December 2025 Portfolio Update

Quote, Portfolio, Complimentary Monthly Commentary, GOING LIVE, Earnings, Private Investments, Book and more ...

Quote for this month:

“Thinking is the hardest work there is, which is probably the reason why so few engage in it.” - Henry Ford

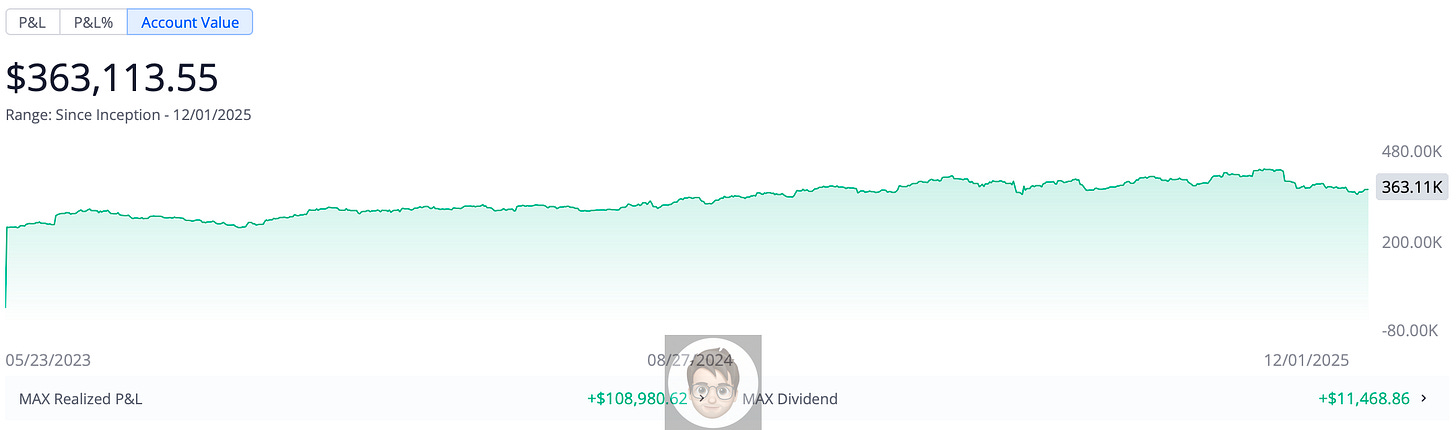

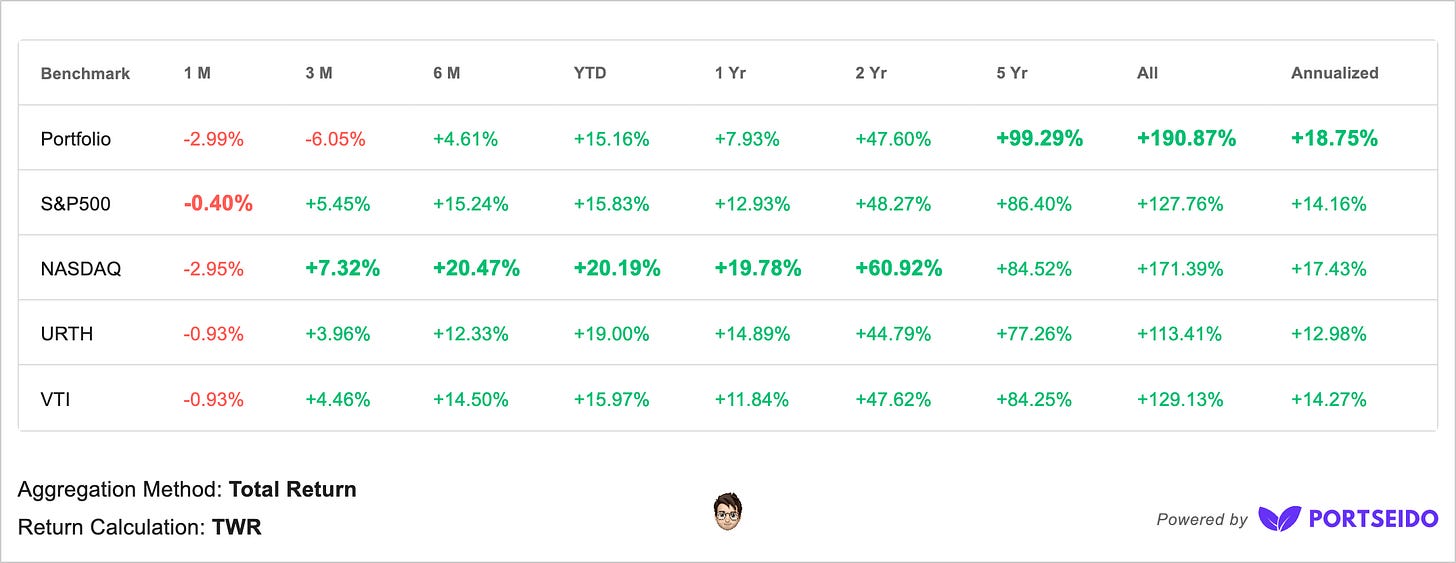

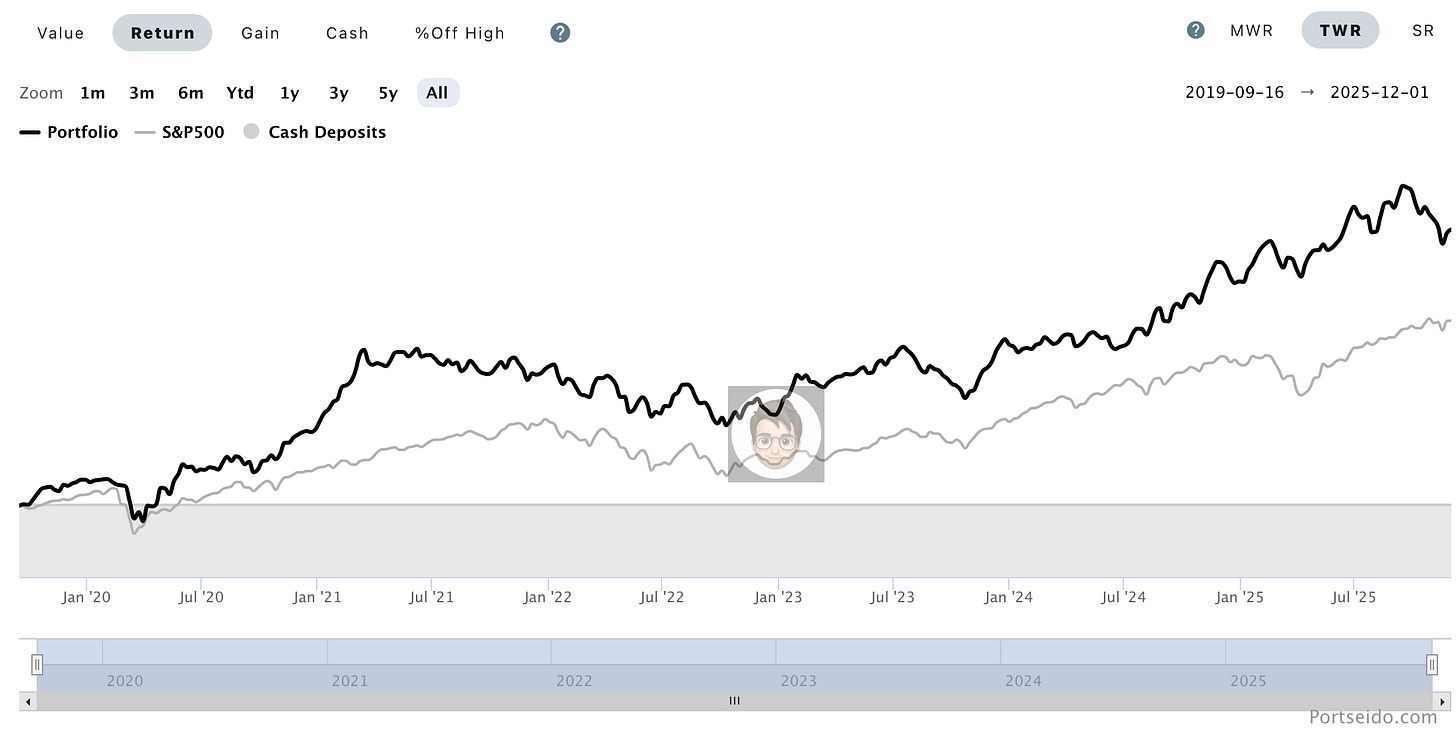

*Portfolio*

*I am NOT a financial advisor. I’m sharing my investing journey. Not investment advice. Do your own research.*

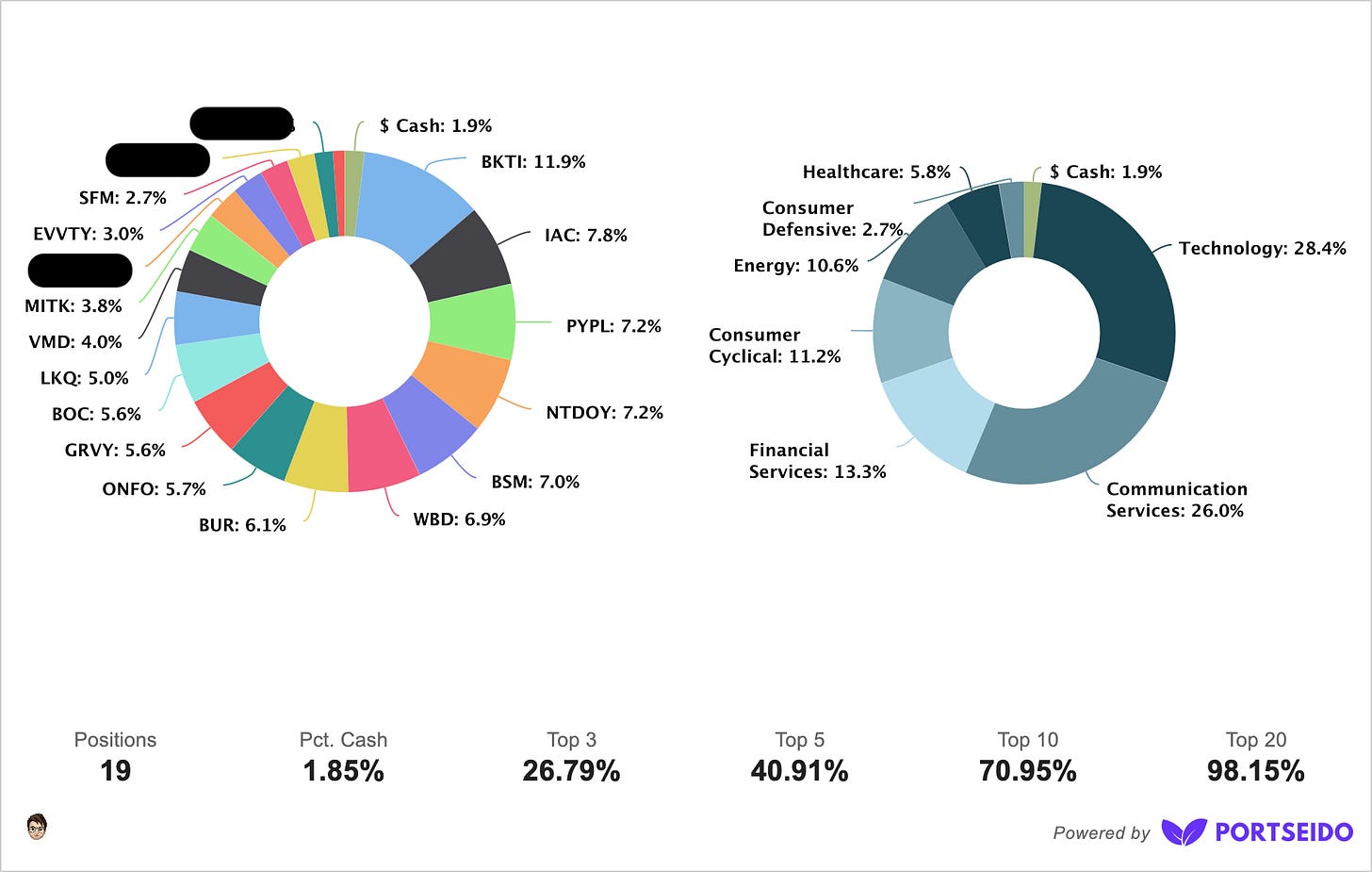

Portfolio (Basic):

Holding since:

2020 - LKQ 0.00%↑ - 03

2021 - SFM 0.00%↑ - 03 | VMD 0.00%↑ - 05 |

2022 - MITK 0.00%↑ - 01 | WBD 0.00%↑ - 04 | $NTDOY - 12

2023 - PYPL 0.00%↑ - 01 | BSM 0.00%↑ - 05 | BUR 0.00%↑ - 09

2024 - ($M??) - 01 | BKTI 0.00%↑ - 04 | BOC 0.00%↑ - 09

2025 - IAC 0.00%↑ - 01* | $GRVY - 08 | $C??? - 08 | $C?? - 10 | $ONFO - 10 | EVVTY - 11|

*IAC originally was purchased in 2021, but sold at the end of 2024 for tax loss purposes and re-bought back in 2025.

*EVVTY originally was purchased in 2022, but sold at the end of 2025 for tax loss purposes and re-bought back in 2025.

Complimentary Monthly Commentary - CMC

We are moving into (are already there?) in holiday season, with a bunch of holidays and schools having winter break means that I will be spending more time with family and probably a bit less time on investing (that’s probably not true lol I live and breath investing) but I think these two last weeks we all deserve a little break. I think 2026 will have a lot of developments if nothing else just the fact that I will be doing a lot of re shuffling within this and the next month or so but you will of course hear about all of it in the following monthly updates!

I hope everyone have great rest of the year and I wish everyone Happy Holidays!

ONFOLIO the new chapter

Just a month ago a revealed that I have established position in ONFO 0.00%↑ and since then there have been big changes and I think 2026 will be an interesting year for ONFOLIO

Onfolio is shifting to a hybrid model that pairs operating cash flow with a diversified digital asset treasury which basically means they are still looking to acquire profitable businesses but also (now) buying $BTC $ETH and $SOL.

I have my thoughts on it and I would rather not go too much in it yet, and I would rather let time show how things will develop, but if you want my option you can always DM me or I’m more willing to share things behind a wall. I don’t have any original thoughts but I usually think in a bit “weird” and not “standard way” and I would rather not have to explain my self (or become pray to trolls) to every single person, if y’all know what I mean.

I would suggest reading these two articles:

Again you can always DM me (my DMs are open) or even better if you have questions regarding ONFOLIO you can ask Dom Wells. Find him on LinkedIn or use contact page on https://onfolio.com/contact/

GRAVITY

I did collab write-up with AppInvestor on GRVY 0.00%↑ check it out below:

Buying back EVOLUTION

As I mentioned in last monthly update, this month I already started buying back shares in $EVVTY

There are also a few other changes that are coming in tomorrow or sometime this week that I will discuss in more details in paid section

GOING LIVE

On December 19th (Friday) at 11:00am (EST) I will be going live with another (much smarter) investor and a friend Alejandro Yela from The Hermit.

I will be doing “schedule” tomorrow and everyone will receive an email notification when live will be starting, this will be the first time I will be doing something 1) live and 2) showing my self on camera … Just for the live session … will see how that goes…

It would be awesome to hopefully “see” someone of you at live session and we could interact … if you can’t but want to ask question, you can DM me or reply to this email.

See y’all on December 19th!

Earnings

Private Investments

I put a few five figures capital into companies that I’m already invested in. These three are making some good moves and I thought I would share more about them:

Ivee

I first learned about Ivee when invested in it via Republic and then I look cab (couple of times) from one of the airports in NY and they kept coming up, so that’s when I decided to get in touch with founders … and good thing I did …

Learn more about Ivee via their website : https://www.goivee.com/ or if you would like you can DM me with questions or I can try and get you in touch with the team…

RAD Intel

I been following RAD Intel for a few years and had a chat with CEO and Jeremy and his team (seems to me) are on to something. Very interesting company and they are moving fast…

Some of their clients are - Hasbro, MGM, Sketchers, and many many more big names!

Learn more about RAD Intel via their website : https://www.radintel.ai/ or if you would like you can DM me with questions or I can try and get you in touch with the team…

UpShift

Similar theme as with the other two, I been following UpShift for sometime and I think Ezra and the team is doing something different (in a good way) from many other start ups specially with the whole AI / self driving vehicles hype…

Learn more about UpShift via their website : https://www.upshiftcars.com/ or if you would like you can DM me with questions or I can try and get you in touch with the team…

Books

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished one audiobooks:

Merger Masters: Tales of Arbitrage by Kate Welling and Mario Gabelli

YZ:

Merger Masters was an interesting book / case studies on different famous investors and how they did their M&A. No one thing really stood out (because really each of them had their own spin on the idea of M&A) and it was a breezy listen while on long drives but what did stood out is the fact there is many ways of doing M&A and in fact you must have some kind of advantage (be it time or knowing how to execute options) or knowledge (or thinking in probabilities better say) that others might not posses or willing to dig into work but also be humble enough to know that sometimes things just don’t work out the way you want them to work out because of politics, human factor, etc.

Goodreads:

Merger Masters presents revealing profiles of monumentally successful merger investors based on exclusive interviews with some of the greatest minds to practice the art of arbitrage. Michael Price, John Paulson, Paul Singer, and others offer practical perspectives on how their backgrounds in the risk-conscious world of merger arbitrage helped them make their biggest deals. They share their insights on the discipline that underlies their fortunes, whether they practice the “plain vanilla” strategy of announced deals, the aggressive strategy of activist investment, or any strategy in between on the risk spectrum.

Merger Masters delves into the human side of risk arbitrage, exploring how top practitioners deal with the behavioral aspects of generating consistent profits from risk arbitrage. The book also includes perspectives from the other side of the mergers and acquisitions divide in the form of interviews with a trio of iconic CEOs: Bill Stiritz, Peter McCausland, and Paul Montrone. All three took advantage of M&A opportunities to help build long-term returns but often found themselves at odds with the short-term focus of Wall Street and merger investors. Told in lively, accessible prose, with bonus facts and figures for transaction junkies, Merger Masters is an incomparable set of stories with plenty of unfiltered lessons from the best managers of our time.

I give it 4 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

Sections below are for paid subscribers only…