This write up was done in collaboration w/ Mark Hogan @

.100% of the research was done by Mark Hogan, I just added couple of final touches.

If you would like to learn more about Mark, check out his Twitter / X & his Substack.

Disclaimer is at the end.

ReposiTrak TRAK 0.00%↑ is a $300M market cap company that sells software to grocery stores to track the food supply chain. The company’s core technology came from CEO Randall Fields’ Mrs. Fields Cookies. Previous company names include Prescient (acquired in 2009), Park City Group (2014), and now ReposiTrak (acquired in 2015).

Quality (4/5)

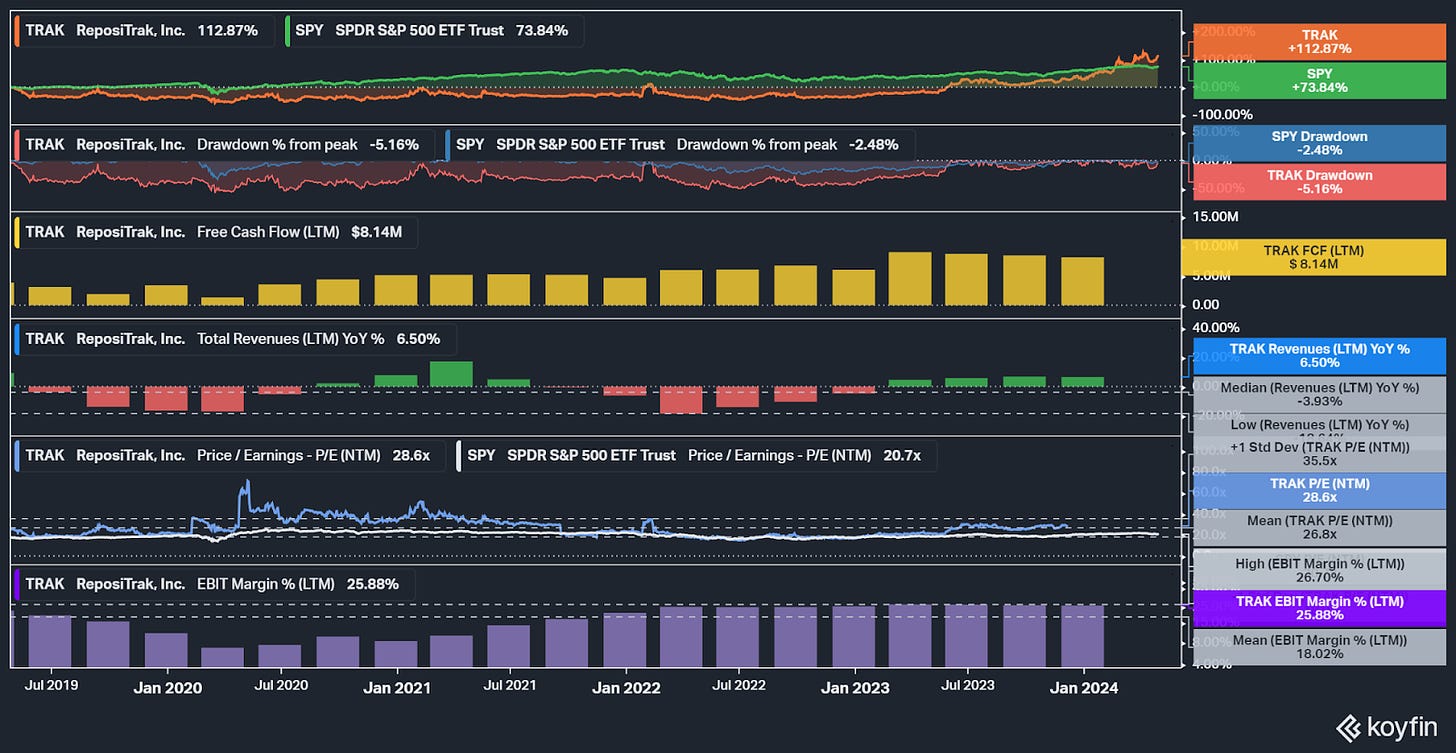

Recurring revenue has been growing at a sustainable 8% CAGR over the last five years. TRAK’s reported revenue during the same time is declining at a 3% CAGR due to a shift to software-as-a-service (SaaS) business model, which is eliminating one-time revenue in favor of subscriptions.

Revenue is 100% based in North America. Unique for a small cap software company, TRAK reported GAAP profitability for 34 straight quarters. The track record for growth has not always been so great, with a revenue last-twelve-months (LTM) year-over-year (YoY) low of -64% during the last 20 years. TRAK has often seen larger drawdowns of its stock price as compared to the overall stock market.

Leverage is not excessive at 1.1X (total assets over total equity). TRAK has $23M of cash on its “fortress” balance sheet as of the last 10-Q filed in February, which is about half of total assets, compared to less than $600K of debt (notes payable and operating leases).

Visibility (4/5)

Recurring revenue is 99% of the total, leading to high topline visibility. However, forecasting may be difficult for the upcoming years due to the new “Traceability” software product that TRAK is rolling out.

“I think the first thing to realize is that when we thought about Rule 204, and this was an error we made in looking into the future, Rule 204 for from the FDA covers, call it, 5% to 7% of the food products that go through a supermarket. Keep that number in mind, 5% to 7%. What just happened is, the industry said, we're going to go from 5% to 7% to 100%. So you can work the numbers out, it's between a 15 and 20 time expansion of the size of the opportunity.”

(source: Q2 2024 earnings call)

Basically, TRAK has a solid cash flow generating legacy business serving compliance customers, and it is using that cash flow to invest in the new high-growth Traceability product. Management says it would not be surprised to see revenue double over the next 2-3 years.

“Maybe it wasn't clear in both John's and Randy's remarks that it is perfectly reasonable in the next two to three years, the top line revenue of the company will double. We will go from being a $20 million a year company to $40 million in two to three years.”

(source: Q2 2024 earnings call)

There can also be uncertainty around FDA rules and timing. As of today, the FDA is to begin enforcement of the FSMA 204 food traceability law on January 20, 2026.

TRAK is a small, simple company that uses no non-GAAP adjustments. The idea of food traceability is understandable but it will be a large, complex undertaking to get thousands of suppliers on board. There are currently no sell-side analysts providing estimates for TRAK.

Management (5/5)

Management is led by Chairman, President, and CEO Randall Fields (76) who was the founder of Mrs. Fields Cookies. The CFO is John Merrill (53). On the Board is Ronald Hodge from Delhaize, a grocer, Peter Larkin from the National Grocers Association, and Robert Allen who was a CEO in the dairy industry.

Over the last decade, the company generated a solid $29M of free cash flow (FCF). I calculate a return on invested capital (ROIC) of around 20% compared to my estimated cost of capital of 10%.

Stock-based compensation is low at 2% of revenue. Insider ownership is high, with insiders owning 42% of common stock outstanding, according to the latest proxy filing. CEO Fields owns 37% of common shares out. Fields and Allen also own Series B Preferred Stock, which management is buying back now as part of its capital allocation plan.

Demand Creation (3/5)

Demand for the traceability software is driven by FDA rules. Per the latest 10-K, “This is the result of growing industry and consumer concern of food contaminations and food safety hazards whether biological, chemical, physical, or allergenic. The risks have elevated regulatory requirements, documentation requisites, and principally “where does your food come from?” transparency on grocery retailers and their suppliers. As more and more retailers, wholesalers and distributors adopt the risk concerns and disclosure requirements, the Company has seen a rising demand for its services.”

Management claims to be the only company doing traceability despite Google searches that show dozens of traceability software offerings from multiple companies.

“Well, keep in mind we're actually doing traceability now, not piloting, not talking, but doing it. We learned every day to the challenges, including challenges that nobody else, in fact, could have anticipated, including us. Our expertise and actual experience is unmatched. And it represents a durable competitive advantage for us going forward. This real life practical knowledge is an enormous competitive advantage. And we believe that we're the only ones that understand that, in total. It's an important moat around our traceability business. And that's in addition to our technology moat.”

(source: Q1 2024 earnings call)

TRAK could have the advantage since they are marketing itself to be a pure-play on traceability with decades of food industry experience. Some larger companies I found with food safety offerings include IBM, Zebra, and Trustwell. I cannot confirm whether or not these competitors are “just talking” about these products like TRAK management says. It could just be marketing pages that do not have a solid offering to back it up if one was to call in and request a demo.

Eventually, TRAK could scale, leading to more efficient sales, while creating a network effect with customers and suppliers. We could even see traceability become a competitive disadvantage for grocery stores that lead to high switching costs. TRAK gives the example of Kroger, which is leading the push for traceability.

“Kroger, the largest grocery chain in the US, recently announced to its supply chain that all suppliers, not just those impacted by FSMA Rule 204, but all food suppliers must comply with Kroger's traceability framework – boom. This announcement dramatically changes everything because this will set the food safety bar for other retailers. This is perhaps the most significant change in the history of the retail food industry.”

(source: Q2 2024 earnings call)

Valuation & Pricing (2/5)

Attached below is my discounted cash flow analysis (DCF).

I set revenue to grow 40% over the next few years, which would mean a doubling of revenue 2-3 years out. Afterwards, I set revenue to grow at a more sustainable 20% rate. EBIT margin is already solid at 26%, so as TRAK scales, I have margins expanding to 30% over time. Reinvestment is high to match revenue doubling, before reaching a more efficient rate in later years. My estimated value comes out to $10.64 vs. today’s price of $16.73. The DCF method could easily underestimate the value of this small, fast growing company. Pricing the stock may be more useful in this scenario.

For my pricing analysis, EPS looks like it could reach about $0.30 this year. With revenue expected to double and EPS expected to grow faster than sales, EPS should be exceeding $0.60 in the next 12-24 months. TRAK currently trades at a 50X multiple. A more reasonable 30X multiple (based on what other software companies are trading for) on $0.60 of EPS would price the stock at about $18.00/share. Almost all software peers with a market cap near $300M appear to be pandemic-winners that are down 90% now and have no earnings. TRAK stands out with its GAAP profitability and strong cash flow. When looking at Price/Sales, TRAK is near the top at 15X, which is ServiceNow territory. The median P/S for small software peers is closer to 2X. Management was buying back shares in the latest quarter at $8.79 (22K shares).

Combining my valuation and pricing, I get a target buy-below price of $14.30, which is 11% lower than today’s price.

Risks

My first risk is from larger competition. Given its small size, TRAK would have a hard time matching the sales forces, marketing spend, and connections of IBM or Zebra. Imagine if Microsoft got interested in food safety, reached out to its grocery customers that use Azure, and offered a low-cost traceability solution.

Next would be if FDA rules get pushed back or if the industry adopts traceability slower than expected. That does not seem to be the case yet as Kroger announced it wanted traceability ready to go even earlier than the FDA deadlines.

As stated in the 10-K: “In September 2020, the FDA proposed a rule for Record Keeping for Food Traceability as part of the FSMA (“FSMA 204”), which was published in November 2022 and went into effect in January 2023. FSMA 204 will apply to all foods on the FDA’s Food Traceability List. In the event (i) FSMA 204 is postponed or delayed, (ii) modified to the extent of applicability of the rules of FSMA 204 to various food industry sectors, (iii) the penalties for violations of FSMA 204 are reduced or eliminated, or (iv) delay or failure by the industry to adopt practices in compliance with FSMA 204, in each case, could slow the adoption of our technology as a compliance tool for FSMA 204, which could have a material adverse effect on our business, results of operations, and financial condition.”

Competitors:

If you manage food safety or quality assurance for your organization, you need to understand how your company can meet the Food and Drug Administration's (FDA) regulatory requirements that are part of the Food Safety Modernization Act (FSMA). This includes traceability recordkeeping requirements, as well as responding to FDA requests within 24 hours with the required data in the designated format.

Costly food recalls, outbreaks of foodborne illnesses, compliance regulations and higher consumer expectations are critical factors driving rapid change in the food and beverage industry. As a result, enterprises in the food supply chain—from the manufacturing plant floor, to transportation and logistics operations, and retail companies—are challenged to implement more effective food safety processes.

Trustwell https://www.trustwell.com/why-trustwell/

With increased emphasis on digitizing the supply chain to improve food safety and transparency, Trustwell offers the food and supplements industries an unmatched ability to connect formulation, compliance and food safety data and processes.

Master Control (HQ located right down the street from TRAK) https://www.mastercontrol.com/quality/food-safety/

Consumers today have access to produce and food products from around the world, thanks to a global food supply chain. On the flip side, globalization makes consumers more vulnerable to foodborne illnesses unless regulations such as the Food Safety Modernization Act (FSMA) in the U.S. and international standards such as ISO 22000 are strictly enforced. Many companies increasingly use food safety software solutions to comply with standards and regulations.

Finally, my earnings estimates could be at risk if TRAK has difficulty scaling up to meet 10X the demand. It may get more expensive than expected to hire software engineers or salespeople, especially when IBM, Zebra, and Microsoft would have deeper pockets.

To conclude, ReposiTrak scores an 18/25 in my latest review of the company. See where it stacks up with the other companies I follow, now on Tableau!

Thank you for reading! Please share your thoughts below.

Additional notes:

TRAK stock trades average daily volume of only 80K shares. That is hardly $1M worth of shares trading daily, possibly making it unsuitable for larger investors.

Holdings Disclosure

At the time of this publication, Mark Hogan and I (YZ) don’t own any shares of TRAK 0.00%↑ .

P.S. Don’t forget to ❤️ if you enjoyed it.

Disclaimer from Mark Hogan

Please see my holdings disclosure located in the Google Sheets link.

Any views or opinions are my own. I do not represent a firm. I am not giving financial advice. The stocks that I write about could increase in value, lose value, or stay the same value. Investing involves risk and losses can occur. Some stocks I write about may not be appropriate for you and you should consult a professional investment advisor. Data presented is from sources I believe to be reliable. The opinions and commentary presented reflect my best judgement at this time and may include “forward-looking statements”, all of which are subject to change at any time without obligation to update them. Actual future results may be different than my expectations.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, the author has not independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author assumes no liability for this information and no obligation to update the information or analysis contained herein in the future.

Disclaimer from YZ

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.