January 2025 Portfolio Update

Free Topics: Quote, Portfolio + Quick Update, 2024Y Review Investing +, $TCS & What Went Wrong, Books ... Paid Topics: Portfolio(s) Discussion, Commentaries, and much more...

Quote for this month:

"The idea of caring that someone is making money faster than you are is one of the deadly sins. Envy is a really stupid sin because it's the only one you could never possibly have any fun at. There's a lot of pain and no fun. Why would you want to get on that trolley?" - Charlie Munger

*Portfolio*

*I am NOT a financial advisor. I’m sharing my investing journey. Not investment advice. Do your own research.*

Portfolio (Basic):

Holding since:

2020 - LKQ 0.00%↑ - 03

2021 - SFM 0.00%↑ - 03 | OPFI 0.00%↑ - 05 | VMD 0.00%↑ - 05 | 08 | SPOT 0.00%↑ - 11

2022 - MITK 0.00%↑ - 01 | WBD 0.00%↑ - 04 | $EVVTY - 09 | $NTDOY - 12

2023 - PYPL 0.00%↑ - 01 | TCS 0.00%↑ - 01 | BSM 0.00%↑ - 05 | BUR 0.00%↑ - 09

2024 - (First ???) - 01 | BKTI 0.00%↑ - 04 | BOC 0.00%↑ - 09 |

2025 - IAC 0.00%↑ - 01 |

Quick Complimentary Portfolio Update

Although I did mention that most of my updates will be provided behind paywall, I thought it would be good idea to let know on exits and “some” entering (entering that are liquid enough or known well enough I have no problem sharing).

As said before in December Update… On Jan 15th, I have exited ANGI 0.00%↑ and got back into IAC 0.00%↑ and getting back into IAC at actually lower cost basis!

Most up-to-date portfolio revealed behind the paywall if anyone is interested.

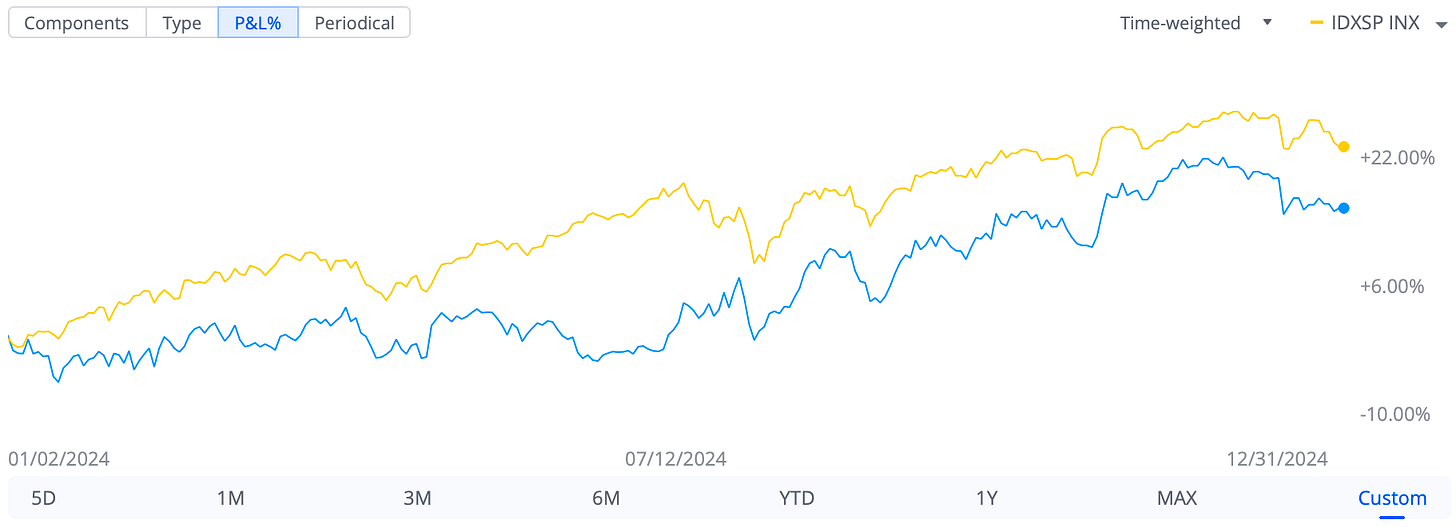

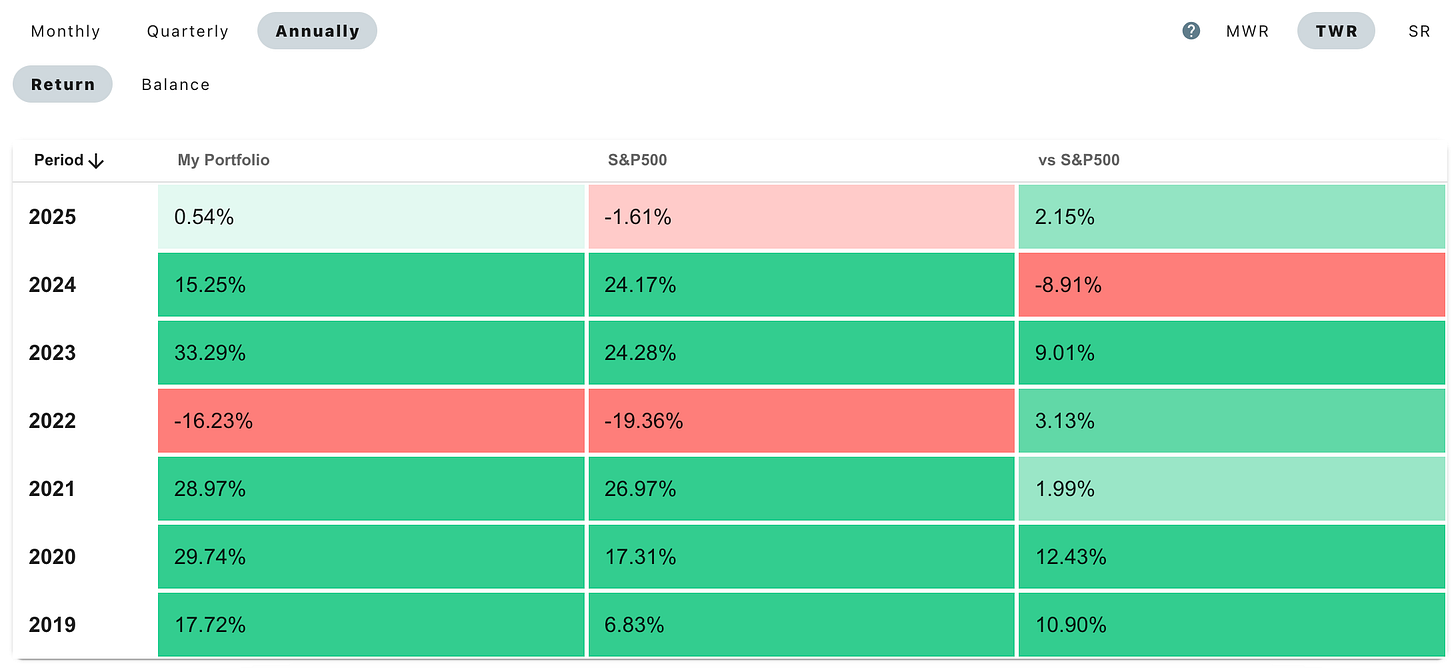

2024Y Review Investing +

Every year I like to review how I did for the last year and just compare things while also keeping “a log” to be able to look back, and also show to everyone consistent and transparent journey…

2024 was the first year that I underperform S&P500 but with My Portfolio finishing up the year “up only” 15%, which I will take it as I think that’s “not too bad”.

Some “fun” stats from Account for maximum transparency:

Two years in a row both SFM and TCS take the spot light, for at least one of them there definitely will not be a third year in a row(if you don’t know why, its because TCS went bankrupt…Divine Comedy…)

When it comes to my best trades of 2024Y:

Like last year I have not fully exited any investments, but honorable mentions are SFM 0.00%↑ , SPOT 0.00%↑ of both I have trimmed and BKTI 0.00%↑ which I’m still fully holding … fundamentally I think SFM and SPOT are running a bit in front of their numbers while BKTI I think still in its early beginnings…

When it comes to my worse trade of 2024Y:

My worst investment is with no doubt is …. is … TCS 0.00%↑… which I will discuss in separate segment (next) but honorable mention is MITK 0.00%↑ with shares trading more or less “flat” and having a new CEO coming in with the previous one getting “kicked out” on some what similar theme is LKQ 0.00%↑ with previous CEO “retiring into the sunset” and a new guy coming in gives me “hope” that he can steer the ship in the right direction. Yet, both LKQ and MITK are on the “short leash” giving both companies about another year before I would consider selling out and moving on… its not about stock price its about not seeing fundamental improvements in the companies with LKQ having a bit longer leash then MITK

Forgot to share the yearly update last month for my Substack (it became a tradition now for me):

December 2024 marks another year on Substack and this blog has come a long way…

December 11 2020 - 2 subscribers

December 11 2021 - 327 subscribers

December 11 2022 - 1,155 subscribers

December 11 2023 - 2,321 subscribers

December 11 2024 - 3,547 subscribers

Above numbers are after removing inactive subscribers

January 1 2025 - 5,561 - all followers as per Substack’s stats.

I’m THANKFUL to all of you who are with me on this journey of trying to turn $100,000 into $1,000,000 and hopefully beyond…

TCS & What Went Wrong

Where do I begin… conformation biases, this biases, that biases …

On the day I went to check out the custom closet from TCS, I was filled into my first 100 shares or better say my first 1 contract from selling put options and on that day numbers from report did not sound too great, but even though I had a bit of a weird feeling in me I went to keep that 1 contact and of course then those first 100 shares…

But that was all more or less anecdotal… or was it…

What really kept me a believer and not willing to sell my shares was not just that I didn’t want to take a loss but that I really thought TCS could of turned around and I still do, its that management in my eyes based on the information that I have (currently) has failed to fully swing for the benefit of the shareholders and instead opted out to safe their warm and comfy corporate seats … again I might be wrong I have never spoken to management although I did email them once with no respond …

All the way to the end and still now, instead of focusing on collecting “cash” and saving, management opted out to open new stores and grow, again maybe they really thought they can save company this way, but they didn’t and so they failed…

A few things that I wanted to point out in all transparency … I did not know that there was a big payment had to be made by the 2025 but again!!! management knew!!! and they needed to save and make that payment!!!

I don’t know why but high gross margins really kept my spirit high with possibility of a better future, but if no one is buying high margins can go down the toilet and I learned a lesson that high gross margins are only one data point from my check list and can not be the north star…

https://www.from100kto1m.com/i/102494661/personal-touch from my write up the first question I ask in Personal Touch … “Does This Company Meets The Check List Requirements?” and the answer was “No” and yet I still went on to invest and “buy into the story” that I told myself.

I went to a two or three locations personally and most of them were not really empty but definitely not “really busy” either but staff was friendly and helpful.

I thought that because there was another fund - Leonard Green & Partners, L.P. - invested into TCS that since there is a big player that they would voice something out but look at the end none of the management has too much skin in the game and LG&P probably has their clients money and not theirs (cant confirm that) so who cares right? again maybe I’m wrong… I will say that Satish Malhotra did take a pay cut and at some point even bought some shares which even more clouded my judgement of thinking…

Another red flag that I did notice but I was already too deep into my own biases was when company went with activating a “poison pill” against a small ish player from Florida that was buying up a lot of the company … the guy was not an activist (from what I gathered) and yet management chickened out and went for drastic take like why????

What I never did was I never pushed harder on getting in touch with management and asking them some questions in the moment, always thinking that wouldn’t make any difference, but would it? or would it not? now we wont know…

I am a business owner myself, I know running a business is not easy.. running with employees is not easy… running a public company is probably even harder no doubt … but I really think that there was definitely an alternative universe were things went a lot different. I’m not saying a 100 bagger (or even 10 bagger) but a modest successful turn around over maybe 3-5-10 years…maybe…maybe yes…

I’m planning to hold the rest of my shares and go through the whole experience that comes with a public company filing for bankruptcy. To really experience it and really feel the discomfort that comes with it. This is the first time and I’m hopeful will be the only/last…but who knows, you know? No one in investing has a perfect batting average and I never thought I would have one, I don’t even like baseball…

I guess its much better that it happened with $30,000 rather then $300,000 or $3,000,000…

PS I’m planning to frame TCS Bankruptcy into a frame and put it in front of my desk as an internal reminder of what went wrong and I will be calling it “The Wall of Shame” I just hope that there wont be too many of those on the wall…

“If you take care of the downside the upside will (for the most part) take care of itself.”

And of course:

“Rule 1: Never lose money. Rule 2: Never forget Rule No. 1.” - Warren Buffett

Books

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished two audiobook and did NOT finish two audiobook:

AI Snake Oil: What Artificial Intelligence Can Do, What It Can’t, and How to Tell the Difference by Arvind Narayanan and Sayash Kapoor

YZ:

AI Snake Oil is very basic and yet for a layman gives a bit more color and reality check on what AI can and cant do yet, and some things that it will probably wont do either. Being on X or surfing the web + using our imagination and medias narrative can be a very dangerous recipe for creating unnecessary scary imaginary scenario… with AI Snake Oil, the book kind of brings you back to reality a bit…

Like with previous inventions and generations, we should embrace new technology… learn about them, implementing them in daily life / work and not be afraid of them that they will replace us.

Use it to your advantage or be left behind because of ignorance or stubbornness…

Goodreads:

Confused about AI and worried about what it means for your future and the future of the world? You're not alone. AI is everywhere—and few things are surrounded by so much hype, misinformation, and misunderstanding. In AI Snake Oil, computer scientists Arvind Narayanan and Sayash Kapoor cut through the confusion to give you an essential understanding of how AI works, why it often doesn't, where it might be useful or harmful, and when you should suspect that companies are using AI hype to sell AI snake oil—products that don't work, and probably never will.

While acknowledging the potential of some AI, such as ChatGPT, AI Snake Oil uncovers rampant misleading claims about the capabilities of AI and describes the serious harms AI is already causing in how it's being built, marketed, and used in areas such as education, medicine, hiring, banking, insurance, and criminal justice. The book explains the crucial differences between types of AI, why organizations are falling for AI snake oil, why AI can't fix social media, why AI isn't an existential risk, and why we should be far more worried about what people will do with AI than about anything AI will do on its own. The book also warns of the dangers of a world where AI continues to be controlled by largely unaccountable big tech companies.

By revealing AI's limits and real risks, AI Snake Oil will help you make better decisions about whether and how to use AI at work and home.

I give it 4 out of 5 stars.

The Ten Commandments for Business Failure by Donald R. Keough

YZ:

This was really an interesting read (or shall I say listen) … a bit of sarcasm and painful truth is how I like my books … Mr Keough basically tells you Ten Things to do if you want to fail aka avoid/don’t do these Ten Things if you want to be successful in business!

I really think of maybe getting couple of copies and sending them out to couple of the companies that I own… If I read this a bit sooner probably could of sent it to that other one that declared bankruptcy last December…

Goodreads:

Don Keough—a former top executive at Coca-Cola and now chairman of the elite investment banking firm Allen & Company—has witnessed plenty of failures in his sixty-year career (including New Coke). He has also been friends with some of the most successful people in business history, including Warren Buffett, Bill Gates, Jack Welch, Rupert Murdoch, and Peter Drucker.

Now this elder statesman reveals how great enterprises get into trouble. Even the smartest executives can fall into the trap of believing in their own infallibility. When that happens, more bad decisions are sure to follow.

This light-hearted “how-not-to” book includes anecdotes from Keough’s long career as well as other infamous failures. His commandments for failure include: Quit Taking Risks; Be Inflexible; Assume Infallibility; Put All Your Faith in Experts; Send Mixed Messages; and Be Afraid of the Future.

As he writes, “After a lifetime in business I’ve never been able to develop a step-by-step formula that will guarantee success. What I could do, however, was talk about how to lose. I guarantee that anyone who follows my formula will be a highly successful loser.”

I give it 4 out of 5 stars.

Two books that I really tried to finish but couldn’t are:

The Alchemy of Finance Paperback by George Soros

Financial Shenanigans by Howard Schilit

Don’t forget to ❤️ this post. It helps a lot!

Sections below are for paid subscribers…