October 2025 Portfolio Update

Quote, Portfolio, Complimentary Monthly Commentary, Latticework, Books, and more ...

Quote for this month:

“If all difficulties were known at the outset of a long journey, most of us would never start out at all.” - Dan Rather

*Portfolio*

*I am NOT a financial advisor. I’m sharing my investing journey. Not investment advice. Do your own research.*

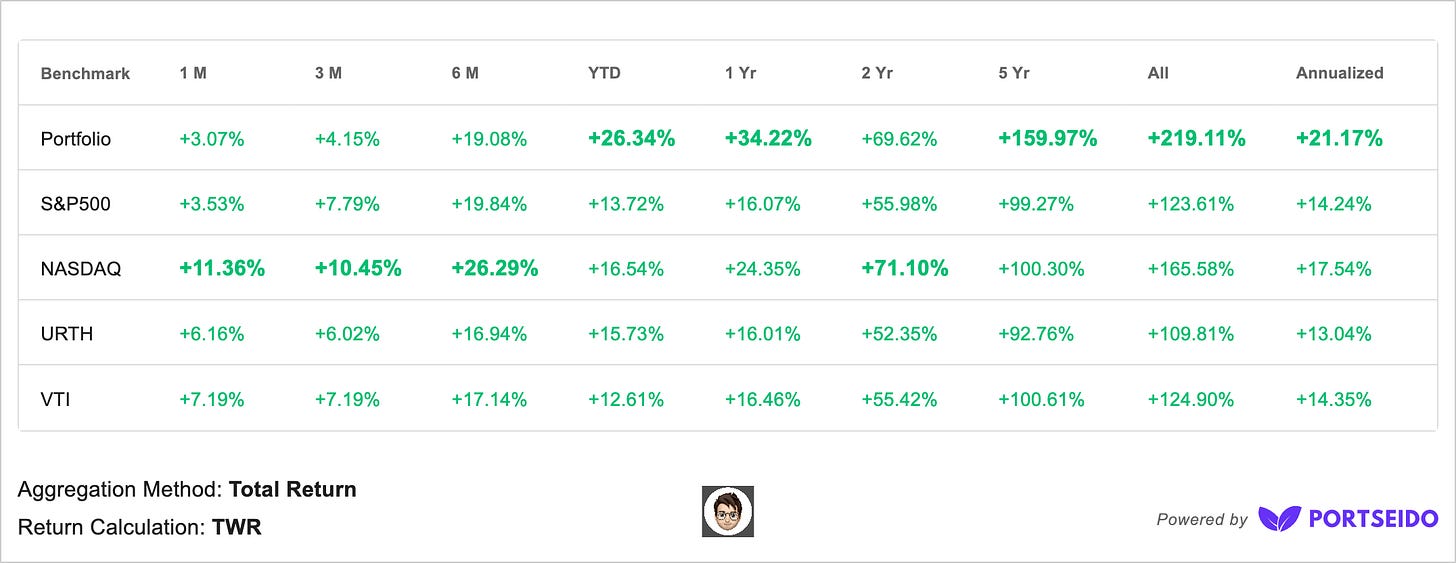

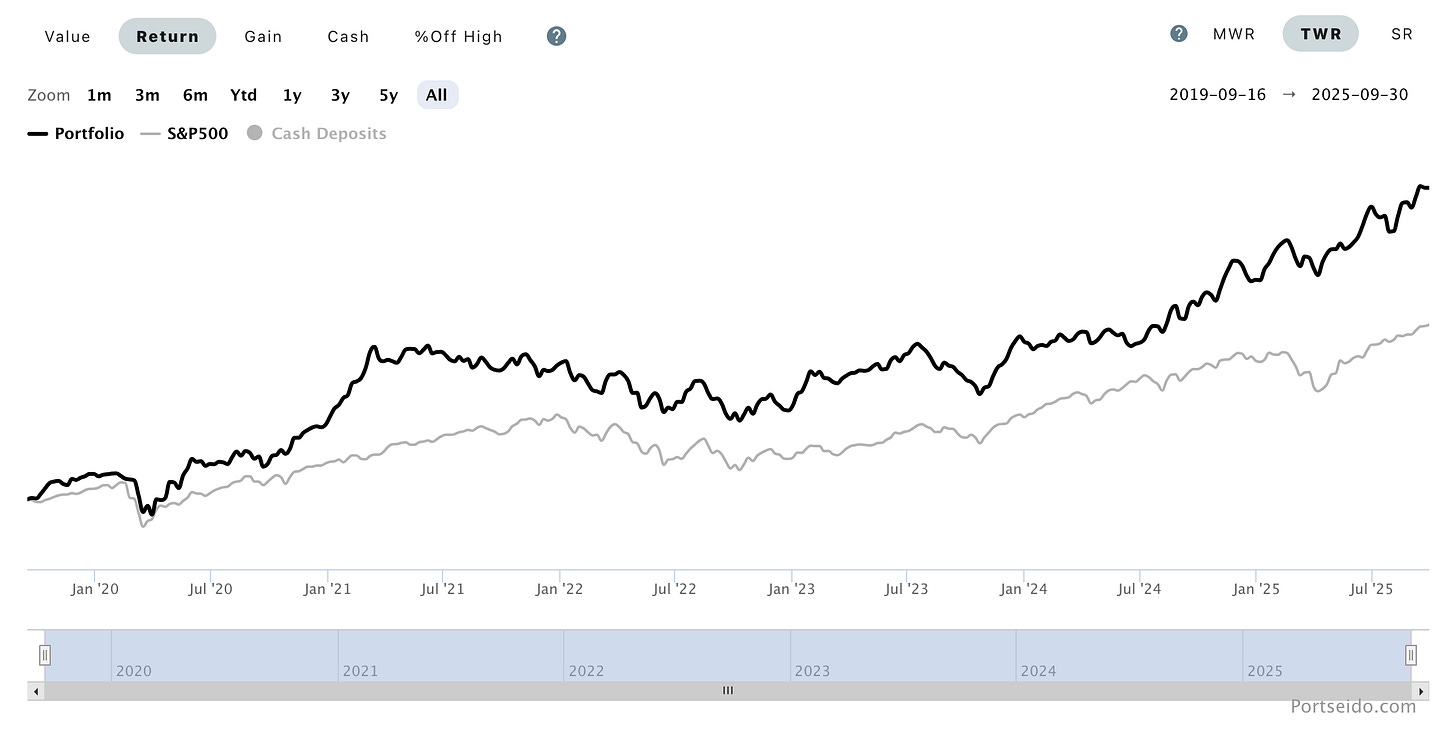

Portfolio (Basic):

Holding since:

2020 - LKQ 0.00%↑ - 03

2021 - SFM 0.00%↑ - 03 | VMD 0.00%↑ - 05 |

2022 - MITK 0.00%↑ - 01 | WBD 0.00%↑ - 04 | $EVVTY - 09 | $NTDOY - 12

2023 - PYPL 0.00%↑ - 01 | BSM 0.00%↑ - 05 | BUR 0.00%↑ - 09

2024 - (First ???) - 01 | BKTI 0.00%↑ - 04 | BOC 0.00%↑ - 09

2025 - IAC 0.00%↑ - 01* | (Second ???) - 03 | (Third ???) - 08 | (Fourth ???) - 08 | (Fifth ???)

*IAC originally was purchased in 2021, but sold at the end of 2024 for tax loss purposes and re-bought back in 2025.

Complimentary Monthly Commentary - CMC

I want to start with saying that this is not the update I wanted to do, but the update that is necessary for monthly update purposes, and what I mean by that is there is something currently happening that I can not talk about in terms of one stock but I really was hoping that by the time I would release this update that I could.

If you noticed (maybe or maybe not) the picture to this update has different amount then the screenshot of portfolio that was taken on 9/30 which was 418,696.97 and the amount that was on post preview was 377,186.55 and the reason is that (no my portfolio did not drop by that much) I actually had to withdraw $30,000 for something I cant discuss yet due to NDA…

I’m hopeful that I will be able to discuss it in the next update and give much more color on how it will impact portfolio tracking and etc.

Even without that company to discuss I have a few things to talk about:

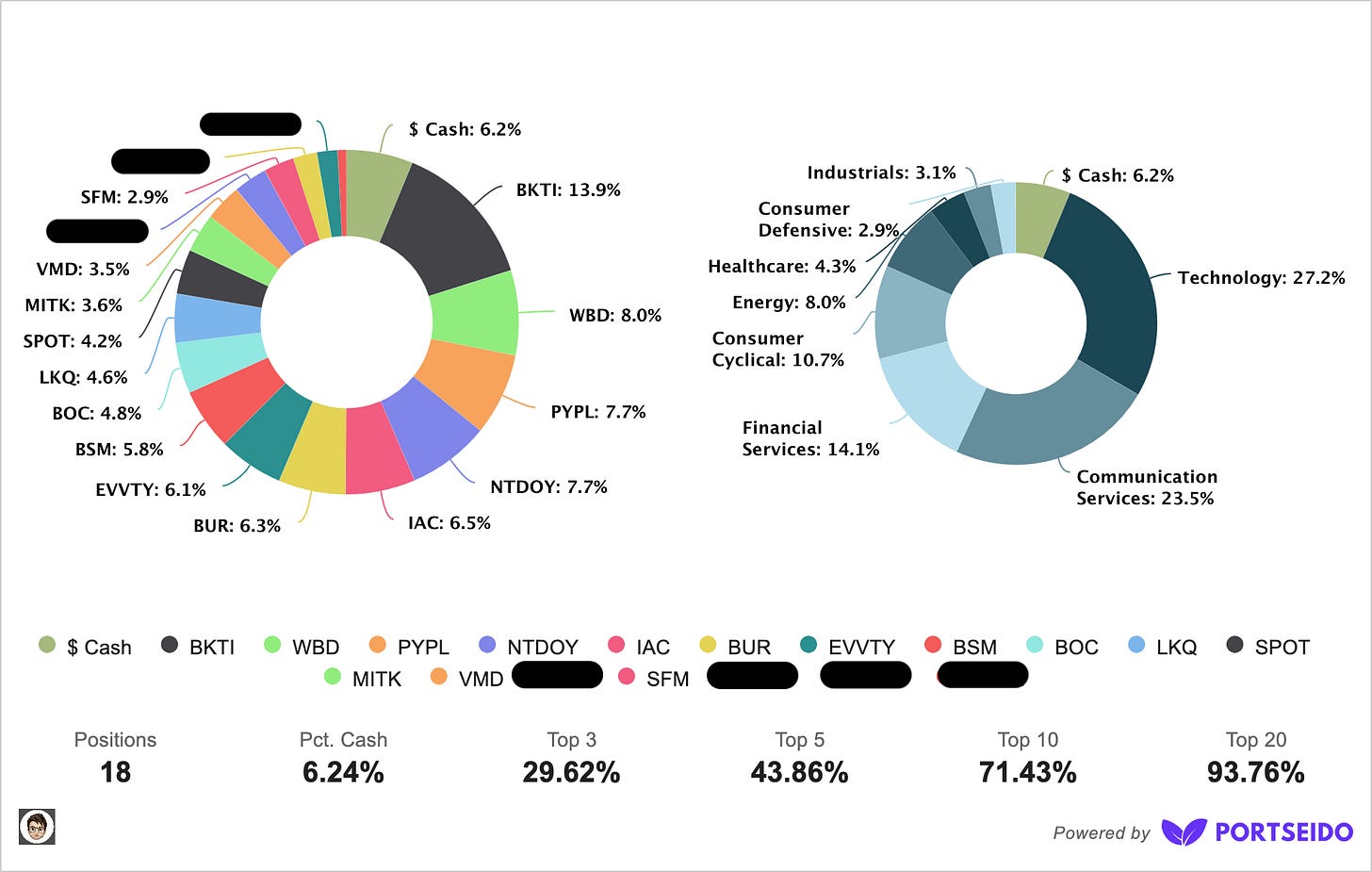

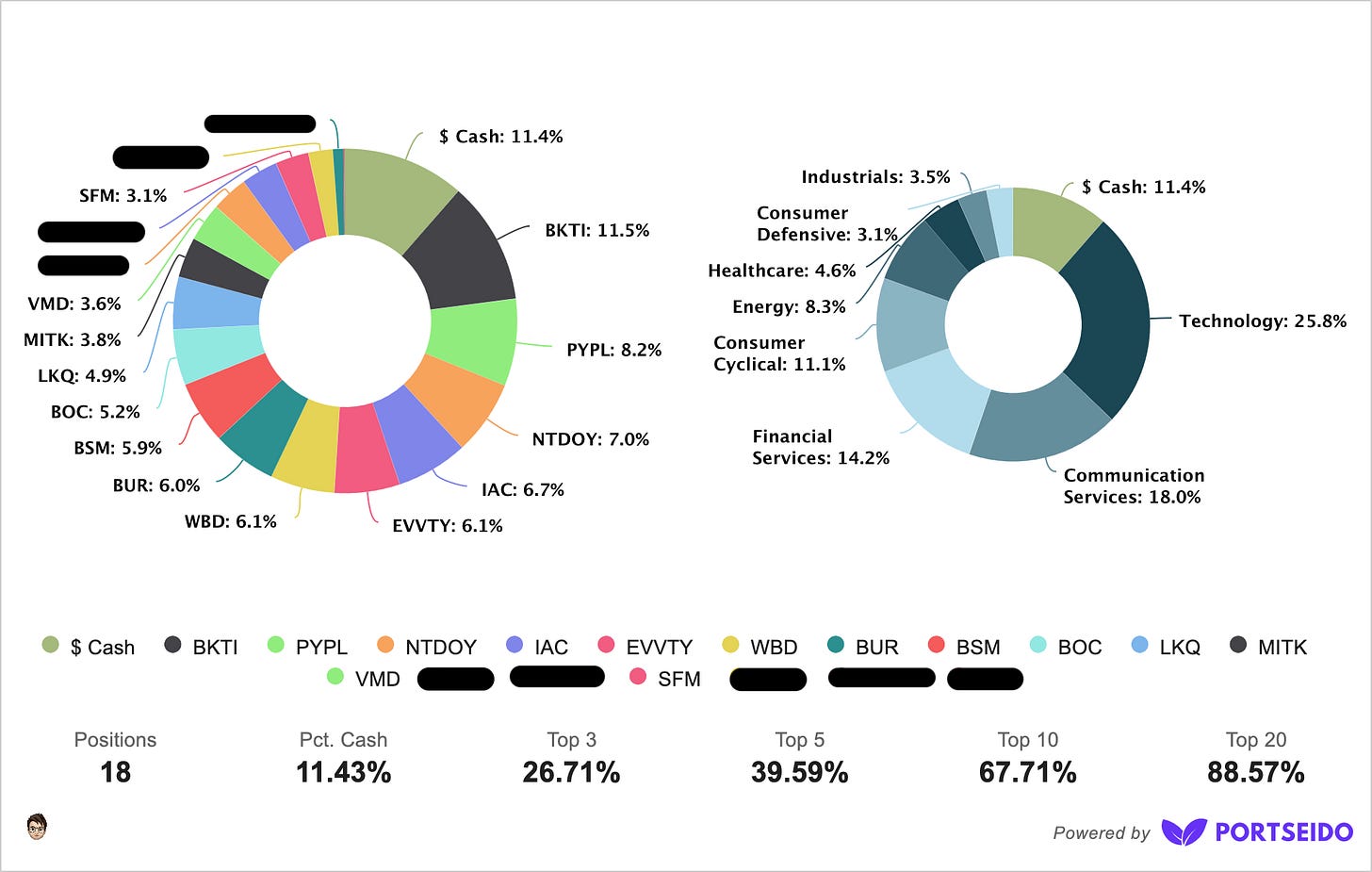

There is a new addition to the portfolio that I added just today, its very tiny as of today but will grow especially closer to the next year … spoiler alert it’s another royalty company but I will give more color on it later in this portfolio update (behind paywall)

SPOTIFY

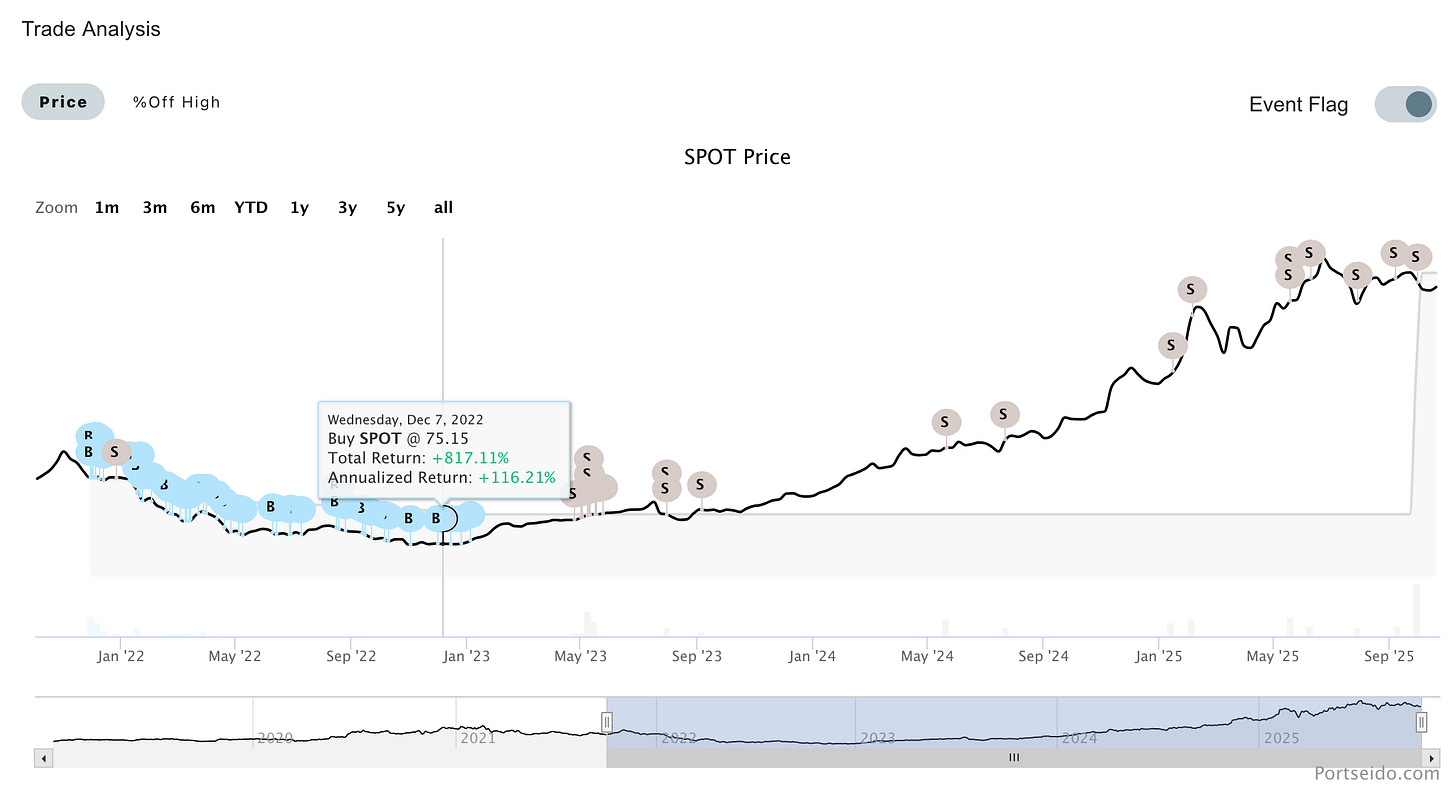

I had to sell out of SPOT 0.00%↑ to meet the required amount (plus a bit more from my own pocket) for the NDA stock.

As you can see from the screenshot above at the lowest buy point to the highest, I clocked in 800% while on average Spotify was a 400% return for me from 2022-2025.

BLACK STONE MINERALS

BSM had September 2025 Investor Presentation (audio link here)

and basically BSM’s management is now very bulling on things in 2030 / 2035 … given AI / Data Centers / etc demand … and honestly I’m not sure how I feel about that, to me it was kind of out of the blue for BSM to now be bullish for 2030-2035! like that’s farrrr awayyyyy … idk .. I’m bullish on BSM because of their structure but nat gas prices need to pick up and I don really understand how they can be confident for 2035 like I’m not sure what will happen tomorrow lol don’t mind next year or 2035 but again little to no debt / light structure and Thomas Carter largest shareholder is buying gives me confidence to hold shares but idk about 2035 … i don’t do macro.

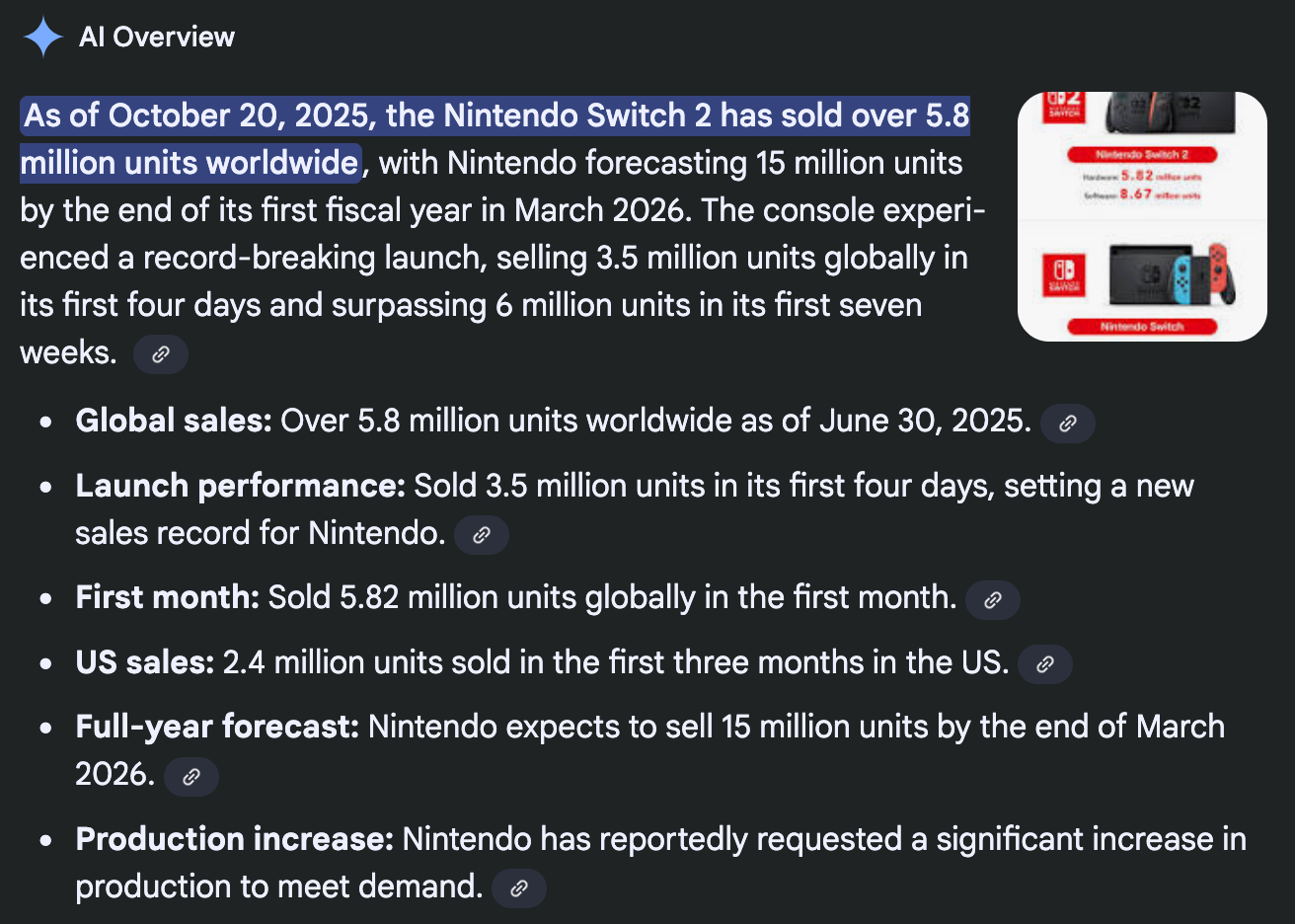

NINTENDO

As some of you may notice - I’m big on boots on the ground / scuttlebutting / sleuthing type of research aka drinking apple cider from SAM 0.00%↑ or playing Pokemon games on Switch 2…

Which brings me that in July Update I discussed my annoyances with Nintendo Switch 2 not having third party apps or that it cant really run any new power hungry games or upcoming GTA which all was fine because when I got my Pokemon Legends ZA I thought it would be worth it… and to some extend it was … and to some extend it was not … which got me into a rabbit hole thought process and research …

Before you watch any of those videos (as either someone who wants to buy Nintendo Switch 2 or the new Pokemon ZA) please scroll down and read my honest opinion which is similar to the videos but not quite so as I look at it as both gamer and investor type of lenses.

… I can keep going with these videos…

The reason for my excitement for Pokemon Legeneds ZA was that I played a bit of Arceus and since I haven’t really played any Pokemon games since the Gameboy days it was really refreshing and exciting to play something like Arceus that I borrowed from my relative. That’s how Nintendo got me …

Pokemon Legends Z-A Launch Sales 40% Lower Than Pokemon Legends Arceus In The UK

Now fast forward to like May to October of 2025, my wife got my Nintendo Switch 2 which came with Mario Kart World Bundle which at the beginning was fun to play but after a few games with my daughters its all pretty much the same and only fun because my 7 y/o is enjoying and I want her to like video games but that game is NOT worth 80 bucks! Moving to Pokemon ZA again my wife got me a present and yes I have amazing wife lets move on … and I been play quite a bit of Pokemon ZA and I wasnt aware in the beginning but you need to buy DLC (which wifey got of course) and have Nintendo Online to fully enjoy that all together is over 100+ bucks and lets not start that technically you can just play ZA on Switch one and not really feel any difference.

What Nintendo got me at is the nostalgia and something I missed as someone who has not played video games in a long time and someone who was a big fan of Pokemon, but you can only EASILY do that once. Yes Pokemon is not made by Nintendo but Game Freak but Nintendo owns like 33+ % of it and Nintendo owns the Switch… I feel like GF really dropped the ball on making Legends ZA really fun and interesting long term game which from the reviews that have failed very much so, I am enjoying it but for a lot of different reasons I think then most of the gamers and those reasons will most like will not be why I would be excited for the next game or console.

Nintendo should have a really strong and profitable end of the year with all of the holidays that are coming, but after that? I don’t know … Nintendo has really been disappointment after disappointment so far when you actually get the products and test them out (and those are the things that I actually did think would be the cases)… As investor sure I can see all of these profits getting milked but that wont last and wallets are as fat as they are until they are not because gamers are not enjoying being used which to me it feels like what Nintendo is doing right now…

EVOLUTION

We finally know who was behind 2021 “short report” (drum roll) Playtech!

Read more below

WARNER BROS DISCOVERY

Warner Bros. Discovery says it’s open to a sale

WBD looking to sell it self, but the whispers are that board is looking for $30 and Paramount’s $20 is “too low” - we will see. I have sold bunch of shares 18-20 and the rest have in call options that are due in Jan of 2026.

Latticework

On October 7th I attended Latticework 2025 conference by MOI Global, it was really interesting and educational day + got to chat with lots of smart folks!

Some thoughts on it from David Park:

https://x.com/investingdpark/status/1975565007258808607 - If you look very hard you can actually find me there on one of the pictures.

Some thoughts on it from Christopher Tsai:

https://x.com/tsaicapital/status/1976714741394350169

Books

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

Co-Intelligence: Living and Working with AI by Ethan Mollick

YZ:

Book was okay, to be honest I don’t remember much that I have listened to but what I do remember is that we should embrace AI/LLMs and implement them in our work/school like calculators (in a way)

Goodreads:

Consumer AI has arrived. And with it, inescapable upheaval as we grapple with what it means for our jobs, lives and the future of humanity.

Cutting through the noise of AI evangelists and AI doom-mongers, Wharton professor Ethan Mollick has become one of the most prominent and provocative explainers of AI, focusing on the practical aspects of how these new tools for thought can transform our world. In Co-Intelligence, he urges us to engage with AI as co-worker, co-teacher and coach. Wide ranging, hugely thought-provoking and optimistic, Co-Intelligence reveals the promise and power of this new era.

I give it 3 out of 5 stars.

Who Knew by Barry Diller

YZ:

I really enjoyed listening to this audiobook … its raw … its unfiltered … its honest … I feel like this is a type of biography I would like to do. If you want to learn more about Mr Diller I would highly recommend reading or listening to this book!

To be honest by the middle end ish of the book I was thinking … I should probably sell my IAC stake … but I haven’t yet, mostly because I’m stubborn and hate selling losing stocks but at least I’m honest … I still have more soul searching to do with IAC…

Goodreads:

Barry Diller, one of America’s most successful businessmen, reveals himself here—his successes, failures, and struggles—with surprising candor and intimacy in a memoir rich in Hollywood lore and filled with business acumen.

Writing in his singular voice, Barry Diller delivers an astute business memoir, an unvarnished look at Hollywood, a primer on media, and a surprisingly frank coming-of-age story.

“I want to work in the mail room at William Morris.” So begins Diller’s show business life. Diller did not aspire to be an agent, nor was he a glove fit for William Morris, the legendary talent agency he describes as resembling a “Jewish Vatican.” But he was a good assistant and student and took it all in.

Before long, Diller was offered a job at ABC. His ascent was meteoric, launching ABC TV’s Movie of the Week at age twenty-seven, becoming CEO of Paramount Pictures at age thirty-two, and launching the Fox TV network at age forty-four. Along the way, Diller oversaw the production of classic films such as Saturday Night Fever, Raiders of the Lost Ark, and Home Alone (a film he credits with saving Rupert Murdoch’s career) and hit TV shows such as The Simpsons, Married…with Children, and Cops. He programmed and developed by instinct—not by research or data.

Diller’s media savvy changed the course of American culture. His championing of Alex Haley’s Roots put long-form miniseries on the map. He was never cowed by the talent—actors, directors, and producers—and worked with them all. Indeed, throughout his career, Diller championed “creative conflict,” encouraging argument in every business he managed (“I’ve never thought decision-making should be peaceful,” he writes). Diller also recognized our digital future, founding IAC and growing it into a billion-dollar constellation of brands, including Match, Tinder, and Expedia.

Moving beyond business, Diller recounts his family life, personal struggles, and regrets, his joyful marriage to Diane von Furstenburg, and where he has found fulfillment.

Intimate, candid, and moving, Who Knew is a different kind of business memoir, one that holds nothing back.

I give it 4.5 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

Sections below are for paid subscribers only…