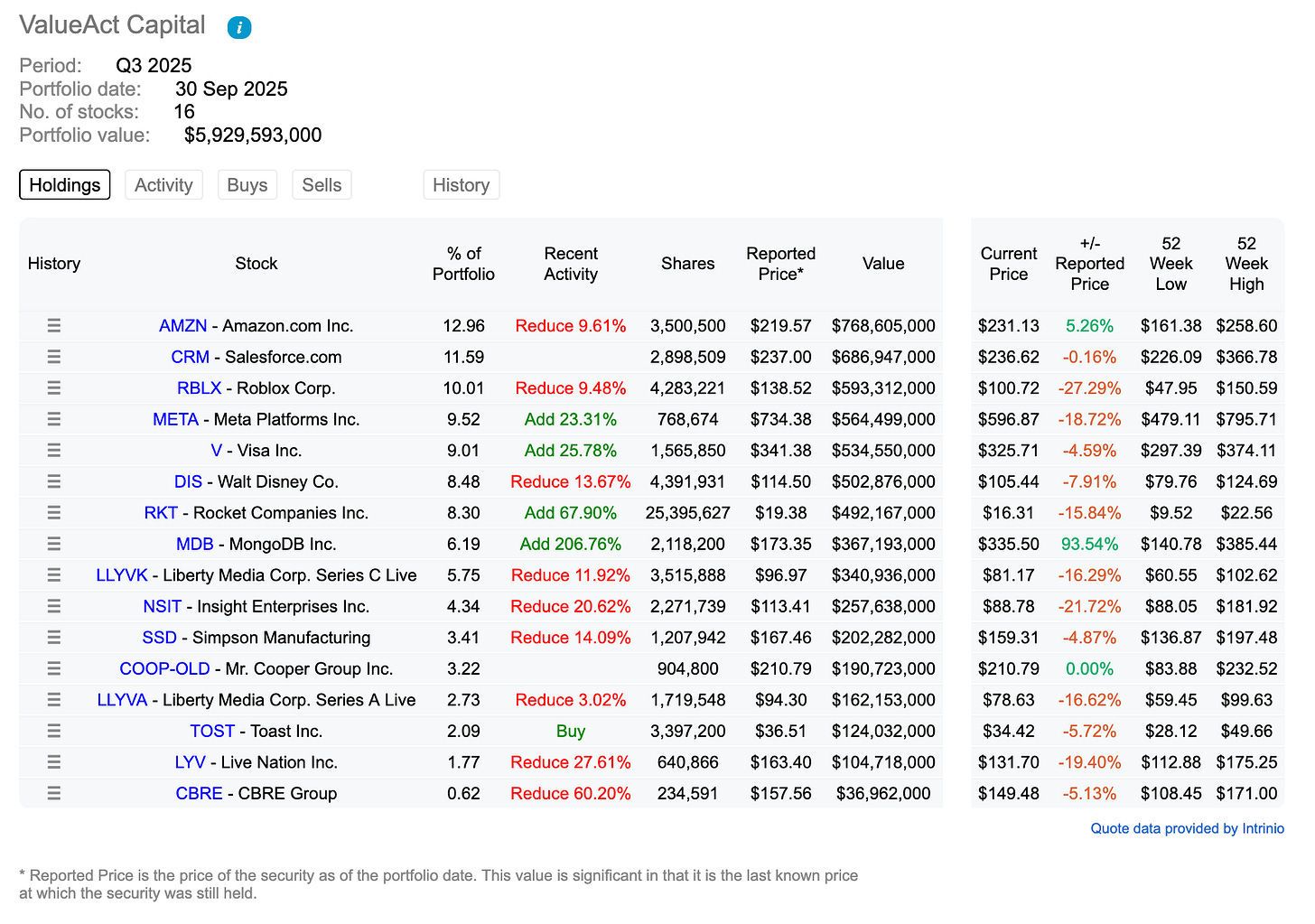

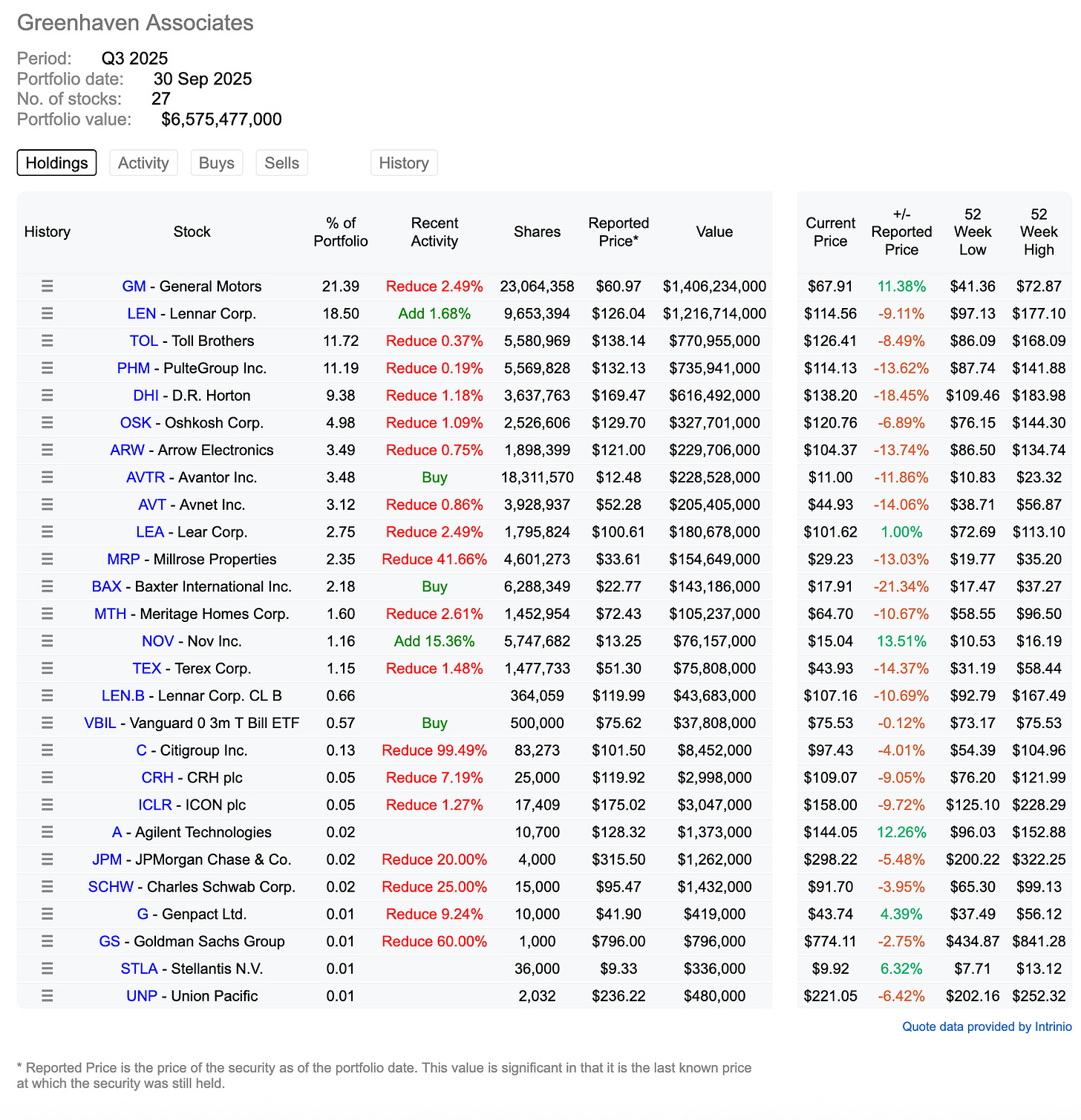

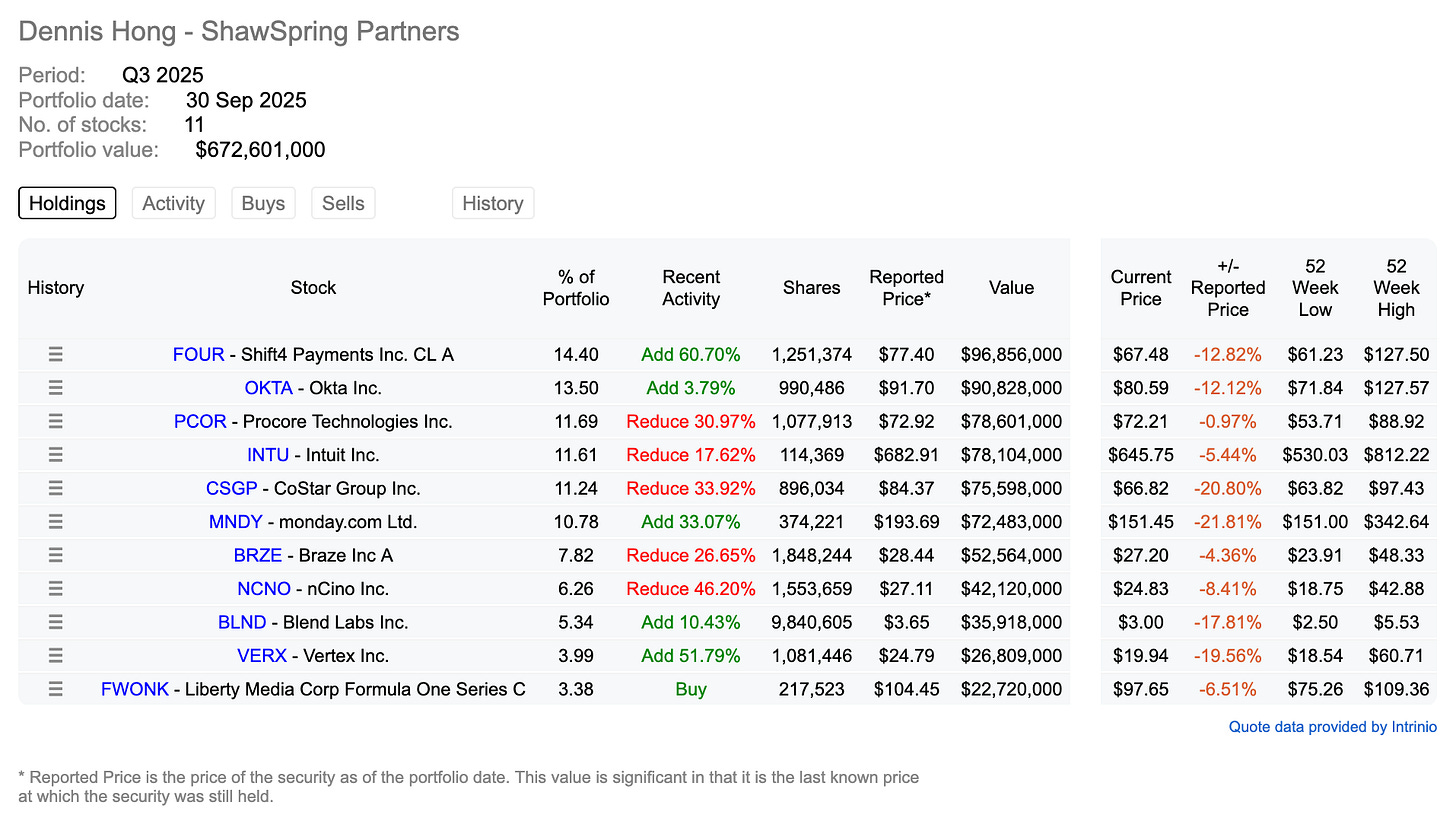

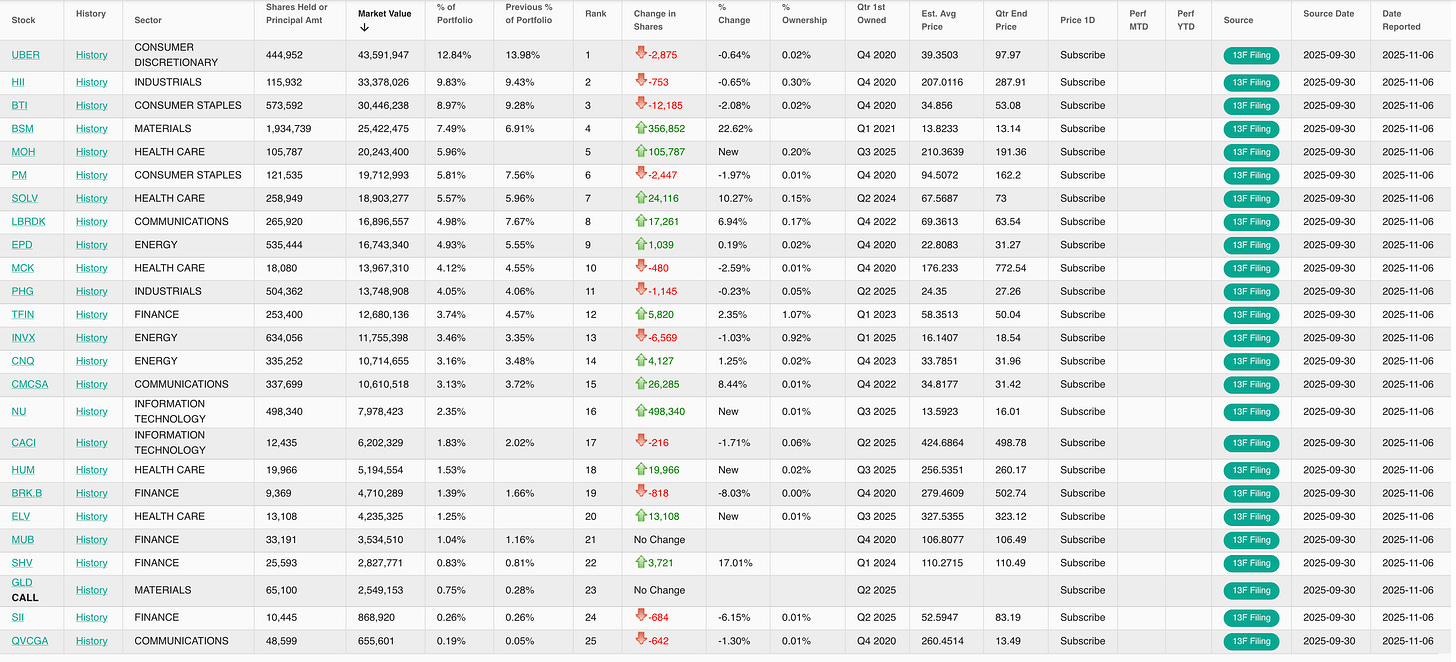

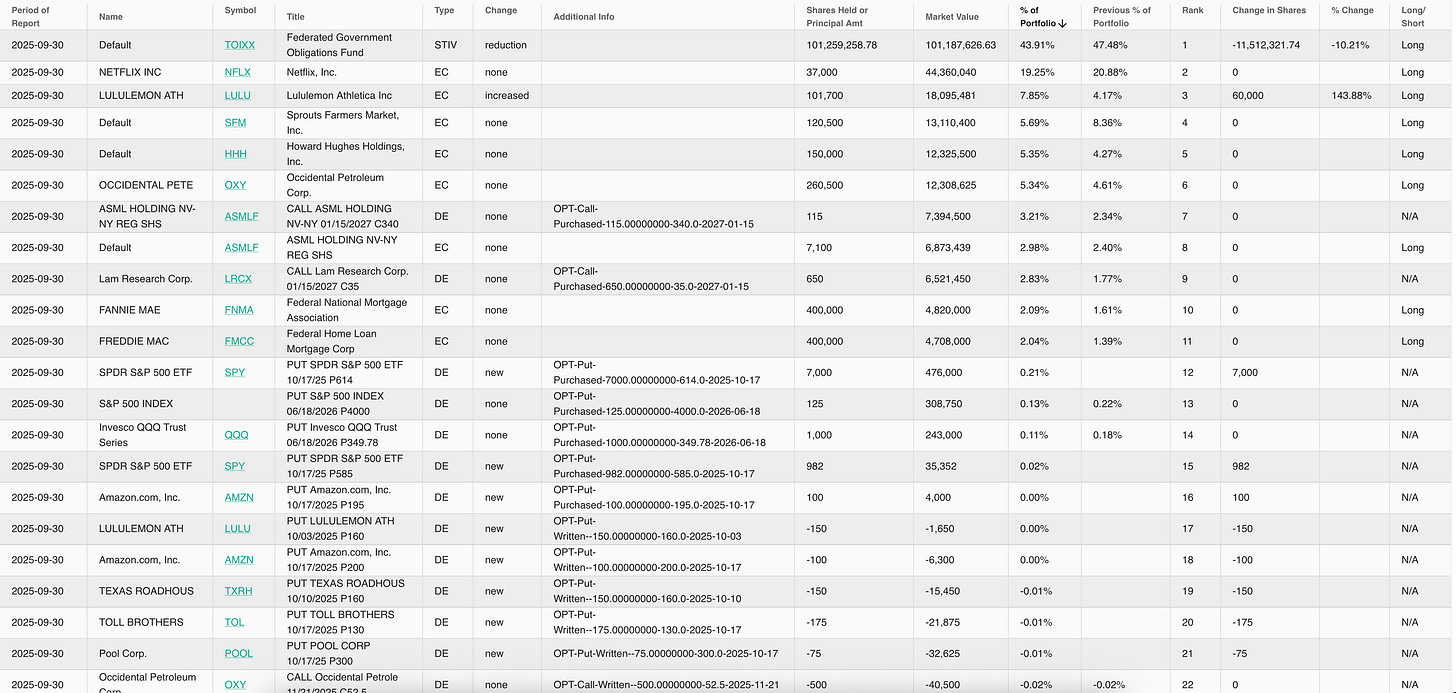

New 13Fs

13Fs are out…

Bill Ackman - Pershing Square Capital Management - Nothing interesting this Q

Lindsell Train - Nothing interesting this Q

Francis Chou - Chou Associates - Added to $STLA

AltaRock Partners - Nothing interesting this Q

Valley Forge Capital Management - Nothing interesting this Q

Don’t forget to ❤️ this post. It helps a lot!

Sections below are for paid subscribers only…