January 2024 Portfolio Update

Topics: Quote, Comments From Me, Portfolio & Discussion, 2023Y Review Investing +, Latticework Note 2023 + Section for Paid subscribers.

Quote for this month:

"The happiness of those who want to be popular depends on others; the happiness of those who seek pleasure fluctuates with moods outside their control; but the happiness of the wise grows out of their own free acts." - Marcus Aurelius

Portfolio Update*

*I am NOT a financial advisor, I’m sharing my investing journey. Do your own research.*

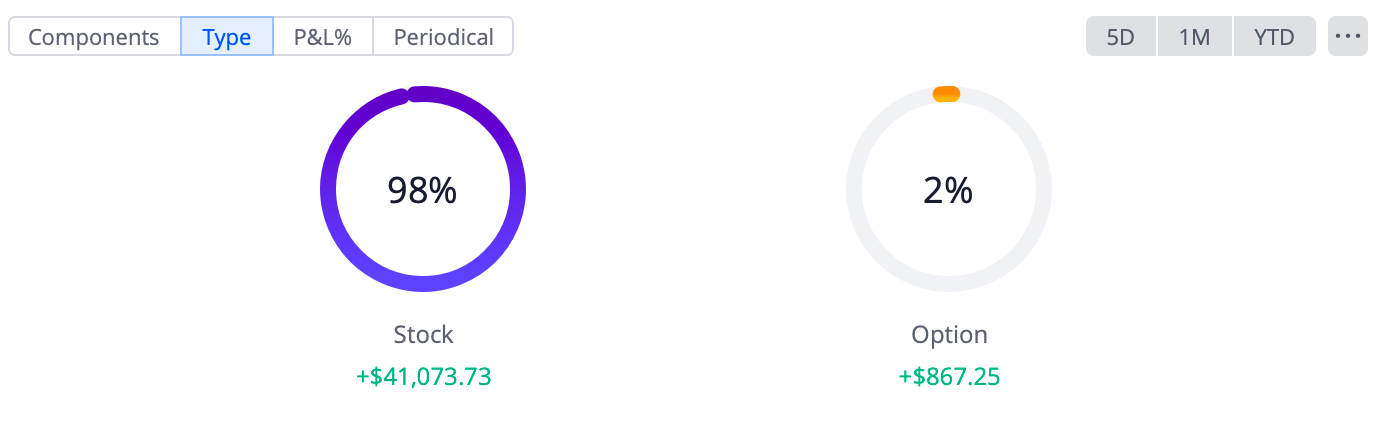

Portfolio (Basic):

Unlock full access / detailed portfolios, consider 7 day free trial to see “behind the curtain”

Comments From Me

I would like to start with saying Happy New Year and I hope everyone had a good time (whatever that may mean to you). I know personally December is an extra busy month for me with extra stuff coming up due to holidays for both personal and work life related stuff … also I think December is the most expensive month for me with all the gift giving lol but December is the month when I take work the least seriously and try to enjoy the “magic of winter holidays”.

Also closed out 2023 with portfolio being over $300,000.

Portfolio Discussion

Currently the numbers as of 01/01/2023: (total) $305,787 - (other) $25,000 = (mine) 280,787.

Not much change in portfolio was done for the month of December due to:

Its the end of the year and I did not want to take any profits and having to pay taxes on in 2024

I’m currently reading “What I Learned About Investing from Darwin” by Pulak Prasad, and it gives me an idea to be even less active

I’m fully invested in the amount of companies that I’m willing to follow/hold , but I can say that definitely will change in 2024, as I’m starting to research couple of new companies that are piqued my interest.

Dividends for December:

One thing that stands out is the performance of OPFI 0.00%↑ it is now in my top 5 holdings.

I’m up a bit over 100% on SFM 0.00%↑ and sold tiny bit, also I did sell some OZK 0.00%↑ at P/B of 1 and at about 90% profit.

2023Y Review Investing +

Reviewing previous yearly posts and it does not make sense to me that on one hand it says on year by year basis I do not outperform SPY but from inception I do, maybe its me writing this late night or maybe that’s just the magic of compounding…but something doesn’t click?

You can see I have been obviously outperforming until the transfer…

(Due to me changing from Margin account to Cash account, the % of me vs SPY have been messed up so I have been relying on Porteido’s numbers although they are not 100% accurate they are close enough…they cant be 100% accurate because Porteido does not include option transactions)

Anyways…Some “fun” stats from both Margin and Cash account for maximum transparency:

All images below (1st is Margin Account and 2nd is Cash Account)

Again apologies for a bit of messy review but I’m big on trying to provide transparency but I’m not really tech savvy and tried my best to show the FULL PICTURE, moving forward I think in 2024 it will be easier to show all in one go via Webull or I might just stick to Porseido.

Just a reminder that with Webull introducing Cash account that pays 5% APY on cash, it was a no brainer for me to transition from Margin account that paid zero on cash holding (so I had to do more option trading) to Cash account that let me be less active and collect 5% APY on any cash that I have so I can be patient and wait for the “right pitch”.

When it comes to my best (closed) trades of 2023Y:

I haven’t really closed any trades for a “good profit” but I have taken a bit off from SFM 0.00%↑ at 100% return, OZK 0.00%↑ at around 90% return …

Notable mentions SPOT 0.00%↑ and OPFI 0.00%↑

This is the thing about investing, you hold something because you believe its undervalued (and it may or may not be so) and it feels to me that over long time most stocks are either are multi-bagger(s) or a zero/flat and sometimes that happens multiple time. I only really got about three ish years under my investing belt as conscious “real” investor so time will tell if lessons I learn are right or if Mr Market will need to correct my thinking with that said… on a short time frame, market is really random and in the long run we really truly see the true value of a company, the problem is … everyone has different definition of short and long term (time frame).

If OPFI 0.00%↑ didn’t do what it did I would probably didn’t do so well by the end of the year, but then again if we are being honest most investors could say that about their X, Y, or Z stock … I just can be real with myself…

That’s why I love this quote by Yogi Berra … that, "In theory there is no difference between theory and practice; in practice there is." It’s not, could-of-should-of but what actually happened that really matters at the end of the day.

When it comes to my worse trade of 2023Y:

Putting PYPL 0.00%↑ and WBD 0.00%↑ aside, my worse trades for the year of 2023 have to be 1) VMD 0.00%↑ and 2) TCS 0.00%↑

You might ask how is VMD is one of my worse trades? well that’s easy in hindsight but I should of sold it out of at around 11-12 when it was trading at around P/E of 40 (and it was also my largest holding) but noooo I had to hold it as never-sell was in my head again in hindsight I could of sold it for 100% and buy it back again , but who knew right?

The reason I said TCS is because of the way I sized the position and my final realization that I’m not big fan of “turn-around” stories … they are hard and need lots of things to go right and even more things NOT to go wrong… usually it seems everything goes bad and then it goes even worse…

Forgot to share the yearly update last month for my Substack:

December 2023 marks another year on substack and this blog has come a long way…

December 11 2020 - 2 subscribers

December 11 2021 - 327 subscribers

December 11 2022 - 1155 subscribers

December 11 2023 - 2321 subscribers

This is after removing inactive subscribers

I’m THANKFUL to all of you who are with me on this journey of trying to turn $100,000 to $1,000,000 and hopefully beyond…

Some Tweaks To The “Paid” part of This Substack

Or more exactly, leaning on the chat feature.

To try and provide even more transparency I will be implementing a few more addons:

Every buy and sell (in main portfolio) will get captured in “screenshot” and posted in chat and those who are paid subscribers will be able to see it with amount of shares, price, and time or I will just write it out if I have time. (This will obviously NOT be an investment advice, just giving more transparency to what I do, to those who care).

Every Friday night, I will be posting screenshot of the portfolio, the benefit of this is again to show more transparency so subscribers can be more up to date on my holdings (not only stocks, but also options) and not having to wait to see update every month.

Obviously with every chat update from me, you are always welcomed to ask questions if anyone wants to get more details on why I’m buying or selling or owning certain stocks or options.

I thought about these add-ons and I think they should not be too hard to implement for me and wont really require too much “maintenance ” so I don’t mind doing it.

Lastly I will be raising monthly subscription to $15 from $10 starting in February but I will be keeping yearly at $60, which is $5 a month…

Latticework Note 2023

David Park was kind enough to share his notes that he took at Latticework 2023, I highly recommend checking the link below with his notes:

I will share my thoughts and more in paid section…

Don’t forget to ❤️ this post. It helps a lot!

Also, I would really appreciate if you would share this post with one person who you think might enjoy it.

IAC 0.00%↑ SFM 0.00%↑ $NTDOY SPOT 0.00%↑ LKQ 0.00%↑ OPFI 0.00%↑ BSM 0.00%↑ PYPL 0.00%↑ WBD 0.00%↑ VMD 0.00%↑ TCS 0.00%↑ $EVVTY BUR 0.00%↑ MITK 0.00%↑ OZK 0.00%↑ OMAB 0.00%↑ FGFPP 0.00%↑ UG 0.00%↑ VEA 0.00%↑ VTI 0.00%↑ MKL 0.00%↑ URI 0.00%↑ C 0.00%↑ RICK 0.00%↑ ARCH 0.00%↑ IDT 0.00%↑ RBLX 0.00%↑ BN 0.00%↑ U 0.00%↑ $ASHTY OPBK 0.00%↑ DJCO 0.00%↑ DLTR 0.00%↑ BOC 0.00%↑ MASI 0.00%↑ DEO 0.00%↑ FLWS 0.00%↑ BABA 0.00%↑ XPEL 0.00%↑ MBLY 0.00%↑ ONON 0.00%↑ MELI 0.00%↑ GDOT 0.00%↑ CDLX 0.00%↑ ASO 0.00%↑ SGA 0.00%↑ IBKR 0.00%↑ ONFO 0.00%↑ DBX 0.00%↑ UHAL 0.00%↑ ENZ 0.00%↑ SPHR 0.00%↑ OTGLY NNI 0.00%↑ CPRT 0.00%↑ $BRKB OPRA 0.00%↑ $VIVHY THRY 0.00%↑

Section below is for paid subscribers…