January 2026 Portfolio Update

Quote, Portfolio, Complimentary Monthly Commentary, 2025Y Review Investing +, New Favorite Show, Books, and more ...

Quote for this month:

“You must survive the bad days, not just look good on average.” - Howard Marks

*Portfolio*

*I am NOT a financial advisor. I’m sharing my investing journey. Not investment advice. Do your own research.*

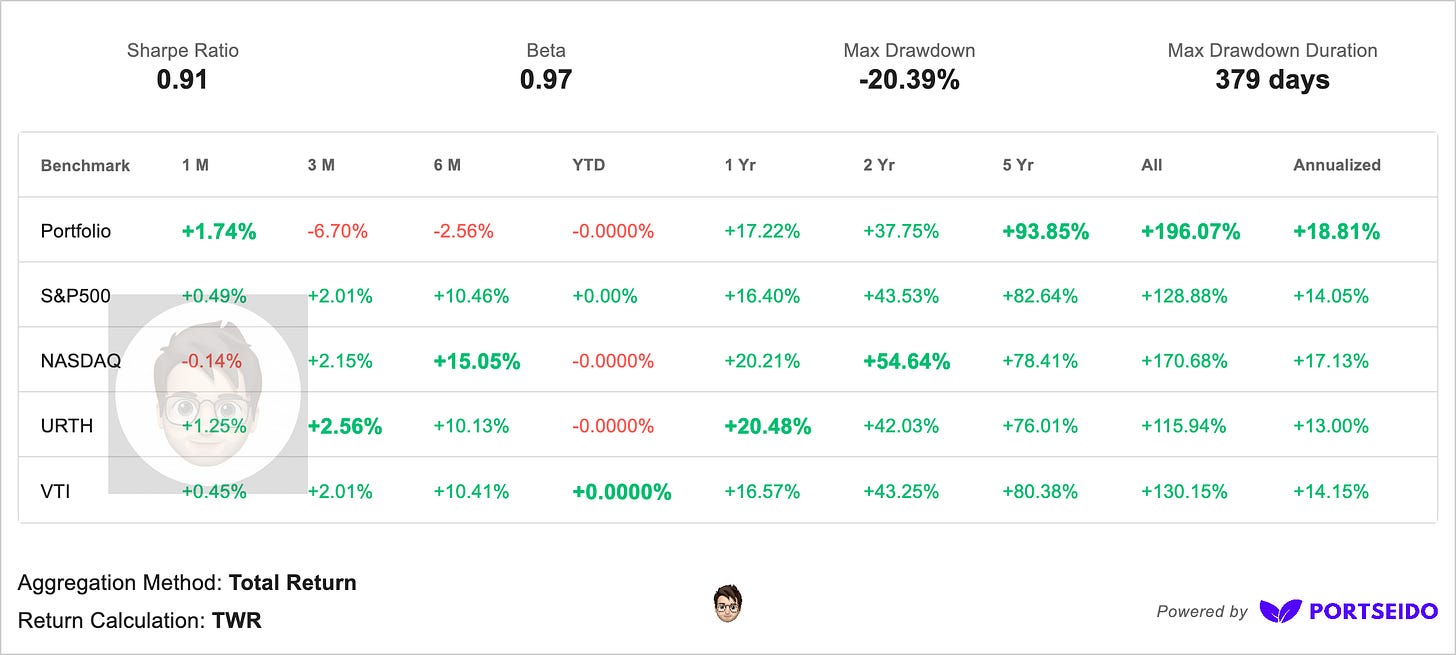

Portfolio (Basic):

Holding since:

2020 - LKQ 0.00%↑ - 03

2021 - SFM 0.00%↑ - 03 | VMD 0.00%↑ - 05

2022 - WBD 0.00%↑ - 04 | $NTDOY - 12

2023 - PYPL 0.00%↑ - 01 | BSM 0.00%↑ - 05

2024 - $M?? - 01 | BKTI 0.00%↑ - 04 | BOC 0.00%↑ - 09

2025 - IAC 0.00%↑ - 01* | GRVY 0.00%↑ - 08 | $CR?? - 08 | $CR?? - 10 | ONFO 0.00%↑ - 10 | $EVVTY - 11 | $F? - 12

*IAC originally was purchased in 2021, but sold at the end of 2024 for tax loss purposes and re-bought back in 2025.

*EVVTY originally was purchased in 2022, but sold at the end of 2025 for tax loss purposes and re-bought back in 2025.

Complimentary Monthly Commentary - CMC

Sold out of BUR 0.00%↑ and MITK 0.00%↑

I sold BUR and MITK given the end of the year to harvests the losses with idea that I will be buying back BUR but I’m contemplating if I want to buy back MITK or just move on, still thinking about it as there just been too many changes with MITK.

Buying back holding that is only shared with paid subscribers for now (its up 25% YTD)

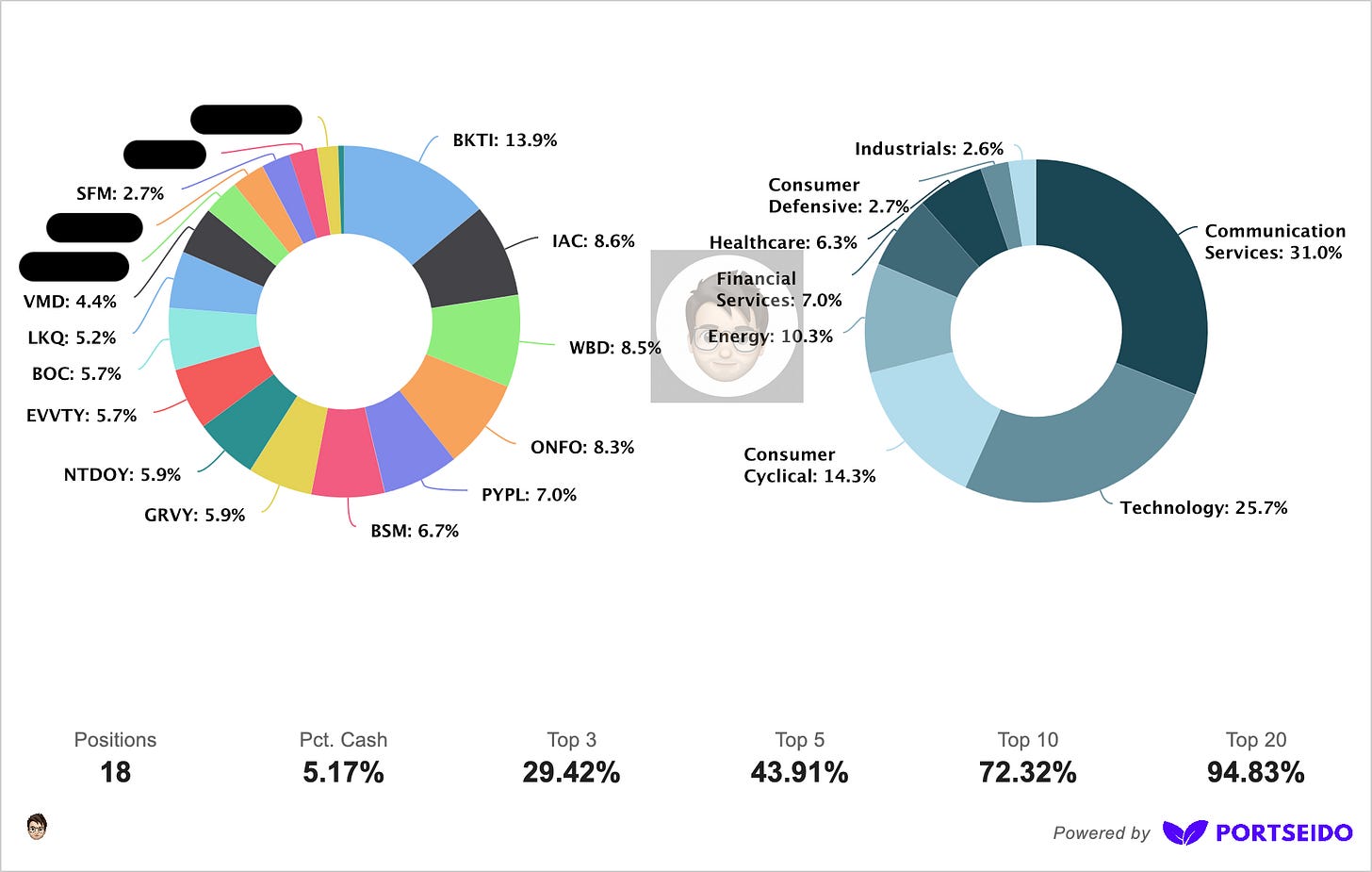

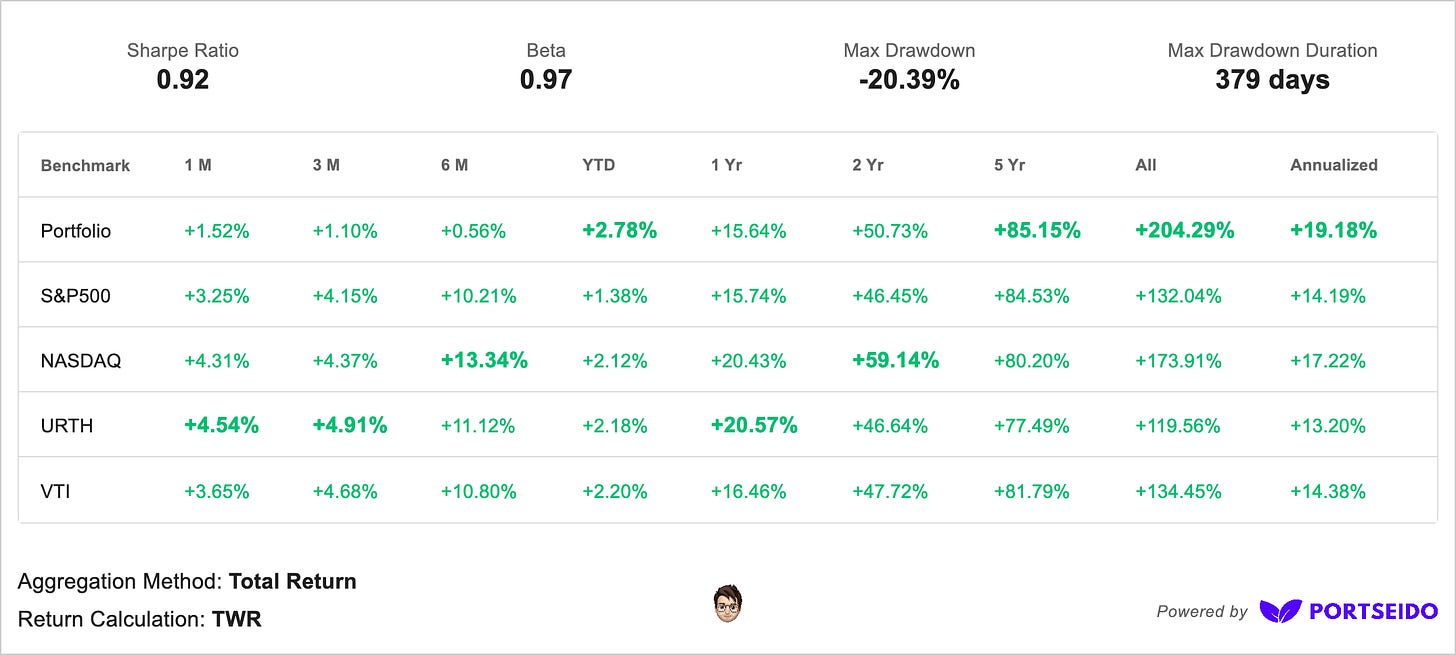

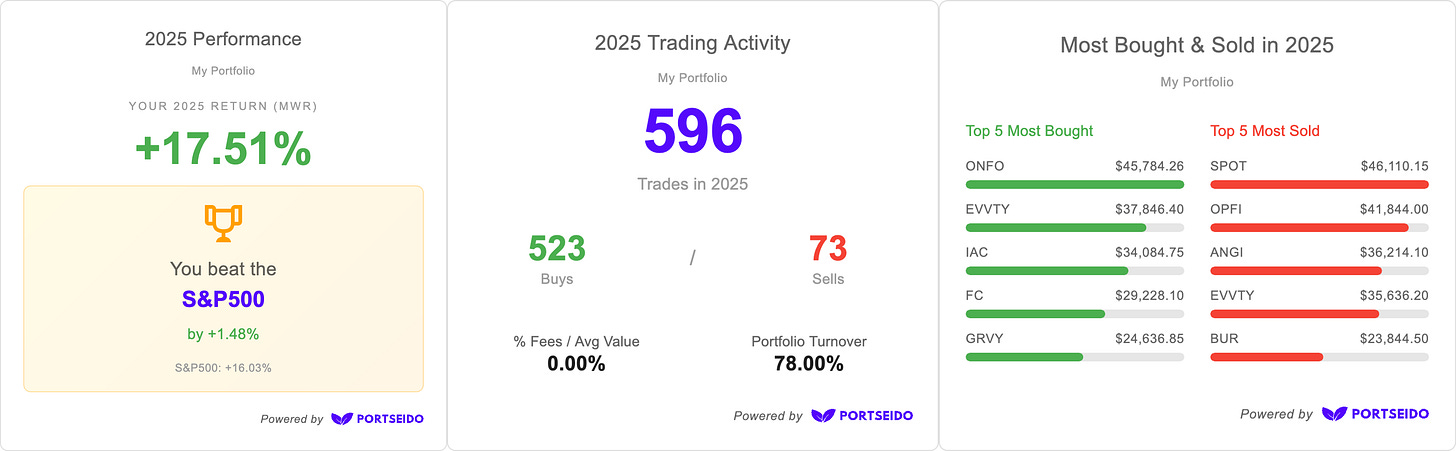

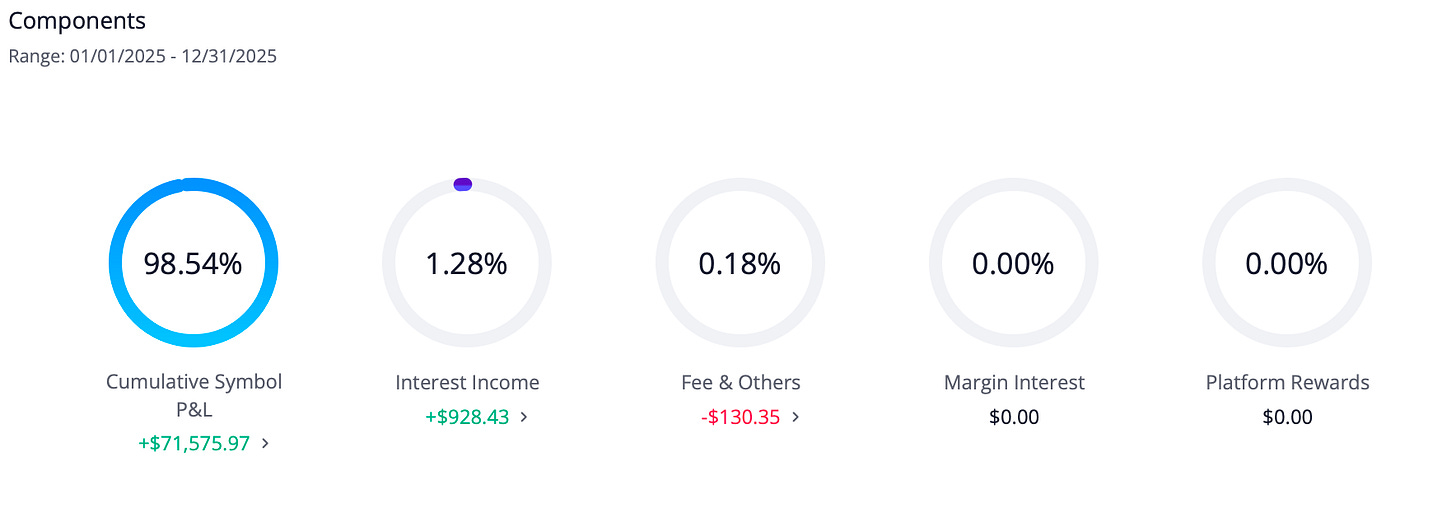

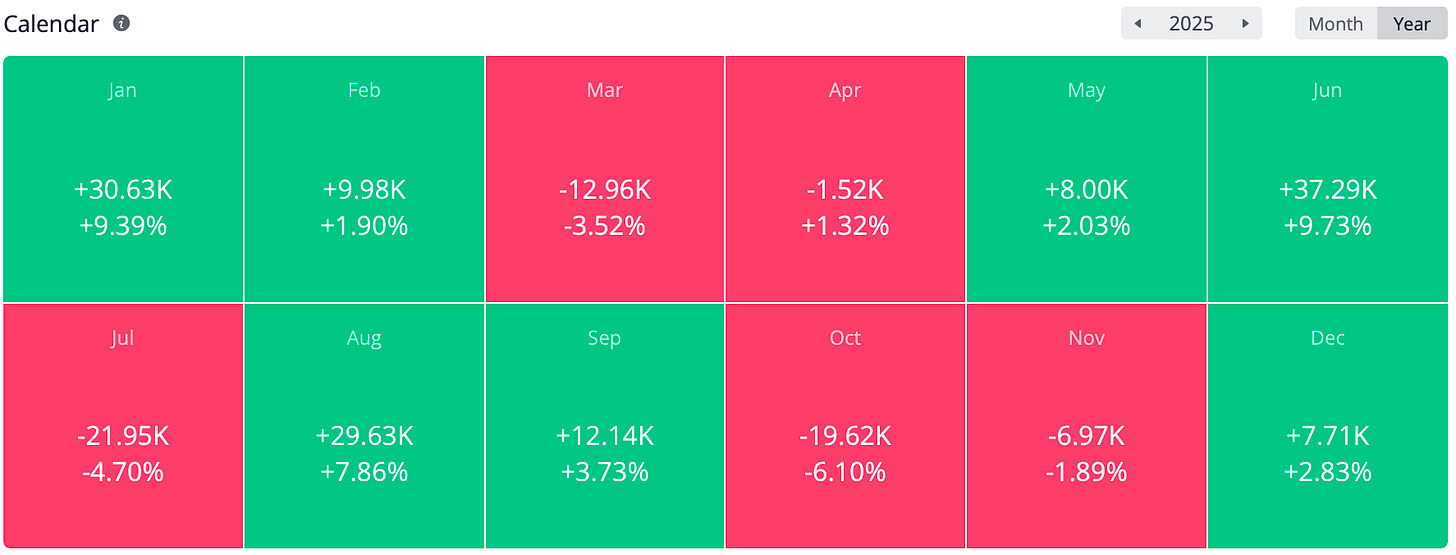

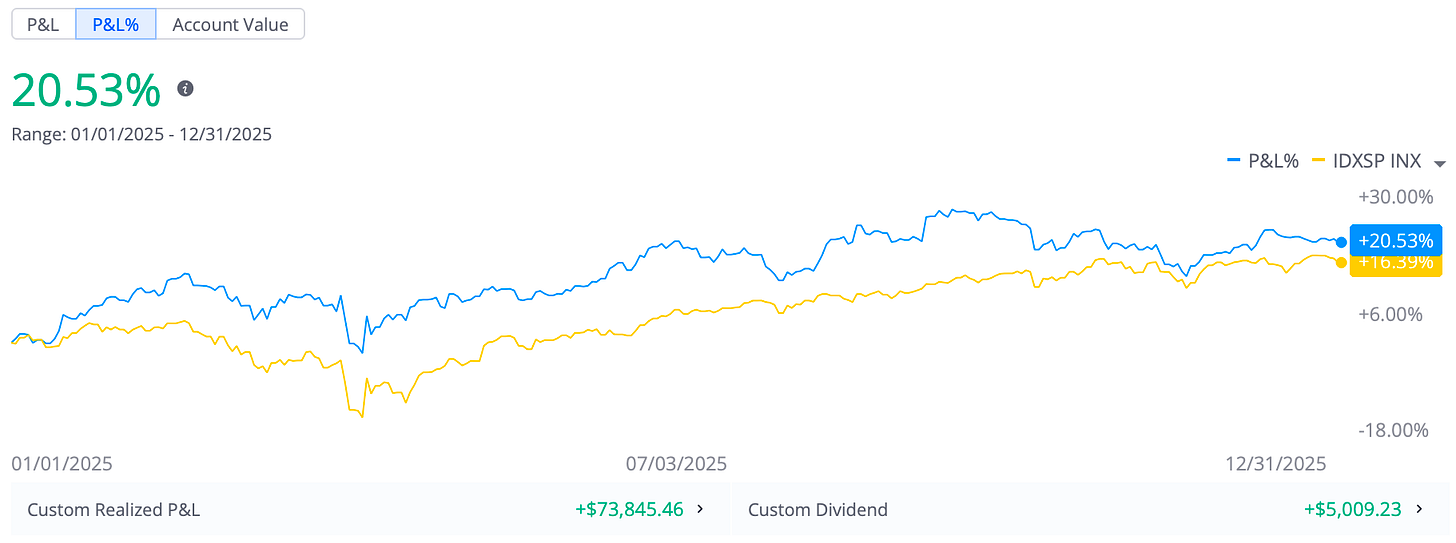

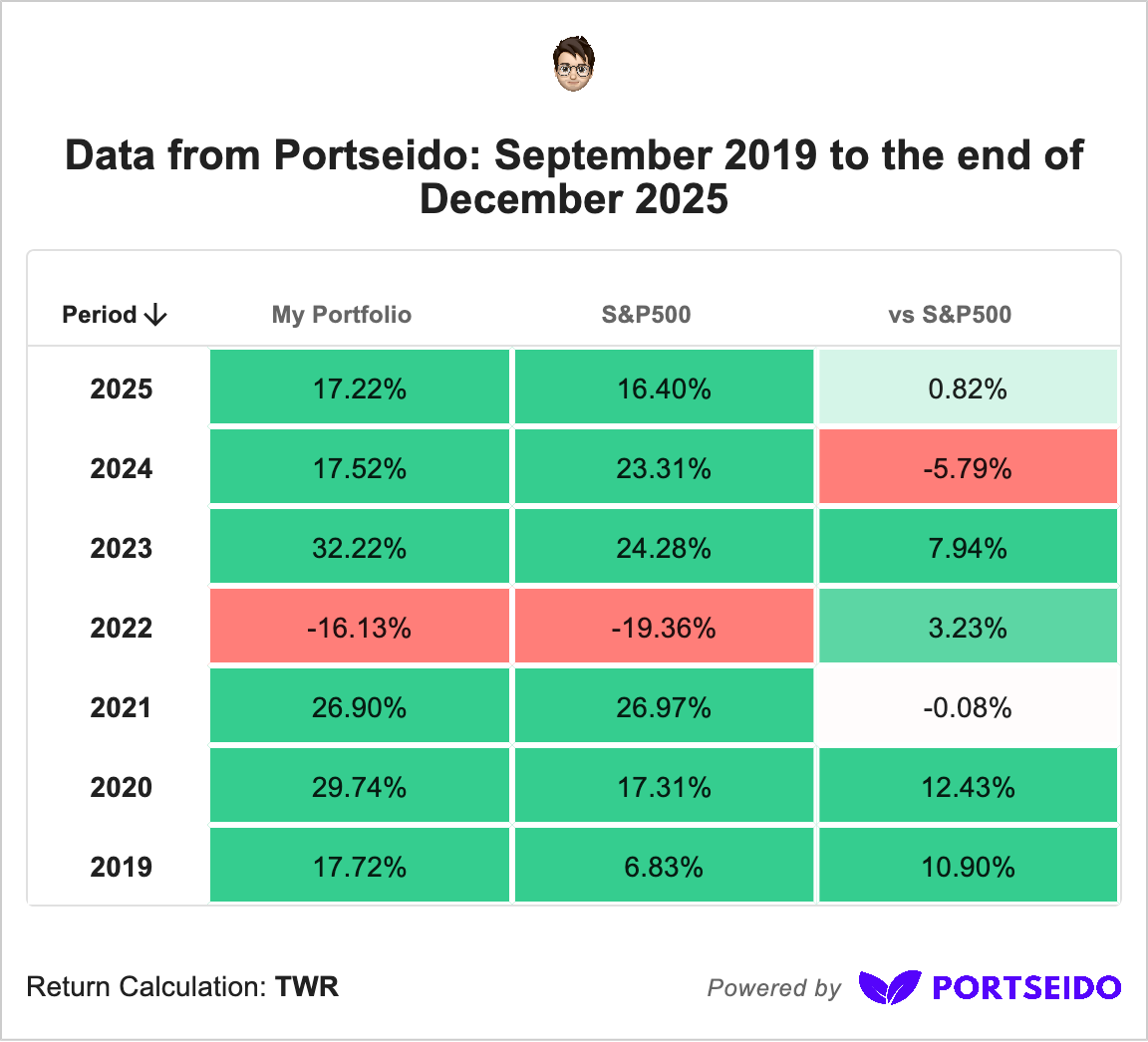

2025Y Review Investing +

Every year I like to review how I did for the last year and just compare things while also keeping “a log” to be able to look back, and also show to everyone consistent and transparent journey…

BKTI has been the clear winner for few years now…

Some “fun” stats from Account for maximum transparency:

When it comes to my best trades of 2025Y:

I guess from P&L point of view my best trades have been selling out of SPOT 0.00%↑ and OPFI 0.00%↑ while also still holding on to BKTI 0.00%↑

When it comes to my worse trade of 2025Y:

Last year I cant say there have been “worse” trades, because even thought I sold out of BUR 0.00%↑ I’m planning to buy it back and I do not count it being bad trade even if the stock went down (due to court hearing with Argentina which is still in play) but I will say holding on to LKQ 0.00%↑ and PYPL 0.00%↑ have been opportunity costs… I guess I will say that MITK 0.00%↑ has been the “bad” that I have sold and need to really think hard if I want to buy back or just move on…

Forgot to share the yearly update last month for my Substack (it became a tradition now for me):

December 2025 marks another year on Substack and this blog has come a long way…

December 11 2020 - 2 subscribers

December 11 2021 - 327 subscribers

December 11 2022 - 1,155 subscribers

December 11 2023 - 2,321 subscribers

December 11 2024 - 3,547 subscribers

December 11 2025 - 3,952 subscribers ( I did big clean up in 2025)

Above numbers are after removing inactive subscribers

January 1 2025 - 5,561 - all followers as per Substack’s stats.

January 1 2026 - 8,345 - all followers as per Substack’s stats.

New Favorite Show

- Landman -

I am not the one commit to any shows …easily … (yes I have show commitment problems) but I really enjoyed Landman (did not watch the last episode yet so no spoilers!) and watching it from perspective of a father and investor makes it so much more … fun.

Highly recommend it!

Books

I realized that my descriptions of the books that I read may not always give them full credit as when I read these books and when I write about them, I only share one or two things that really stand out to me. So I have decided to also include a quick short description from Goodreads (no affiliations) so that way you get my thoughts but also more generic description to get a better feel for the books and in so hopefully adding them to your “to-read-list”.

This time around I finished three audiobooks:

1929: Inside the Greatest Crash in Wall Street History--and How It Shattered a Nation by Andrew Ross Sorkin

YZ:

I really enjoyed Andrew Sorkin’s 1929 and all the details of how the crash unfolded and how people reacted vs how things have happen with in the last 10-20 years and how people react … a lot has changed and yet many things still stay the same…

Goodreads:

From the bestselling author of Too Big to Fail, “the definitive history of the 2008 banking crisis,”* comes a spellbinding narrative of the most infamous stock market crash in history. With the depth of a classic history and the drama of a thriller, 1929 unravels the greed, blind optimism, and human folly that led to an era-defining collapse—one with ripple effects that still shape our society today.

In 1929, the world watched in shock as the unstoppable Wall Street bull market went into a freefall, wiping out fortunes and igniting a depression that would reshape a generation. But behind the flashing ticker tapes and panicked traders, another drama unfolded—one of visionaries and fraudsters, titans and dreamers, euphoria and ruin.

With unparalleled access to historical records and newly uncovered documents, New York Times bestselling author Andrew Ross Sorkin takes readers inside the chaos of the crash, behind the scenes of a raging battle between Wall Street and Washington and the larger-than-life characters whose ambition and naivete in an endless boom led to disaster. The dizzying highs and brutal lows of this era eerily mirror today’s world—where markets soar, political tensions mount, and the fight over financial influence plays out once again.

This is not just a story about money. 1929 is a tale of power, psychology, and the seductive illusion that “this time is different.” It’s about disregarded alarm bells, financiers who fell from grace, and skeptics who saw the crash coming—only to be dismissed until it was too late.

Hailed as a landmark book, Too Big to Fail reimagined how financial crises are told. Now, with 1929, Sorkin delivers an immersive, electrifying account of the most pivotal market collapse of all time—with lessons that remain as urgent as ever. More than just a history, 1929 is a crucial blueprint for understanding the cycles of speculation, the forces that drive financial upheaval, and the warning signs we ignore at our peril.

I give it 4.5 out of 5 stars.

Retail Gangster: The Insane, Real-Life Story of Crazy Eddie by Gary Weiss

YZ:

Retail Gangster is one book I did not think I would listen/read never mind the fact that I would enjoy it, but given that I live in Brooklyn (be it different years) it was too nostalgic hearing the stories and the streets! Crazy Eddie is a real story that should of not happen and yet it did. If you enjoy the likes of Enron, Madoff, etc … you will enjoy story of Crazy Eddie.

Goodreads:

Back in the fall of 2016 we heard the news about the passing of Eddie Antar, "Crazy Eddie" as he was known to millions of people, the man behind the successful chain of electronic stores and one of the most iconic ad campaigns in history. Few things evoke the New York of a particular era the way "Crazy Eddie! His prices are insaaaaane!" does. The journalist Herb Greenberg called his death the "end of an era" and that couldn't be more true. What's insane is that his story has never been told.

Before Enron, before Madoff, before The Wolf of Wall Street, Eddie Antar's corruption was second to none. The difference was that it was a street franchise, a local place that was in the blood stream of everyone's daily life in the 1970s and early '80s. And Eddie pulled it off with a certain style, an in your face blue collar chutzpah. Despite the fact that then U.S. Attorney Michael Chertoffcalled him "the Darth Vader of capitalism" after the extent of the fraud was revealed, one of the largest SEC frauds in American history after Crazy Eddie's stores went public in 1984, Eddie was talked about fondly by the people who worked for him. They still do--there are myriads of ex-Crazy Eddie employee web pages that still attract fans, and the Crazy Eddie fraud scheme is now taught in every business school across the United States.

Many years have passed since the franchise went down in spectacular fashion but Crazy Eddie's moment has endured the way that iconic brands and characters do--one only need Google the media outpouring that accompanied his death. Maybe it's because it crystallized everything about 1970s New York almost perfectly, the merchandise and rise of consumer electronics (stereos!), the ads (cheesy!), the money (cash!). In Retail Gangster, investigative journalist Gary Weiss takes readers behind the scenes of one of the most unbelievable business scam stories of all time, a story spanning continents and generations, reaffirming the old adage that the truth is often stranger than fiction.

I give it 4 out of 5 stars.

The Fairfax Way: Inside Prem Watsa’s Secret to Lasting Success by David Thomas

YZ:

Well timed book given the retirement of Warren Buffett … Story of Fairfax and story of Prem Watsa, I wish I read book existed 5 - 10 years ago because I think there just have been sooo much misunderstanding and distrust about Fairfax and for no real good reason (except that’s what Wall St. wanted I guess) if you ever wanted to learn about Prem Watsa and Fairfax, The Fairfax Way is a perfect book to get better understanding and appreciation for what Prem Watsa and the team at Fairfax has build and more importantly what they potentially can build in the future!

Indigo:

Even those who have heard of Prem Watsa and Fairfax Financial probably don’t understand them. The company sprawls across more than 100 countries and is known for its complex finances—so complex, they once attracted a who’s-who of Wall Street short sellers who misread the company as the next Enron and decided it could be profitably pushed into an open grave. The hedge funds even had Bob Dylan lined up to sing at the company’s funeral party. Fairfax stared down regulators and fought back. Dylan never got the chance to sing.

Watsa, now 75, stole a page from Warren Buffett in building a $45 billion global empire built on value investing and insurance assets. Its bold and creative trades are legendary, often moving against the herd and making billions while others lose their shirts. These days, the company is back winning billion-dollar bets, but away from the headlines. The Fairfax Way explores the lessons learned and why skies are now blue above a transformed company.

In its 39-year history, Fairfax’s annual compound return of 19.2% trounces the S&P 500’s 11.3%. Lately, it is outperforming even Silicon Valley tech stocks and winning back an investor following. It’s time to get to know Fairfax better. The company’s holdings include strategic investments like Bauer hockey sticks, William Ashley wedding gifts, Sleep Country mattresses, Golf Town stores, and Seaspan container ships. If you took home Swiss Chalet chicken last week or went for steak at the Keg, you ate at Fairfax restaurants.

It’s time to get to know Prem Watsa better, too. People long misjudged him as a recluse. Truth is, he simply always wanted to build a business, not talk to the media. After 40 years, he and his executives have finally decided it’s a good time to open up.

For all the colourful dealmaking, billion-dollar bets, high-stakes hedge fund wars, Thomas reveals an inspiring story for our current troubled times. What emerges is that many people just had trouble believing Fairfax had the audacity to build a company culture based on the golden rule—treat others as you would have them treat you. The Fairfax Way captures the inside story of how a culture of treating people right can be a secret competitive moat to long-term outperformance.

I give it 4.5 out of 5 stars.

Don’t forget to ❤️ this post. It helps a lot!

Sections below are for paid subscribers only…