June 2023 Portfolio Update

Topics: Quote, Portfolio Update & Discussion, Comments from Me, Trip to Omaha (Public Info), VC investments, Books, Trip to Omaha (Private Info), Lots of Stock Ideas, and much more...

Quote for this month:

“The actual risk of a particular investment cannot be determined from historical data. It depends on the price paid.” —Seth Klarman

Before I begin, a two quick note,

My Portfolio officially closed above $250,000 !!!

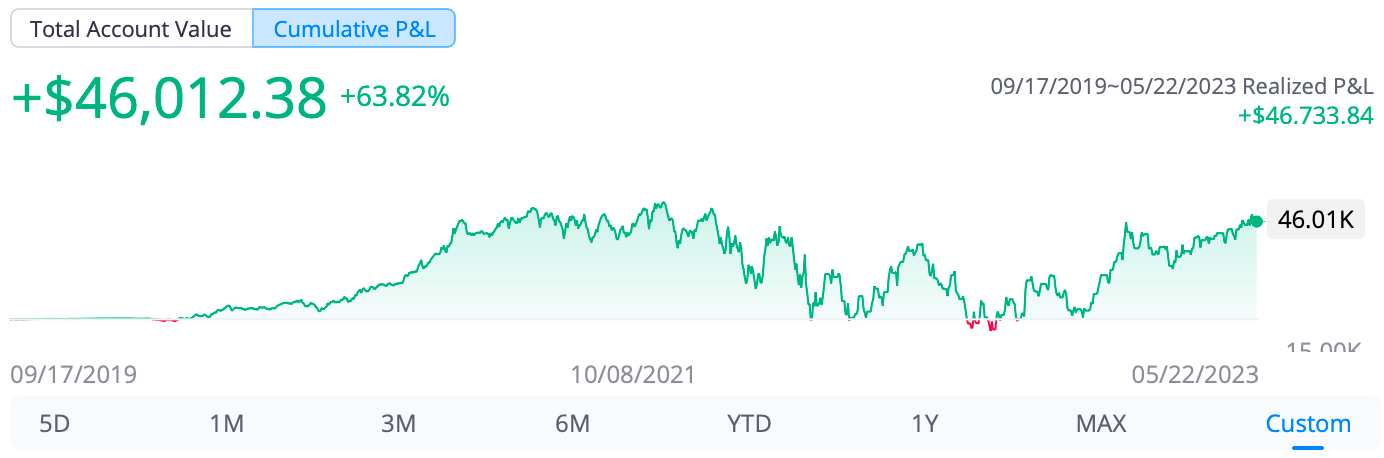

I have moved my account from margin to cash (with in Webull, because in cash account I can earn APY which is currently is 5%), but by moving my account from margin account to cash account, Webull tells me they can not “transfer or reset” the P&L on the new cash account so it looks all weird and incorrect. I’m trying to figure how to fix it moving forward but for this time I included screen shots from both old margin account and new cash account to provide (to my best ability) full transparency.

Latest update, I’m currently trying to transfer all of the trading data to Portseido (they do not support options, not good) and at the same time waiting for the team at Snowball to get back to me, I’m very frustrated but I hope by next portfolio update I will have everything figured out…

Portfolio Update*

*I am NOT a financial advisor, I’m sharing my investing journey. Do your own research.*

Portfolio (Basic):

To get access to detailed (full) portfolio breakdown + some other things

(which will be at the end) consider becoming a paid subscriber:

Portfolio Discussion

As I mentioned before I have transitioned from Margin account to Cash account which means now my unused cash in generating me 5% APY, the only thing that I learned is it has to be UNUSED meaning if I do put options Webull automatically “puts that cash” on the sides as collateral, which means in order for me to do put options (moving forward) they will need to generate more “cash” then the cash that is generating me 5% APY (everyday)

Moving on to the actual stocks…

Seems like since last time the “bank crisis” is over? Or at least for now. OZK held up well and did not go down below my buy in price to “load up”

I sold out of OZKAP 0.00%↑ (for profit) and have started new position in Black Stone Minerals L.P. while also starting a small position in United-Guardian,.

I highly recommend reading everything that Invariant has on UG 0.00%↑

BSM 0.00%↑ is a royalty play on minerals + 11% dividend, no debt, insiders own about 16% of shares and are / were buying around current prices or higher

… I might do my next write up on it…

UG 0.00%↑ is a very small market cap company, currently paying around 7% dividend, high ROIC-ROE-ROA, with positive change in management, founder on board owns large amount of shares + no debt.

IAC has increased it’s position in Turo and I have increased my position in IAC 0.00%↑ read more about Turo from Contrary Research, click here.

Increased stake in TCS 0.00%↑ OPFI 0.00%↑ WBD 0.00%↑ PYPL 0.00%↑

Decreased stake in SPOT 0.00%↑ and exited GOOG 0.00%↑ (for profit)

Dividends for May:

Comments From Me

Just a quick comments from me, I really enjoyed my trip to Omaha and all the new people I have met. Big thank you to Tilman to setting up the AirBnB and all of the meet ups.

Check out Good Investing Community and mention my name to Tilman.

I really hope to be able to make it to Omaha next year (and hopefully years to come).

Based of the last months poll, I’m very please to see (although the poll was only of 19 votes) that 68% of you said you enjoy monthly updates!

I wanted to do another two polls and ask two questions:

The reason for asking these are (first of all I was inspired by ValueStockGeek), I feel like I could provide more knowledge (or at least my thoughts/opinions) on a lot more different topics be it about me, life, philosophy, investing, etc. but sometimes in a rush of writing monthly portfolio updates, I forget to add a segment or I’m not sure if (you) my readers would be interested in me talk about “this or that”

With monthly AMA this would give another/different opportunity for me to share more from me, this of course assuming that people would actually care/want that!

If there is actually demand for that please don’t be shy and email me at from100kto1m@substack.com or via Twitter Direct Messages.

All questions will be anonymous and no topic of limit as long as (I believe) I can provide good/satisfying answer.

PS sorry the monthly update is coming out a bit “late” but with my frustration with Webull and my birthday (June 15 :D ) and birthdays of my girls which are also not too far from mine, I have been busy with life…

Trip to Omaha (Public Share)

I must say (overall) I had a blast in Omaha, to be away from my “norm” and to chat with like minded people from all over the world was great!

Some Highlights from the trip:

David Park did highlights of Guy Spier’s ValueXBRK via Twitter Thread

New Additions to VC Portfolio

Books

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished three audiobook:

The Myth of Capitalism: Monopolies and the Death of Competition by Jonathan Tepper

YZ:

I was about quarter (ish?) way thorough the book, I wanted to return it. The bashing of capitalism and the likes of Warren Buffett was a bit too much for my taste, BUT I decided to give it a try and not be closed minded… After finishing it, I can confirm I’m pro-capitalism and 89.99% of things that have been said I do not agree, BUT there were some thought provoking ideas, yet they were so generic and in my opinion not really applicable to the real word + in reality the capitalist (and competition) we have right now is the best thing that we can do given what other alternatives are out there (communism, socialism, dictatorship, etc.) … I’m all pro finding something that will work better for society then capitalist but I can also say it gives the best chance to those who really want to try (yes I understand not everyone given same hand, but life is hard and messy and its not perfect but I’m a believer that the harder you work the luckier you get)

In conclusion after listening to this book I just realized (confirmed?) that monopolies are the best companies you can invest in as investor, simple as that.

Goodreads:

The Myth of Capitalism tells the story of how America has gone from an open, competitive marketplace to an economy where a few very powerful companies dominate key industries that affect our daily lives. Digital monopolies like Google, Facebook and Amazon act as gatekeepers to the digital world. Amazon is capturing almost all online shopping dollars. We have the illusion of choice, but for most critical decisions, we have only one or two companies, when it comes to high speed Internet, health insurance, medical care, mortgage title insurance, social networks, Internet searches, or even consumer goods like toothpaste. Every day, the average American transfers a little of their pay check to monopolists and oligopolists. The solution is vigorous anti-trust enforcement to return America to a period where competition created higher economic growth, more jobs, higher wages and a level playing field for all. The Myth of Capitalism is the story of industrial concentration, but it matters to everyone, because the stakes could not be higher. It tackles the big questions of: why is the US becoming a more unequal society, why is economic growth anemic despite trillions of dollars of federal debt and money printing, why the number of start-ups has declined, and why are workers losing out.

I give it 3 out of 5 stars.

The Spider Network: How a Math Genius and a Gang of Scheming Bankers Pulled Off One of the Greatest Scams in History by David Enrich

YZ:

The Spider Network is a great edition to another book like Flash Crash from April monthly read, and shows that a lot of times no one really knows what is going on (be it in finance world or “regular” day to day world) and a lot of times everyone is for him/her self.

Sucks how things turned out for some folks in the book (trying to not spoil it)

If you work in fiance world… be careful out there… and try to build good character + good moral compass, please.

Goodreads:

In 2006, an oddball group of bankers, traders and brokers from some of the largest financial institutions made a startling realization: Libor—the London interbank offered rate, which determines the interest rates on trillions in loans worldwide—was set daily by a small group of easily manipulated administrators, and that they could reap huge profits by nudging it fractions of a percent to suit their trading portfolios. Tom Hayes, a brilliant but troubled mathematician, became the lynchpin of a wild alliance that included a prickly French trader nicknamed “Gollum”; the broker “Abbo,” who liked to publicly strip naked when drinking; a nervous Kazakh chicken farmer known as “Derka Derka”; a broker known as “Village” (short for “Village Idiot”) who racked up huge expense account bills; an executive called “Clumpy” because of his patchwork hair loss; and a broker uncreatively nicknamed “Big Nose” who had once been a semi-professional boxer. This group generated incredible riches —until it all unraveled in spectacularly vicious, backstabbing fashion.

With exclusive access to key characters and evidence, The Spider Network is not only a rollicking account of the scam, but also a provocative examination of a financial system that was crooked throughout.

I give it 4 out of 5 stars.

You Can Be a Stock Market Genius by Joel Greenblatt

YZ:

I feel like I have listened to “You can be a stock market genius” before and yet when I was listening to the book, it was eye opening to me.

My guess is most know about this book, but if you do not… drop everything else you are reading / listening to and start with this one.

I will be add it to my must suggest books to newbies even if it was written in 1997, my favorite part is on Arbitrage and Mergers which I still know less then 1% but I can see how there is still can be alpha generated since you have to actually put it work to make it work and by work I mean read such things as 10Ks and most importantly Proxy Statements.

Goodreads:

A comprehensive and practical guide to the stock market from a successful fund manager—filled with case studies, important background information, and all the tools you’ll need to become a stock market genius.

Fund manager Joel Greenblatt has been beating the Dow (with returns of 50 percent a year) for more than a decade. And now, in this highly accessible guide, he’s going to show you how to do it, too. You’re about to discover investment opportunities that portfolio managers, business-school professors, and top investment experts regularly miss—uncharted areas where the individual investor has a huge advantage over the Wall Street wizards. Here is your personal treasure map to special situations in which big profits are possible,

-Spin-offs

-Restructurings

-Merger Securities

-Rights Offerings

-Recapitalizations

-Bankruptcies

-Risk Arbitrage

Prepared with the tools from this guide, it won’t be long until you’re a stock market genius!

I give it 4 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

IAC 0.00%↑ SFM 0.00%↑ LKQ 0.00%↑ SPOT 0.00%↑ VMD 0.00%↑ OZK 0.00%↑ WBD 0.00%↑ TCS 0.00%↑ PYPL 0.00%↑ MITK 0.00%↑ BSM 0.00%↑ OMAB 0.00%↑ OPFI 0.00%↑ UG 0.00%↑ C 0.00%↑ VEA 0.00%↑ VTI 0.00%↑ OPBK 0.00%↑ URI 0.00%↑ MKL 0.00%↑ LH 0.00%↑ RICK 0.00%↑ DJCO 0.00%↑ BAM 0.00%↑ GDOT 0.00%↑ DLTR 0.00%↑ ONFO 0.00%↑ BOC 0.00%↑ PBR 0.00%↑ OXY 0.00%↑ CDLX 0.00%↑ RBLX 0.00%↑ SGA 0.00%↑ DBX 0.00%↑ ONON 0.00%↑ ASO 0.00%↑ MASI 0.00%↑ BUR 0.00%↑ KRE 0.00%↑ CVS 0.00%↑ NNI 0.00%↑ UHAL 0.00%↑ IDT 0.00%↑ FLWS 0.00%↑ PAR 0.00%↑ SSSS 0.00%↑ CPRT 0.00%↑ DEO 0.00%↑ LWAY 0.00%↑ TROW 0.00%↑ IBKR 0.00%↑ BABA 0.00%↑ EDR 0.00%↑ WWE 0.00%↑

Section below is for paid subscribers only…