September 2025 Portfolio Update

Quote, Portfolio, CMC, 13Fs, WWE On Netflix, Books, and more ...

Quote for this month:

"You see, but you do not observe" - Sherlock Holmes

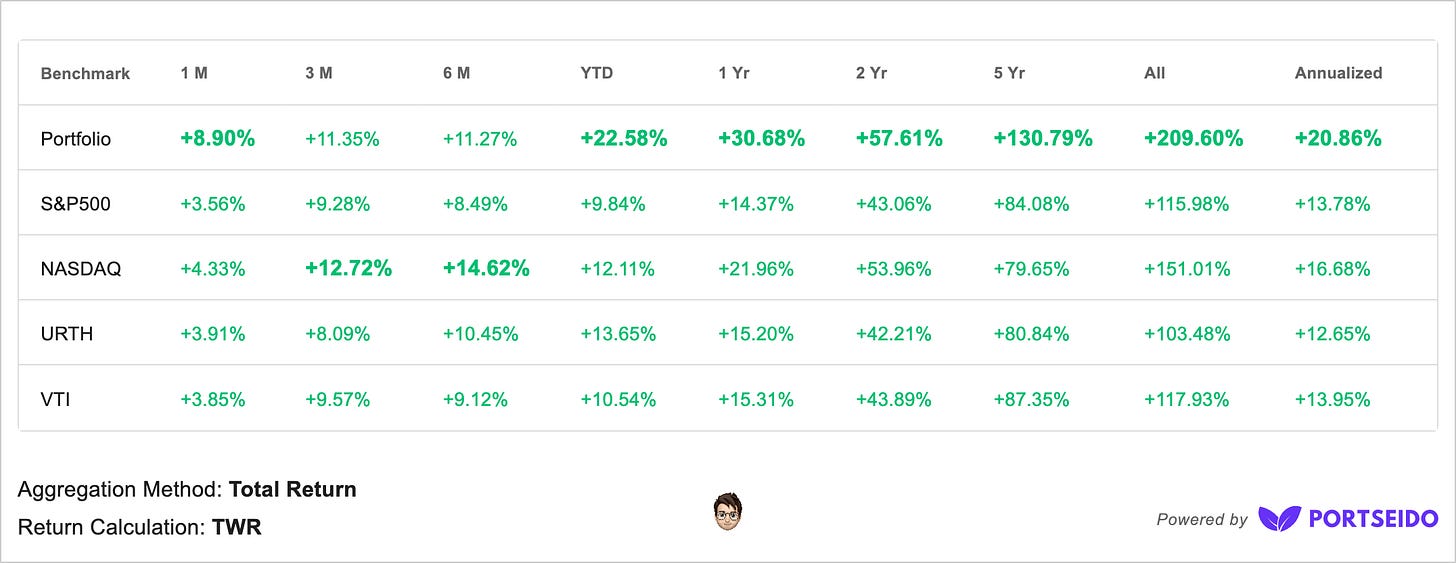

*Portfolio*

*I am NOT a financial advisor. I’m sharing my investing journey. Not investment advice. Do your own research.*

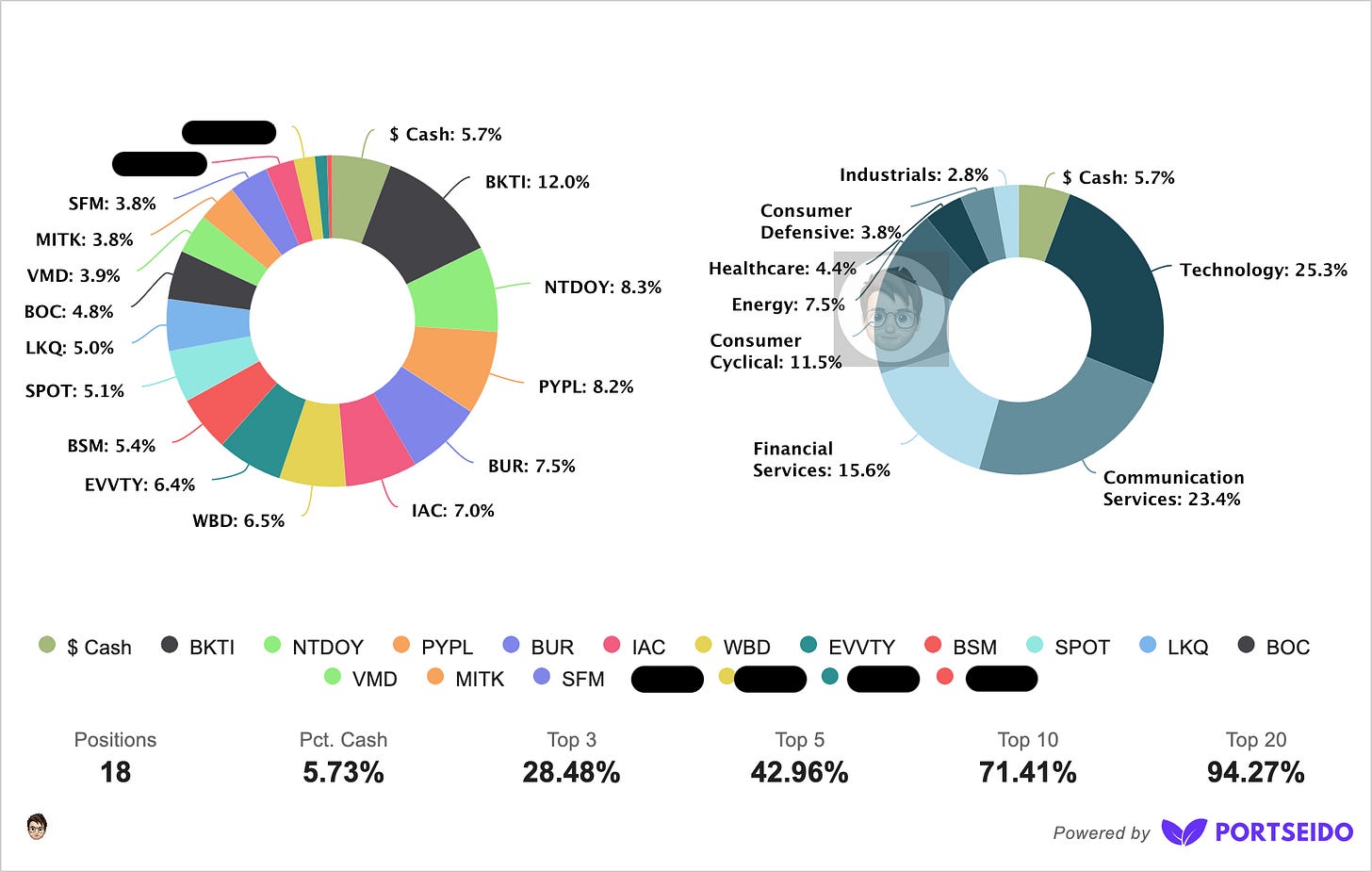

Portfolio (Basic):

Holding since:

2020 - LKQ 0.00%↑ - 03

2021 - SFM 0.00%↑ - 03 | VMD 0.00%↑ - 05 | SPOT 0.00%↑ - 11

2022 - MITK 0.00%↑ - 01 | WBD 0.00%↑ - 04 | $EVVTY - 09 | $NTDOY - 12

2023 - PYPL 0.00%↑ - 01 | BSM 0.00%↑ - 05 | BUR 0.00%↑ - 09

2024 - (First ???) - 01 | BKTI 0.00%↑ - 04 | BOC 0.00%↑ - 09

2025 - IAC 0.00%↑ - 01* | (Second ???) - 03 | (Third ???) - 08 | (Fourth ???) - 08

*IAC originally was purchased in 2021, but sold at the end of 2024 for tax loss purposes and re-bought back in 2025.

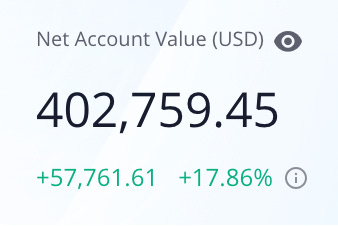

Complimentary Monthly Commentary - CMC

First of all I wanted to start with a bit of celebration (although a tiny one as anything could change) but for the first time ever Sept. is the first monthly update where we closed above 400,000!

and the big thank you goes out to….. no not me … BK Technologies BKTI 0.00%↑

BKTI is executing well on everything that company has promised so far and a big surprise was the significantly improved gross margins from 37.3% in Q2/24 to 47.4% in Q2/25! The orders are coming in for the new BKR 9000, everyone loves it and BKTI is working on BKR 9500 and RelayONE and working slowly but surely on InteropONE.

Since last update I have initiated 2 starting positions which I’m still trying to buy more of so discussion about those two are behind paywall.

What I will say is one is based out of Canada and the other is in South Korea, so although based on the chart of Portseido that I’m mostly (65%) invest in US based companies, I would say at about 30-40% of that 65% is either very niche US based or do business outside of US too.

Lastly, two weeks ago (August 25th) I was back to Omaha for Annual Meeting for BOC.

Alex Bossert has been doing a great job following BOC so I highly recommend, checking him out on X and reading what he has to post:

https://x.com/alexbossert/status/1960417697227006194

As for comments from me, I’m still holding my shares (even have been buying a bit lately) but there are a few key things I’m looking to happen with in the next 6-12 month and if those things do not happen, I would consider changing my stand on the company, until then “💎🙌”

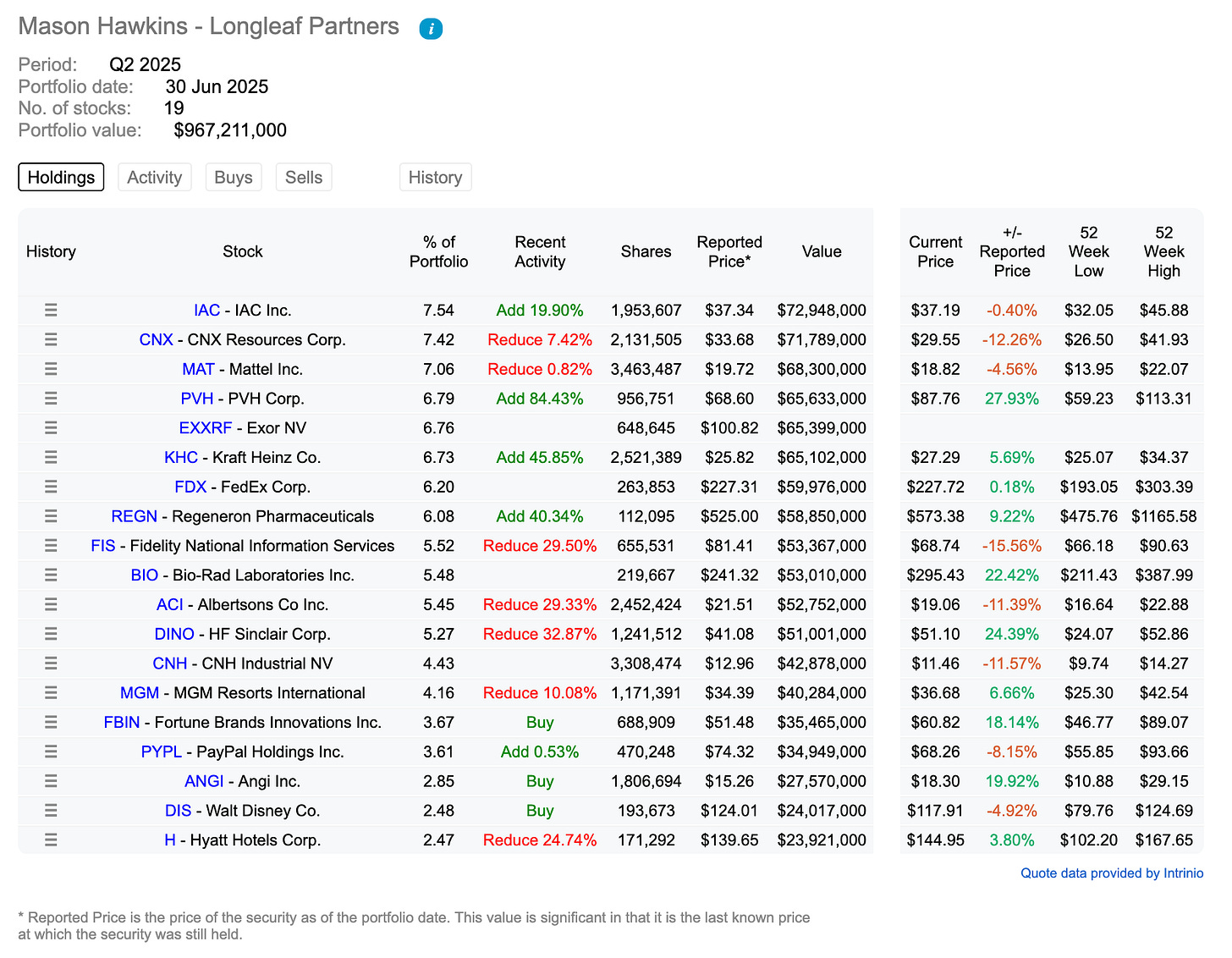

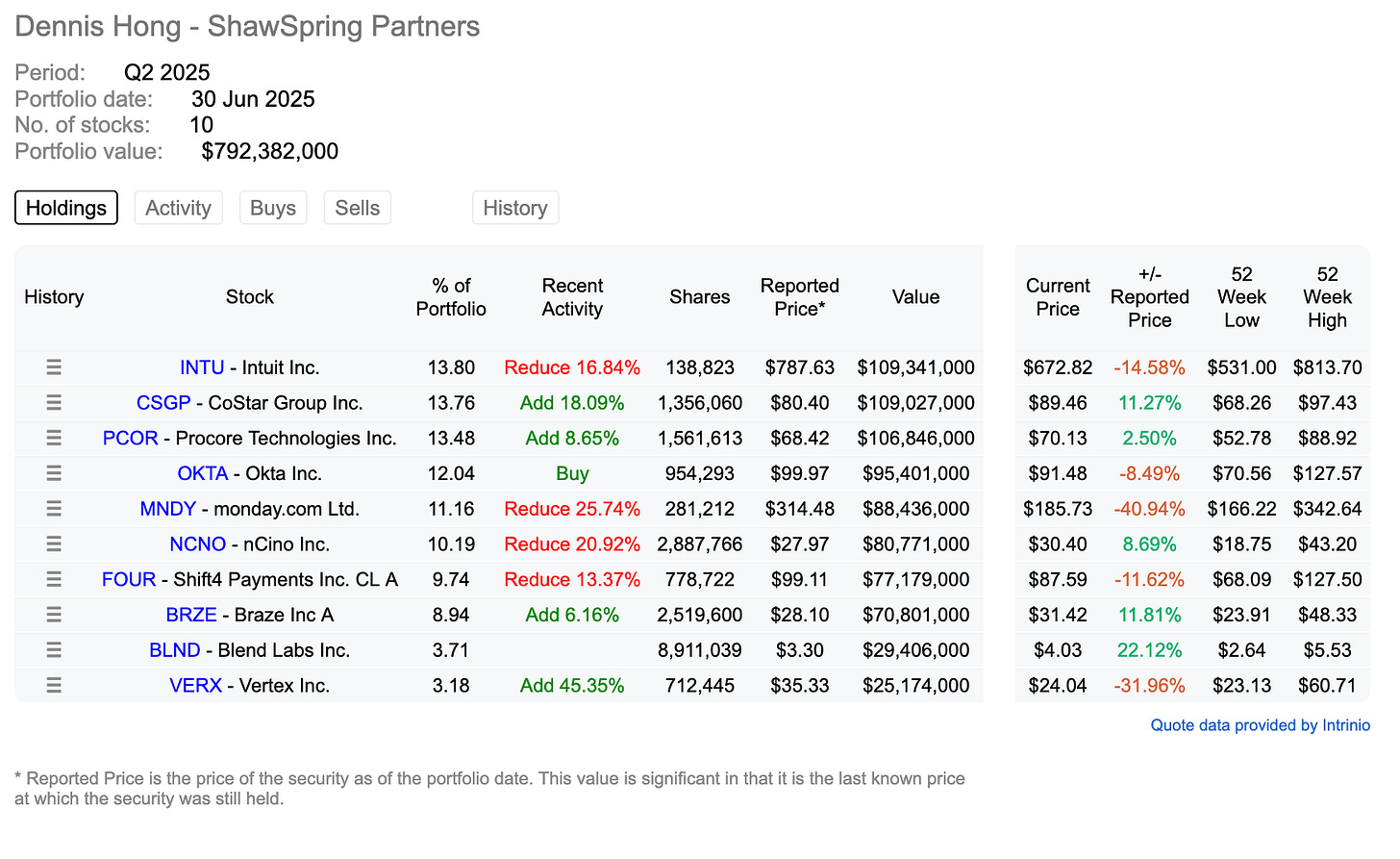

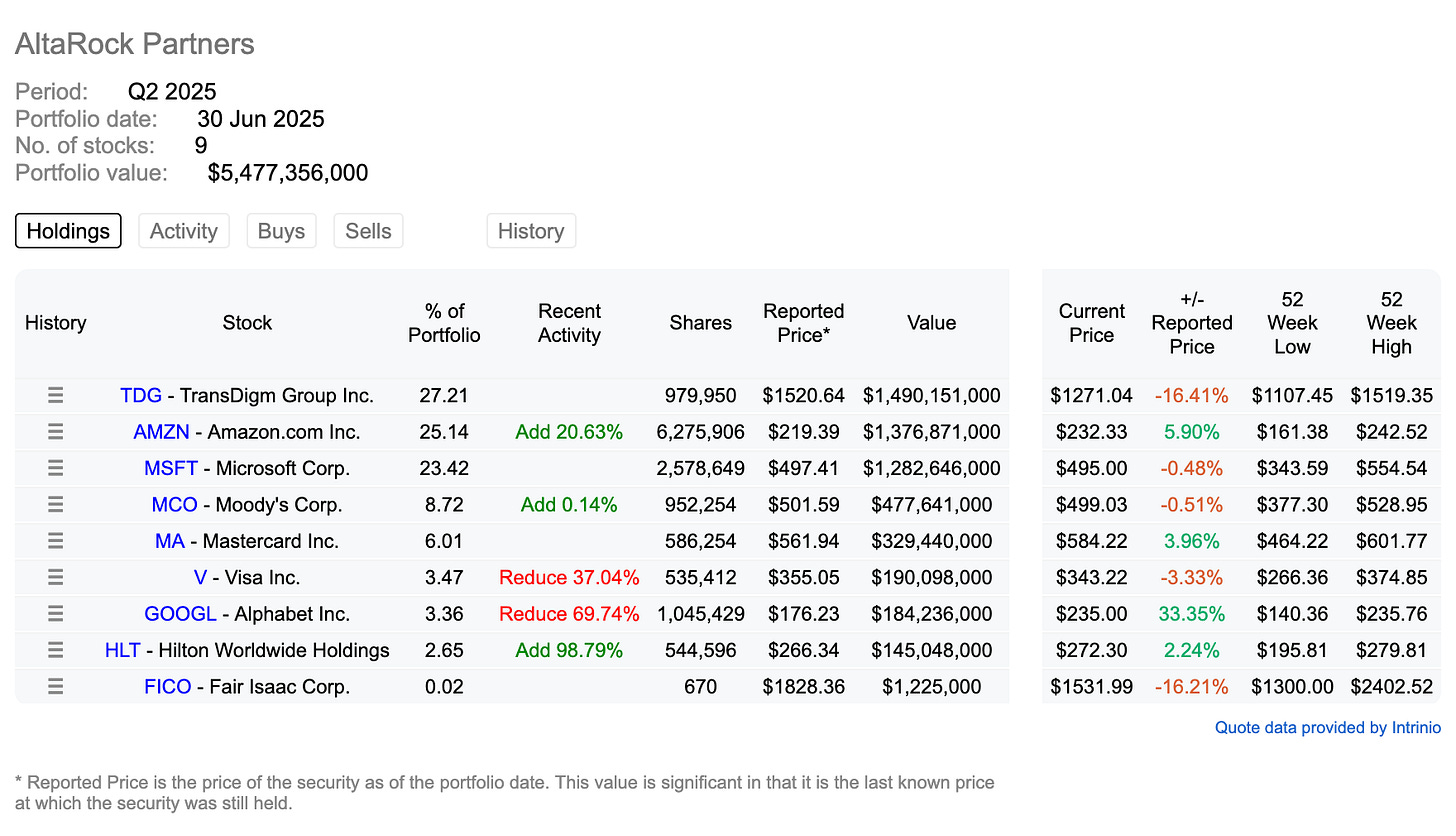

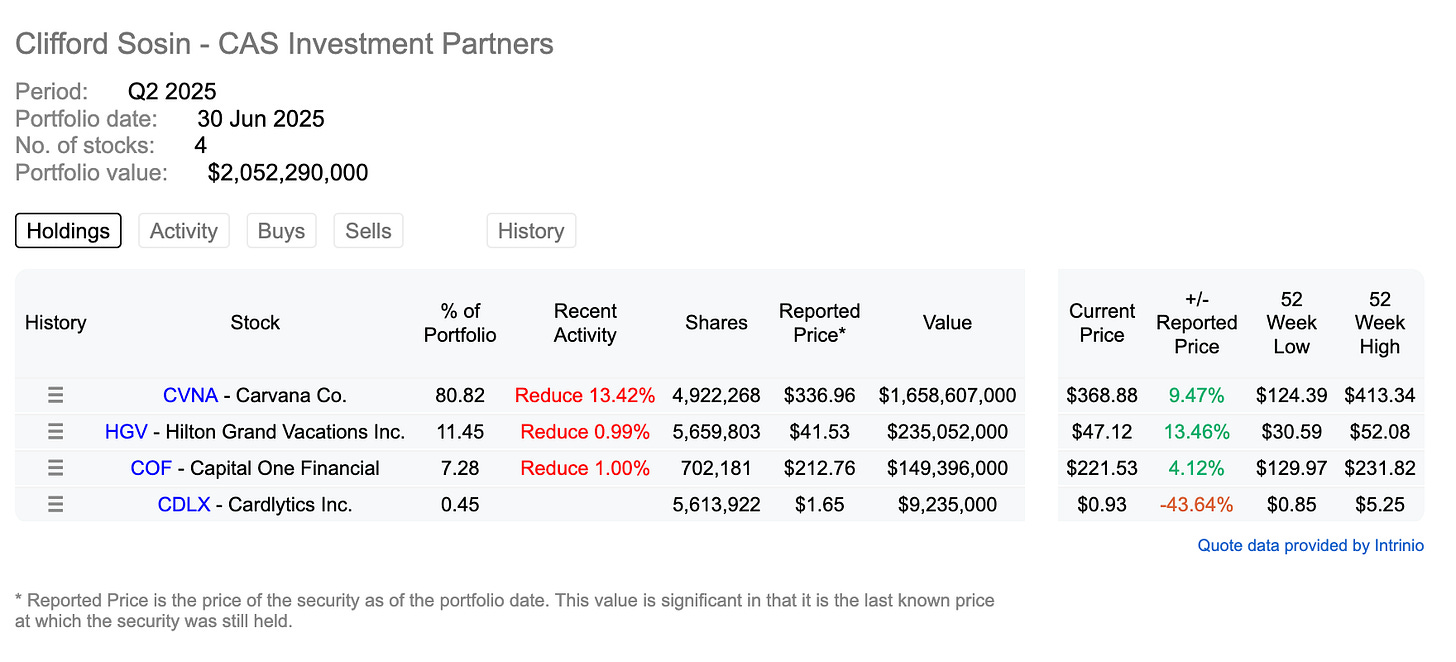

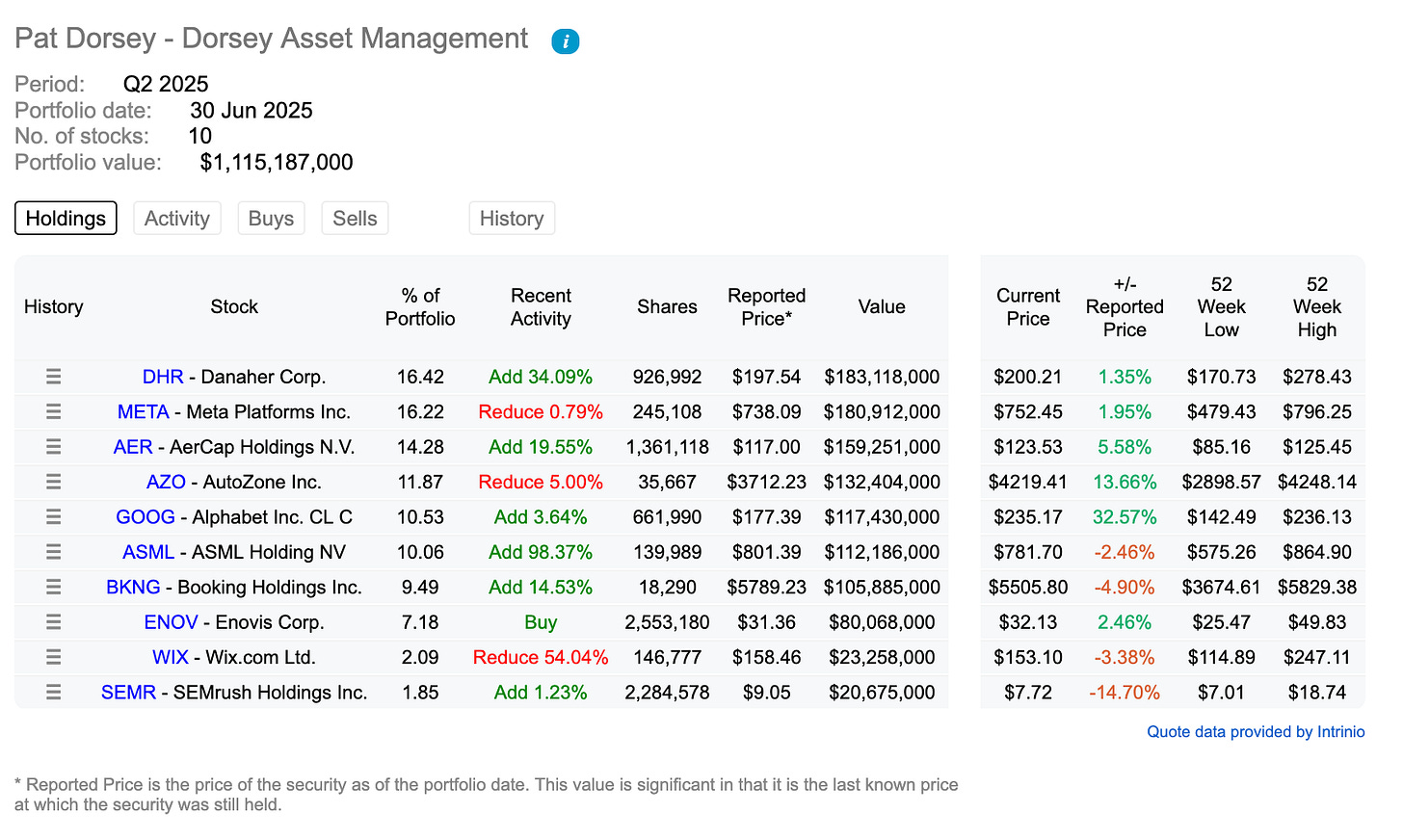

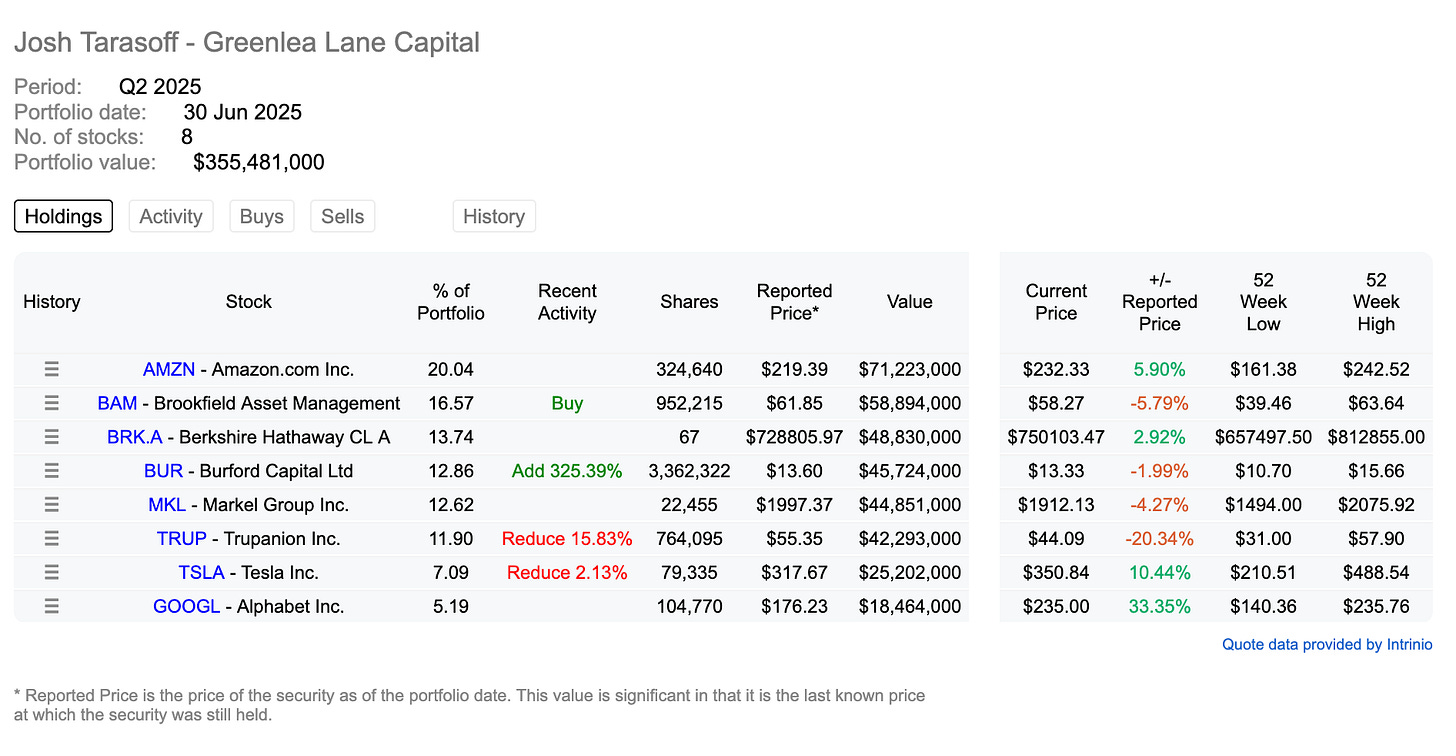

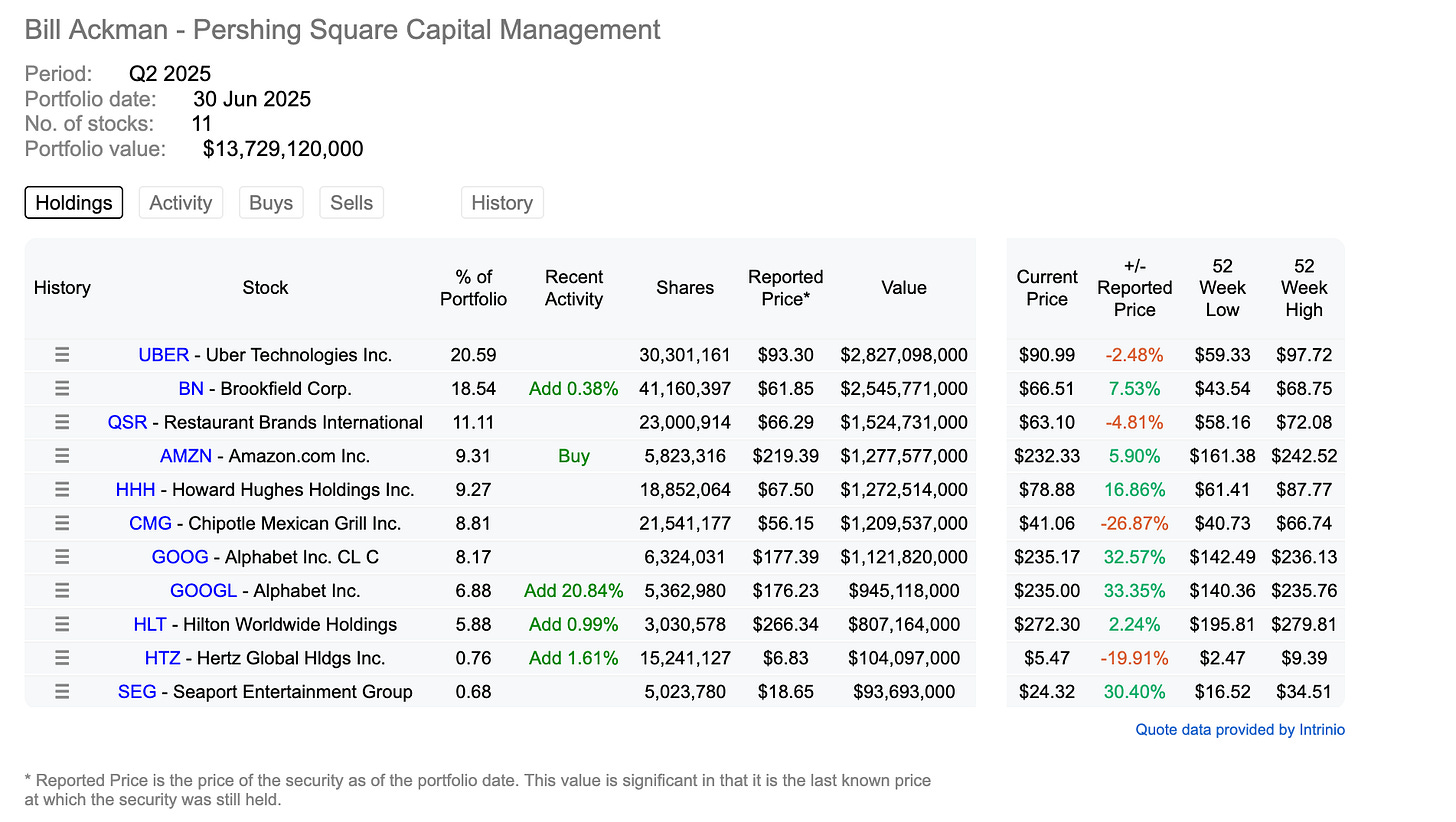

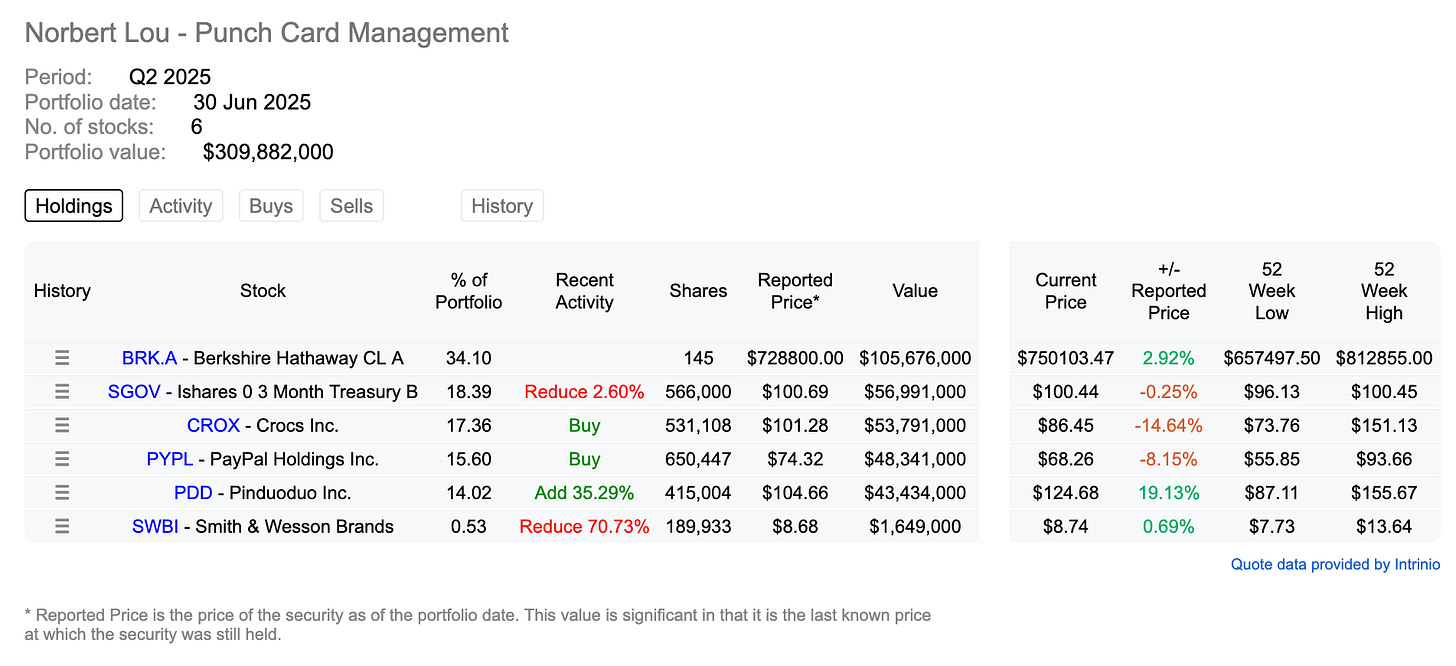

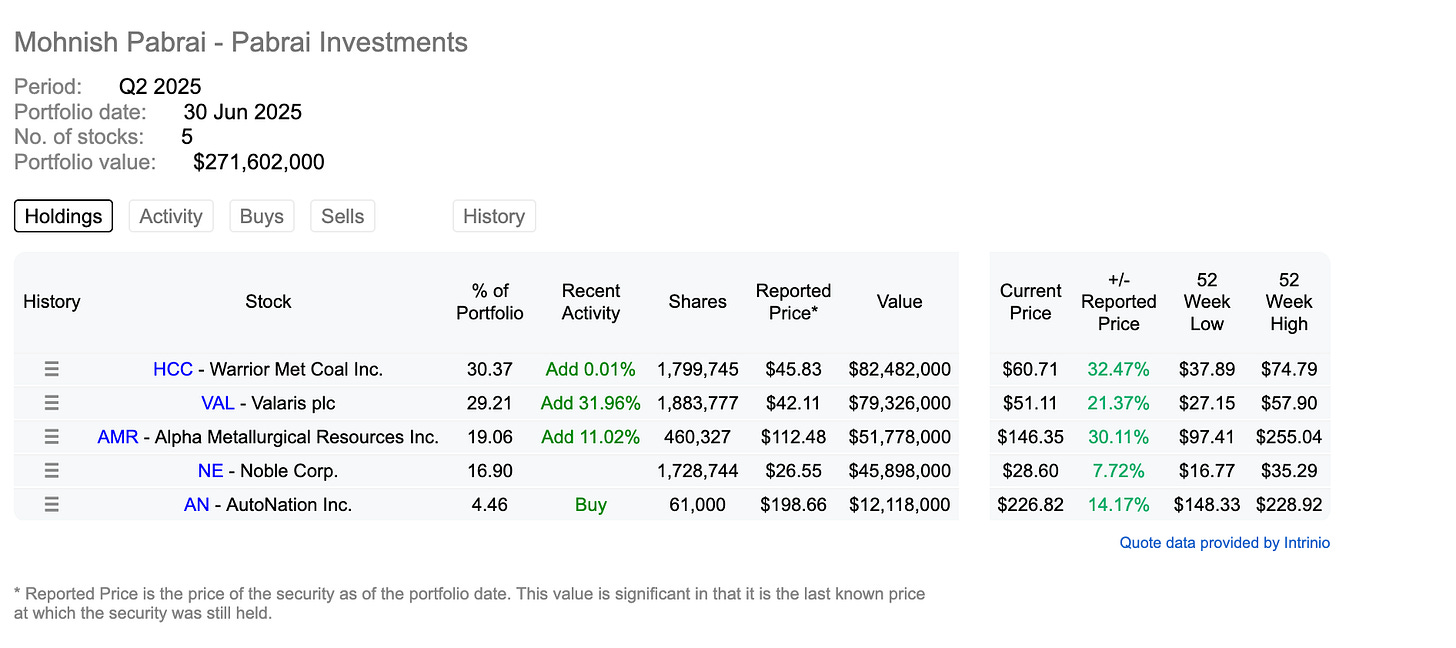

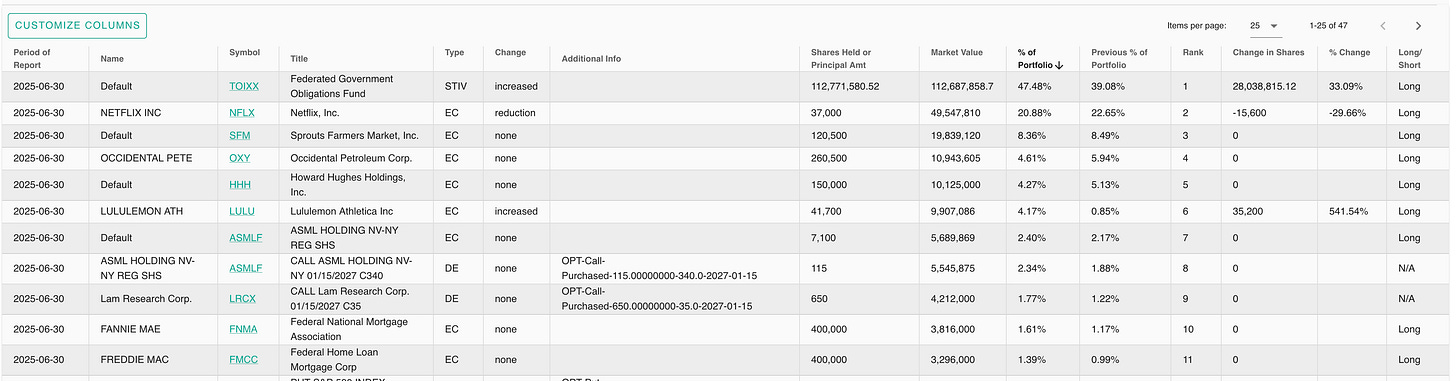

13Fs

The fund below called Longleaf Partners is a new fund that I saw on dataroma. Interestingly enough the reason it picked my curiosity is the almost 20% addition to IAC holding … its top position. They also own PYPL.

Returns since inception are lagging SPY (by about one percent) but I think maybe this fund is potential for idea generations as some of the names are very familiar to me so might be looking at it on quarterly basis.

Notable mentioned:

Lindsell Train - 10,000%+ increase in GOOGL 0.00%↑ & 8%+ increase in PYPL 0.00%↑

Valley Forge Capital Management - Nothing interesting this Q

Terry Smith - Fundsmith - Nothing interesting this Q

Prem Watsa - Fairfax Financial Holdings - Nothing interesting this Q

Francis Chou - Chou Associates - Nothing interesting this Q

Francois Rochon - Giverny Capital - Nothing interesting this Q

WWE On Netflix

Last month (or so) I finished watching documentary on Vincent McMahon and watched a few episodes of the new documentary on WWE…

The above trailers are for just that purpose to get snippets, if you are interested take a look at both of them available on Netflix.

The reason I decided to bring these up is that $WWE used to be publicly traded company and I used to own it before it became TKO 0.00%↑ when Endeavor bought them out and merge WWE with UFC.

First documentary gave me an interesting perspective on having to be a big fan of WWE (watching wresting, PPVs, playing video games WWE, playing wresting with friends) the documentary gave me a nostalgic flashbacks to being a kid while at the same time it was an interesting thought processes of 1) a kid and 2) of an investor and how two had such a different perspectives and “feelings” and reasons for having attachment to WWE and at some point they both intertwined and disconnected.

The first documentary also gave me a better understanding and some respect to Mr McMahon, I say some because as a businessperson he did a lot for wrestling and yet as a human … well I am not the one to judge, but I do have my thoughts … as a human and the one that’s worth billions sometimes life is not that easy … I will leave it at that..

Which brings me to the second documentary and the one that I would call Part 2 or the new beginning of WWE and how they are revealing things behind scenes almost in real time and well to be frank, I don’t like it… I didn’t like watching it as an old fan or an old investor … the one theme that I kept coming back in my head is …. why? like seriously why reveal all of these things? It’s like telling a 5 year old that Santa is not real or even better example (I think) come to the house in Santa costume, give a 5 y/o present and then take off custom and reveal that you are the friend of a family (or something a long those lines) … to me that’s just killing the magic …

To be honest I don’t know why I really wanted to share this with all of you as I no longer own shares of WWE/TKO and I’ll probably will not in the near future and I do not watch WWE and don’t play WWE video games … but I guess that little kid inside me just wanted to share the frustration with the future …

We want to keep the things that we love the same and have them never change, but in order to stay alive and hopefully succeed we must evolve and change… the only thing change is not always for the best …

"the only constant is change" - Heraclitus

Books

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

Suit Yourself: A Portfolio Strategy for Every Personality Type by Benjamin Tan

YZ:

I met (virtually) Ben back in the day when Commonstock was a thing and recently have reconnected with him via Substack. Ben has (recently) written a book and was kind enough to provide me with a copy to read. Also check out his Substack:

Suit Yourself provides a framework for self-awareness in investing, encouraging readers to understand their unique cognitive and emotional inclinations using the Enneagram. Until Ben has mentioned Enneagram, I have never heard of Enneagram, so it was interesting to read about something new especially when it comes to investing and behavior/psychology.

Basically Enneagram framework helps you figure out which out of 9 types are you while paring with another 2 types to help fight biases of the type that is closest to you. Its not an exact science but again one “framework” to better understand yourself and help you better understand yourself as investor.

Ben provides Enneagram (more serious) with pop culture (more relatable) to make it more fun to read and easier to be able to connect, a great balance I shall say.

I’m (like Ben) more of a type 5 which is Sherlock Holmes, get a copy of this book and find out which type are you, I think this book would be helpful to both seasoned and novice investors.

The better you know yourself the better you can navigate the market and the real world too!

I give it 4 out of 5 stars.

How the World Really Works: A Scientist's Guide to Our Past, Present and Future by Vaclav Smil

YZ:

How the World Really Works is one of those books that I would love to finish listening, but I will be honest its just a bit too dry and long for me (+ I been pounding this/similar topics for a bit now too), when listening to it I had the similar feeling as when I was trying to read / listen to Thinking, Fast and Slow by Daniel Kahneman … I just cant get to finish it … I will try to pick it up at some later point (maybe)

Goodreads:

We have never had so much information at our fingertips and yet most of us don't know how the world really works. This book explains seven of the most fundamental realities governing our survival and prosperity. From energy and food production, through our material world and its globalization, to risks, our environment and its future, How the World Really Works offers a much-needed reality check - because before we can tackle problems effectively, we must understand the facts.

In this ambitious and thought-provoking book we see, for example, that globalization isn't inevitable and that our societies have been steadily increasing their dependence on fossil fuels, making their complete and rapid elimination unlikely. Drawing on the latest science and tackling sources of misinformation head on - from Yuval Noah Harari to Noam Chomsky - ultimately Smil answers the most profound question of our age: are we irrevocably doomed or is a brighter utopia ahead?

no rating

Don’t forget to ❤️ this post. It helps a lot!

Sections below are for paid subscribers only…