Onfolio Holdings Inc. ($ONFO) - One Pager

"Oh no ... not another serial acquirerrrrr..."

From quick scan of this company’s financials and stock chart, this company gives feel of sadness, darkness, and hopelessness but if you decide to looking a bit deeper … things get more interesting and show sparks of bright future …

Overview

Onfolio Holdings Inc. (Onfolio, ONFO) was founded in 2019 by Dominic Wells and in 2022 Onfolio completed its IPO and got listed on the NASDAQ - ONFO 0.00%↑ .

As of June 27th ONFO has Market Cap. of $4.61M and EV of $7.33M.

Onfolio acquires controlling interests in and manages small very niche online businesses. These businesses typically operate in sectors with long-term growth opportunities, have positive and stable cash flows and can be managed by ONFO’s existing team or already have strong management teams in place. ONFO aims to build a diversified portfolio of online businesses with positive cash flow that will accelerate future organic growth.

Onfolio's strategy involves identifying undervalued and under-optimized online businesses, acquiring them, and then using its operational expertise to improve their performance. Onfolio focuses on becoming a "world-class serial acquirer" by leveraging its operating and financial capabilities across a diverse portfolio.

In 2024, ONFO acquired three new businesses: RevenueZen, DDSRank, and Eastern Standard, contributing a total of $6M in revenue.

Management Team

Dom Wells is the Founder and current CEO of Onfolio. He is active on social medias (LinkedIn, X, YouTube, etc.) His LinkedIn posts and Onfolio’s YouTube videos (although some videos are a year or so old) give some glimpse into what kind of CEO Dom Wells is and what he is looking to do with ONFO.

From 10K - 2024 - “He is responsible for developing and implementing our Company’s long term business strategy and direction. From August 2013 to April 2019, Mr. Wells was the founder and director of Digital Wells Limited (Hong Kong), where he grew the Company and the Human Proof Designs (Humanproofdesigns.com) website. Human Proof Designs is an internet marketing agency offering website creation, search engine optimization services, content marketing and content creation services, and affiliate marketing training. After founding Digital Wells Limited (Hong Kong) and growing it for 5 years, Mr. Wells exited the company in 2019.”

Esbe Van Heerden was previously President and CFO of ONFO, she is no longer with the company, “supposedly left on good terms”.

Adam Trainor is currently COO and Interim CFO of Onfolio since January 1, 2025.

From 10K - 2024 - “Prior to that Mr. Trainor served as the director of a portfolio of our Company from November 2020 to January 2022, overseeing Vital Reaction LLC, Outreachama LLC, Getmerankings LLC, alongside various content/media properties. He is responsible for executing our business strategy and managing portfolio/department leadership. Before joining Onfolio, Mr. Trainor served as the CEO of Vital Reaction LLC, from April 2019 to December 2020. Mr. Trainor is also a board certified chiropractic physician and clinical nutritionist and has worked in a variety of pain management settings, including at Walter Reed National Military Medical Center in Bethesda, MD from November 2018 to April 2019. Also, from September 2010 to January 2019, Mr. Trainor served as the founder and CEO of Thirdspace LLC, an academic tutoring agency where he ran all aspects of the agency.”

“When asked about Adam being Interim CFO, I was told Adam does a great job and while company is looking for permanent person, ONFO is not in a hurry.”

Major Shareholders:

Dominic Wells - CEO / Founder - 22% or about 1,165,500 shares

Esbe van Heerden - Ex President - 4% or about 252,000 shares (checked in 2023)

Onfolio’s Portfolio

Current business models: D2C eCommerce, B2B SEO and marketing services as well as B2B digital products.

Financials

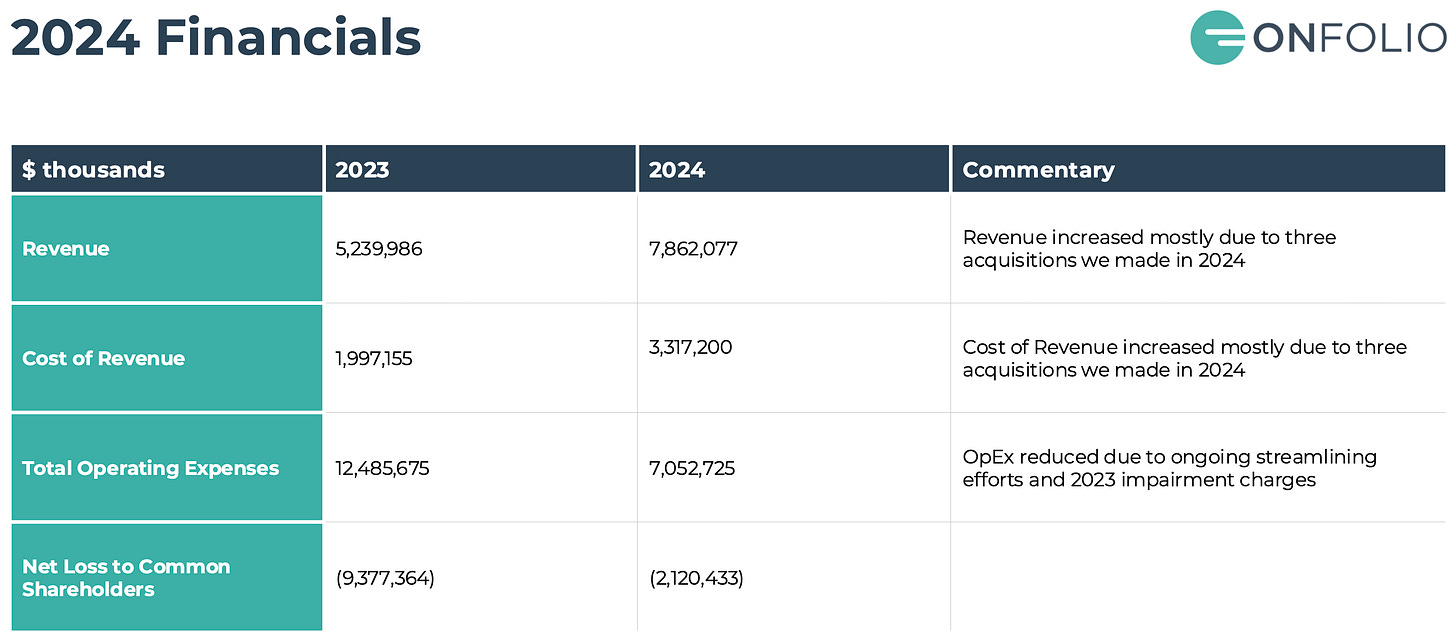

When it comes to Financials there is not much to talk about … for now …

As you can see from two pictures above, company is still loosing money but slowly trying to turn things around.

Onfolio primarily earns revenue through website management, digital services, advertising and content placement on its websites, product sales, and digital product sales. Management services revenue is earned and recognized on a monthly basis as the services are provided. Advertising and content revenue is earned and recognized once the content is presented on the Onfolio's sites in accordance with the customer requirements. Product sales are recognized at the time the product is shipped to the customer. Also, Onfolio earns revenue from online course subscriptions that may have monthly or annual subscriptions.

Opportunity / Growth

Onfolio plans to keep growing via acquisition of other smaller profitable companies that are in ONFO’s circle of competence and at the same time those new companies would provide synergies to the existing companies in it’s portfolio while also adding more cash flow. Nice Flywheel …

A quick example is Revenuezen and Contentellect working together where CE is fulfilling all the link building work for RZ’s clients.

Being public means having a few extra levers to pull for accelerated growth:

Issuing Preferred Shares - learn more click here

Issuing Debt / Notes (most cases not undesirable)

Doing Joint Ventures (example Onfolio Agency SPV) - learn more click here

Issuing common shares (most cases not undesirable)

Out of the four mentioned above, ONFO has been using mostly Preferred and SPVs to get new capital. Preferred Shares yield 12% annually and pay dividends quarterly while SPV unlocks joint ventures with majority (but not all) of ownership of the companies that get acquired.

CEO has said multiple times that he prefers not issuing new common shares or debt.

Risks

There are many risks that come with investing in companies … even more so if those companies are not profitable…

One of the current risks is that Onfolio is still not “profitable” … largely due to SG&A and other expenses that come with acquired new companies but ONFO is optimistic that second half of 2025 is the turning point…

ONFO must get control of their expenses while at the same time keep on growing & acquiring new companies.

Some other risks:

Failure to successfully integrate acquired companies

Not able to meet the payments for the Preferred shares

Google Traffic Changes and AI

Unable to find new companies to acquire

Being de-listed for not complying with Nasdaq

Warrants, Cyber-attacks, etc.

Conclusion

In conclusion, 2022-2024 there was a lot of painful lessons but learning is part of the process and as long as you do not make the same mistakes twice those type of mistakes are part of the growth … with that said Onfolio is still speculative play mostly because there is still uncertainty and not much past history to give us guidance on.

(I like to see at least five to ten years of public data).

This is a bet that Dominic Wells and the team at Onfolio can deliver on everything that they preaching, which are:

Soon to become profitable

Successfully acquiring / integrating new companies

For now keep growing via M&A but soon to grow organically

Keep paying out dividends on the preferred shares and profits on SPVs and maybe at some point even retiring preferred and buying out shareholders out of SPV

Until Onfolio gets its profitability in order, Mr Market will not believe anything that the management has to say…

But I guess in that lies the opportunity…

Holdings Disclosure

At the time of this publication, I do not own shares in my main portfolio because Onfolio does not meet all of the metrics for my main portfolio BUT I do own shares of ONFO 0.00%↑ in my IRA account & I own Preferred Shares, also I own units in Onfolio Agency SPV LLC.

So as you can see I own bunch of different things that are all related to Onfolio sooooo I’m most likely very biased towards the company, which means please do your own due diligence!

P.S. Don’t forget to ❤️ if you enjoyed it.

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

As you say: Onfolio is barely in its Early-Stage phase.

I have known Dominic for 3 years and is an operator with a philosophy similar to that of Buffett & Muger in BRK.

On the other hand, Dominic is a person who has digital business know-how. I think that being aware of the dynamics, especially in AI, gives it that advantage as an operator. However, execution is difficult. It reminds me of what Andrew Wilkinson has done with Tiny; or the case of Boston-Omaha.

These 3 cases are an example of narratives and not based on numbers.