January 2023 Portfolio Update

Topics: Quote, Portfolio Update & Discussion, 2022Y Review, Tasks Ninja, My Current VC Investments, Book, and a new section for paid subscribers that includes a few more additional topics...

Before we begin, I would like to remind everyone that starting with this post there is a little bit of change in the structure of monthly portfolio updates.

I have decided to add additional section for “paid subscribers only” where I will go in greater details about my public equities portfolios (taxable and IRA), any private deals and venture capital deals, and time to time other more personal stuff about me or investing (things that I don’t want search engine to pick up) … so does this mean you have to become paid subscriber? Short answer is no, but if you have enjoyed what I have been doing for the past 2+ years I think you will enjoy/benefit from becoming a paid subscriber.

Quote for this month:

“Life can only be understood backwards; but it must be lived forwards.” - Søren Kierkegaard

Portfolio Update*

*I am NOT a financial advisor, I’m sharing my investing journey. Do your own research.*

Portfolio (Basic):

To get access to full portfolio keep reading on, I have moved it lower…

Portfolio Discussion

One major point of update is that I have sold out of PayPal at the end of last year for tax purposes. I had a substantial profit that I did not see a point to pay taxes on and so I sold PayPal for a loss to (almost) negate the profit with idea that I will buy back PYPL 0.00%↑ around the end of January before the earnings.

I used some of the proceeds to buy some Spotfiy, IAC, Mitek, additionally I added to Oppfi and Pref. shares of OZK.

Dividends for December:

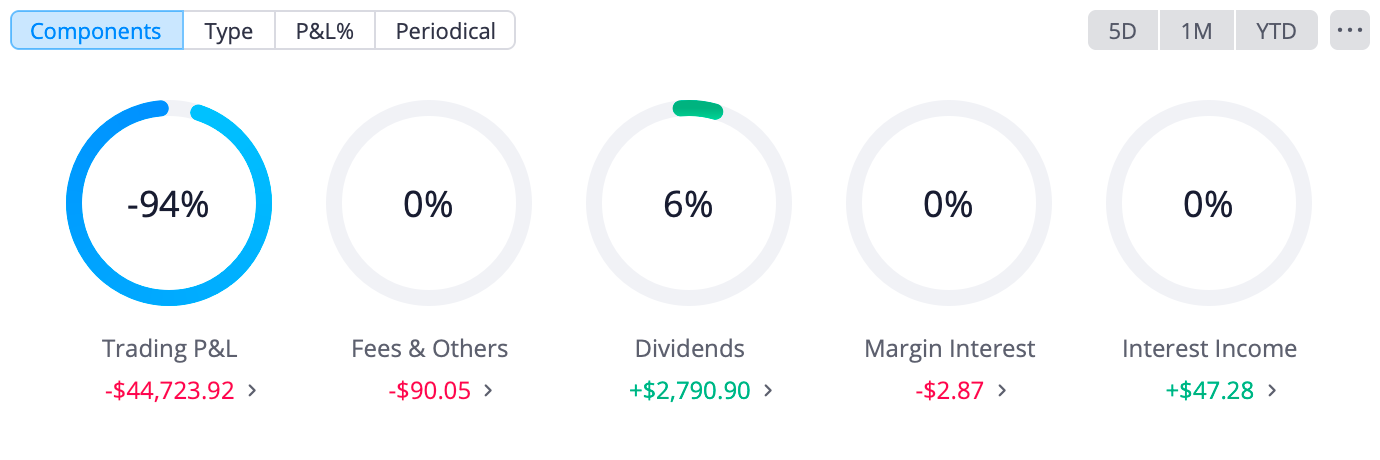

2022Y Review

For the 2022Y Review I would like to go over a few things:

Show some stats

My best investment(s)

My worst investment(s)

I finished 2022Y with -16.88% while S&P500 with -19.44% (while in 2021 +20.35% vs +26.89, in 2020 +13.56% vs +16.26% and in 2019 September +20.31% vs +7.77%) all of these are comparisons that Webull provided me within the app.

When it comes to my best (closed) trades of 2022Y:

I probably have to go with Meta, because I sold it at $325 (Average price was about $280) with my belief/thoughts that Meta is not my kind of company due to how it handles information of its users AND addiction/negativity of social networks that it owns.

When it comes to my worse trade of 2022Y:

I probably have to go with PayPal and WarnerBro Discovery.

PayPal because there was no reason for me to buy into it at all until about sub $85 and yet I got carried away with Twitter was saying and Investor Day with their SuperApp. Although I sold out of PayPal, I am planning to buy it back although maybe not at as large of a size (we will see).

As for WBD, I still like it but I should of waited before the “dust has settled” with all of the unknowns and me not being knowledgeable about mergers. I still like the company and believe that IP is good and overtime management should be able to figure it out (or some bigger fish will buy it out) but there was no reason to buy it ASAP and again I got greedy and inpatient.

The big drag on performance are IAC, Spotify, and PayPal. Ex PayPal I still very much bullish on IAC and Spotify (both about -50%) and think both will just need more time to play out. Give it a bit more time and I will again start buying more of both which will bring down cost basis.

As I said before and I will say again, I truly believe market gives you at least two times to buy something and sell something so if you miss the first one, you just need to be patient and wait…and in the rare cases that there is no second chance overall, you will be much more successful when you are patient and wait for the company to come to you rather then rush after without fully thinking it through.

Comments From Me

I’m realizing that it might take me sometime to get used to the new schedule that I’m creating for myself (to find more time for investing/substack posting) so I would like to just say bare with me as I reschedule my schedule and carve out more time for committed writing/substack time.

With that said I will probably not be as “involved” in things for Jan/Feb(ish) as I would like to finish reading all of the books that I got as presents for the holidays.

I got actual physical copies which means I actually need to stay in one place and read them, crazy! (for someone who is usually obsessed with audiobooks).

Two more books on the way, titles to be announced as I do not know them (they are also surprise gifts).

Tasks Ninja

Tasks Ninja is the project that I’m involved in as investor.

Currently team went into beta with https://tasks.ninja/

If you are a product manager or if you are part of remote / large team, I highly recommend checking it out and trying it.

There is 14 days free trial and no credit card is needed.

If you would like to invest or have more questions regarding Tasks Ninja as product, I can connect you with CEO for more details/information.

My Current VC Investments

Which brings me to my other already closed VC or Private Deals (whatever you want to call them):

Some you may know, some you may not…

Books

Only had time to finish one audiobook last month which:

Where Good Ideas Come From: The Natural History of Innovation by Steven Johnson

This one was a bit different from what I’m used to “Where Good Ideas Come From” describes how the process of innovation is similar to evolution and why good ideas have to be shaped over time, build on existing platforms, require connections, luck, and error and how you can turn something old into something new. (taken from here)

Book was a bit (for my taste) generic and not “too useful”, the one thing I got from it is that all ideas should be OPEN and SHARED with everyone for the maximum benefit, especially when that benefit might not be directly related to you.

I give it 3 out of 5 stars.

Don’t forget to ❤️ this post

Full Portfolio Update

I would like to point out that there is a new column that I have added in the full portfolio update for paid subscribers and that is Avg Price, so now you will be able to know exactly what are my cost basis for all of the stocks/companies that I own.